PHOTO

Manama, Kingdom of Bahrain | The General Council for Islamic Banks and Financial Institutions (CIBAFI), the global umbrella of Islamic financial institutions successfully held today a Webinar on “Islamic Social Financing: Assessing Islamic Banks’ Current Initiatives and Potential Impact”.

The webinar discussed the role of Islamic banks in social financing, examining both the opportunities and challenges in Islamic social finance. It also covered strategies for advancement and partnerships to further develop the field.

The webinar served as a soft launch for the ninth edition of the CIBAFI Global Islamic Bankers’ Survey (GIBS) 2024 Report, which focuses on the role of Islamic banks in social financing. The webinar focused on the report’s examination of the benefits and challenges of Islamic social finance. It emphasized the crucial role of Islamic banks in advancing social causes and aimed to provide a comprehensive resource for institutions navigating this dynamic sector.

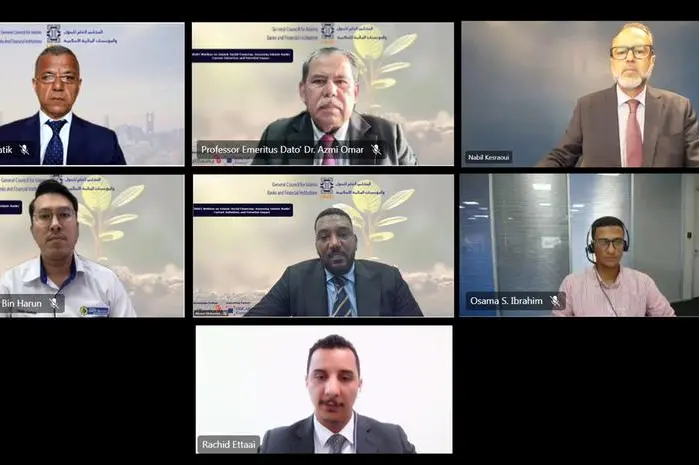

The webinar was inaugurated by welcoming remarks from Dr. Abdelilah Belatik, Secretary General of CIBAFI. It also featured keynote speech from Prof Emeritus Dato’ Dr. Mohd Azmi Omar, President and CEO, INCEIF, Malaysia.

Commenting on the GIBS 2024 Report, Dr. Belatik said: "CIBAFI is committed to addressing key industry trends and challenges. This year’s report highlights the significant role Islamic banks play in promoting social welfare and financial inclusion. It provides insights into how these banks can drive positive societal impact amid economic and geopolitical challenges. We hope this report will enhance understanding and inspire effective strategies within the Islamic finance sector."

The session continued with a presentation by Mr. Rachid Ettaai, Business Development Manager at CIBAFI, on the report's main findings. The report reveals Islamic banks' involvement in social finance, focusing on microfinance, along with the potential growth in Zakat funding and Islamic crowdfunding. It also addresses challenges like lack of awareness and regulatory issues and underscores the need for digital innovation and strategic partnerships to boost sustainability and inclusivity.

The webinar featured discussions from industry experts, including Mr. Nabil Kesraoui, Founder & CEO of FinDev Advisory, Tunisia; Mr. Muhd Fikri Naim Bin Harun, General Manager of Lembaga Zakat Selangor (MAIS), Malaysia; Dr. Abozer Mohamed, Senior Islamic Finance Specialist at the Islamic Development Bank Institute, Saudi Arabia; and Mr. Osama Bishari, Head of Microfinance at Assaray Trade & Investment Bank, Libya.

CIBAFI extends its gratitude to its partners, Albaraka Türk Katılım Bankası A.Ş. "Knowledge Partner" and DDCAP "Supporting Partner", for their support in the launch of the GIBS 2024 Report.

-Ends-

About CIBAFI:

The General Council for Islamic Banks and Financial Institutions is an international non-profit organization founded in 2001 by the Islamic Development Bank (IsDB) and a number of leading Islamic financial institutions. It is an affiliated organ to the Organisation of Islamic Cooperation (OIC). With over 140 members from more than 30 jurisdictions all around the world, CIBAFI is recognized as a key piece in the international architecture of Islamic finance. Its mission is to support the IFSI growth by providing specific activities and initiatives that leverage current opportunities while preserving the value proposition of Islamic finance. CIBAFI office is located at Jeera III, 7th Floor, Office 71, Building 657, Road 2811, Block 428, Manama, Kingdom of Bahrain.

For more information on CIBAFI, please contact:

CIBAFI Secretariat at email: media@cibafi.org