PHOTO

-

However, the shipments are expected to increase by 3% YoY in Q4 2023.

-

The iPhone 15 Pro series’ share in the overall iPhone 15 series is projected to increase to 65% in Q4 2023.

-

India will become Apple’s new growth focus, but the brand’s underperformance in China will hinder its growth in 2024.

London, San Diego, Seoul, New Delhi, Beijing, Buenos Aires, Hong Kong:

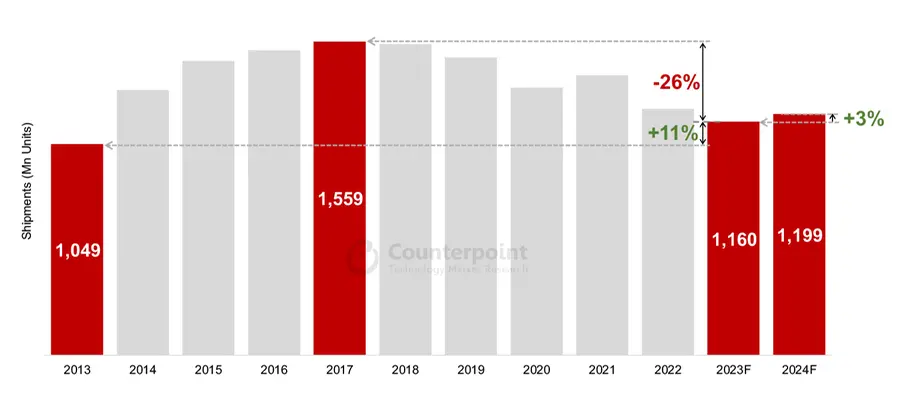

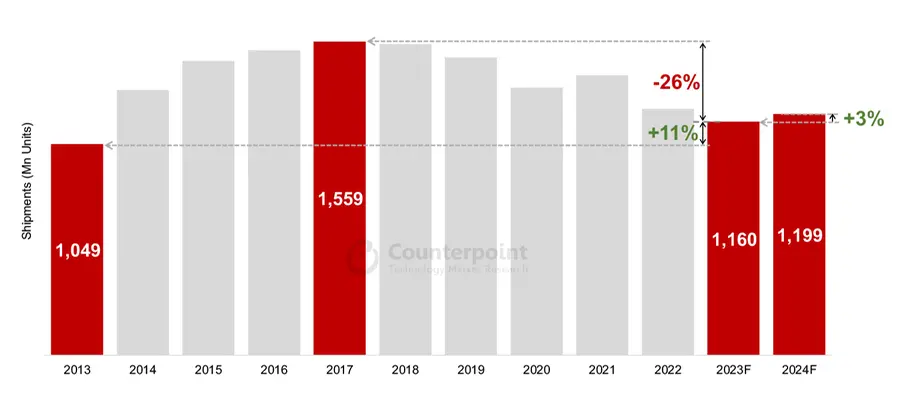

Global smartphone shipments in 2023 are projected to decline 5% YoY to reach 1.2 billion, the lowest level in almost a decade, according to Counterpoint Research’s Smartphone 360 Global Smartphone Shipment Forecast. However, the shipments are expected to increase by 3% YoY in Q4 2023 to reach 312 million units.

North America (NAM) and Europe’s shipments are expected to remain stagnant. But China and emerging markets such as the Middle East and Africa (MEA) and India have managed to break out from their declines and will recover to become the new drivers of growth in the smartphone market from Q4 2023 onwards.

Apple, the usual market leader in Q4 with its newly launched series, is expected to record a volume decline of 3% YoY in Q4 2023, mainly due to Huawei’s aggressive expansion in China and prolonged delay in smartphone upgrades in Japan. However, Apple will try to offset the underperformance in volume terms by growing in value terms with a better product mix. In Q4 2022, the shipment share of the iPhone 14 Pro series in the entire iPhone 14 series was 61%. In Q4 2023, however, the iPhone 15 Pro series’ portion in the iPhone 15 series is projected to increase to 65%.

Global Smartphone Market Shipments, 2013-2024F

Source: Counterpoint Research

After destocking efforts end with a relatively healthy inventory by the year-end, smartphone shipments in 2024 are projected to grow by 3% YoY. We can also expect a recovery focused on emerging markets, backed by increasing consumer confidence and improving macroeconomic conditions.

Apple will be just in line with the market growth in 2024 while facing pressures in its traditional markets. The retention of high interest rates in the US, which hit consumer spending, and intensifying competition in China’s premium smartphone market, mainly due to Huawei, are expected to hinder Apple’s growth throughout 2024.

Huawei, driven by its newly launched Mate 60 5G series and older P-series 4G devices, recorded an enormous success in Q3 2023. Assuming that Huawei can expand the production of its Kirin SoCs via partnerships, the brand is expected to continue to grow 37% YoY in 2024.

Associate Director Liz Lee said, “India, maintaining its momentum for premiumization, is expected to become Apple’s new growth focus. Apple’s India shipments are predicted to grow 23% YoY in 2024. However, due to its underperformance against Huawei in China, Apple’s global market share will unavoidably decline slightly YoY in Q4 2023 and across 2024.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

-Ends-