PHOTO

- 450 trillion dollars in worldwide net private wealth and is set to increase more than 6 percent annually to the end of the decade

Azerbaijan, Baku – The COP29 Presidency hosted the Business, Investment & Philanthropy Climate Platform to harness the collective power of the private sector and drive progress for climate action. This year’s event marks the second edition of the inaugural Business and Philanthropy Climate Forum, which was first held during COP28 last year in the UAE. The convening continues to serve as the primary platform for private sector engagement inside the COP process.

The event gathered over 900 global leaders from the business, finance and philanthropic communities to drive practical and sustained action towards achieving the goals of the Paris Agreement and the UAE Consensus.

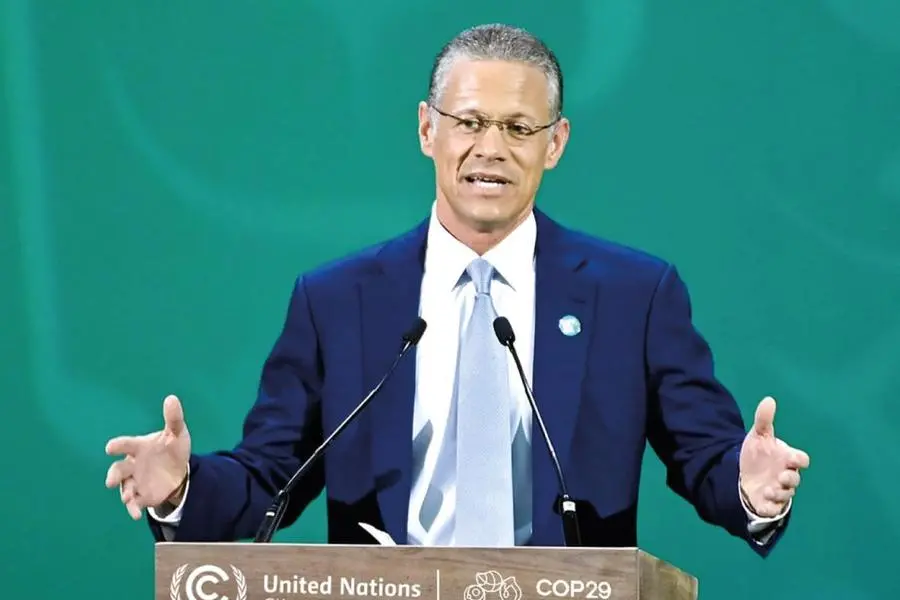

The agenda featured a range of high-profile speakers including COP29 President, H.E. Mukhtar Babayev, Minister of Ecology and Natural Resources, Azerbaijan; H.E. Mikayil Jabbarov, Minister of Economy, Azerbaijan; H.E. Nigar Arpadarai, COP29 UN Climate Change High-Level Champion; Makhtar Diop, Managing Director, IFC; The Rt Hon Lord Alok Sharma KCMG, COP26 President; H.E. Majid Al Suwaidi, CEO, Alterra Fund; and H.E. Badr Jafar, Special Envoy for Business and Philanthropy, UAE.

In his keynote address, H.E. Badr Jafar, who chaired the inaugural Business & Philanthropy Climate Forum at COP28, shared a profound perspective on the urgent need for global cooperation in climate finance. "The UAE Consenses serves as a beacon for multistakeholder climate action, and we stand at a critical juncture where the power of public-private partnerships must be harnessed to unlock the vast resources required to address the escalating challenges of climate change."

Building on the foundations laid during COP28 Business & Philanthropy Climate Forum in Dubai which saw over US $7bn in private capital commitments, the Baku edition focused on finance and real economy actors for progress with attendees from around the world keen to advance the integration of the private sector in climate action.

Emphasizing the indispensable role of the private sector, H.E. Badr Jafar added: "Governments alone cannot shoulder this responsibility; we need the innovation, resources, and commitment of the private sector more than ever. As businesspeople, as philanthropists, as investors, we can and must take this long-term approach, transcending short-term politics. That is what will drive consistent progress that builds and scales impact."

The event’s discussions referred to the trillions of dollars per year needed to deliver net zero and nature positive outcomes across the developing countries of the world. However it was also highlighted that there is well over 100 trillion dollars in assets under management, between sovereign wealth, pensions, insurance and family offices. Worldwide net private wealth stands at over 450 trillion dollars and it is set to increase more than 6 percent annually to the end of the decade. Therefore the availability of capital is not necessarily the issue – what is urgently required are the mechanisms to channel this capital towards investments in climate solutions across the so-called Global South.

The sessions also dedicated significant attention to advancing public-private collaboration, specifically targeting the acceleration of foreign direct investment (FDO) for climate action. Discussions pinpointed the key enablers of FDI for developing countries and highlighted the importance of consistent, scaled-up financial flows to emerging markets.

The various messages delivered at the foum resonated with urgency and optimism. Collaborative efforts showcased at the event set the stage for ongoing and scaled action at future COP meetings. The Business & Philanthropy Climate Forum remains a critical platform for integrating business and philanthropic leadership into the global climate action framework. By bringing together leaders from all key sectors, the forum fosters multistakeholder discussions and action, driving progress toward global climate and nature targets.

About Crescent Enterprises

Crescent Enterprises is a leading multinational company, growing diversified global businesses that are sustainable, scalable, and profitable. Headquartered in the United Arab Emirates, with business operations in 15 countries, it operates under four enterprise platforms:

- CE-Operates, an operating business platform, focusing on smart infrastructure as the main driver of economic development and growth.

- CE-Invests, a strategic investment platform investing in late-stage businesses and private equity funds.

- CE-Ventures, a corporate venture capital platform targeting early-stage technology- enabled high-growth businesses and venture capital funds globally.

- CE-Creates, an internal business incubator, building start-ups that are socially and environmentally conscious.

Crescent Enterprises operates with a value system and culture that embraces corporate governance, inclusive growth, and responsible business practices.

For further information, please visit: www.crescententerprises.com

Crescent Enterprises

CrescentEnterp