PHOTO

- Impressive revenue growth of 10% for Q2 2023 reaching KD 461m (USD 1.5 billion)

- Zain Group receives a first-ever cash dividend of USD 42 million from Zain KSA

- Chairman, Mr. Osamah Al Furaih: “Board working closely with management in driving shareholder value through sound ESG practices, operational efficiencies and growing new business verticals”

- VC & Group CEO, Bader Al-Kharafi: “Solid growth in Enterprise, Digital and Fintech revenues boosts financial performance, reassures Board to declare a half-year dividend of 10 fils per share”

- Data Revenue grew 9% to represent 39% of Total Group Revenue for H1 ’23

- Enterprise revenue up 27% for H1 as ZainTech and local B2B teams secure key clients and enter strategic partnerships

- Digital services including Dizlee API platform witness revenue growth of 15% for H1

- Focus on Fintech and Digital Operator entities driving healthy customer and revenue growth

- Establishment of Zain Omantel International (ZOI) set to revolutionize the international telecommunications wholesale landscape

- Zain and TASC Towers enter exclusive negotiations with Ooredoo to create a joint independent tower entity comprising of 30,000 towers

- Zain wins two prestigious ‘Best Corporate Governance’ awards in Kuwait

- Zain publishes 12th sustainability report, entitled ‘An Inclusive Transition for Future Generations’

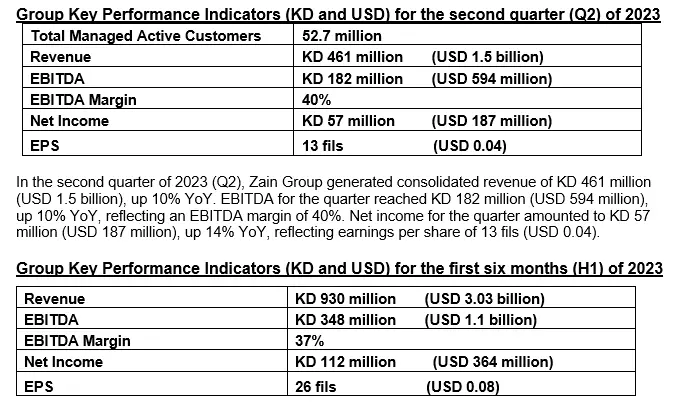

Kuwait City: Zain Group, a leading provider of innovative technologies and digital lifestyle communications operating in seven markets across the Middle East and Africa, announces its consolidated financial results for Q2 and six months ended June 30, 2023. Zain served 52.7 million customers at the end of the period, a 2% increase year-on-year (YoY).

Key Operational Notes for H1’ 2023

- For the 3rd consecutive year, Board declares an interim dividend of 10 fils per share for first six months of 2023 that will be payable to entitled shareholders on 14 September 2023.

- Zain Kuwait wins the number range fees litigation amounting to KD 24.68 million (USD 80.3m)

- Zain Group receives a first-ever cash dividend of SAR 158 million (USD 42m) from Zain KSA

- Data revenue reaches USD 1.2 billion, representing 39% of Group revenue

- Over the six months, Zain Group invested USD 178 million in CAPEX (tangible and intangible)

- Operations in Kuwait, KSA, and Bahrain witness impressive growth in 5G revenues, and soft launch of 5G in Jordan

- Establishment of Zain Omantel International (ZOI) set to revolutionize the international telecommunications wholesale landscape

- Zain and TASC Towers Holding enter exclusive negotiations with Ooredoo to create a joint independent tower entity comprising of 30,000 towers

- Fintech services witness exponential growth as total revenue increased 294% YoY, customers grew 73% to reach 1.3 million, with transaction value doubling YoY

- Zain’s “Tamam” platform in Saudi Arabia awarded ‘Best Personal Finance Solution’ in Middle East

- Enterprise revenue up 27% as ZainTech and local B2B teams secure multiple deals offering compelling ICT services to businesses and governments across the region

- ZainTech acquires Adfolks, a UAE-based cloud transformation services firm and enters strategic partnerships with UAE operator du and Mastercard

- Dizlee API platform and VAS digital services witness healthy revenue growth of 15%

- Zain’s digital operator Yaqoot in KSA, and oodi in Iraq, report strong YoY growth in key KPIs

- Playhera Max cloud gaming platform launched in KSA in June 2023

- Zain wins World Finance Best Corporate Governance Award 2023 and Best Corporate Governance of a listed company in Kuwait by the Arab Federation of Capital Markets

- Zain publishes 12th sustainability report entitled, ‘An Inclusive Transition for Future Generations’

Commenting on Q2 and H1 2023 results, Chairman of the Board of Directors of Zain Group,

Mr. Osamah Al Furaih said, “This exceptional performance is a result of the Board and management’s focus on driving sustainable shareholder value through effective environmental, social and governance (ESG) practices, network upgrades expansion, and growing new lucrative business verticals with a focus on providing customers with an exceptional telecom experience.”

He added, “Our conducive relationships with the management of Omantel and government authorities across our markets is supporting us in our mission to reap the benefits of digital transformation as we drive systemic change and provide meaningful connectivity to the communities we serve and beyond.”

On the ongoing situation in Sudan, the Chairman commented, “We are extremely proud of our people who are working 24/7 and making personal sacrifices in providing vital connectivity to the Sudanese community. The Board and group management are in constant and close cooperation with the management teams there in supporting them on multiple fronts, taking all reasonable measures to protect our people, assets, and commercial operations during this turbulent time. We pray for the safety of all the people in Sudan and are hopeful that the conflict will end soon.”

Mr. Bader Al-Kharafi, Zain Vice-Chairman and Group CEO commented, “The solid growth in Enterprise, Digital and Fintech revenues combined with operational efficiencies across our markets was key to the impressive financial performance for the first half of 2023. On the back of these robust results combined with our strong balance sheet and financial solvency, and in accordance with our declared 35 fils per share minimum dividend policy for the next three years starting 2023, the Board is pleased to declare a third consecutive half-year dividend of 10 fils per share.”

“The sound performance of all our operations is a testament to our firm commitment and success in executing our ambitious ‘4Sight’ corporate strategy to drive growth through digital transformation and new lucrative business streams, as we methodically manage the continuing competitive and socio-economic challenges that several of our markets face.”

“The USD 42 million cash dividend received from Zain KSA for its 2022 financial year, is significant in that apart from being the operator’s first ever-cash dividend distribution to shareholders, it is indicative of the successful achievement of Zain KSA’s transformational turnaround in recent years whereby it reported record revenues and profits in 2022, and likewise for the first six-months of 2023. We are very optimistic of the growth potential of Zain KSA in creating shareholder value and playing a key role in Saudi Vision 2030.”

“Our pioneering Tower sale and leaseback strategy is making substantial progress and creating shareholder value on multiple fronts. We are quietly confident that our recently announced deal of Zain and TASC Towers entering exclusive negotiations with Ooredoo to create a jointly owned independent tower entity comprising of 30,000 towers, will materialize and create enormous value for all our respective stakeholders. We are thankful of Ooredoo’s board and management for their trust and genuine spirit of partnership to take these exclusive discussions forward.”

“I'm very excited by the potential opportunities that the strategic establishment of ‘Zain Omantel International’ (ZOI), a first-of-its-kind joint venture will bring as it will revolutionize the telecommunications wholesale landscape. It will become the Middle East’s premier wholesale powerhouse serving regional operators, international carriers, and global hyperscalers. The partnership will create new opportunities for growth and innovation, with Zain and Omantel customers benefiting from quality internet connectivity, voice, roaming, and messaging. ZOI will manage all international wholesale requirements of Zain and Omantel operations in eight countries, serving over 55 million customers, and benefitting both entities on financial, commercial and operational levels.”

“Our enterprise solutions arm ZainTech is fast becoming the digital transformation partner of choice for governments and businesses across our markets, the UAE and beyond. The recent acquisition of Adfolks, a UAE-based cloud transformation services firm brings a wealth of expertise in developing bespoke and agile technology solutions that will enable ZainTech to drive even more value for its clients in the dynamic and constantly evolving technology landscape by streamlining their digital transformation journey, making it simpler and more seamless than ever before.”

“Furthermore, the recent go-to-market strategic partnership between ZainTech and prominent UAE operator ‘du’ will unlock synergies while embracing ESG principles towards a Net Zero future. The collaboration will enable both companies to offer enterprise customers an innovative and comprehensive suite of solutions across various areas, including Sustainability, IoT, Drones-as-a-Service (DaaS), Data Practice, Cloud Managed Services, and App Modernization, as well as international connectivity.”

“Our fintech entities in KSA, Iraq, Jordan and South Sudan, as well as our pure digital operators in Saudi Arabia and Iraq are witnessing exponential revenue and customer growth, as are the Dizlee API platform and related digital VAS activities in all our markets. We will continue to foster and grow these lucrative areas of business across our footprint.”

Al-Kharafi concluded, “As a leading entity listed on the Premier Market in Kuwait, Zain seeks to exceed the regulations issued by all financial regulatory bodies including the Ministry of Commerce and Industry, the Capital Markets Authority and Boursa Kuwait. Accordingly, it was a gratifying achievement to be recognized as possessing the ‘Best Corporate Governance’ practice in Kuwait for three years in a row by World Finance Publishing House as well as the award of the Best Corporate Governance of a listed company in Kuwait by the Arab Federation of Capital Markets. This milestone justly rewards our Investor Relations, Corporate Governance, and Sustainability teams’ high ethical standards, transparency and professionalism towards all our stakeholders.”

Financial KPIs of key markets for six-month period (H1) ended June 30, 2023

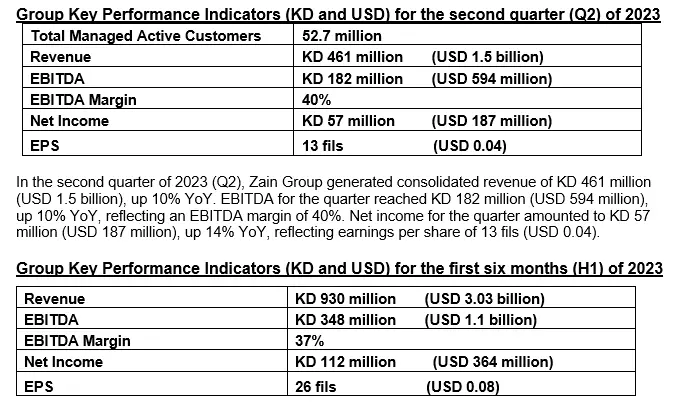

Kuwait: Maintaining its market leadership, the flagship operation of Zain Group saw its customer base grow 2% YoY, to serve 2.6 million customers. The Group’s most profitable operation, revenue remained stable at KD 173 million (USD 563 million), with EBITDA increasing by 39% to reach KD 90 million (USD 295 million), reflecting an EBITDA margin of 52%, mainly due to the successful number range fees litigation of KD 24.68 million (USD 80.3 m) which also impacted net income reaching KD 63 million (USD 206 million). Data revenue represented 39% of total revenue. Despite the intense competition, the operator continues to expand and grow its leading nationwide 5G network capturing the largest 5G customer base and revenue market share in the country. Winning key corporate and government accounts through its unrivaled B2B offerings, as well as the continual introduction of new appealing digital services including Zain Max, a quad-play redefining a new generation of Internet and entertainment plans for postpaid customers, are key parts of the operator’s focus.

Saudi Arabia: Revenue grew 10% YoY to reach USD 1.3 billion, with EBITDA amounting to USD 401 million, reflecting an EBITDA margin of 31%. Net income grew 220% for the six-month period reaching USD 183 million. The operator’s 5G network covering over 50 cities saw data revenue represent 41% of total revenue and customers served stood at 8.7 million.

Iraq: Revenue grew 17% to reach USD 455 million, EBITDA reached USD 166 million, reflecting an EBITDA margin of 37%, with net profit jumping nearly eight-fold to reach USD 43 million compared to USD 5 million last year. The operator’s customer base reached 17.7 million customers maintaining its market leading position.

Sudan: Despite the ongoing conflict, revenue soared 46% to reach USD 303 million, with strong EBITDA growth of 46% reaching USD 154 million, reflecting an EBITDA margin of 51%. Net income for the period grew 23% reaching USD 136 million. Data revenue grew by 67% representing 35% of total revenue, customers base increased by 3% to reach 16.9 million, maintaining its market leadership position.

Jordan: Revenue grew 4% YoY to reach USD 261 million, EBITDA reached USD 106 million, reflecting an EBITDA margin of 41%, with net income reaching USD 38 million. With the ongoing expansion of FTTH and 4G services across the country and soft launch of 5G in parts of the Kingdom, data revenue grew 2% representing 49% of total revenue. Zain Jordan served 3.8 million customers (up 5% YoY) maintaining its market leadership.

Bahrain: Revenue grew 11% YoY reaching USD 98 million. EBITDA for the period was stable at USD 29 million, reflecting an EBITDA margin of 30%. Net income reached USD 7.3 million, with data revenue growing 7% to represent 45% of total revenue.

-Ends-

Contact Group Investor Relations at IR@Zain.com

For additional information, including detailed supplemental schedules, financial statements, and details about our investor call, please visit www.zain.com/en/investor-relations

About Zain Group:

Zain is a leading telecommunications operator across the Middle East and Africa providing mobile voice and data services to over 52.7 million active customers as of June 30, 2023. With a commercial presence in 7 countries, Zain operates in: Kuwait, Bahrain, Iraq, Jordan, Saudi Arabia, Sudan and South Sudan. In Morocco, Zain has a 15.5% stake in ‘INWI’, through a joint venture. Zain is listed on Boursa Kuwait (stock ticker: ZAIN). We recommend the Investor Community download the “Zain Group Investor Relations” Mobile App. For more information please email info@zain.com or visit: www.zain.com; www.facebook.com/zain; www.twitter.com/zain; www.youtube.com/zain; www.instagram.com/zaingroup; www.linkedin.com/company/zain