PHOTO

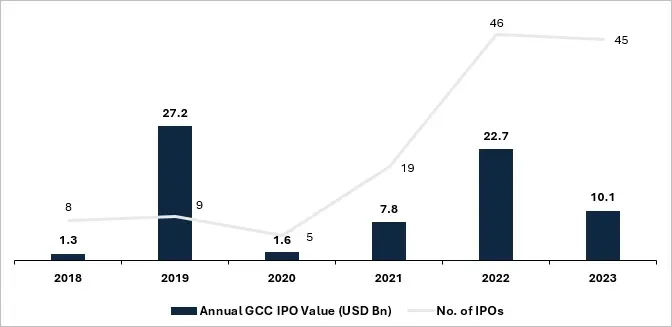

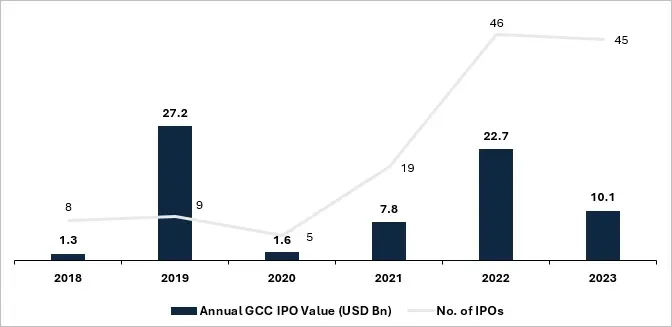

Kuwait: Kuwait Financial Centre “Markaz” released its research report titled “Initial Public Offerings (IPO) in the GCC markets”. During the year of 2023, Initial Public Offerings (IPO) in the Gulf Cooperation Council Countries (“GCC”) raised total proceeds of USD 10.1 billion through 45 offerings, marking a year-on-year decline of 55% by value compared to the previous year, where issuers raised USD 22.7 billion through 46 offerings.

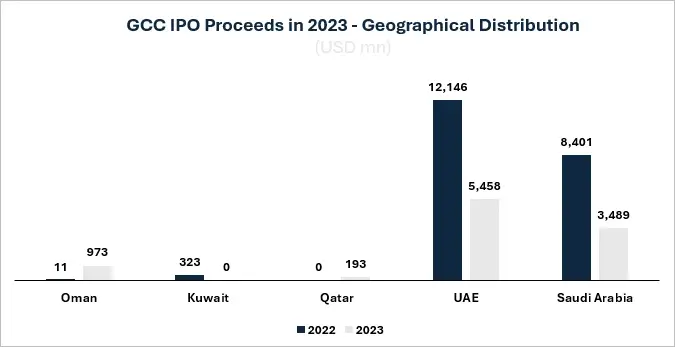

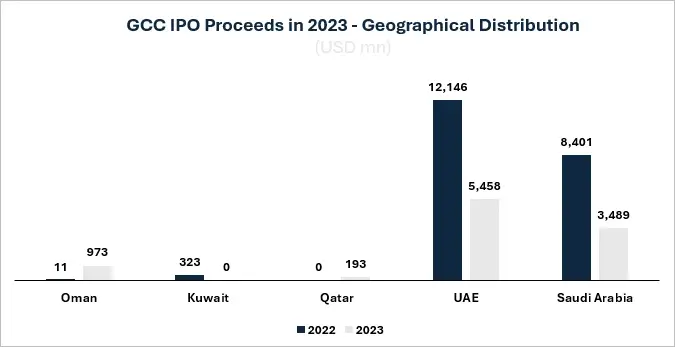

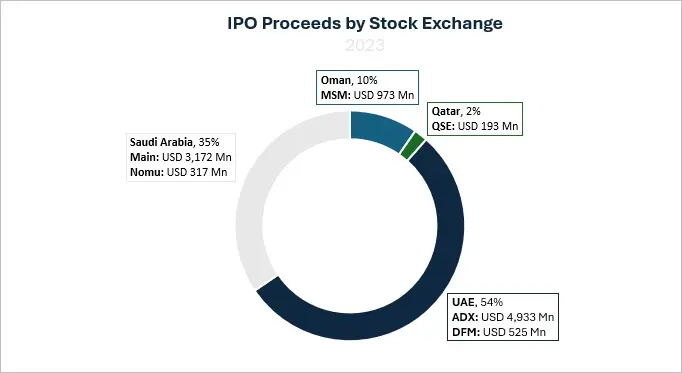

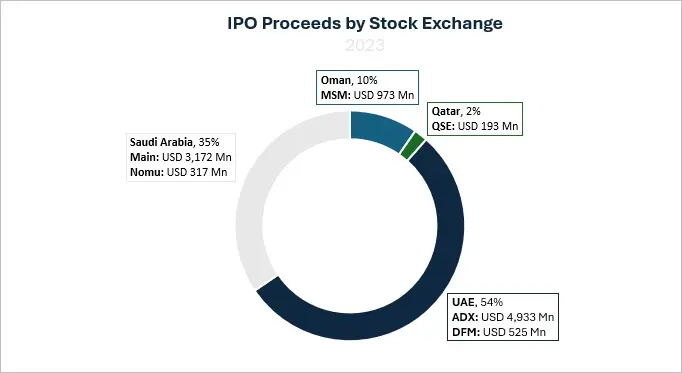

Geographical Distribution:

Markaz’s report stated that the UAE led the region in terms of IPO proceeds during 2023, raising a total of USD 5.5 billion from 7 offerings constituted 54.0% of total GCC IPO proceeds. However, this constituted a decrease of 55.0% in the value of UAE IPOs compared to the year 2022. Abu Dhabi Securities Exchange (ADX) witnessed the highest proceeds in the UAE with USD 4.9 billion followed by offerings that were listed on the Dubai Financial Market (DFM) which raised a total of USD 0.5 billion. In Saudi Exchange (Tadawul) IPO proceeds was USD 3.5 billion during the year with 35 offerings recording the highest number of IPOs in the GCC during FY 2023 and 35.0% of total GCC IPO proceeds. Muscat Securities Market (MSM) witnessed two IPOs with total proceeds of USD 973 million, constituting 10.0% of total GCC IPO proceeds raised during 2023. Qatar had one IPO that raised a total of USD 193 million and constituted 2.0% of the total GCC IPO proceeds in 2023.

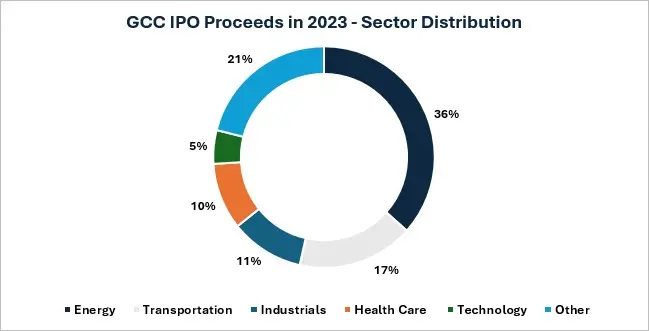

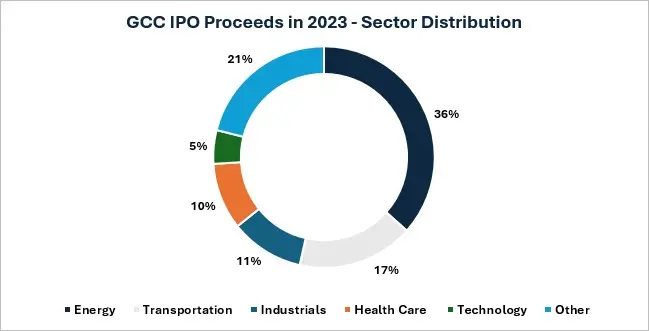

Sector Distribution:

Although, there were only 2 IPOs of companies from the energy sector, it accounted for nearly 36.0% of the total proceeds during the year. Companies in the transportation sector raised USD 1.72 billion through 16 IPOs, constituting 17.0% of total GCC IPO proceeds raised during 2023. This was followed by IPOs from the industrial and healthcare sectors that raised USD 1.1 billion (2 IPOs) and USD .985 billion (1 IPO) respectively. There was only one IPO from the technology sector (Presight AI company) with an offered size of USD 496 million. Other IPOs primarily include companies from the capital goods, consumer services, financials, F&B and Media sector among others.

Top 5 GCC IPOs by Proceeds during 2023:

Markaz’s report highlights the top 5 GCC IPOS by proceeds in 2023. Abu Dhabi National Oil Company gas business, ADNOC Gas, raised USD 2.5 billion in proceeds marking the largest IPO on ADX in March 2. ADNOC Gas offered 3.84 billion shares, or 5% stake, which was covered more than 50 times. ADNOC Gas IPO proceeds constituted 25% of total GCC IPO proceeds in the period.

ADES Holding Company IPO raised a total of 1.2 billion USD in proceeds on September 28 making it the second largest IPO in 2023. ADES Holding Company was listed on Tadawul in the Main Market and offered 338 million shares. The company was covered 9.8 times and the proceeds constituted 12% of total GCC IPO proceeds in 2023.

Pure Health IPO raised a total of USD 985 million in proceeds on December 19 marking it the third largest IPO on ADX after ADNOC Gas. Pure Health offered 1.11 billion shares or 10% stake. Pure Health IPO proceeds constituted 9.7% of total GCC IPO proceeds in 2023.

ADNOC Logistics and Services IPO raised a total of USD 771 million in proceeds on May 25 marking it the fourth largest IPO on ADX. ADNOC Logistics and Services offered 1.41 billion shares or 19% stake and was covered 163 times. ADNOC Logistics and Services IPO proceeds constituted 7.6% of total GCC IPO proceeds in 2023.

OQ Gas Network is the largest IPO in Oman in year 2023 that raised a total of USD 728 million in proceeds on October 9 through the sale of 2 billion shares, or 49% stake, with total demand of investors which reached 13.9 times. OQ Gas Network IPO constituted 7.2% of total GCC IPO proceeds of 2023.

Annual GCC IPO Value (USD Bn)

Sources: The information and statistical data herein have been obtained from sources (Bloomberg, Capital IQ, Zawya and daily newspapers) we believe to be reliable but in no way are warranted by us as to its accuracy or completeness. Markaz has no obligation to update, modify or amend this report.

Sources: The information and statistical data herein have been obtained from sources (Bloomberg, Capital IQ, Zawya and daily newspapers) we believe to be reliable but in no way are warranted by us as to its accuracy or completeness. Markaz has no obligation to update, modify or amend this report.

Sources: The information and statistical data herein have been obtained from sources (Bloomberg, Capital IQ, Zawya and daily newspapers) we believe to be reliable but in no way are warranted by us as to its accuracy or completeness. Markaz has no obligation to update, modify or amend this report.

Sources: The information and statistical data herein have been obtained from sources (Bloomberg, Capital IQ, Zawya and daily newspapers) we believe to be reliable but in no way are warranted by us as to its accuracy or completeness. Markaz has no obligation to update, modify or amend this report.

GCC IPO Pipeline

| Company | Country | Sector | Market | Offering Size (shares) | Status | |

| Pan Gulf Marketing Company | Saudi Arabia | Media | Nomu - Parallel Market | 600,000 | Subscription opens Q1 2024 | |

| WSM Digitalization & Transformation Company | Saudi Arabia | Technology | Nomu - Parallel Market | 390,000 | Subscription opens Q1 2024 | |

| Almodawat Specialized Medical Hospital Company | Saudi Arabia | Medical | Nomu - Parallel Market | 475,000 | Subscription opens Q1 2024 | |

| Lulu Group International | UAE | Retail | NA | NA | Expected for H1 2024 | |

| Spinneys Dubai LLC | UAE | Retail | NA | NA | Expected for H1 2024 | |

Sources: The information and statistical data herein have been obtained from sources (Bloomberg, Capital IQ, Zawya and daily newspapers) we believe to be reliable but in no way are warranted by us as to its accuracy or completeness. Markaz has no obligation to update, modify or amend this report.

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.16 billion as of 30 September 2023 (USD 3.75 billion). Markaz was listed on the Boursa Kuwait in 1997. Over the years, Markaz has pioneered innovation through the creation of new investment channels. These channels enjoy unique characteristics and helped Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund in Kuwait), Forsa Financial Fund (the first and only options market maker in the GCC since 2005), and the GCC Momentum Fund (the first passive fund of its kind in Kuwait and across GCC that follows the momentum methodology), all conceptualized, established, and managed by Markaz.

For further information, please contact:

Sondos S. Saad

Corporate Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com