PHOTO

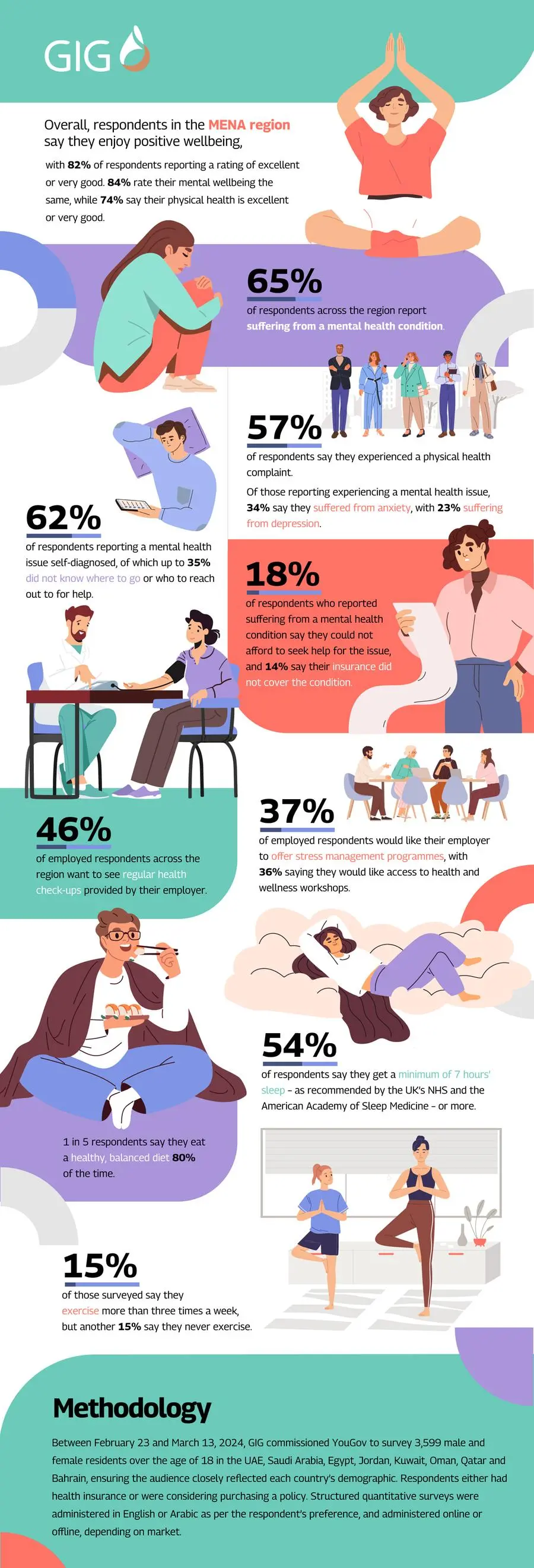

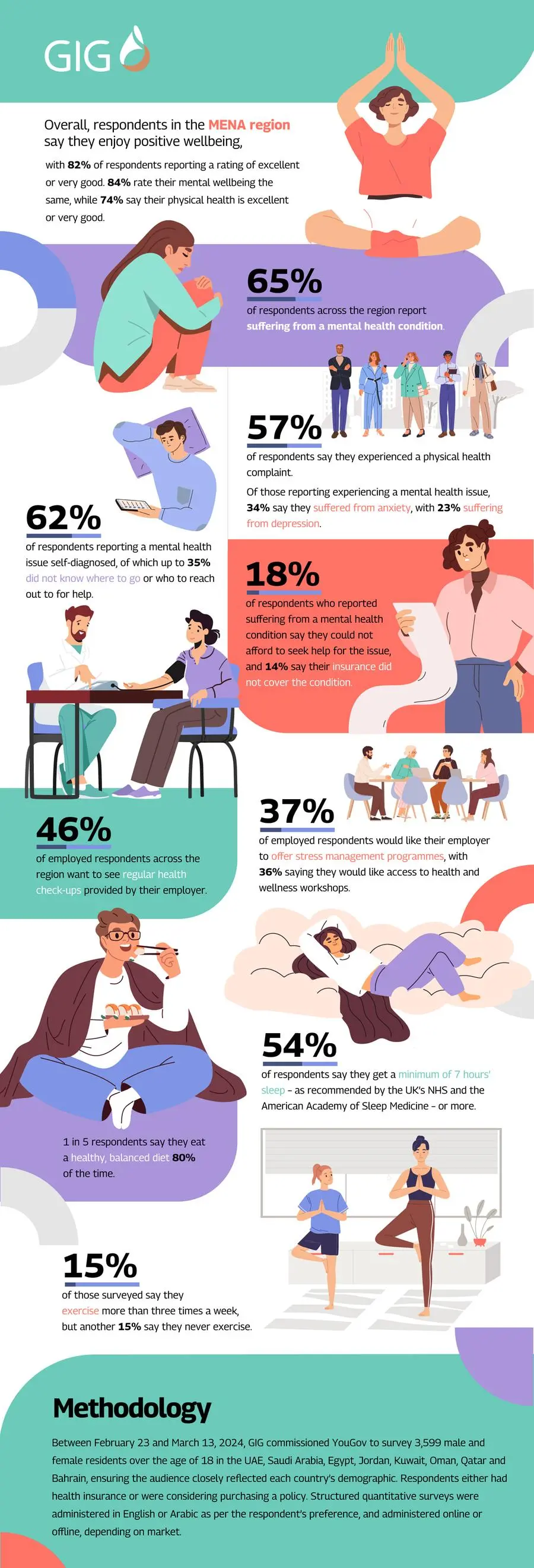

- 65% of respondents report experiencing mental health challenges in the past year, yet a surprising 82% still rate their overall wellbeing as positive.

- 74% of those surveyed report excellent or very good physical health, though ailments like allergies (15%) and musculoskeletal disorders (14%) are prevalent.

- Report highlights a need for the industry to address care gaps with comprehensive wellbeing initiatives, and prompts calls for greater industry focus on holistic wellbeing.

Kuwait City: Gulf Insurance Group (GIG) – a leading insurance provider in the Middle East and North Africa – has announced the launch of a new report that offers unique insight into the wellbeing landscape in the region. GIG’s inaugural Wellbeing Report, which underscores the company’s firm commitment to advancing holistic health, reveals both intriguing trends and areas where improvements could have a significant impact on wellbeing.

Conducted by renowned research firm YouGov on behalf of GIG Group, the report delves into key factors influencing overall wellbeing, including physical health, mental health, and lifestyle habits. Despite a generally positive outlook on wellbeing among survey respondents – based in the UAE, Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, Egypt, and Jordan – the report highlights an important trend: a significant portion of the population is facing mental health challenges and could benefit from additional support.

“We are proud to introduce our Wellbeing Report, a cornerstone of our mission to promote holistic wellbeing for all our members across the MENA region,” says Khaled Saoud Al Hasan,

Vice Chairman & CEO, Gulf Insurance Group. “With wellbeing emerging as a key focus in today’s world, our report aims to provide a clear and comprehensive picture of the wellbeing landscape and identify areas for ongoing improvement and support.”

Survey respondents were asked a range of questions about factors impacting their overall wellbeing, from physical ailments and medical conditions such as allergies and diabetes to mental health diagnoses such as depression and anxiety. The survey also explores lifestyle influences, including sleep, diet, and exercise, as well as stressors and activities undertaken to promote mental peace.

“The findings are both insightful and eye-opening,” continued Khaled Saoud Al Hasan. “While 82% of respondents reported positive overall wellbeing and 84% rated their mental wellbeing as good, 65% acknowledged facing mental health challenges in the year preceding our survey. Even more notably, 62% of those who reported mental health challenges based their responses on self-diagnosis, suggesting opportunities for better awareness and understanding of mental wellbeing in the region. Moreover, up to 35% of respondents in some countries were unsure of where to seek help, underscoring an urgent need for enhanced communication and support structures.”

In addition to mental health challenges, the report also highlights significant findings in physical health and lifestyle habits. While 74% of respondents assessed their physical health positively, ailments such as allergies (15%) and musculoskeletal disorders (14%) were frequently reported. Furthermore, lifestyle factors showed room for growth, with only 54% of respondents getting the recommended 7 hours of sleep per night, and more than half not engaging in regular exercise. These insights underscore the need for a more holistic approach to wellbeing that addresses both mental and physical health as well as lifestyle choices.

Workplace wellbeing emerged as another area of focus, with many respondents expressing a desire for employer-driven initiatives such as regular health checks, stress management programmes, and wellness workshops. Digital tools such as mental wellbeing and fitness apps were also highlighted as areas where employees would like to see greater support from their employers.

Laura Gerstein Alvarez, Chief Employee Benefits Officer, GIG Gulf concluded: “Our report opens the door for important dialogue within the industry. Why is there such a high rate of self-diagnosis for mental health challenges, and how can we ensure that all our members have access to the support they need? While these findings point to areas for further attention, we are confident that this report will inspire meaningful discussions and prompt actions to enhance wellbeing across the region.”

The survey, conducted by YouGov on behalf of GIG Group, gathered responses from 3,599 individuals – males and females over the age of 18 – across eight countries: the UAE, Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, Egypt, and Jordan. Participants were either current health insurance holders or prospective buyers, ensuring a diverse and representative sample. All responses were collected confidentially, with responses remaining anonymous to ensure the integrity and authenticity of the data.

-Ends-

ABOUT GIG

GIG is the largest insurance Group in Kuwait in terms of written and retained premiums, with operations in life and non-life as well as Takaful insurance. GIG has become one of the largest insurance networks in the Middle East and North Africa with companies in Kuwait, Bahrain, Jordan, Egypt, Turkey, Algeria, UAE, KSA, Oman, Qatar, Iraq, and Lebanon. Its reported consolidated assets stand at US$ 4.07 billion as at 30 June 2024.

Gulf Insurance Group enjoys the privilege of being the first triple-rated insurance Group in Kuwait. The Group holds a Financial Strength Rating of ‘A’ (Excellent) and issuer credit rating of ‘a+’ with Stable outlook from A.M. Best Europe – Rating Services Limited, a Financial Strength Rating of “A” with Positive outlook from Standard & Poor’s and an Insurance Financial Strength Rating (IFSR) of ‘A2’ from Moody’s Investors Service carrying a Stable outlook.

GIG is a majority-owned subsidiary of Fairfax Financial Holdings Limited, a Canadian holding company listed on the Toronto Stock Exchange, which, through its subsidiaries, is primarily engaged in property and casualty insurance and reinsurance and the associated investment management.

For more information, visit www.gulfinsgroup.com

FOR MORE INFORMATION

GIG:

Rawaan Hussien

Communication Executive

Rawaan.Hussien@gig-gulf.com

WEBER SHANDWICK:

Karan Narsinghani

Account Director

KNarsinghani@webershandwick.com

IMPORTANT LEGAL INFORMATION AND CAUTIONARY STATEMENTS CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained herein may be forward-looking statements including, but not limited to, statements that are predictions of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties and can be affected by other factors that could cause actual results and GIG GULF’s plans and objectives to differ materially from those expressed or implied in the forward-looking statements. GIG GULF undertakes no obligation to publicly update or revise any of these forward-looking statements, whether to reflect new information, future events, or circumstances or otherwise.