PHOTO

Muscat - HSBC Bank Oman S.A.O.G. announced today that it is doubling the size of its SME-focused International Growth Fund, initially launched last year. HSBC is committing an additional OMR 20 million to Oman's international and internationally aspirant SMEs, bringing the total value of the Fund to OMR 40 million. The Fund continues to be open to new and existing importing and exporting customers who are based in Oman, and have cross border trading requirements or aspire to grow internationally.

Announcing the launch, Iain Morrison, General Manager and Head of Commercial Banking, HSBC Bank Oman, said, "Today we are pleased to announce the allocation of an additional OMR 20 million to our International Growth Fund. Last year, we launched this first Fund of its kind in Oman in the knowledge that SMEs are critical to the future of Oman's economy and that supporting their growth and prosperity is vital. Today, we are reaffirming this commitment and are confident that the unique combination of our local knowledge and international expertise will continue to enable international and internationally aspirant SMEs in Oman to thrive."

Morrison added, "Our initial Fund has been allocated across a range of sectors, such as those supporting oil and gas, as well as construction and general trading, for example, foodstuffs."

The Fund continues to be administered by HSBC Bank Oman's Business Banking team. Daniel Felton, Head of Corporate and Business Banking for HSBC Bank Oman said, "International and internationally aspirant SMEs play an important role and have a unique opportunity to increase their contribution to the local economy. Industry research reports that SMEs represent over 90% of the total number of registered firms in Oman but the combined contribution to GDP is only around 15%. This, combined with the fact that 78% of firms in Oman employ five people or fewer and therefore account for less than 10% of total employment nationwide, demonstrates the opportunity that these businesses have to make a material contribution to the growth and diversification of the economy in Oman1."

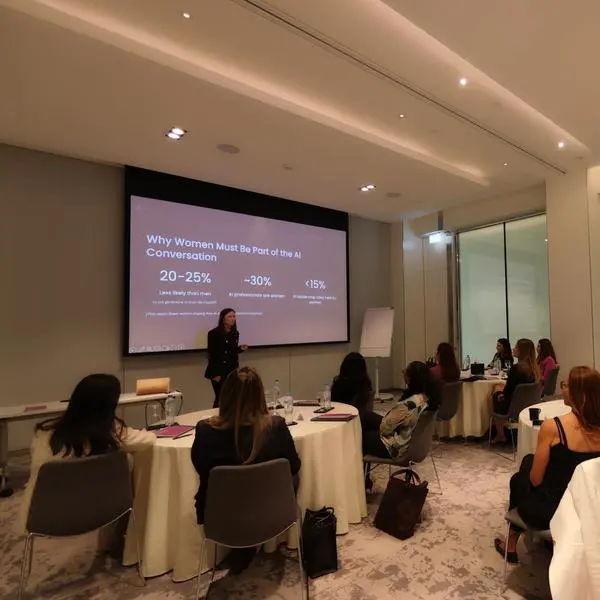

Felton added, "At HSBC Bank Oman, supporting SMEs is not just about financing. There are other solutions that a bank can offer, including cash management, corporate cards, online banking and more. In addition, and perhaps most importantly, educating SME owners and providing them with access to the right information is critical in helping them to achieve their growth ambitions. Our quarterly "Growth Series" seminars have been very popular with our SME clients, helping to share useful industry information as well as providing direct access to industry experts."

The SME sector is very important to Oman's economy, both from an employment perspective and for the role these businesses play in the traditional oil & gas industries. The sector helps contribute to the diversification of the Oman economy in areas such as tourism, professional services, health care and logistics.

HSBC Bank Oman provides access to a wide range of business products and services for SMEs through to large Corporates. Corporate financing solutions, including Trade, Treasury, Global Payments and Cash Management, Corporate Credit Cards, Custody, Clearing, and Time Deposits are available to more than 10,000 corporate clients across the county. HSBC Bank Oman is part of a global network of 6,100 offices in over 72 countries and territories in Europe, Asia, North and Latin America, and the Middle East and North Africa.

1 - Oxford Business Group

-Ends-

HSBC in Oman

HSBC is the largest international bank operating in the Middle East, and Oman is an important market in the region for the bank. Oman has one of the most stable political, social and economic environments in the region, with a growing economy supported by a young population and significant investments in infrastructure.

Oman is also a key access hub to the fast-growing trade corridors connecting the MENA region with Asia - a major focus for growth for HSBC. Its economy is forecast to grow at a compound annual growth rate of 4% forecast from 2011 to 2016.

HSBC in the MENA Region:

HSBC is the largest and most widely represented international banking organisation in the Middle East and North Africa (MENA), with a presence in 11 countries across the region. HSBC has operations in the United Arab Emirates, Egypt, Qatar, Oman, Bahrain, Kuwait, Lebanon, Algeria and the Palestinian Autonomous Area. In Saudi Arabia, HSBC is a 40% shareholder of Saudi British Bank (SABB), and a 49% shareholder of HSBC Saudi Arabia for investment banking in the Kingdom. HSBC also maintains a representative office in Libya.

This presence, the widest reach of any bank in the region, comprises some 267 offices and around 12,000 employees. In the year ending 31st December 2014, HSBC in the MENA region made a profit before tax of US$ 1.8bn.

HSBC Holdings plc HSBC Holdings plc, the parent company of the HSBC Group, is headquartered in London. The Group serves customers worldwide from around 6,100 offices in 72 countries and territories in Asia, Europe, North and Latin America, and the Middle East and North Africa. With assets of US$2,549bn at

30 September 2015, HSBC is one of the world's largest banking and financial services organisations.

For more information, please contact:

Shaza Taher

Associate Media Relations Director

TRACCS Oman

Telephone: +968 24 649-099

Email: shaza.taher@traccs.net

© Press Release 2015