PHOTO

Dubai, UAE: Talabat Holding plc (“talabat” or the “Company”), the leading on-demand online food ordering, delivery, takeaway and groceries and convenience retail marketplace in the MENA region, today announces an increase in the size of its initial public offering (the “IPO” or the “Offering”) for the sale of its shares (the “Shares, each a “Share”) on the Dubai Financial Market (“DFM”). The Offering size increase follows significant international and regional investor demand in the Second Tranche (as defined below), including a number of sizeable anchor orders from global long-only and technology sector investors.

KEY HIGHLIGHTS

- The total Offering size has been increased to 4,657,648,125 Shares from the previously announced 3,493,236,093 Shares.

- The Offering size now represents 20% of the Company’s total issued share capital (increased from the previous Offering size of 15% of the Company’s total issued share capital).

- All Shares to be offered are existing shares held by the Company’s sole shareholder, Delivery Hero MENA Holding GmbH (the “Selling Shareholder”), a wholly-owned subsidiary of Delivery Hero SE (“Delivery Hero”), a public company listed on the Prime Standard of the Frankfurt Stock Exchange.

- Based on the unchanged price range for the sale of its Shares of AED 1.50 to AED 1.60 per share (the “Offer Price Range”) and assuming all the Shares in the Offering are sold, the revised size of the Offering is expected to be between AED 7.0 billion (c.US$ 1.9 billion) and AED 7.5 billion (c.US$ 2.0 billion).

- The additional 1,164,412,032 Offer Shares have been wholly allocated to the Qualified Investor Offering (Second Tranche), which is restricted to Professional Investors, as defined in the UAE Prospectus.

- Based on the Offer Price Range, talabat’s market capitalisation at the time of listing will be between c. AED 34.9 billion (c. US$ 9.5 billion) and c. AED 37.3 billion (c. US$ 10.1 billion).

- The subscription period remains unchanged and will close on 27 November 2024 for UAE Retail Investors (as defined below) and on 28 November 2024 for Professional Investors.

- The final offer price will be determined through a book building process and will be announced on 29 November 2024.

- Admission of the Shares to trading on DFM (the “Admission”) is expected to take place on or around 10 December 2024.

INCREASE IN OFFERING SIZE

Following the no objection from the Securities and Commodities Authority of the UAE (the “SCA”), the selling shareholder will now offer 4,657,648,125 Shares, equivalent to 20% of talabat’s total issued share capital. The Offering size was increased from 3,493,236,093 Shares, representing 15% of the Company’s total issued share capital, to cater to significant investor demand in the Second Tranche and to foster a supportive trading ecosystem for talabat post-Admission.

The decision to increase the size of the Offering has been taken on the back of a number of sizeable anchor orders from global long-only and technology sector investors, including several that are investing for the first time on the DFM.

Based on the unchanged Offer Price Range and assuming all the Shares in the Offering are sold, the size of the Offering is expected to be between AED 7.0 billion (c.US$ 1.9 billion) and AED 7.5 billion (c.US$ 2.0 billion), with the additional Offer Shares wholly allocated to the Qualified Investor Offering (Second Tranche), which is restricted to Professional Investors, as defined in the UAE Prospectus.

SUBSCRIPTION PROCESS

As previously announced, the Offering comprises:

- A public offering (the “UAE Retail Offering”) to UAE Retail Investors and other investors in the UAE, including Eligible Employees of talabat (as defined in the UAE Prospectus and referred to as the “First Tranche”) and;

- An offering to Professional Investors (as defined in the SCA Board of Directors’ Chairman Decision No.13/R.M of 2021 (as amended from time to time), as defined in the UAE Prospectus and referred to as the “Qualified Investors Offering” or the “Second Tranche”).

The IPO subscription period opened on 19 November 2024 and will close on 27 November 2024 for UAE Retail Investors and on 28 November 2024 for Professional Investors. The Offer Price Range has been set between AED 1.50 and AED 1.60 per share, implying a market capitalisation at the time of listing of between c. AED 34.9 billion (c. US$ 9.5 billion) and c. AED 37.3 billion (c. US$ 10.1 billion). The final offer price will be announced on 29 November 2024.

The completion of the Offering and Admission is expected to take place on or around 10 December 2024, subject to market conditions and obtaining relevant regulatory approvals in the UAE, including approval of admission to listing and trading on DFM.

The details of the Offering are included in the UAE Prospectus and public subscription announcement (the “Public Announcement”) for the UAE Retail Offering, and in an English-language International Offering Memorandum for the Qualified Investor Offering. The UAE Prospectus and the Public Announcement were published on 11 November 2024. The International Offering Memorandum was published on 19 November 2024. The UAE Prospectus and the International Offering Memorandum are available at https://ipo.talabat.com.

Emirates NBD Capital PSC has been appointed as Listing Advisor.

Emirates NBD Capital PSC, J.P. Morgan Securities PLC, and Morgan Stanley & Co International PLC have been appointed as joint global coordinators and joint bookrunners.

Abu Dhabi Commercial Bank PJSC, Barclays Bank PLC, EFG-Hermes UAE Limited (acting in conjunction with EFG Hermes UAE LLC), First Abu Dhabi Bank PJSC, Goldman Sachs Bank Europe SE, ING Bank N.V., and UniCredit Bank GmbH have been appointed as joint bookrunners.

Emirates NBD Bank PJSC has been appointed as the Lead Receiving Bank. Abu Dhabi Commercial Bank PJSC, Abu Dhabi Islamic Bank PJSC, Al Maryah Community Bank LLC, Dubai Islamic Bank PJSC, Emirates Islamic Bank PJSC, First Abu Dhabi Bank PJSC, Mashreq Bank PSC and Wio Bank PJSC have also been appointed as Receiving Banks.

The Internal Shariah Supervision Committee of Emirates NBD Bank PJSC has issued a Shariah pronouncement confirming that, in its view, the Offering is compliant with Shariah principles. Investors should undertake their own due diligence to ensure that the Offering is compliant with Shariah principles for their own purposes.

-Ends-

For more information please visit the IPO website: https://ipo.talabat.com

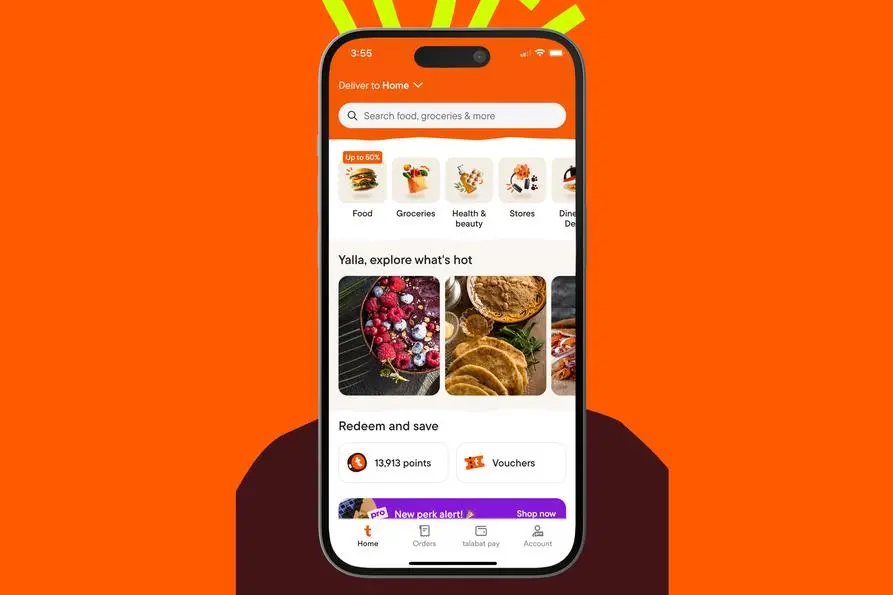

About talabat

Since launching in Kuwait in 2004, talabat, the MENA region’s leading on-demand food, grocery and retail platform for everyday deliveries, has been offering convenience and reliability to its customers. talabat’s local roots run deep, offering a real understanding of the needs of the communities we serve in eight countries across the region. We harness innovative technology and knowledge to simplify everyday life for our customers, optimise operations for our restaurants and local shops, and provide our riders with reliable earning opportunities daily. At talabat, we foster an innovative environment where our talabaty employees can strive to create a positive impact across the region through the use of our platform.

MEDIA & INVESTOR RELATIONS ENQUIRIES

Teneo (Financial Communications Advisor)

Andy Parnis

Shady Hamid

talabat@teneo.com

Teneo

IMPORTANT NOTICE: This email is intended only for the addressee named above. It may contain confidential or legally privileged information.