Dubai, UAE: Emirates NBD Bank PJSC ("Emirates NBD") announced today that it proposes to increase its issued share capital by an amount up to AED 758,823,529 from AED 5,557,774,724 to an amount not exceeding AED 6,316,598,253, by creating up to 758,823,529 new shares in the share capital of Emirates NBD (the "New Shares") in order to raise up to AED 6,450,000,000 (which includes a share premium of AED 7.50 per New Share) by way of a rights issue (the "Rights Issue"). Further, Emirates NBD has today published an invitation to its shareholders (the "Invitation") to subscribe for New Shares. Frequently asked questions relating to the Rights Issue will be made available on Emirates NBD's website (www.emiratesnbd.com) on or around today's date.

The New Shares will be issued at an issue price of AED 8.50 per New Share (the "Issue Price"), reflecting the nominal value of AED 1.00 per New Share and a share premium of AED 7.50 per New Share. This represents a discount of 35.36 per cent. to the price of each of Emirates NBD's shares on the Dubai Financial Market ("DFM") at the close of business on 16 October 2019.

The New Shares will rank pari passu with Emirates NBD's existing shares including the right to receive all future dividends and other distributions declared, made or paid after 31 October 2019, including any dividends to be approved and paid in respect of Emirates NBD's financial year ending 31 December 2019.

The terms and launch of the Rights Issue were approved by the Board of Directors of Emirates NBD on 15 October 2019, following the approval of the Rights Issue at Emirates NBD's General Assembly meeting held on 20 February 2019. The Rights Issue has also been approved by the UAE Security and Commodities Authority and the UAE Central Bank.

Emirates NBD intends to use the net proceeds raised from the Rights Issue to strengthen its capital base and to support future growth of the business of Emirates NBD.

Emirates NBD increased its foreign ownership limit ("FOL") from 5 per cent. to 20 per cent. on Monday, 2 September 2019 and announced its intention to increase its FOL to 40 per cent. in the future, and will seek necessary approvals from its shareholder and the relevant regulatory authorities at the appropriate time.

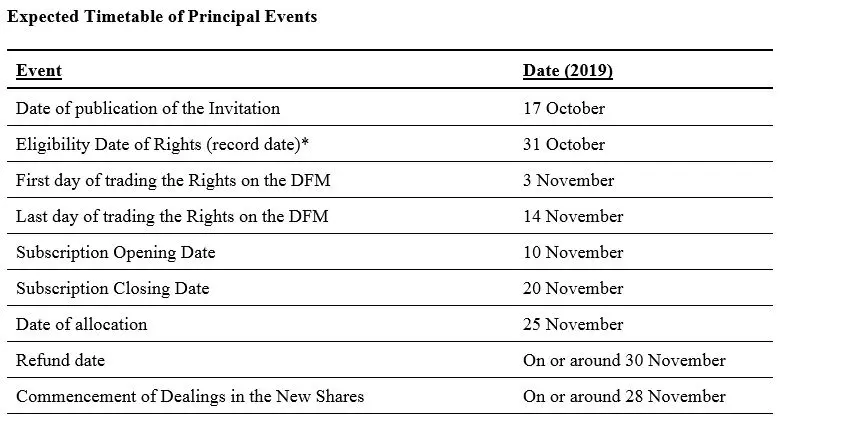

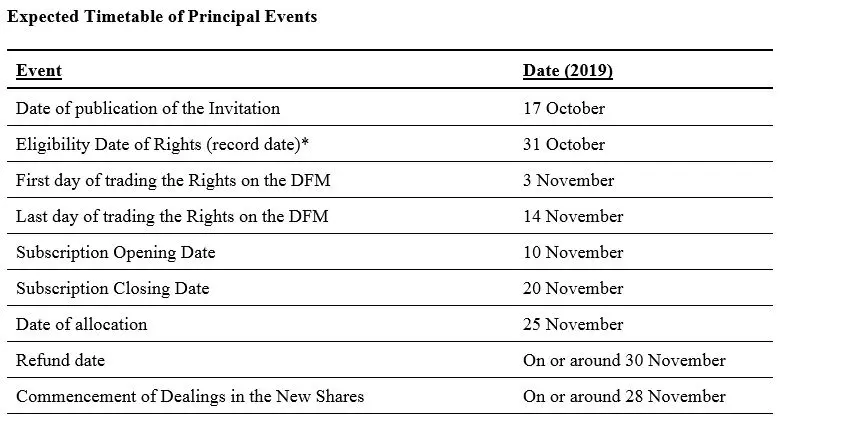

The Rights Issue will be conducted through the issue of tradable securities (the "Rights") pursuant to the Decree of the UAE Securities and Commodities Authority’s Chairman of the Board No. 11RM of 2016 to registered shareholders of Emirates NBD as at the close of business of the DFM on Wednesday, 16 October 2019 in the amount of 1 Right for every 8 shares held on such date. In order to receive Rights on 31 October 2019, investors must ensure that they execute any purchase orders for shares at least two days prior to 31 October 2019, i.e. on or before 2:00 p.m. (UAE time) on 29 October 2019, to allow for the settlement of trades on the DFM (which operates on a T+2 basis).

Shareholders of Emirates NBD will be entitled to trade their Rights on the DFM, whether to sell some or all of their Rights or to buy additional Rights, commencing on Sunday, 3 November 2019 and ending on Thursday, 14 November 2019 (the "Rights Trading Period").

The holders of Rights, which includes shareholders of Emirates NBD and any persons who purchased Rights during the Rights Trading Period (the "Eligible Persons"), will be entitled to exercise their Rights to subscribe for New Shares at the Issue Price commencing on Sunday, 10 November 2019 and ending on Wednesday, 20 November 2019.

The New Shares will be allocated to Eligible Persons on Monday, 25 November 2019. Refunds will be given to Eligible Persons, who did not receive the number of New Shares that they subscribed for, on or around Saturday, 30 November 2019.

Mr. Hesham Abdulla Al Qassim, Vice Chairman and Managing Director of Emirates NBD said: "This milestone announcement is testament to our long-term commitment to our shareholders and the UAE investor community. We are pleased to offer our valued and loyal shareholders an exceptional opportunity to participate in our continued growth and success as we remain key partners to the growth agenda and vision of our nation’s esteemed leadership".

Emirates NBD Capital PSC ("ENBD Capital") has been appointed as Lead Manager and Bookrunner in respect of the Rights Issue. ENBD Capital, Citigroup Global Markets Limited ("Citi") and Morgan Stanley & Co. International plc ("Morgan Stanley") are advising Emirates NBD regarding structuring, sizing and pricing of the Rights Issue. Emirates NBD has appointed itself as the Sole Receiving Bank. Clifford Chance LLP and Matouk Bassiouny & Ibrahim have been appointed as International Legal Adviser and UAE Legal Adviser, respectively.

* In order to receive Rights on 31 October 2019, investors must ensure that they execute any purchase orders for shares at least two days prior to 31 October 2019, i.e. on or before 2:00 p.m. (UAE time) on 29 October 2019, to allow for the settlement of trades on the DFM (which operates on a T+2 basis).

The dates set out in this expected timetable of principal events may be adjusted by Emirates NBD, in which event details of the new dates will be notified to shareholders.

Enquiries: Please contact: (i) Emirates NBD's call centre at +971 4 316 0066; or (ii) ENBD Capital's call centre at +971 4 303 2800.

About Emirates NBD:

Emirates NBD is a leading banking Group in the region. As at 30 June 2019, total assets were AED 537.8 Billion, (equivalent to approx. USD 146 billion). The Group has a significant retail banking franchise in the UAE and is a key participant in the global digital banking industry, with over 90 per cent of all financial transactions and requests conducted outside of its branches. Emirates NBD was declared the Most Innovative Financial Services Organization of the Year at the 2017 BAI Global Innovation Awards.

The bank currently has 233 branches and 1081 ATMs and SDMs in the UAE and overseas and a large social media following, being the only bank in the Middle East ranked among the top 20 in the ‘Power 100 Social Media Rankings’, compiled by The Financial Brand. It is a major player in the UAE corporate and retail banking arena and has strong Islamic Banking, Global Markets & Treasury, Investment Banking, Private Banking, Asset Management and Brokerage operations.

The Group has operations in the UAE, the Kingdom of Saudi Arabia, Egypt, India, Singapore, the United Kingdom and representative offices in China, Indonesia and Turkey.

The Group is an active participant and supporter of the UAE’s main development and community initiatives, in close alignment with the UAE government’s strategies, including financial literacy and advocacy for inclusion of People with Disabilities under its #TogetherLimitless platform. Emirates NBD Group is a Premier Partner and the Official Banking Partner for Expo 2020 Dubai.

On 31 July 2019, Emirates NBD acquired Denizbank A.S., a leading bank in Turkey with total assets of AED 134 billion as at 30 June 2019 (equivalent to approximately USD 36 billion). Denizbank operates through a network of 749 branches, with presence in Turkey, Austria, Germany, Bahrain and Moscow.

For more information, please visit: www.emiratesnbd.com.

Legal Disclaimer

This announcement has been issued by and is the sole responsibility of Emirates NBD. No representation or warranty, express or implied, is or will be made as to, or in relation to, and no responsibility or liability is or will be accepted by either Citi, ENBD Capital or Morgan Stanley, or by any of their respective affiliates or agents, as to or in relation to, the accuracy or completeness of this announcement or any other written or oral information made available to or publicly available to any Eligible Person or its advisers, and any liability therefor is expressly disclaimed.

This announcement has been reviewed and approved by the UAE Securities and Commodities Authority. The information set out in this announcement has not been verified by any regulatory authority, including the UAE Securities and Commodities Authority or the DFM. The purchase of securities in a company involves financial risk. Before deciding to trade in your rights and/or buy any securities and/or if you do not understand the contents of this announcement, you should (a) consult a financial advisor and obtain your own financial advice and (b) ensure that you have read carefully the Invitation.

This announcement and the information contained herein is not an offer of securities for sale, or solicitation of an offer to purchase securities, in the United States (including its territories and possessions, any State of the United States and the District of Columbia), Canada, Australia or Japan. The securities discussed herein have not been and will not be registered under the US Securities Act of 1933, as amended (the "Securities Act") or under any securities laws of any state or other jurisdiction of the United States and accordingly may not be offered, sold, taken up, exercised, resold, renounced, transferred or delivered, directly or indirectly, within the United States except pursuant to registration of the securities under the Securities Act or an applicable exemption from the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. The securities discussed herein will only be offered and sold outside the United States in offshore transactions pursuant to Regulation S under the Securities Act. There will be no public offer of securities in the United States.

The information contained herein does not constitute or form part of any offer or solicitation to purchase or subscribe for any securities in Emirates NBD nor should it form the basis of, or be relied upon in connection with, any decision or commitment to purchase or subscribe for any securities in Emirates NBD. The securities discussed herein will not be offered in any jurisdiction other than in compliance with the applicable laws, rules and regulations governing the issue, offering the sale of securities to the public.

Emirates NBD is not taking any action to permit an offering of the securities discussed herein in any jurisdiction outside the United Arab Emirates. This announcement is only directed at Eligible Persons. The securities are only available to, and an invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with Eligible Persons.

Citi is advising Emirates NBD regarding structuring, sizing and pricing of the Rights Issue and no one else in connection with the Rights Issue and will not regard any other person as a client in relation to the Rights Issue and will not be responsible to anyone other than Emirates NBD for providing the protections afforded to clients of Citi nor for giving advice in relation to the Rights Issue or in relation to any matter, transaction or arrangement referred to in this announcement or the Invitation.

ENBD Capital is acting exclusively as Lead Manager and Bookrunner for Emirates NBD for the purposes of the Rights Issue, as well as advising Emirates NBD regarding structuring, sizing and pricing of the Rights Issue, and no one else in connection with the Rights Issue and will not regard any other person as a client in relation to the Rights Issue and will not be responsible to anyone other than Emirates NBD for providing the protections afforded to clients of ENBD Capital nor for giving advice in relation to the Rights Issue or in relation to any matter, transaction or arrangement referred to in this announcement or the Invitation.

Morgan Stanley is advising Emirates NBD regarding structuring, sizing and pricing of the Rights Issue and no one else in connection with the Rights Issue and will not regard any other person as a client in relation to the Rights Issue and will not be responsible to anyone other than Emirates NBD for providing the protections afforded to clients of Morgan Stanley nor for giving advice in relation to the Rights Issue or in relation to any matter, transaction or arrangement referred to in this announcement or the Invitation.

Citi and Morgan Stanley may at their sole discretion and in-line with their usual business dealings choose to subscribe or oversubscribe for New Shares pursuant to the Rights Issue, subject to Citi and Morgan Stanley, respectively, becoming an Eligible Person.

This announcement may contain "forward-looking statements" concerning Emirates NBD. Generally, the words "will", "may", "should", "continue", "believes", "expects", "intends", "anticipates" or similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those suggested by them. Many of these risks and uncertainties relate to factors that are beyond Emirates NBD's ability to control or estimate precisely, such as future market conditions and the behaviour of other market participants, and therefore undue reliance should not be placed on such statements. Neither Emirates NBD, Citi, ENBD Capital, Morgan Stanley, nor any other entity involved in the Rights Issue or their respective advisers, assumes any obligation to, and does not intend to, update or revise publicly these forward-looking statements, except as required pursuant to applicable law.

This announcement does not constitute a recommendation concerning the Rights Issue. The value of shares (including the securities discussed herein) can go down as well as up. Past performance is not a guide to future performance. Eligible Persons should consult a professional advisor as to the suitability of the Rights Issue for the individual concerned.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.