PHOTO

- Offering 100% digital processes, the application forms part of a series of transformational projects.

- H.E. Khalid Al Bustani: The Authority develops proactive services to ensure customers’ happiness, help establish a modern housing system for UAE citizens, in line with the requirements of the government of the future.

Abu Dhabi, UAE – The Federal Tax Authority (FTA) has launched its new smart application ‘Maskan’, which forms part of its continuous efforts to implement digital transformation plans and provide outstanding tax services, in line with government priorities and strategic directions.

The application offers additional features for UAE citizens looking to recover the Value Added Tax (VAT) they incurred on the construction of their new homes using 100% paperless, digital procedures.

In a press statement issued today, the Authority explained that the application’s launch forms part of its contribution – with a diverse set of initiatives under the transformational projects series – towards developing faster, more efficient digital services, minimising paper usage, and reducing the number of documents required for service execution, among other facilities.

The Federal Tax Authority launched this initiative as part of its strategy to implement the directives of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, to develop government services, and adopt highly efficient business models focused on eliminating bureaucracy in procedures and proactively providing state-of-the-art integrated services, making the UAE government services the best in the world.

The "Maskan" application is among the transformative projects within the federal government performance agreements for 2023-2024. These quality projects propel the UAE towards the future and enhance its competitiveness by achieving significant impacts across all sectors in a short period. The new initiative promotes the UAE as a global hub for the new economy and contributes to creating a supportive ecosystem for the UAE to be the most pioneering and advanced nation over the next decade, in line with the objectives of the "We the UAE 2031" vision.

Furthermore, the FTA asserted that the ‘Maskan’ digital platform was designed in accordance with the latest standards to ensure performance efficiency and speed, and offer simple and clear procedures. This offers UAE citizens a digitalised, faster, and more seamless procedure to recover the VAT they incurred on the construction of their new homes.

The Authority held a series of brainstorming sessions and consultative meetings during the platform’s preparation stage, bringing together citizens and suppliers, where the FTA team noted attendees’ opinions on the development process based on their experience with the previous refund mechanism. The feedback was then taken into account in designing the ‘Maskan’ application.

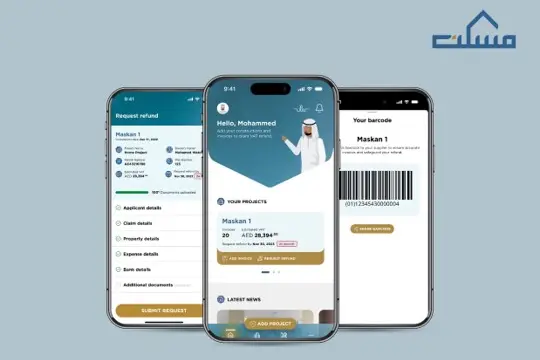

The Authority indicated that the full launch of the ‘Maskan’ application’s smart features will be rolled out over two stages: The first has already been activated, allowing UAE citizens (applicants) to create their own file and enter tax invoices related to the purchase of supplies for the construction of their home by simply uploading the files or attaching photos and submitting the refund request.

The FTA added that the second phase will be initiated before the end of July 2024, introducing all of the application’s characteristics and features and allowing citizens to scan a barcode from the ‘Maskan’ app to upload tax invoices from outlets registered with the Authority to each applicant’s account, instead of submitting conventional paper invoices, as was the process in the previous system, which are susceptible to loss or damage, and risk disqualifying UAE citizens from reclaiming tax on their eligible purchases.

His Excellency Khalid Ali Al Bustani, Director General of the FTA, said: “The launch of the ‘Maskan’ digital platform forms part of our efforts to implement the wise leadership’s vision to establish a modern housing system that ensures UAE citizens’ happiness and provides them with stability and a high quality of life. The platform offers transparent and streamlined procedures to expedite the process for refunding taxes that Emirati citizens incurred on the construction of their new homes.”

“Moreover, the launch falls under the FTA’s continuous development plans, designed to keep pace with the government’s digital strategy to drive smart transformation,” H.E. Al Bustani added. “The objective is to provide sustainable, proactive, and innovative services that reflect the leadership and excellence of the government system, meet users’ expectations, and fulfil the needs and requirements of the government of the future, which, in turn, align with the aspirations of smart city residents, and provide them with renewed opportunities for sustainable development and wellbeing.”

For his part, Mr. Abdullah Al Bastaki, Executive Director of the Information Technology Sector at the Federal Tax Authority, explained that the launch of the “Maskan” application will streamline and expedite the process for citizens’ reclaim of the value-added tax paid for the construction of their new homes. It came within the framework of the Authority’s commitment to the “Zero-Government Bureaucracy (ZGB)” programme, which was launched by the UAE government to enhance efficiency in public services.

The programme initiated during this year’s government sessions seeks to accelerate the implementation of Zero Bureaucracy by fostering strong partnerships with the private sector.

The FTA participated in the programme that targets the elimination of 2000 government procedures within a year, and reducing the time taken for government services by 50%.

Al Bastaki stressed that the FTA will continue to provide facilities in all its services by abolishing more procedures and reducing the service duration in line with the programme for “Zero Government Bureaucracy.”

The FTA anticipated that the new app will significantly enhance citizen satisfaction with the VAT refund service on the construction of their new homes, highlighting some of the most notable features it provides, namely the ability to create an account using the unified login feature allowing customers to access the Authority’s digital platforms with the UAE PASS digital identity solution, generate a personal QR code for each applicant, and with a single click, have the application extract all details from the tax invoice and automatically calculate the VAT amount eligible for a refund.

To download the App via iOS: https://apps.apple.com/us/developer/federal-tax-authority/id1488610661

To download the App via Android: https://play.google.com/store/apps/details?id=maskanrefund.tax.gov.ae

-Ends-

About Federal Tax Authority

The Federal Tax Authority was established by Federal Decree-Law No. (13) of 2016 to help diversify the national economy and increase non-oil revenues in the UAE through the management and collection of federal taxes based on international best practices and standards, as well as to provide all means of support to enable taxpayers to comply with the tax laws and procedures. Since its inception in 2017, the FTA has been committed to cooperate with the competent authorities to establish a comprehensive and balanced system to make the UAE one of the first countries in the world to implement a fully electronic tax system that encourages voluntary compliance, with simple procedures based on the highest standards of transparency and accuracy – beginning from registration, to the submission of tax returns, to the payment of due taxes through the Authority’s website: www.tax.gov.ae