Dubai, UAE: The UAE’s leading property portals Bayut & dubizzle have published their combined Dubai Property Market Reports for Q3 2022. Based on the data collected by these powerhouse portals, prices in Dubai’s property sector have continued to appreciate across popular neighbourhoods in the emirate. This sustained growth in rent and sale prices is testament to the healthy demand for affordable and luxury properties in Dubai.

- Based on the combined data from Bayut & dubizzle’s sales prices for apartments and villas in the most prominent neighbourhoods of Dubai have recorded upticks of 1% to 14% in Q3 2022.

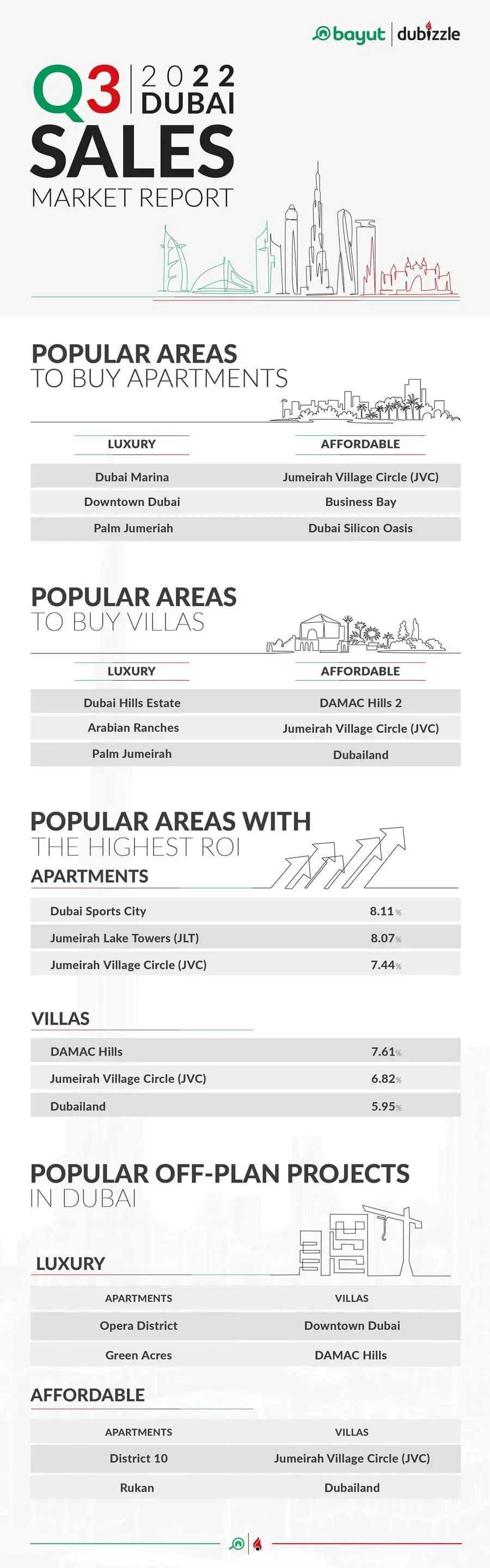

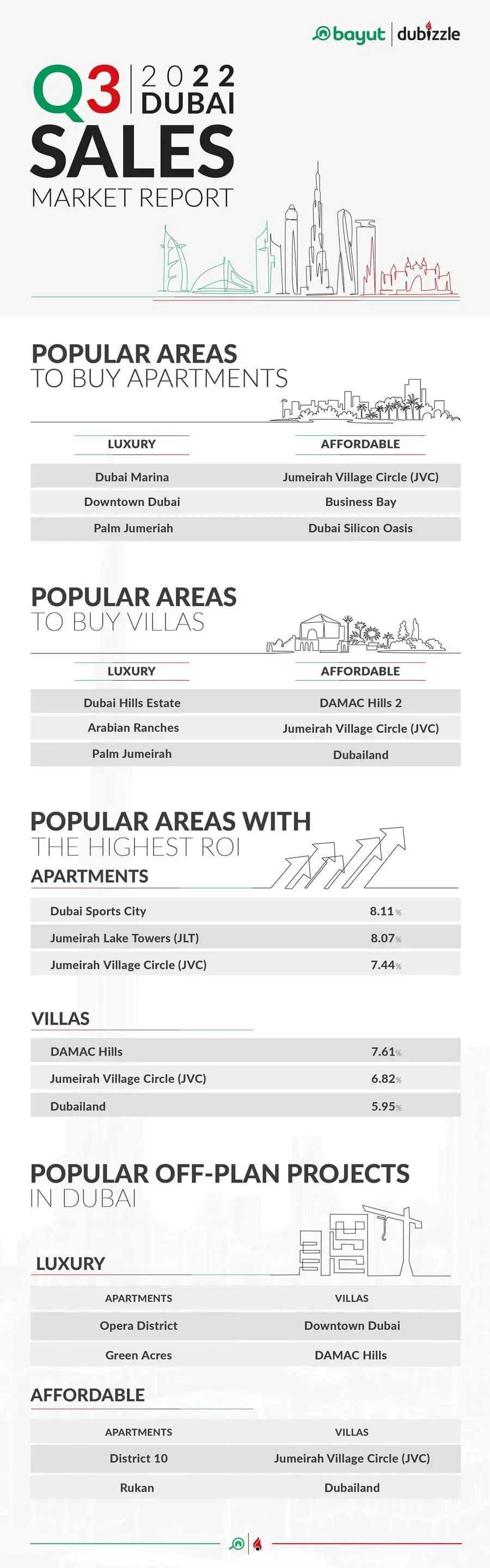

- Prospective investors in search of affordable apartments and villas have focused their interests in areas like Jumeirah Village Circle (JVC), Business Bay, DAMAC Hills 2 and Dubailand. Potential buyers for luxury properties have concentrated more on the established communities of Dubai Marina, Downtown Dubai, Dubai Hills Estate and Arabian Ranches in Q3 2022.

- Prices for budget-friendly rental apartments in Dubai’s prominent areas have experienced increases of 2% to 21%, while luxury apartment rentals have appreciated by up to 14%. Buy-to-let villas in the affordable segment have become more expensive by up to 15%, whereas areas with upscale villa properties have recorded upticks of up to 25% in asking rents.

- Tenants looking for affordable housing options have been keen on Jumeirah Village Circle (JVC) and Business Bay for apartments, whereas DAMAC Hills 2 and Mirdif have been popular for affordable villa rentals. For luxury rentals, tenants have preferred Dubai Marina and Downtown Dubai for apartments, while Al Barsha and Jumeirah have remained the top choices for villas.

- Based on the data released by Dubai Land Department, the emirate recorded 22,229 residential property sales transactions worth AED 50.83B during Q3 2022. This could be attributed to the influx of foreign investment and business-friendly initiatives in Dubai.

Properties for Sale

Apartments:

Dubai Marina has continued to top the popularity charts for luxury apartment sales in Dubai.

- The sales priceper-square-foot for flats in Dubai Marina has increased by 2.18% to average at AED 1,532 during Q3 2022.

- Potential investors for expensive flats have also considered properties in Downtown Dubai, Palm Jumeirah, Jumeirah Beach Residence and Dubai Hills Estate. The average sale priceper-square-foot for all these communities has appreciated by up to 6%.

- According to the search trends observed at Bayut and dubizzle, Jumeirah Village Circle has remained the most attractive option for affordable flats in Dubai.

- Buyto-let apartments in Jumeirah Village Circle have experienced an uptick of 1.94% in average sales priceper-square-foot, at AED 891 in Q3 2022.

- Buyers looking for affordable apartments for sale in Dubai have also shown a keen interest in neighbourhoods like Business Bay, Dubai Silicon Oasis, Jumeirah Lake Towers and Dubai Sports City. There has been an increase of 2% to 15% increase in the average sales priceper-square-foot. The highest uptick was recorded for properties in Dubai Silicon Oasis.

Villas:

Based on the data collected by Bayut & dubizzle, the average sale prices for luxury villas in Dubai have increased in most of the popular neighbourhoods during Q3 2022.

- Dubai Hills Estate has emerged as the most soughtafter district for buy-to-let luxury villas, during the third quarter of 2022. The sale priceper-square-foot for villas in Dubai Hills Estate has recorded an uptick of 3.36%, averaging at AED 1,660.

- The buyto-let expensive villas in Arabian Ranches have also remained a popular option for buyers. The average priceper-square-foot for villa properties in this neighbourhood has appreciated by 1.52% in Q3 2022, to stand at AED 1,241.

- The iconic Palm Jumeirah and the suburban districts of Arabian Ranches 2 have also recorded price appreciation of up to 3%. The average sale priceper-square-foot for houses in The Villa has decreased by 2.15%.

- For affordable villas in Dubai, buyers and investors have remained heavily focused on DAMAC Hills 2 (Akoya Oxygen) In Q3 2022.

- The average sale priceper-square-foot for villas in DAMAC Hills 2 has recorded a modest increase of 3.91% to average at AED 636.

- Jumeirah Village Circle has also been a popular choice for buyto-let villas in the affordable category. The priceper-square-foot for villas in this community has experienced an increase of 1.04%, to stand at AED 672 in Q3 2022.

- Other suburban districts like Dubailand, The Springs and DAMAC Hills have also reported price upticks of 2% to 5% during Q3 2022.

Rental Yields in Dubai

- Dubai Sports City has generated healthy rental returns of 8.11% for affordable apartments, during the third quarter of 2022.

- Dubai Hills Estate with its projected ROI of 7.17% has been the investor favourite for luxury apartments.

- Based on projected rental yields, the budgetfriendly villas in DAMAC Hills have generated the most attractive projected returnon-investment of 7.61% in Q3 2022.

- For luxury villas, Arabian Ranches has offered the most lucrative projected rental yields of 5.94%.

Off-plan Projects in Dubai

- As per the combined data released by Bayut & dubizzle, District 10 in JVC has been the most preferred offplan development for affordable apartments in Dubai. Investors in search of reasonably-priced off-plan villas have centred their search on Rukan in Dubailand.

- When it comes to luxury properties, Binghatti Canal Building in Business Bay has attracted the most investor interest for offplan apartments, whereas buyers looking for expensive off-plan villas have been most keen on Portofino in DAMAC Lagoons.

Properties for Rent

Apartments:

According to the search trends on Bayut & dubizzle, Jumeirah Village Circle has remained the top favourite for tenants interested in affordable apartment rentals in Q3 2022.

- The asking rent for flats in JVC has experienced moderate increases of 1% to 6% during Q3. The average cost of renting a studio flat has remained unchanged at AED 36k. The 1 and 2bedroom flats have been priced at AED 51k and AED 72k on average.

- Besides JVC, renters have also shown interest in the rental properties in Al Nahda, Bur Dubai, Deira and Dubai Silicon Oasis. Price trends observed on Bayut & dubizzle show that the rental costs of apartments in these areas have recorded appreciations of up to 12%. However, prices for studio flats in Al Nahda, Bur Dubai and Dubai Silicon Oasis have remained unchanged.

Tenants in search of luxury apartments for rent in Dubai have continued to prefer the properties in Dubai Marina during Q3 2022.

- The rental costs for flats in Dubai Marina have increased by 2.36% for 2bed units, averaging at AED 139k. 1bed and 3-bed units have remained constant at AED 91k and AED 209k, respectively.

- Downtown Dubai, Dubai Hills Estate, The Lagoons and Jumeirah Beach Residence have also emerged as popular options for luxury apartment rentals in the emirate. The average asking rents for flats in these areas have generally increased by up to 14% in Q3 2022.

Villas:

For affordable villa rentals, DAMAC Hills 2 has emerged as the most popular area among prospective tenants, during Q3 2022.

- The rental costs for villas in DAMAC Hills 2 have appreciated by up to 3% for 3 and 5bed houses, averaging at AED 91k and AED 115k, respectively. Asking rents for 4bed villas in DAMAC Hills 2 have decreased by 3.83%, to average at AED 72k in Q3 2022.

- Mirdif has also been a popular option for tenants looking for affordable houses in Dubai. During Q3 2022, the area experienced price appreciations of 2% to 9% across the board. On average, tenants have paid AED 99k for 3bed, AED 124k for 4-bed and AED 134k for 5-bed units during Q3.

- Potential tenants interested in reasonablypriced villa properties have also shown a keen interest in areas such as Dubailand, Jumeirah Village Circle and The Springs. The rental costs for villa properties in these areas have experienced general upticks of 4% to 15%, with price decreases recorded for certain bed types.

According to Bayut & dubizzle’s combined market report, popular villa communities in the luxury segment have seen a general uptrend in rental costs in Q3 2022.

- Al Barsha has emerged as the top choice for luxury villa rentals in Dubai. The rental values for villas in Al Barsha have increased by 10% to 18% for 4 and 6bed units, which respectively average at AED 230k and AED 459k. The average rental costs for 5bed rental villas in Al Barsha has decreased by 1.53% to stand at AED 305k in Q3 2022.

- Jumeirah has also continued to attract highincome tenants. Prices for rental villas in Jumeirah have remained constant for 4bed units and increased by 2.63% for 5-bed units. The asking rents for 6-bed houses decreased by 6.15% in Q3 2022.

- Renters have also been inclined towards luxury houses in areas like Dubai Hills Estate, Arabian Ranches 2 and Umm Suqeim. These locales have reported price increases of up to 25%. The only exception has been the 5bed units in Arabian Ranches 2, which became more affordable by 0.91%.

Commenting on the findings, Haider Ali Khan, the CEO of Bayut & dubizzle and the Head of EMPG MENA said:

We are at a pivotal point in the Dubai real estate market with more transparency coming into the market thanks to the recent announcements from DLD and RERA. Whether it’s recording the number of occupants in a property or introducing digital forms to authorise agents listing properties, such consolidations are important as we continue our successful journey to become a more global market attracting investments from around the world.

The volume and value of transactions in Dubai have been on an upward trajectory since 2021 and as per data released by DLD, August recorded the highest performance ever in a month in the last 10 years. This is a clear indication that demand is high for real estate in Dubai, which can only be sustained by creating better, digitised systems. We too have introduced various solutions to support this with our recent launches; Search 2.0, SmartShare and Dubai Transactions.”

-Ends-

Note: For an accurate representation of price changes, this report compares the average price-per-square-foot in an area to analyse sales trends for villas and apartments in Q3 2022 to those observed in Q2 2022. These prices are however subject to change, based on the building, amenities, developer and other deciding factors. For the rental properties, the report compares the average cost for individual unit types between the two periods, in popular Dubai neighbourhoods.

Disclaimer: The above report is based on prices advertised by real estate agencies on behalf of their clients on Bayut.com and dubizzle.com, and not representative of actual real estate transactions conducted in Dubai except for instances where the DLD has been quoted.

About Bayut

Bayut is the UAE’s most trusted property website for buying, selling and renting homes. Bayut provides detailed insights, extensive content resources and updated statistics allowing end-users to make the best decision when searching for properties in the UAE.

Since Bayut was established in 2008, the company has seen accelerated growth, increasing not only the number of real estate partners it works with, but also obtaining substantial traffic growth over the past few years. Haider Ali Khan joined Bayut in 2014 as the CEO and the company has continued to showcase very high growth over the past five years including closing multiple rounds of funding from top Venture Capital firms such as Naspers, KCK, Exor, and other notable names. To further expand their reach in this region, Bayut also launched Bayut.sa in 2019, with its headquarters in Riyadh.

Bayut is a part of the Emerging Markets Property Group (EMPG) which also operates the largest property classified sites in Pakistan, Bangladesh and Morocco. In April 2020, the group merged with the Netherlands-based OLX group in certain key markets, and was valued at $1 Billion, giving it the coveted unicorn status. The group now also owns and operates Dubizzle in the UAE, OLX Pakistan, OLX Egypt and OLX Lebanon, in addition to several other OLX platforms in the broader Middle East region including Bahrain, Oman, Kuwait and Qatar.

About dubizzle:

dubizzle is the leading classifieds platform for users in the United Arab Emirates. Since its launch in 2005, dubizzle has become the number one platform for users to buy, sell, or find anything in their community. A community where underused goods are redistributed to fill a new need, and become wanted again, where non-product assets such as space, skills, and money are exchanged and traded in new ways that don’t always require centralized institutions or ‘middlemen’.

For further information, please contact:

Stephen Nixon

Media lead

Stephen.nixon@dubizzle.com