PHOTO

- Chairman, Osamah Al Furaih: “Another momentous year for Zain in increasing shareholder value by evolving the business and implementing noteworthy ESG initiatives”

- Vice-Chairman & Group CEO, Bader Al Kharafi: “Our strong balance sheet and operational performance allows us to reward shareholders with an attractive 70% payout ratio”

- Q4 2023 revenue KD 494 million (USD 1.6 billion), net profit KD 43 million (USD 140 million)

- Key operations in Kuwait, KSA, Iraq and Jordan deliver impressive net profit growth

- Jordan becomes the 4th Zain operation to offer 5G services

- Data revenue grew 8%, represents 39% of total revenue

- Digital services revenue up 9%; Fintech customer growth of 40%, revenue soared 195%

- Enterprise revenues up 20% as ZainTECH and local B2B teams target strategic clients

- Tower sales and leaseback in KSA, Kuwait, Jordan and Iraq creating value and efficiencies

- Zain maintains region’s highest A- rating on the ‘CDP Score Report–Climate Change 2023’

- Zain brand valuation reaches a milestone USD 3 billion, up 11% year over year

Kuwait City, Kuwait : Zain Group, a leading provider of innovative technologies and digital lifestyle communications operating in eight markets across the Middle East and Africa, serving a customer base of 50.6 million, announces its consolidated financial results for the full-year 2023, and fourth quarter ended 31 December 2023

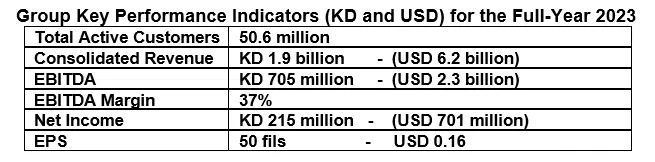

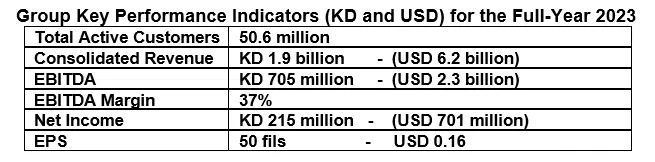

For the full-year 2023, Zain Group generated consolidated revenue of KD 1.9 billion (USD 6.2 billion), a Y-o-Y increase of 10%. Consolidated EBITDA for the period increased by 5% Y-o-Y, to reach KD 705 million (USD 2.3 billion), reflecting an EBITDA margin of 37%. Consolidated net income reached KD 215 million (USD 701 million), up 10% Y-o-Y and reflecting earnings per share of 50 fils (USD 0.16).

Board H2 2023 dividend recommendation.

The Board of Directors of Zain Group recommended a cash dividend of 25 fils per share for the second half (H2) of 2023.This dividend follows the semi-annual dividend of 10 fils distributed earlier in 2023, totaling 35 fils per share for the year and reflecting a 70% payout ratio, one of the highest among listed entities in the region and in line with the Board’s previously committed minimum cash dividend policy of 35 fils in total, for three years that commenced in 2023.

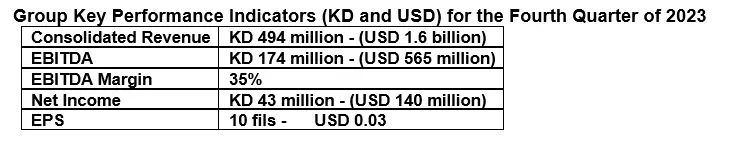

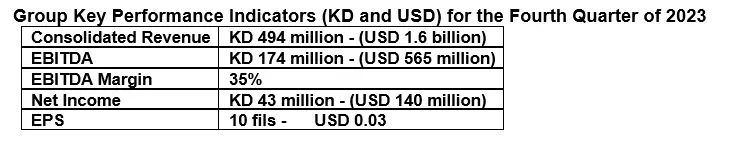

For the fourth quarter (Q4) of 2023, Zain Group generated consolidated revenue of KD 494 million (USD 1.6 billion), up 8% Y-o-Y. EBITDA for the quarter amounted to KD 174 million (USD 565 million), reflecting an EBITDA margin of 35%. Net income for the period amounted to KD 43 million (USD 140 million), representing earnings per share of 10 fils (USD 0.03).

Key Operational Notes for 4th quarter and 12 months ended 31 December 2023

- Throughout 2023, Zain Group invested USD 994 million in CAPEX representing 16% of revenue, mainly on 4G and 5G rollouts, and expansion of FTTH infrastructure and spectrum license fees

- Consolidated data revenue grew 8% to reach USD 2.4 billion, representing 39% of the Group’s revenue for the year.

- Agreement with Ooredoo Group and TASC Towers to create the largest tower company in MENA region valued at USD 2.2 billion with nearly 30,000 towers across six countries.

- Tower sales and leaseback in KSA, Kuwait, Jordan and Iraq boosting efficiencies and net profit

- Zain Jordan launches 5G services, making it the fourth Zain operation offering 5G

- Zain KSA launched the world’s 1st zero-carbon 5G network in the Red Sea

- ZainTECH acquires STS, a leading regional digital transformation solutions provider

- Groupwide B2B revenues inclusive of ZainTech grew 20% as a result of dynamic ICT services

- Zain Omantel International established a unique PAN Middle Eastern network, complemented by extensive global assets including AFRICA ONE, PEACE, and Blue Raman subsea cables

- Groupwide FinTech customers grew 40% Y-o-Y, with revenue up 195% Y-o-Y, and total transaction volume tripling to reach $11 billion.

- Launch of new FinTech brand ‘Bede’ in Bahrain offering microfinance services

- Digital services groupwide witness revenue growth of 9% Y-o-Y, inclusive of Dizlee (API) platform offering 81 live services, and counting over 275 million API transactions since launch in mid-2018

- ‘Best Telecom and Corporate Governance’ company in Kuwait by International Finance Magazine

- Zain’s Diversity, Equity & Inclusion (DEI) program acknowledged with two awards at the SAMENA Council endorsed MEA Business Achievement Awards

- Zain maintains region’s highest A- rating on the ‘CDP Score Report–Climate Change 2023’, among the leaders globally; commits to Science-Based Targets initiative emission guidance

- Zain brand valuation grows 11% to USD 3 billion according to Brand Finance 2024 rankings

Commenting on the 2023 full year results, the Chairman of the Board of Directors of Zain Group, Mr. Osamah Al Furaih said, “It was a momentous year for Zain on multiple levels as the Board worked together with the executive management team on increasing shareholder value by evolving the business and implementing noteworthy ESG initiatives. Our focus on operational efficiency, network upgrades, driving enterprise revenues and the development of new lucrative business verticals were instrumental in achieving these 2023 impressive results.”

The Chairman continued, “The Board is confident of the company’s readiness to exploit the next phase of growth of the numerous technologies and digital services we provide across our footprint. I would like to recognize the government bodies in Kuwait and across our markets for supporting the telecom sector and empowering Zain to provide meaningful connectivity to the communities, businesses, and governments we serve.”

Zain Vice-Chairman and Group CEO, Bader Al-Kharafi commented, “Our Group-wide efforts in monetizing innovative digital services and enterprise solutions on the back of our state-of-the-art networks and technologies, combined with cost optimization initiatives and passive Tower infrastructure strategy, are driving strong operational and financial performance on all our KPIs.”

“Accordingly, we are in a solid position to recommend a H2 dividend of 25 fils (following the 10 fils earlier in H1) that will result in the second consecutive total annual dividend of 35 fils, reaffirming the commitment we made at the beginning of 2023. This reflects an annual 70% payout ratio, one of the highest in the region providing a strong indication of our healthy balance sheet and financial solvency as the Board and management cooperate to grow the business in a sustainable manner.”

“Across all our markets, our management teams are being very agile in dealing with the many socio-economic and competitive challenges and this is reflected in the overall financial results. In Kuwait, the operation delivered impressive results for the year on all levels and the marketing partnership with digital operator Red Bull Mobile is experiencing impressive growth, successfully targeting the youth offering appealing options for prepaid voice and internet services. Likewise, our other digital operators in KSA (Yaqoot) and Iraq (oodi) are witnessing robust growth offering the latest innovative technologies and services to customers.”

“We are very pleased with the impressive operational performance of our operations in KSA, Iraq, Sudan, Jordan and Bahrain, all delivering year on year growth in their financials. The completion of the sale and leaseback of our network towers in KSA and Iraq during 2023 are driving efficiencies on multiple levels and contributing to their financial performances, following the success we had in the pioneering tower sales in Kuwait and Jordan previously.”

“In late 2023, Zain further solidified its position as the regional leader in the tower arena, with a pioneering agreement with Qatar’s Ooredoo Group and TASC Towers, which aims to incorporate nearly 30,000 towers across six countries, combining our respective passive infrastructure portfolios with a combined estimated current enterprise value of USD 2.2 billion. This value creative agreement for all parties is progressing in stages, and we are very appreciative of Ooredoo’s management for raising the notion of collaboration and regionalization to an entirely new level.”

“Throughout the year, we continued to invest heavily in network expansions, upgrades and technologies that drove data and B2B related revenues. Notably, Zain Jordan became the first operator in the country to launch 5G commercial services in December 2023, becoming the fourth Zain operation to offer 5G technology, firmly placing Zain as the region’s leading provider of this exclusive high-speed and reliable service.”

“ZainTECH witnessed several milestones during the year, growing both organically and through acquisitions, notably that of STS in October 2023, a leading regional digital transformation solutions provider. This acquisition will further boost the 20% annual growth witnessed in B2B revenues across our footprint reflecting the sound cooperative business model between ZainTECH and our local operations’ B2B teams in making Zain the connectivity and enterprise partner of choice.

“Early in 2024, we launched the Bede fintech brand in Bahrain which is set to be rolled out across our footprint. Bede stems from Arabic meaning of “in my hand”, catering to consumers’ lifestyles and emerging demands beyond basic telecom services. In Bahrain, this Shariah-compliant AI powered platform offers consumer micro-finance in minutes over a mobile app and will be developed in the future to offer a variety of financial services and products. The impressive and profitable growth of Tamam in Saudi Arabia, and Zain Cash in Iraq and Jordan has firmly established these FinTech entities as market leaders for the unbanked and underbanked in their respective markets. We will continue to foster their growth through innovation.”

“Across our footprint, Zain is guided by the four pillars of our five-year corporate sustainability strategy, centered on Climate Change, Social Business, Inclusion, and Generation Youth. Notably, the A- score that Zain maintained in the latest ‘CDP Score Report–Climate Change 2023’, positioned us first in the region and among leaders globally with respect to climate control initiatives. Our Diversity, Equity and Inclusion (DEI) program continues to be a conducive force within, boosting the company’s productivity and overall morale and much more. It’s rewarding to see this initiative being recognized through various awards from organizations.”

“On a final note, BrandFinance’s recent valuation of the Zain brand that saw it increase 11% from USD 2.7 billion to USD 3 billion is a testament to the investment Zain has placed in establishing its name and identity over the past 17 years. The successful media campaigns, having 23 million social media fans and over 250 million video views annually, the many corporate sustainability, DEI initiatives we have introduced over the years, combined with our ongoing innovation and investment in network upgrades that result in quality mobile and digital services and exceptional customer experience, has made Zain one of the most inspirational and recognized corporate brands in the region and beyond.”

Financial KPIs of key markets for the 12 months ended December 31, 2023

Kuwait: Maintaining its market leadership, the flagship operation saw its customer base increase by 4% to serve 2.7 million customers. The Group’s most profitable operation saw its full year 2023 revenue grow by 5% Y-o-Y to reach KD 360 million (USD 1.2 billion), with EBITDA increasing by 18% to KD 156 million (USD 509 million), reflecting an EBITDA margin of 43%. For the full year, the operator recorded net income of KD 104 million (USD 339 million) reflecting a 26% increase. Data revenue represented 37% of total revenue.

Saudi Arabia: The operator generated revenue of USD 2.6 billion up 9% Y-o-Y, with EBITDA amounting to USD 794 million, reflecting an EBITDA margin of 30%. Net income for the year soared 131% to reach USD 338 million. With its dynamic 5G network covering 54 cities, data revenue represented 40% of total revenue and customers served stood at 8.9 million, up 3%.

Sudan: Despite the ongoing conflict, the operator generated revenue of USD 558 million, up 14%, with EBITDA amounting to USD 269 million, up 7% and reflecting an EBITDA margin of 48%. Net income for the period reached USD 216 million. Data revenue grew by 22%, representing 35% of total revenue, while the operator’s customer base stood at 14.2 million, maintaining its market leadership.

Iraq: Revenue reached USD 974 million up 20%, and EBITDA amounted to USD 375 million up 16% Y-o-Y, reflecting an EBITDA margin of 39%. Net profit reached USD 88 million compared to USD 15 million last year. The operator’s customer base reached 17.9 million customers.

Jordan: Zain Jordan revenue increased 3% to reach USD 525 million, EBITDA reached USD 217 million, reflecting an EBITDA margin of 41%. Net income for the year increased 10% to reach USD 76 million. With the expansion of 4G and launch of 5G services across the country, data revenue grew 1% representing 50% of total revenue. Zain Jordan customer base grew by 3% to reach 3.9 million customers, maintaining its market leading position.

Bahrain: The operator generated revenue of USD 192 million, up 7% Y-o-Y. EBITDA increased 2% to reach USD 60 million, reflecting an EBITDA margin of 31%. Net income grew 2% to reach USD 15.4 million, with data revenue growing 6% to represent 47% of total revenue.

-Ends-

About Zain Group: Zain is a leading telecommunications operator across the Middle East and Africa, serving 50.6 million active customers as of December 31, 2023. With a commercial presence in 8 countries, Zain provides mobile voice and data services in: Kuwait, Bahrain, Iraq, Jordan, Saudi Arabia, Sudan and South Sudan. Headquartered in the UAE, ZainTECH, the Group’s one-stop digital and ICT solutions provider, is playing a key role in the transformation of enterprise and government clientele across the MENA region. Also UAE based, Zain Omantel International (ZOI) is revolutionizing the international telecommunications wholesale landscape as the premier wholesale powerhouse serving regional operators, international carriers, and global hyperscalers. In Morocco, Zain has a 15.5% stake in ‘INWI’, through a joint venture. Zain is listed on the Boursa Kuwait (stock ticker: ZAIN). We recommend the Investor Community to download the “Zain Group Investor Relations” Mobile App. For more, please email info@zain.com or visit: www.zain.com; www.facebook.com/zain; www.twitter.com/zain; www.youtube.com/zain; www.instagram.com/zaingroup; www.linkedin.com/company/zain