PHOTO

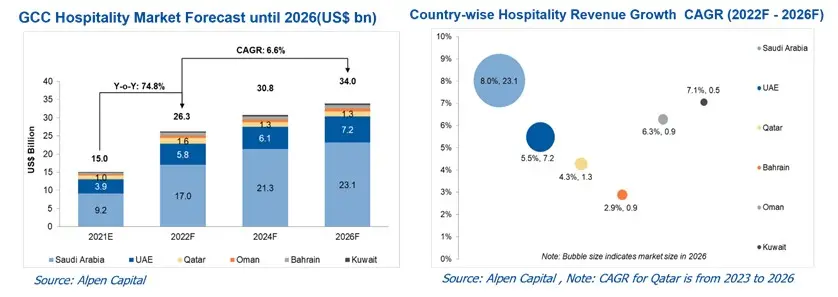

DUBAI – Alpen Capital’s latest hospitality sector report for the GCC projects the industry will return to pre-pandemic levels in 2022, registering a 74.8% year-on-year growth and reaching a revenue of USD 26.3 billion. It adds the industry is expected to grow with a Compounded Annual Growth Rate (CAGR) of 6.6% up to 2026.

UAE-based investment banking advisory firm, Alpen Capital, launched its latest GCC Hospitality Industry report on Wednesday, August 3rd featuring detailed studies and forecasts on the hospitality sector, analyzing recent trends, growth drivers and challenges facing this dynamic segment. It also profiles some of the renowned hospitality companies in the region.

The report was launched over a webinar followed by a panel discussion featuring Sanjay Bhatia, Managing Director, Alpen Capital; Hala Matar Choufany, President - Middle East, Africa & South Asia, HVS Yahia Idris, Principal, Nova International. Sameena Ahmad, Managing Director, Alpen Capital moderated the discussion.

Factors like increasing tourist arrivals, mega events like EXPO 2020 Dubai and the upcoming FIFA World Cup 2022 and easing of visa regulations will lead to the industry’s growth. With regional governments actively supporting the development of business, leisure, and entertainment centers through significant investments, the GCC is becoming a hub of action with a long list of events in the pipeline.

The pandemic has accelerated the adoption of technology and digitization for operators looking to streamline procedures as well as improve overall level of customer experience. The demand for mid-scale hotels, service apartments and Airbnb’s is also on the rise as it offers flexibility and affordability.", says Sameena Ahmad, Managing Director, Alpen Capital (ME) Limited.

“Revival in business activity as economies reopened post the pandemic led to M&A activity stirring up again in the region. GCC witnessed several cross-border transactions as companies focused on strengthening their geographical presence while also expanding and diversifying their service offerings. Going forward, consolidation in the hotel sector is likely to intensify as pressure on companies to drive earnings and gain market share continues to mount in the face of rising competition and increasing threat from online portals and alternative lodging service providers. “, says Sanjay Bhatia, Managing Director, Alpen Capital (ME) Ltd.

According to Alpen Capital, the GCC Hospitality industry revenues are forecasted to grow at a pace of 6.6% CAGR between 2022 and 2026 to reach US$ 34.0 billion. Strategies adopted by the regional governments, economic recovery, increase in tourist arrivals along with innovative solutions being offered by the operators are primary drivers of growth for the industry.

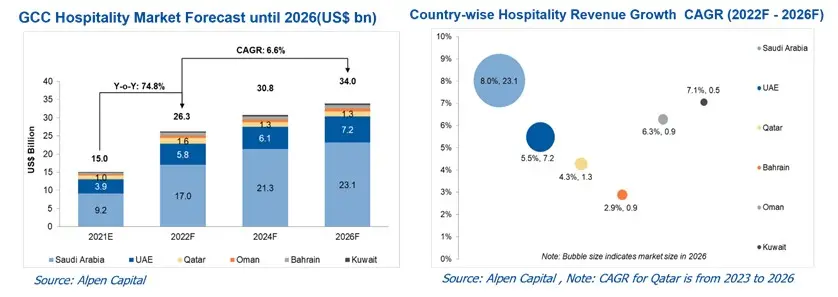

Growth in the hospitality sector revenue of individual GCC countries is expected to range from a CAGR of 2.9% to 8.0% between 2022 – 2026. Largest markets in the GCC, Saudi Arabia and UAE, are expected to witness CAGRs of 8.0% and 5.5%, respectively. Kuwait, Oman and Bahrain are expected to grow at 7.1%, 6.3% and 2.9%, respectively. Whereas growth in Qatar is expected to normalize post the completion of the FIFA World Cup 2022 with a CAGR of 4.3% between 2023-2026.

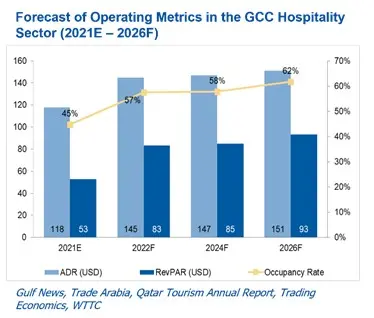

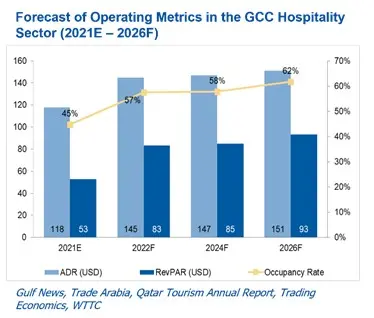

After witnessing a significant increase this year, the hospitality operating metrics are likely to witness steady growth going forward. Average occupancy rate across the GCC is forecasted to rise from 57% in 2022 to 62% in 2026. The Average Daily Rate is forecasted to increase from USD 145 this year to USD 151 in 2026, whilst Revenue Per Available Room is expected to increase from USD 83 to USD 93 representing an annualized growth rate of 1.1% and 2.9%, respectively.

Business confidence in the region is bouncing back quicker with the reopening of borders and easing of travel restrictions. GCC is fast becoming a global center for business, entertainment, and sporting events, and is set to host major events like FIFA World Cup 2022, Formula 1 Grand Prix, World Aquatics Championship, Geneva International Motor Show Qatar, Asian Games, etc. Moreover, improvements in per capita income will increase domestic consumer demand which will continue to help boost the tourism sector. GCC countries are also upgrading their transportation ecosystem, from expanding airport capacity to adopting Hyperloop-based transport and a new railway corridor. They have been actively investing in developing tourism-related infrastructure while promoting leisure destinations. Saudi Arabia, especially, has undertaken several socio-economic reforms to make the Kingdom more modern, liberal, and business and tourism friendly to increase its attractiveness for international tourists.

However, the report also notes that global inflation, sharp adjustments in oil prices and revenue pose threats to the industry. The high rate of inflation is likely to impact consumer spending power, whilst travel could also be impacted by uneven vaccination rates and new COVID-19 strains.

The Covid-19 outbreak required the region’s hospitality sector to diversify its offering to remain competitive and relevant to attract visitors, and the industry responded with innovation and vibrant new business models. Notable trends include the introduction of mid-scale brands and serviced apartments, with digitization helping operators streamline workflows, reduce costs, and enhance customer experience. The Airbnb model has also started gaining considerable ground in the GCC, the Alpen report stated. Religious tourism continues to play a significant role and growth in the number of pilgrims has compelled Saudi Arabia to offer a wide range of hospitality services. Other states are adopting distinct models of engagement between heritage and religious spheres to attract tourism. Going forward the GCC hospitality industry is expected to emerge stronger from the crisis, ahead of its peers.

-Ends-

About Alpen Capital:

Alpen Capital (ME) Limited is incorporated as a limited liability company in the Dubai International Financial Centre, Dubai, United Arab Emirates and is licensed by the Dubai Financial Services Authority. Alpen Capital offers a full range of investment banking advisory services in the areas of M & A, Debt, Equity and Capital Markets to some of the largest business conglomerates and financial institutions in the GCC and South Asia. Apart from the UAE, it has offices in Qatar, Oman and India.

About Alpen Asset Advisors:

Alpen Asset Advisors Limited, is an independent wealth management firm offering private banking and asset management services. It offers a comprehensive offering covering all asset classes, investment themes & styles and sectors. With our open architecture platform we identify investment opportunities and design an investment program to achieve the wealth creation within the given risk appetite.

For media queries, please contact:

Sameena Ahmad, Corporate Affairs

Email: sameena.ahmad@alpencapital.com

Alpen Capital (ME) Ltd

www.alpencapital.com

Rasheed Palliyalil

Watermelon Communications

Dubai, UAE

rasheed@watermelonme.com