PHOTO

The country's built asset wealth is US$ 3.5 trillion, followed by the UAE and Qatar

Jeddah, Kingdom of Saudi Arabia: Saudi Arabia is the region's leader in built asset wealth according to the according to the latest Global Built Asset Wealth Index published by Arcadis, the leading global Design & Consultancy firm for natural and built assets.

The index, which was compiled for Arcadis by the Centre for Economics and Business Research (Cebr), calculates the value of all the buildings and infrastructure that contribute to economic productivity in 32 countries, which collectively make up 87% of global GDP.

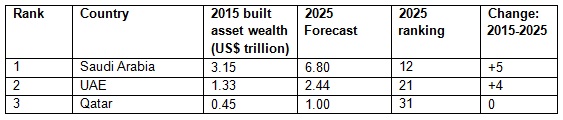

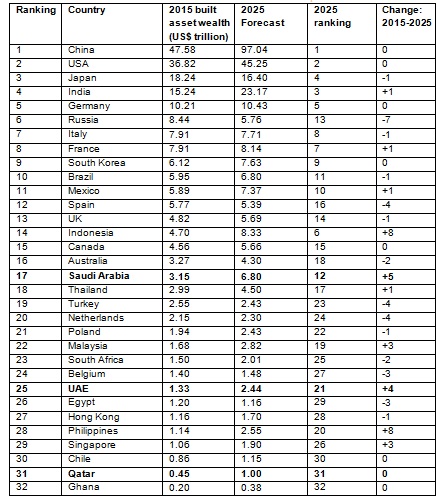

Total built asset wealth globally now stands at an estimated US$ 218 trillion, which is the equivalent to US$ 30,700 per person alive today. The stock of built assets is closely correlated with a nation's economic output. On average, countries analyzed have a built asset stock worth 2.9 times GDP. China now has a built asset wealth of US$ 47.6 trillion, overtaking the USA which comes in second place with a wealth of US$ 36.8 trillion. On a regional basis, Saudi Arabia has a built asset wealth of US$ 3.15 trillion, while the UAE and Qatar rank respectively at US$ 1.33 trillion and US$ 0.45 trillion.

"The health and wealth of a nation can be measured in many different ways and while factors such as GDP or employment have great value, a prosperous society is underpinned by a well-developed built environment that meets the needs of its people and economy," said Alan Richell, Head of Business Advisory in the Middle East at Arcadis. "Saudi Arabia has achieved phenomenal progress in its built asset stock in recent years, recording a 200% growth rate between 2000 and 2014. From a global perspective, Saudi Arabia has the third highest rate of built asset growth in the world."

The top Middle East nations in the Arcadis Global Built Asset Wealth Index are:

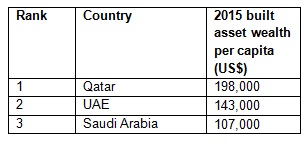

Qatar and Singapore stand comfortably ahead of the pack on built assets per capita, at US$198,000 and US$192,000 respectively. The countries near the top of this ranking are disproportionately made up of smaller nations, either by population or area, so the density of the built asset stock is much greater per resident. Saudi Arabia, by comparison, has a smaller built asset stock per capita where its built asset wealth is spread amongst its large and growing population.

The top Middle East nations per capita in the Arcadis Global Built Asset Wealth Index are:

Richell comments: "The Global Built Asset Wealth Index shows a dramatic shift of wealth to emerging economies. Despite some challenges in the short term, Saudi Arabia is clearly emerging as a major player in the built asset sector."

Overall Arcadis Built Asset Wealth Ranking and Forecast

The report highlights can be viewed from www.arcadis.com/builtassetindex

The full report can be downloaded here.

-Ends-

For further press information please contact:

Julie Nguyen, PR & Communications Manager at Arcadis

+971 (0)56 188 2465 / Julie.nguyen@arcadis.com

About the study

This research, conducted by the Centre for Economics and Business Research and based on over 20 independent global sources, calculates the value of the buildings and infrastructure in 32 countries, which collectively make up 87% of global GDP. Built asset wealth was broken down into construction (including infrastructure) and machinery and equipment and forecasts were made of stock increases and depreciation.

To forecast the composition of investment, or fixed capital formation, Cebr established econometric relationships in each of the countries within our sample to estimate its evolution over the forecast horizon. For each country this required an assessment of investment growth in constant purchasing power parity adjusted to US dollars, the composition of investment, the depreciation of the existing stock and the rate of population growth.

To forecast the depreciation of the existing stock an average service life for each of the components of fixed capital formation (residential and non-residential construction and machinery and equipment) was established, based on an extensive literature review. This works out around 14 years for assets of machinery or plant and approximately 70 years for construction assets. The rate of depreciation in each economy depends on the ratio between these two quantities in its overall stock of assets.

About Arcadis

Arcadis is the leading global Design & Consultancy firm for natural and built assets. Applying our deep market sector insights and collective design, consultancy, engineering, project and management services we work in partnership with our clients to deliver exceptional and sustainable outcomes throughout the lifecycle of their natural and built assets. We are 28,000 people active in over 70 countries that generate more than €3 billion in revenues. We support UN-Habitat with knowledge and expertise to improve the quality of life in rapidly growing cities around the world. www.arcadis.com. Arcadis. Improving quality of life.

The first Global Built Asset Wealth Index was published in 2013. For further information on Arcadis' Built Asset Wealth Index, including the full per capita ranking, and regional breakdowns, please visit the Arcadis website: www.arcadis.com/builtassetindex

About Centre for Economic and Business Research

Centre for Economics and Business Research (Cebr) is an independent consultancy with a reputation for sound business advice based on thorough and insightful research. Since 1992, Cebr has been at the forefront of business and public interest research. They provide analysis, forecasts and strategic advice to major multinational companies, financial institutions, government departments, agencies and trade bodies. For more information visit www.cebr.com

© Press Release 2015