- A landmark survey* of individual investors across the United Arab Emirates (UAE) by Friends Provident International (FPI) highlights the need for much greater regulation of financial advice provided by ‘celebrity’ social media influencers

Dubai: One of the key features of the financial advice landscape in the UAE is that social media influencers play an important role.

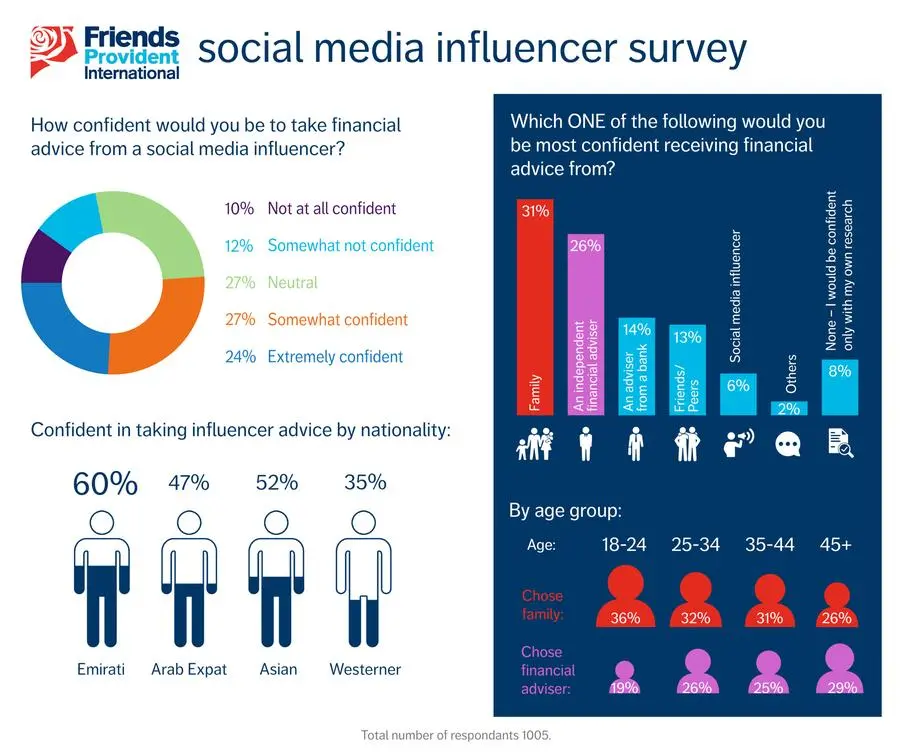

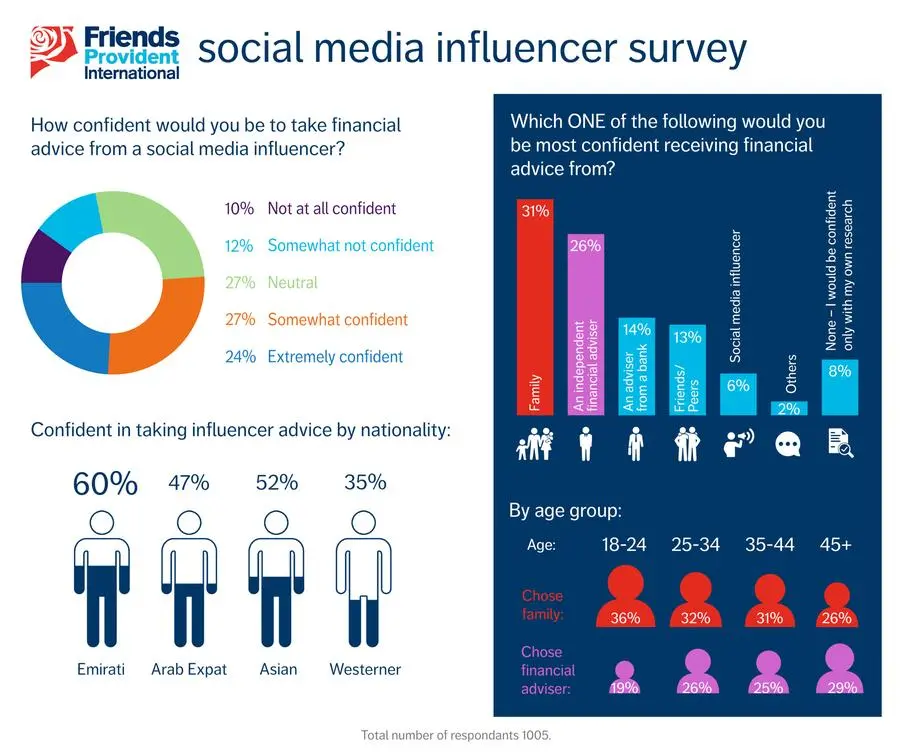

No fewer than 24% of individual investors say that they would be ‘extremely confident’ in taking financial advice from a social media influencer. An additional 27% say that they would be ‘somewhat confident’ in doing so.

The figures vary markedly by nationality. At one extreme, 60% of Emirati investors would be ‘extremely’ or ‘somewhat’ confident in taking financial advice from a social media influencer. At the other extreme, the corresponding figure is just 35% for Westerners. Some 46% of Westerners say that they would be ‘somewhat not confident’ or ‘not at all confident’ in taking financial advice from a social media influencer.

Social media influencers: providing financial advice to some, but advice on financial futures to very few

Later in the survey investors were also asked to name which one provider of advice would make them feel better equipped to make decisions about their financial futures.

Social media influencers were named by just 6% of investors. Of increasing importance are friends/peers (13%), bank advisers (14%), independent financial advisers (IFAs - 26%) and family (31%). Some 8% of investors rely entirely on their own research efforts, while 2% depend on other sources of advice in relation to their financial futures.

The extent to which investors rely on family members for advice about their financial futures varies widely. Women (39%) are much more likely than men (27%) to use a family member as a sole source of advice. The same is true of those who are aged 18-24 (36%) than those who are 45 or older (26%). Investors with monthly incomes of AED10,000 or less (37%) depend on family members more than those with monthly incomes of over AED25,000 (22%).

Notes David Kneeshaw, Group Chief Executive of International Financial Group Limited, of which FPI is part:

“Individual investors in the UAE often place far too much weight on the views of social media influencers - who may be completely ignorant or paid to promote a particular idea or product.”

David also added “A concerted publicity campaign that highlights the benefits of professional advice is not all that is needed. As is the case in other countries in which FPI operates, there should be far greater regulation in the UAE that curbs the impact of social media influencers”

*The survey was conducted during December 2022. There were 1,005 respondents. Respondents were classified according to: nationality; Emirate of residence; age; gender; and monthly income.

-Ends-

For further information please contact

Nigel Sillitoe

CEO, Insight Discovery

Email: sillitoe@insight-discovery.com

About Friends Provident International

Friends Provident International (FPI) is a global life assurance company with offices in the Isle of Man, UAE, Hong Kong and Singapore. FPI has been working in the GCC and Middle East since 2007, distributing competitive life assurance and investment solutions, via a network of expert independent financial advisers.

Regulated by the Central Bank UAE, FPI is authorised to market products to regulated financial advisory firms operating throughout the GCC. Customers trust FPI to give them the freedom to get the most from life, to protect the things they value and to save for what is important to them.

FPI has over 40 years of experience in the international life assurance market and can trace its heritage back to 1978. It was purchased by Friends Provident in 2003, and renamed Friends Provident International.

FPI provides savings, investment and protection to customers in Asia and the UAE. With offices in Dubai, Hong Kong, Singapore and the Isle of Man, they have staff worldwide, who are committed to helping customers achieve their financial goals. FPI was purchased by IFGL in July 2020.