Kuwait City: KAMCO Investment Company K.S.C. (Public), a regional non-banking financial powerhouse with one of the largest AUMs in the GCC, announced the successful completion of the legal execution of the merger by amalgamation with Global Investment House (Global), whereby KAMCO is the merging company and Global the merged.

This announcement comes after the cancelation of treasury shares and the successful completion of the share swap of 138,877,635 Global shares (owned by shareholders other than KAMCO) against the issuance of 104,884,308 new KAMCO shares according to the swap ratio of 0.75522821 KAMCO share for each Global share. The share swap was concluded on Thursday 12th of December 2019 where minority shareholders in Global have now become shareholders in KAMCO.

Merger Process

Newly issued shares will be eligible for trading on Boursa Kuwait starting Sunday 15th of December 2019. Following the merger, the authorized, issued and paid up share capital of KAMCO stood at KWD34.2mn.

Commenting on the completion of the merger process, KAMCO’s CEO, Faisal Mansour Sarkhou, said, “We are pleased to have completed the legal execution of the merger within the preset time frame. In the coming weeks, we will work towards integrating our operations and systems in preparation for a fresh start in 2020.”

He added, “We welcome new shareholders to KAMCO ensuring them of our commitment to continue creating value for all stakeholders through our fee-based business model that is client driven with focus on innovative strategies and team capabilities.”

Overview of KAMCO post-merger

Legal Name: KAMCO Investment Company K.S.C. (Public)

Share Capital: KWD 34.2 million

Listing: Boursa-Kuwait (ticker: KAMCO – Bloomberg: KAMCO KK Equity - Thomson Reuters: KAMC.KW)

AUM: USD 13.7 billion (as at 30 September 2019)

Geographical Presence: Kuwait, Saudi Arabia, United Arab Emirates, Jordan, Turkey

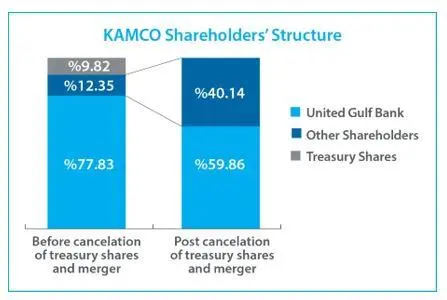

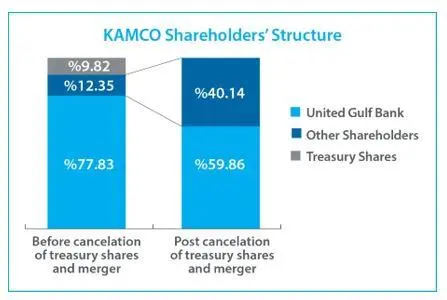

KAMCO shareholder structure post-merger

KAMCO enjoys a larger and more diversified shareholder base with non-controlling shareholders representing more than 40% of total issued shares.

Sarkhou concluded by expressing his gratitude and appreciation towards the Capital Markets Authority, Ministry of Commerce and Industry, Central Bank of Kuwait, Boursa Kuwait, as well as other regulatory authorities for their ongoing support and cooperation throughout this process. He also thanked the boards of directors and teams of both companies for working side by side to ensure the successful outcome of this transaction. Sarkhou also thanked clients and shareholders for their trust assuring them of KAMCO’s commitment to create value for all stakeholders.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.