DUBAI: Dubai’s prime residential market received a 5.27% surge in volume in Q4 2021 at AED 17.07 billion. The residential market also saw an increase in prices by 41%, with an average price of prime property at AED 4.6 million. 5,205 apartments and 552 villas were transacted in Q4 2021 in the Dubai prime residential market, according to analysis by LUXHABITAT Sotheby’s based on data from the Dubai Land Department. The Dubai prime residential market areas used for the analysis included Al Barari, Arabian Ranches, Downtown Dubai, Dubai Marina, Business Bay, Emirates Living, Jumeirah, Jumeirah Beach Residence, Mohammed bin Rashid City, Jumeirah Golf Estates, Jumeirah Islands, Jumeirah Lake Towers and Palm Jumeirah.

The top 3 areas in terms of sales volume were Palm Jumeirah (AED 3.4 billion), Downtown Dubai (AED 3.2 billion) and Business Bay (AED 2.5 billion). In the prime residential market, the Al Barari area showed the highest growth of sales from AED 122 million to AED 373 million (owing to new launches), followed by Jumeirah (AED 122 million to AED 372 million) and Arabian Ranches 1 (AED 176 million to AED 452 million).

A PHENOMENAL YEAR FOR LUXHABITAT SOTHEBY’S & HONEY DEYLAMI

LUXHABITAT Sotheby’s is proud to reveal that it has been responsible for over 3% of the total sales volume from Dubai’s overall residential market at AED 300 billion, which is over AED 9 billion in sales in 2021. The company has reported a revenue growth of over 800% from 2020. Out of these sales, AED 2 billion+ has been closed by Associate Director, Honey Deylami.

Honey has had a phenomenal year of high-end transactions with record-breaking figures, with her emerging to be the number one performer for the year 2021 at LUXHABITAT Sotheby’s. In 16 years of her real estate and investment career, Honey has developed her own special way of dealing with ultra-luxury and premium properties with discerning owners. Her methodology involves offering the product to the right clients as opposed to a broad marketing strategy. Over the years, she has accumulated an impressive network of UHNW clientele from world's renowned celebrities and family offices from all over the world. In her role as Associate Director at LUXHABITAT Sotheby’s, Honey claims the company has contributed heavily to her success and achievements.

Some of Honey’s iconic and memorable transactions from last year include a Dubai Hills mansion that was listed and sold within a week, a rare Bulgari penthouse sale and an overseas sale of a penthouse at One Palm. “These sales required extra attention and focus from my side due to discerning buyers and sellers.” Honey reveals. Honey has also sold rare large penthouses in Atlantis The Royal Residences, One Palm and Mr. C Residences to her UHNW long term clients and has emerged as the top sales broker for the units sold at both Atlantis The Royal Residences and One Palm.

“The keys to my success are my client’s trust over the years, my knowledge and experience in the luxury market for the last 16 years and of course, patience! Majority of my clients are long term ones who trust me to recommend the right property for them. I always put myself in my client’s shoes and think about whether I would invest in those properties myself.” Said Honey.

EXPECTATIONS FOR 2022

Honey expects 2022 to be the best year yet for Dubai’s luxury property market. “I believe that we are still short in stock of premium and luxury properties, specifically larger apartments, penthouses and luxury beachfront or golf course view villas. I expect a strong market in 2022 specially in the luxury market segment as we still see a strong demand in those areas and not enough supply.”

5 BEST PRIME RESIDENTIAL AREAS IN TERMS OF SALES VOLUME

PRIME VILLA MARKET

The prime villa market received a contraction of 33.78% as the market moved towards heavy apartment purchases. The last quarter reported AED 4.1 billion sales volume with an average price of AED 10.6 million for a villa. There has also been an increased in the price/sqft by 21% – indicating an added interest in quality villas.

PRIME APARTMENTS MARKET

Sales volume of apartments increased by 35% to AED 11.1 billion. The average prime apartment now costs approximately AED 2.4 million, with an average price per square feet at AED 1,652.

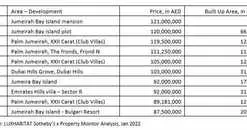

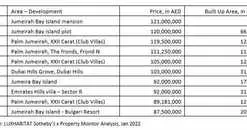

TOP 10 RESIDENTIAL TRANSACTIONS IN 2021

Out of the top 10 residential transactions, three were transacted by LUXHABITAT Sotheby’s, including the most expensive property – a Jumeirah Bay Island mansion for AED 121 million. The company also sold the One100 Palm villa for AED 119.5 million, a dual residential plot in Jumeira Bay for AED 120 million, and a Dubai Hills ‘Tree of Life’ mansion for AED 103 million. With several record plots also sold in Jumeirah Bay, other significant transaction highlights include the selling out of the Four Seasons Residences project in Dubai Water Canal, a 17,172 sqft triplex penthouse at the Dorchester Collection by Omniyat at AED 75 million and Bulgari penthouse for AED 40 million.

About LUXHABITAT Sotheby’s International Realty

Headquartered in Dubai, LUXHABITAT Sotheby’s International Realty focuses on residential and commercial luxury sales and leasing, luxury property management, institutional investments, and luxury project developments in the UAE and beyond. LUXHABITAT Sotheby’s International Realty represents the marketing and sales partnership between Sotheby’s International Realty brand in the entire GCC region and LUXHABITAT, a design-led real estate marketing and technology company. Together, we are now the biggest and strongest marketing and selling platform for luxury real estate in Dubai, making us the foremost luxury real estate brokerage in the market today. We are focused in sourcing the best quality properties in premium residential areas such as Emirates Hills, Palm Jumeirah, Al Barari, Jumeirah Islands, Jumeirah Golf Estates, Meadows, Lakes and Arabian Ranches as well as the best apartments and penthouses in upscale buildings such as Le Reve, Index Tower, Six Towers, Burj Khalifa, The Address Hotels, among others. For more information, visit its award-winning website at www.luxhabitat.ae

For further press information, images or to arrange interviews with Honey Deylami, please contact Aneesha Rai E: ar@luxhabitat.ae

© Press Release 2022

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.