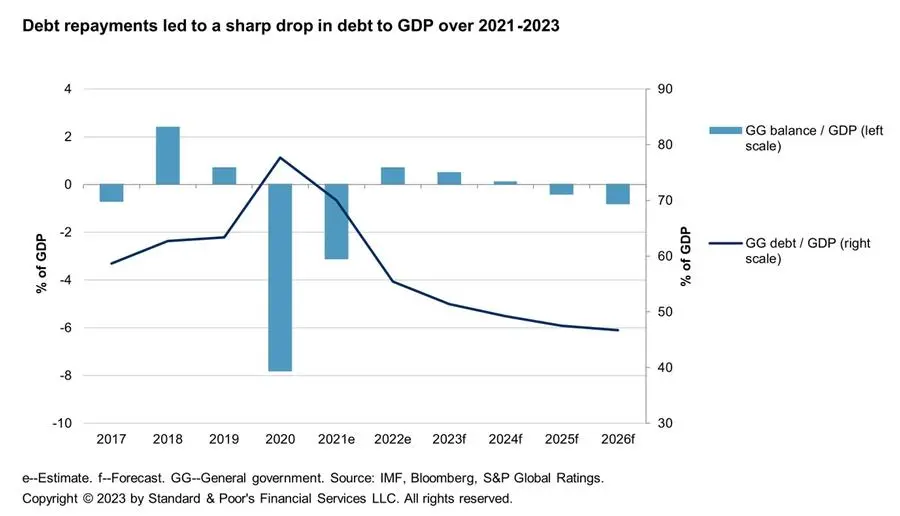

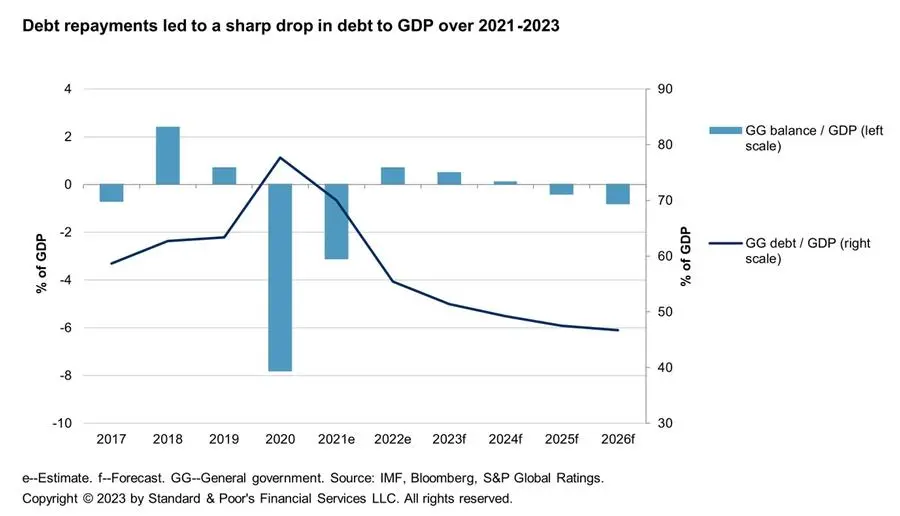

We forecast a reduction in government debt to about 51% of GDP in 2023 from a cyclical high of 78% in 2020. The government's debt stock could fall even faster if the reduction in nominal debt, which occurred in 2021 and to a more significant extent in 2022, continues over the coming years.

Nevertheless, broader public sector debt will remain high at about 100% of GDP, when considering liabilities from nonfinancial government-related entities (GREs) of about 48% of GDP.

This year, we expect Dubai's real GDP to expand about 3%, while local and United Arab Emirates (UAE)-wide structural and social reforms and programs should support longer-term growth.

In this article, S&P Global Ratings responds to frequently asked questions from investors on how we view Dubai's economic fundamentals from a credit perspective. This is also important for the analysis of the Dubai-based issuers we rate. Since we do not rate Dubai itself, our views are based on publicly available information.

Frequently Asked Questions

What are Dubai's economic growth prospects?

We expect Dubai's relatively well-diversified and service-oriented economy to expand about 3.0% in 2023, slowing from an estimated 5.0% in 2022 and 6.2% in 2021. In our view, this year will be more reflective of regular economic activity in the emirate compared with the post-pandemic recovery years. We expect continued strong momentum in the hospitality, real estate, trade, and financial services sectors to support growth.

Dubai received 14.4 million international overnight visitors in 2022, narrowing the gap with the 16.7 million pre-pandemic in 2019. This robust performance continued in 2023, with 4.7 million international visitors recorded in the first quarter versus close to 4.8 million in the same period of 2019. Average hotel occupancy also stood at 81% in first-quarter 2023 according to data published by Dubai Department of Economy and Tourism --a high level considering the increased room supply in recent years. In addition to hospitality, the real estate sector expanded strongly in 2022. Residential real estate transactions increased 45% by volume and 77% by value to UAE dirham (AED) 528 billion (see "Dubai Property Market 2023: Demand Should Hold Up Against Global Economic Pressures," published March 10, 2023, on RatingsDirect).

We expect economic growth to be sustained at about 3% in the next two to three years. In turn, we took several positive rating actions on corporates headquartered in Dubai in recent months, including two real estate developers Emaar Properties PJSC (BBB-/Stable/--) and Damac Real Estate Development Ltd. (BB-/Positive/--), a mall operator Emaar Malls Management LLC (BBB-/Stable/--), and an education group GEMS MENASA (B/Stable/--). Our 2023 outlook for corporates in Dubai is stable because we expect resilient performance despite mounting global economic pressures--such as high inflation and interest rates--even as global debt capital markets remain challenging. We expect continued albeit slower growth, generally balanced funding and debt maturity profiles, and healthy profitability to help rated entities navigate volatility in global financial markets.

Is Dubai still susceptible to boom and bust cycles?

Dubai's open economy is structurally exposed to the cyclicality of global and regional demand.

Although hydrocarbons directly contribute only about 2% to Dubai's real GDP, the Gulf Cooperation Council (GCC)'s oil market indirectly affects the emirate's trade, transport, tourism, and real estate markets. Given our relatively high medium-term oil price assumptions, we expect regional sentiment and therefore demand to remain supportive of economic activity in Dubai (see "S&P Global Ratings Revises Approach To Determining Its Hydrocarbon Price Decks; Changes Definition Of Long-Term Price," published April 20, 2023).

Dubai's reputation as one of the safer, more socially liberal, and accessible destinations in the GCC supports population and capital inflows from other regions in times of political turmoil. In addition to its effect on global oil markets, the Russia-Ukraine war has also led to large inflows of Russian nationals and capital. Notably, Russians were one of the emirate's top five real estate buyers by nationality in 2022. Dubai's tourism momentum was also reinforced by the success of the 2020 World Expo (Expo 2020), which spanned October 2021 to March 2022 after being delayed by the pandemic, and spillovers from the FIFA World Cup hosted by Qatar in late 2022.

Although Dubai can be characterized as having a high cost of living, official statistics suggest it is experiencing relatively limited inflation pressure, averaging 4.7% in 2022. We project a moderation to 2%-3% in the next two to three years. The negative effects of banking sector volatility in other regions also appear limited in the UAE due to banks' good funding and liquidity profiles and our expectation that government support would be provided if needed (see"Why Most GCC Banks Can Manage Contagion Risk From SVB," published March 16, 2023, and "UAE Banking Sector 2023 Outlook," published Jan 13, 2023).

What are the key government policies supporting economic growth?

We expect UAE-wide social and economic reforms to benefit Dubai and support its medium- and long-term economic growth prospects. Recent reforms introduced to more closely align the operating environment with those in more developed markets include:

- The ability for foreigners to own 100% of mainland companies in more than 1,000 commercial and industrial activities;

- The switch to a Monday-Friday workweek from Sunday-Thursday;

- Simplification and expansion of eligibility criteria for the 10-year 'golden' residence visa; - The launch of a five-year 'green' residence visa scheme; and

- Social reforms such as the decriminalization of alcohol consumption (without a license) in authorized areas and pre-marital cohabitation.

We expect these reforms to help Dubai and the wider UAE economy attract businesses and retain skilled workers.

Government labor reforms introduced in 2022 and early 2023 include shorter fixed-term contracts, a minimum wage, flexible working hours, and the introduction of unemployment insurance. Moreover, the Dubai government established a Virtual Asset Regulatory Authority in 2022, which issued new guidelines for virtual assets like cryptocurrencies in early 2023. Although these broad-based reforms underpin Dubai's position as the favored destination for expats in the region, the UAE government's Emiratization policy also nurtures employment opportunities for the local population.

We do not factor any significant impact on Dubai's economy related to the Saudi Arabian government's aim to encourage multinationals to base their regional headquarters in the kingdom.

Most international companies' regional offices tend to be in Dubai and continued labor, foreign investment, and other business reforms by the UAE and Dubai government will maintain the emirate's attractiveness, in our view. Equally, we don't think that the introduction of a corporate tax from June 2023 will significantly deter the establishment of new businesses. The announced 9% tax rate will remain competitive for the region and globally, and many companies will benefit from recently announced exemptions (see "The Introduction Of Corporate Tax In The UAE Will Benefit Government Revenue Diversity Without Overburdening Companies, Banks, Or Insurers," published Feb. 7, 2022). At the same time, free zones will continue to offer tax-free operations, while we do not expect personal income, capital gains, or dividend taxes to be introduced in the short term.

We also believe that the government's announcement of the Dubai Economic Agenda D33 (D33) earlier this year is an important step toward achieving sustainable and diversified economic growth in the long run. Key goals include doubling the size of Dubai's economy by the next decade along with an almost similar magnitude of growth in foreign direct investment and trade. The authorities aim to achieve these objectives by, among other things, increasing trade with nontraditional markets, attracting the world's best universities, supporting small and midsize enterprises, and launching a plan for green and sustainable manufacturing. These projects are expected to provide the necessary impetus to increase foreign direct investment to AED60 billion annually from AED32 billion currently and increase private sector investment to up to AED1 trillion in the next decade. The D33 plan will run alongside the federal government's "We The UAE 2031"

plan and the "Dubai 2040 Urban Master Plan". In our view, even if all of the ambitious targets included in the plans are not achieved, they provide an impetus to support economic activity in Dubai over the medium term.

How does Dubai's wealth compare with that of the other emirates?

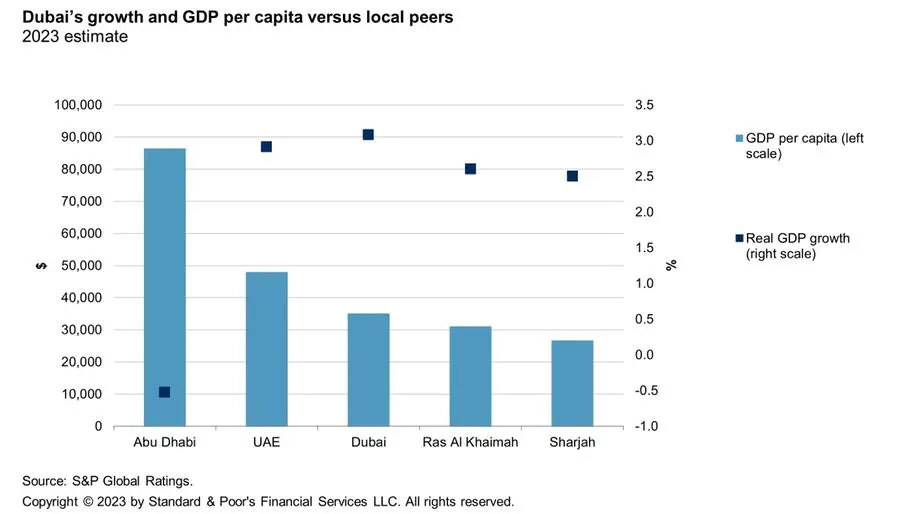

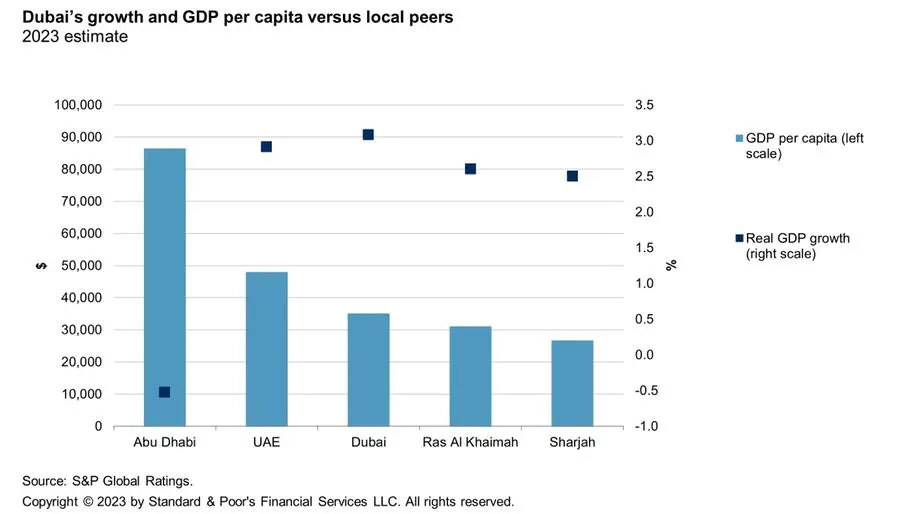

In our view, labor supply has been a key driver of economic activity in Dubai rather than productivity gains or capital investment. We note that many people live in the surrounding emirates, especially Sharjah, and commute to Dubai for work. This population stood at about 1 million in 2021, according to estimates published by the Dubai Statistics Center. As per the same source, Dubai's resident population reached 3.5 million in 2021 and we project it will cross 4.0 million by 2026 on the back of strong expatriate inflows. This, along with our moderating growth forecast, will result in largely flat real GDP per capita growth in the next two to three years. We forecast Abu Dhabi (AA/Stable/A-1+), Ras Al Khaimah (RAK; A-/Stable/A-2), and Sharjah's (BBB-/Stable/A-3) populations will reach 3.3 million, 0.4 million, and 1.5 million respectively in 2023.

We estimate Dubai's GDP per capita (in U.S. dollars) at about $34,000 in 2023, which is significantly lower than that of Abu Dhabi given the latter's high hydrocarbon sector wealth. We forecast broadly similar GDP growth rates in Dubai and the smaller emirates in 2023, with Abu Dhabi's growth weakened by an expected decline in hydrocarbon output due to OPEC+ production cuts (see chart 1). In nominal GDP terms, we estimate Dubai's economy is about 3.3x the size of Sharjah's and 10.5x that of RAK.

What are your expectations for the Dubai government's fiscal deficits?

Broadly in line with the government's 2023 budget, we expect modest fiscal surpluses averaging about 0.3% of Dubai's GDP in 2023-2024, following an estimated surplus of 0.7% of GDP in 2022.

In 2020, Dubai recorded a deficit of about AED30 billion (7.8% of GDP), owing to a pandemic-related increase in health care spending, a reduction in economic activity, and the subsequent decline in revenue. According to our estimates, the deficit narrowed to 3% in 2021 as revenue recovered.

In our fiscal forecast, we project revenue and expenditure will stabilize at about 16% of GDP each in the next two to three years. We expect taxes (customs, value-added, corporate tax on profits earned by foreign banks operating in Dubai, and excise among others) to make up about 40% of government revenue, with about 60% originating from nontax sources such as fees, fines, and grants. This includes land transfer and mortgage registration fees, housing and municipality fees, transport-related fees, and profit shares from companies such as Dubai Electricity and Water Authority (DEWA). Economic activity--especially in trade, tourism, and real estate--and population growth will support tax and nontax revenue growth alike. Fees constitute more than 80% of nontax revenue and we expect this income stream to remain strong. Our expenditure forecasts are more conservative than the government budget because we account for higher spending, partly to achieve some of the initiatives outlined in the D33 plan.

The UAE announced a new corporate income tax of 9% on profits above $102,110 from June 2023.

It is unclear how the authorities will distribute the tax receipts between the federal government and the emirates. We expect the bulk of revenue gains from corporate tax to accrue from 2025 owing to the expected lag between tax filing by companies and the cash payments being received by the emirates. We expect the tax returns from businesses to increase transparency, which could help reduce concerns raised by anti-money-laundering watchdog, the Financial Action Task Force (FATF), around business activities within free zones (see "What The UAE's Inclusion On FATF's Gray List Will Likely Mean For Corporates, Banks, And Insurers," published March 7, 2022).

Is Dubai's debt burden still a concern?

We expect Dubai's gross general government debt will decline to 51% of GDP ($66 billion) by year-end 2023 from 78% of GDP in 2020. The government has been repaying its debt, including $2.9 billion in bonds from 2020 to first-quarter 2023, and reduced its loans from Emirates NBD by 30% over the same period. The components of our gross general government debt estimate for 2023 are as follows:

- 44% is loans from Emirates NBD, a Dubai-based bank. The government of Dubai owns 56% of Emirates NBD through its holding company Investment Corp. of Dubai (ICD).

- 30% is the $20 billion in loans extended by Abu Dhabi and the Central Bank of the UAE (CBUAE) in the wake of the 2009 financial crisis.

- 26% is outstanding securities issued by the government, as well as other bilateral and syndicated facilities.

In our base case, we assume the government debt stock will remain broadly flat in nominal terms over the period to 2026, but decline as a share of GDP (see chart 2). We expect the $20 billion facility provided by Abu Dhabi and the CBUAE to be rolled over and broadly the same amount of Emirates NBD loan and bilateral and syndicated facilities. The Abu Dhabi and CBUAE facilities have been rolled over twice before, most recently in March 2019 for a five-year period with a concessional 1% interest rate.

Despite a declining government debt burden, Dubai's sizeable public sector debt (100% of GDP) and relatively limited assets constrain its ability to absorb economic shocks. Nevertheless, the robust recovery of the real estate and tourism sectors should help some GREs to deleverage and reduce rollover risks amid current favorable operating conditions. By our reckoning, Dubai's government liquid assets largely comprise ICD's minority listed holdings, which we estimate at about 6% of GDP in 2023. As a result, we estimate net general government debt at about 45% of Dubai's GDP in 2023 and net public sector debt at 93% of GDP.

The establishment of the government of Dubai's Debt Management Office in 2022 should help further improve the structure of its debt, perhaps by lengthening maturities, diversifying funding sources, and developing an efficient market for government securities. We also expect to see some improvement in transparency, with more regular reporting of debt-related data.

Nevertheless, currently significant shortcomings remain in the dissemination of fiscal data.

Dubai is actively monetizing its assets with plans to list 10 government-owned companies announced last year. Some were listed in 2022, with estimated cash proceeds for the government of about AED30 billion ($8 billion). These included part sales of utility DEWA (AED22.3 billion raised), toll operator Salik (AED3.7 billion), and district cooling service provider Empower (AED2.6 billion). With six more companies still to be listed, the government should see another liquidity boost, which could support further debt reduction.

-Ends-

Copyright © 2023 by Standard & Poor’s Financial Services LLC. All rights reserved.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors.

Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities.

As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

STANDARD & POOR’S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor’s Financial Services LLC.

PRIMARY CREDIT ANALYST

Juili Pargaonkar Dubai

juili.pargaonkar@spglobal.com

SECONDARY CONTACTS

Trevor Cullinan Dubai

trevor.cullinan@spglobal.com

Tatjana Lescova

Dubai

tatjana.lescova@spglobal.com

Dhruv Roy

Dubai

dhruv.roy@spglobal.com