Abu Dhabi, UAE:

First Abu Dhabi Bank (FAB), the UAE’s largest bank and one of the world’s largest and safest financial institutions, reported its financial results for the nine-month period ended 30 September 2021.

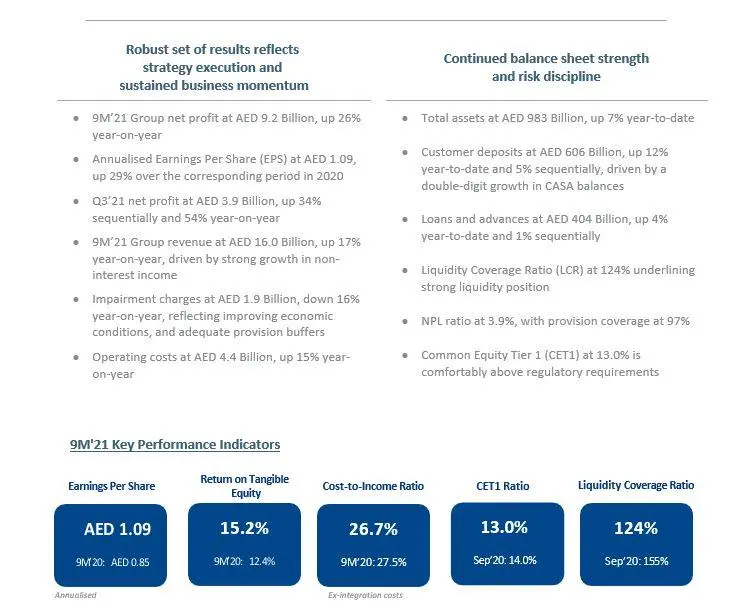

The Group generated a net profit of AED 9.2 Billion in the nine-month period ended 30 September 2021, up 26% over the corresponding period in 2020, reflecting positive underlying trends across core businesses in an improving environment, and the positive outcome of strategic initiatives to enhance returns. Group revenue was up 17% supported by business growth, solid fee generation and a strong trading performance, helping to offset headwinds from low interest rates. Operating expenses were up year-on-year reflecting ongoing investments in digital and strategic initiatives, and the inclusion of Bank Audi Egypt. The Group’s foundation remains robust across liquidity, capital and asset quality metrics.

HANA AL ROSTAMANI

GROUP CHIEF EXECUTIVE OFFICER

FAB's standout performance in the first nine months of 2021, underlines the tangible progress we are making in driving our growth and transformation plans, as we continue to play a prominent role in supporting the wider economic recovery. Group net profit for the nine-month period grew 26% year-on-year to AED 9.2 Billion, as we achieved our highest profit to-date in the third quarter, capitalising on the noticeable rebound in activity in Abu Dhabi and the wider region.

Our robust pipeline translated to increased business activity and deal execution, as FAB continues to offer world-class solutions to clients, leading landmark transactions, and winning key mandates. During the third quarter, FAB maintained its status as the top-ranked regional bank across all MENA investment banking league tables and became the top custodian in the UAE by value of assets, which is a major achievement underlining the Group's superior credentials. We were also proud to be the Sole Lead Receiving Bank on the ADNOC Drilling IPO, Abu Dhabi’s largest listing to-date, with FAB acting as, both, Joint Global Coordinator and Joint Bookrunner on this transaction, leveraging our global network to attract quality institutional investors. Looking ahead, our pipeline remains strong in a buoyant market.

Other areas of strategic focus are progressing well, as we continue to build specialised capabilities within our core businesses to support future growth, while accelerating transformation. New product propositions are being rolled out in key areas, capitalising on partnerships and technology to deliver superior solutions and service. We also continue to make progress against our international strategy. The integration of our operations in Egypt is on track to be completed during 2022, and we have recently received regulatory approval to establish our first branch in Shanghai, which will further expand our strategic footprint in Asia, enabling us to offer enhanced connectivity for our clients.

With the UAE at the forefront of the post-pandemic recovery and as we enter the final quarter of 2021, I am optimistic about the opportunities that lie ahead, not only for us as a bank, but also as an engine to the Nation's ambitious vision for the next 50 years and beyond. Our recent commitment to become a Net Zero bank by 2050 marks a new milestone in our sustainability journey, and an important step to help address the great challenges that face the world and society.

As we move forward, FAB's competitive strengths, including our global network, agile mindset and focus on people, culture and technology, are positioning us for sustainable performance and long-term success, as we shape the bank of tomorrow.

JAMES BURDETT

GROUP CHIEF FINANCIAL OFFICER

FAB's robust set of results demonstrates the benefits of our diversified business model in a recovering economy, and our ability to take advantage of market opportunities to enhance Group returns.

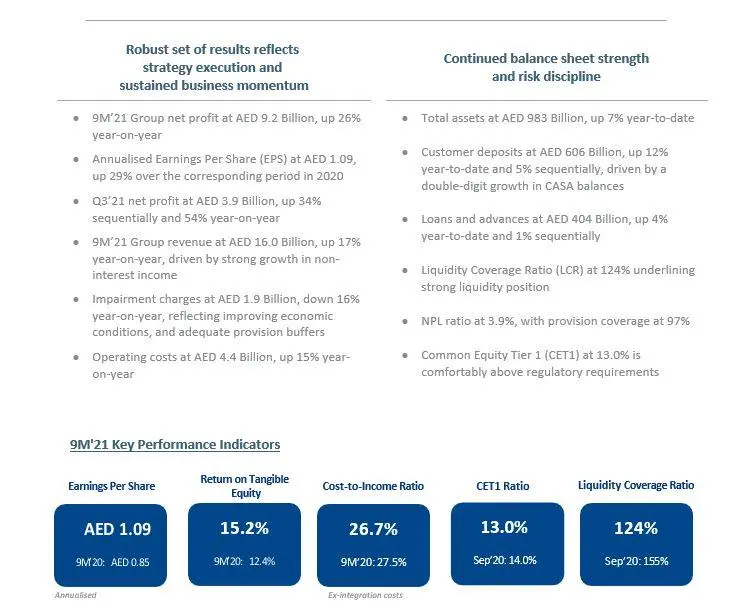

We achieved a record net profit of AED 3.9 Billion in the third quarter of 2021, up 34% sequentially and 54% year-on-year, bringing Group net profit for the nine-month period to AED 9.2 Billion, up 26% year-on-year. Return on Tangible Equity also improved to 15.2%, up from 12.4% the prior comparative period.

Our Investment Banking business was a major contributor to the Group's earnings growth, on the back of an exceptional trading performance, and sustained activity across a number of areas including Debt Capital Markets, Trade Finance, Advisory, and Equity Capital Markets where FAB continues to showcase undisputed regional leadership. We are also seeing positive underlying trends in our Corporate & Commercial, Consumer, and Private Banking businesses, with corporate and consumer confidence strengthening during the period.

The Group continues to present industry-leading operating efficiency, delivering positive Jaws and a Cost-to-Income ratio below 27%, amid ongoing investments in people, products, processes, and technology. As we build for the future, these investments will continue in order to help us create new efficiencies, improve customer experience and strengthen competitive advantage.

We demonstrate balance sheet strength across all key ratios. Asset quality metrics are stable, and Liquidity Coverage Ratio was 124% at the end of September. We also maintained a solid capital position comfortably above regulatory requirements with CET1 at 13.0%, and our strong capital generation capacity enabling us to absorb the adverse impact of regulatory headwinds and the inclusion of Bank Audi Egypt during 2021.

Despite the uneven global recovery and although new challenges may arise, FAB is uniquely positioned to accelerate growth and transformation, and to deliver superior and sustainable shareholder returns.

ECONOMIC OVERVIEW AND OUTLOOK

Global markets and macro sentiment have broadly sustained their positive momentum in the third quarter of 2021 driven by COVID-19 vaccine rollout, improving business and consumer sentiment, and the impact of global monetary and fiscal support measures. Some factors, however, have emerged that could hamper the global economic recovery with concerns over inflationary pressures being less ‘transitory’, supply chain constraints, and a hawkish Fed.

Domestically, the UAE continued its economic rebound on the back of its world leading COVID-19 vaccination programme, clearly reflected in consumer spending exceeding pre-pandemic levels as well as PMIs averaging two-year highs. In addition to the various supportive fiscal, monetary and regulatory measures, federal and regional governments introduced new initiatives and continued to commit to large investments to shore up business confidence and sustain the economy’s positive momentum. With the Expo 2020 underway and oil prices sustaining above USD 70 bbl, real GDP growth for UAE is expected to be 2.4% in 2021 and 3.8% for 2022, compared to previous forecasts of 2.4% and 3.0% respectively.

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.