PHOTO

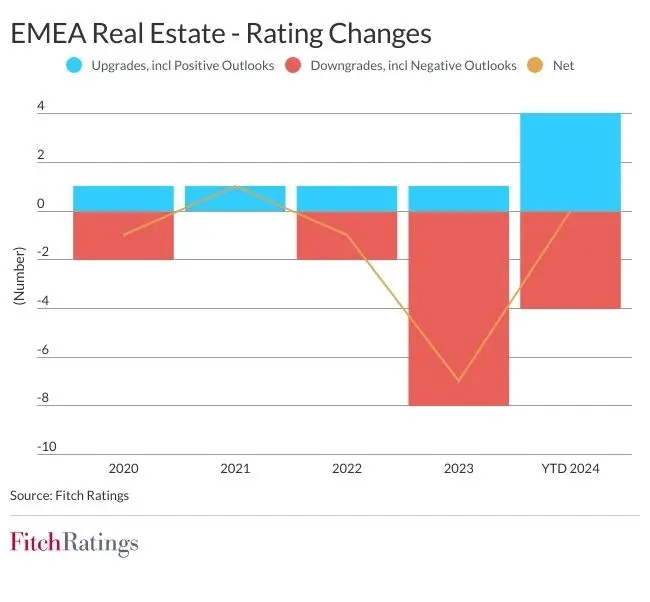

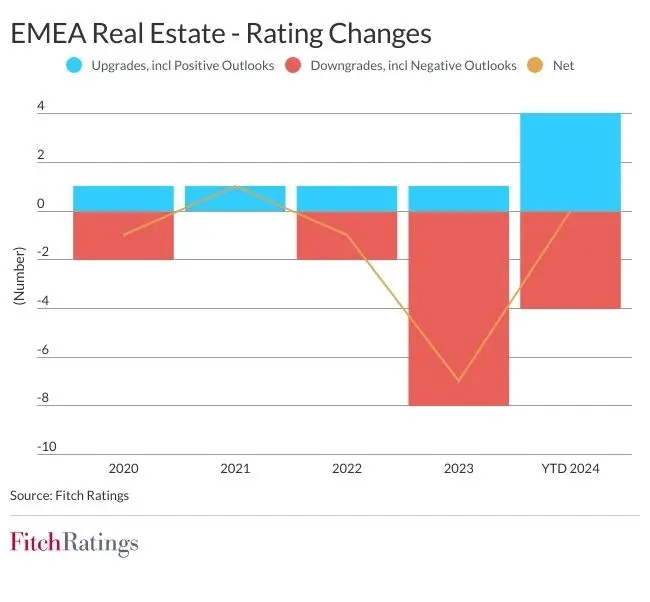

Fitch Ratings has changed its sector outlook for EMEA real estate to neutral from deteriorating, reflecting a largely complete recalibration of asset values to higher interest rates and improved access of sound property companies to bond markets.

As explained in our EMEA Real Estate 2024 Mid-Year Outlook, we believe that the worst of commercial property valuation declines have now been booked and that market confidence has improved, with interest rates unlikely to increase further. This is a notable shift since last year, which was accompanied by the sector facing unreceptive bond markets that were waiting for asset values to settle. From 2022 until end-2023, real estate companies predominantly used bank funding and disposals to meet their scheduled debt maturities, but, since December 2023, bond market access for stronger companies has improved significantly, which, in turn, improved their funding options.

Most Fitch-rated issuers have gradually chipped away at their refinancing wall in the past 12 months. Canary Wharf, Sirius, Warehouses de Pauw, Wereldhave, Catena and SEGRO have issued equity; Klépierre, Vonovia and Unibail-Rodamco-Westfield have issued long-dated bonds, while Vonovia and SBB have received private equity financing. However, several companies still face near-term refinancing risk, including Canary Wharf, Heimstaden Bostad, Peach Property and SBB, and their ratings reflect this.

Strong tenant demand for offices in prime locations with flexible space and good ESG credentials is fuelling rising office rents in major western Europe central business districts, where vacancy rates are low. However, some secondary offices are at risk of becoming obsolete due to a combination of tenants requiring less space, remote working practices, particularly in long-commute locations and “brown discounts” due to building upgrade costs to meet EPC standards. Secondary office vacancy rates are rising fast.

Retail landlords that have invested in shopping centres are reporting increased rents, retailers using cost-effective physical stores to also fulfil online orders and successful brands expanding their store sizes. Adjacent or surplus space may be repurposed into footfall-conducive residential use. UK shopping centre values and rents have stabilised, after declines in passing rent since 2018.

The logistics asset class continues to show solid growth. Alongside prospective logistics and e-commerce growth, there is a need for modern ESG-compliant energy-efficient space for on-shoring and near-shoring, as well as for new production technologies. Speculative build remains disciplined.

Supply in many European residential-for-rent markets remains tight. Rent indices phase inflation-linked rent increases over multiple years to help ensure tenant affordability. Companies’ portfolios cannot churn vacated units quickly enough to attain rents closer to market levels. This means that potential rent increases remain locked-up as inherent value, while landlords’ costs and the cost of capital rise. Consequently, many residential-for-rent companies’ interest coverage ratios are tightening. However, market rents would have to reduce significantly to adversely affect regulated units’ rents, and rents have already risen sharply in the unregulated UK market.

-Ends-

Tahmina Pinnington-Mannan

Director, Corporate Communications

Fitch Group, 30 North Colonnade, London E14 5GN

tahmina.p-mannan@thefitchgroup.com