PHOTO

Abu Dhabi, United Arab Emirates: UAE Banks Federation, the sole representative and unified voice of UAE banks, reiterated its commitment to supporting efforts that enhance secure and smooth banking experience, in particular, initiatives related to cybersecurity that constitute an essential shield against cyber threats, in order to increase trust and develop the UAE banking sector in the face of the broad and accelerated digital transformation that the world in general, and the banking and financial sector in particular, is experiencing.

This came during UAE Banks Federation's participation in the 3rd Cybersecurity Conclave as the strategic partner. The event was recently organised under the leadership of UAE Cybersecurity Council, Dubai Electronic Security Centre, and the Private Office of Sheikh Saeed bin Ahmed Al Maktoum at the Jumeirah Beach Hotel in Dubai.

The event also saw the Federation's outstanding efforts in developing the banking and financial sector being recognised with the Excellence in Banking Sector Service Award presented by H.E. Dr. Mohammed Hamad Al Kuwaiti, Head of Cybersecurity of the UAE Government presented it to Mr. Jamal Saleh, Director General of UAE Banks Federation. This prestigious award reflects the IT community's appreciation of the contributions made by UAE Banks Federation in supporting the digital transformation of the banking sector and protecting the industry from the risks of cyberattacks, which has helped strengthen the UAE's position as a global financial and banking hub, as well as in boosting customer confidence in the UAE banking sector, as the UAE ranks second globally in terms of customer trust in banks.

More than 200 government officials, cybersecurity experts and executives from the banking, finance and other vital economic sectors attended the specialised conference to discuss current challenges in cybersecurity, trends and development opportunities in the field. The UAE is one of the most prominent countries in digital transformation and is encouraging investment in cybersecurity to improve its cyber defences and protect its digital infrastructure, especially given the increasing reliance on digital technologies in various sectors.

H.E. Dr. Mohammed Hamad Al Kuwaiti, Mr. Jamal Saleh; Mr.Sultan Al Owais, Director of Smart Services at the Prime Minister's Office; Dr. Aloysius Cheang, President of Cybersecurity & Privacy Protection and Chief Security Officer for Huawei Middle East & Central Asia; and Olivier Busolini, Head of Information Security at Mashreq Bank, delivered keynote speeches at the conference.

In his keynote address, Mr. Jamal Saleh, Director General of UAE Banks Federation, said, "Cybersecurity is of paramount importance to UBF and the banking sector, which is a vital driver of the global economy, especially in the digital age that has changed the way financial transactions and asset management are handled, making the protection of our financial systems an absolute necessity."

"Under the direct supervision and in full cooperation of Central Bank of the UAE and other relevant authorities in the country, we are working to implement anti-fraud measures, protect financial systems and continuously raise awareness among customers and the public to educate them with the different types of fraud and ways to prevent them. The Federation also organises the Cyber Wargaming every year in partnership with Central Bank of the UAE and UAE Cyber Security Council to improve cybersecurity and follow best practices to enhance the safety and security of the banking and financial sector's digital infrastructure."

The Cyber Wargaming event is based on virtual experiments to test the capabilities of cybersecurity teams in tackling and discovering attacks to identify strengths and gaps through simulated attacks designed by experts in the field. UAE Banks Federation focuses on developing capabilities to protect the banking sector's digital infrastructure with increased exposure to e-commerce, digital banking services and applications, which has led to the emergence of different types of cyberattacks and financial crimes using new technologies and are evolving to become more complex than before and more specific to their targets.

The Director General of UBF added, "One of the most important factors that reinforce the importance of cybersecurity in the banking and financial sector is that our industry is based on the principle of trust, and banks are always striving to achieve the highest level of trust among their customers, of which cybersecurity is an essential element as its aids the provision of secure digital systems. The second factor lies in the fact that the banking and financial sector is an attractive target for cybercrime, which is witnessing rapid development. Hence, it requires constant evolution of solutions and tactics to protect digital banking and financial systems, which is no longer an option but a necessity.

He noted that regulatory compliance is the most important factor, and all stakeholders in the banking ecosystem have realised the importance of cybersecurity and the fact that regulatory compliance in this area is not limited to the legal aspect but goes beyond becoming the essential means of ensuring that banking and financial institutions adhere to the highest standards of cybersecurity.

Mr. Jamal Saleh urged participants at the Conclave to continuously develop their digital security systems and build strong defences so that cybersecurity becomes a shield that protects from the risks of attacks and preserves assets and data. He also stressed the importance of individuals being responsible and doing the required due diligence, as they are the first line of defence and the weakest link in the cybersecurity chain, as hackers exploit human vulnerabilities through fraudulent tactics, such as phishing and social engineering, and pointed to the importance of vigilance and cautious behaviour to reduce the risks of fraud and e-crimes.

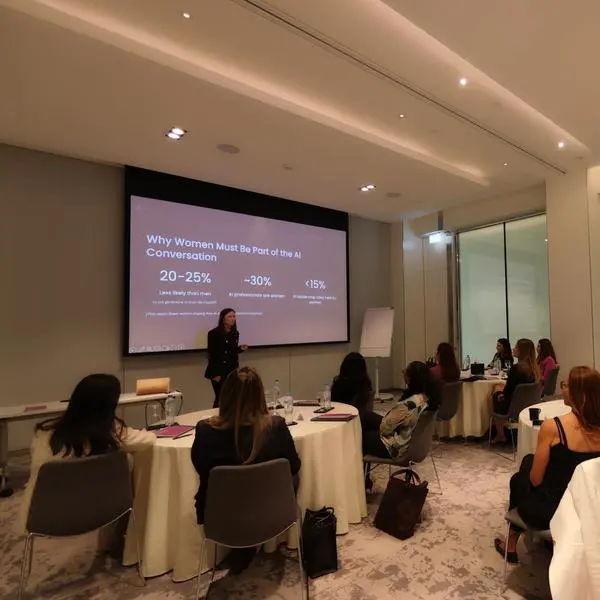

Panels at the conference covered a comprehensive overview of the cybersecurity landscape, the role of women in cybersecurity, particularly Emirati women who specialise in this area, vulnerabilities in cloud computing, resilience to cyberattacks, and other important topics that contribute to improving the protection of digital systems.

About UAE Banks Federation (UBF):

Established in 1982, UAE Banks Federation (UBF) is the sole representative body comprising 59 members of banks and organisations operating in the UAE. UBF advocates the interests of all its members and enhances cooperation and coordination between them in order to elevate the UAE's banking ecosystem for the benefit of members, customers, and the overall UAE economy.

UBF's mission and objectives are focused on representing its members and defending their rights and interest. UBF provides a platform for cooperation and the exchange of ideas and expertise among its members and plays a significant role in raising public awareness about the contributions of the UAE banking sector to the economic and social development of the country.

UBF has a 22-member Advisory Council consisting of CEOs and General Managers from member banks and financial institutions, which oversees the implementation of UBF's policies and activities. The CEOs Council also makes directional decisions through UBF's General Secretariat for UBF's 26 technical and 3 advisory committees, which in turn are tasked to discuss all issues relevant to the UAE banking and financial services ecosystem. UAE Banks Federation also includes a CEOs Consultative Council, which consists of chief executives of other member banks.

For further information, please contact:

Sooyin Lee

UAE Banks Federation

sooyin@uaebf.ae