PHOTO

Researchers link positive credit outcomes to participation in youth financial literacy courses. Recent studies, from esteemed organizations such as the Union of Arab Bankers, demonstrate the effectiveness of the private sector, governments, and civil society organizations collaboration on financial education for high-school students. Those studies clearly demonstrated improvements in credit outcomes for young adults who were exposed to rigorous financial education programs.

According to the Union of Arab Bankers, 2 out of 3 adults in the world are financially illiterate, in other words, most people around the world lack an understanding of basic financial concepts. Consumers that do not know the basic financial practice end up spending more on transaction fees, incur bigger debts, and suffer from high-profit rates and fees. Financially educated consumers, on the other hand, are in a better position to make smart financial decisions, maximize their opportunities and capitalize on their profit.

One of the core objectives of Qatar’s Second Strategic Plan for financial sector 2017-2022 is to promote financial inclusion and financial literacy within the country. The plan which was launched by Qatar Central Bank (QCB), Qatar Financial Center Regulatory Authority (QFCRA) and Qatar Financial Markets Authority (QFMA) constitutes on important building for achieving the Qatar National Vision 2030.

In May 2018, Qatar Islamic Bank (QIB) signed an agreement with INJAZ Qatar to sponsor and deliver a financial literacy program titled ‘How Money Works?’ to 1,250 students in Qatar over a period of three years. Launched last October, the program educates students between 15 to 19 years old, ranging from secondary school to university students.

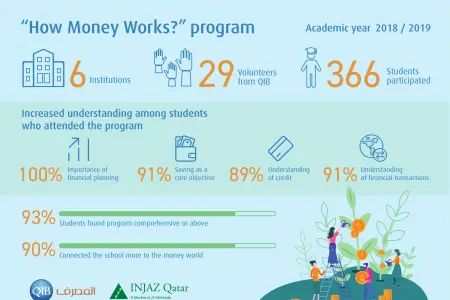

QIB and Injaz have kicked off the second academic year of the ‘How Money Works?’ three-year program. For the coming year, the program will continue to target University students, in addition, it will simultaneously expand the teachings to independent and private schools across Qatar to reach 400 students in total.

The program explores techniques to earn money and manage it prudently by budgeting, saving and investing. The sessions are delivered by QIB employees who volunteered to share their expertise, with the support of INJAZ Qatar volunteers.

When it comes to a resilient economy like Qatar, offering a financial education program to the youth is essential. QIB, as a leading Bank in Qatar, has become an innovator within its industry locally, regionally, and internationally in offering the latest digital products and services, and also by building comprehensive corporate social responsibility (CSR) programs. “How Money Works?” is a key CSR program seeking out contemporary solutions to global problems and empowering the youth in Qatar with necessary tools to prosper in the future.

Commenting on the first-year program results, Mashaal Abdulaziz Al Derham, Assistant General Manager, Head of Corporate Communications & Quality Assurance at QIB said, “As a leading Bank in Qatar, we have a duty to our youth to support them in managing their finances better. The first-year results are an assertion to a successful beginning of the program. During the next two years, the program will be offered more frequently at Qatar University and at the same time we will increase the number of schools the program will be offered to.”

On the same occasion, Mr. Amar Benaissa, Director of Programs at INJAZ Qatar, stated: “We are extremely pleased with the results and program impact of the first year of our partnership with Qatar Islamic Bank. Financial literacy for students is an extremely important tool to improve the financial capability of our youth and community. Students should be taught how to manage their finances at a very early age, both for their professional and personal use. Not only will this make them financially responsible and independent, but it will also help reduce any economic impact during crisis times. This is why QIB’s “How money works?” program has received a great demand from both high schools and universities, and will certainly continue to grow and impact more students year after year.”

During the academic year 2018/2019, "How Money Works?" was successfully delivered to 366 students from 6 different institutions with the help of dedicated QIB volunteers. A survey conducted by INJAZ before and after the sessions showed significant increase of financial understanding from students and 100% realization of the importance of financial planning and budgeting. 91% of the program’s students said that saving had become one of their core objectives, 90% said that material given during the sessions connects the school to the financial world, and 93% of the students had rated the program and the volunteers as "comprehensive" or above.

INJAZ Qatar is part of INJAZ Al-Arab, a network of 14 MENA countries working on a common mission to prepare and inspire young Arabs to succeed in a global economy. Founded in 2007, INJAZ Qatar has since reached over 73,000 students across more than 80 schools and universities, thanks to 100 corporate partners and over 2,000 corporate volunteers.

-Ends-

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.