PHOTO

Dubai, United Arab Emirates: Saxo, the leader in online trading and investment, today announces significant pricing changes across many of its key markets, with a global rollout starting from 15 January 2024.

Clients in the Middle East region can now enjoy substantial price reductions, especially when they trade US stocks, amongst other products such as ETFs, ETPs, Listed Options and Futures.

“In today's investment landscape, the value we offer to our clients is a combination of our ability to provide cost-effective solutions together with our award-winning platforms and services. Lower costs mean higher potential gains for our growing number of clients. As we cross the milestone of serving over 1 million clients globally, our scale enables us to significantly lower our fees and prices. This scale isn't just a number – it's a testament to the trust our clients place in us and a responsibility we take seriously to continuously seek ways to enhance their investment experience. This pricing overhaul is an important strategic move for us for the future, as we take another big step forward to create more win-win with our client" Damian Hitchen, CEO at Saxo Bank MENA.

What can investors expect from Saxo’s price changes?

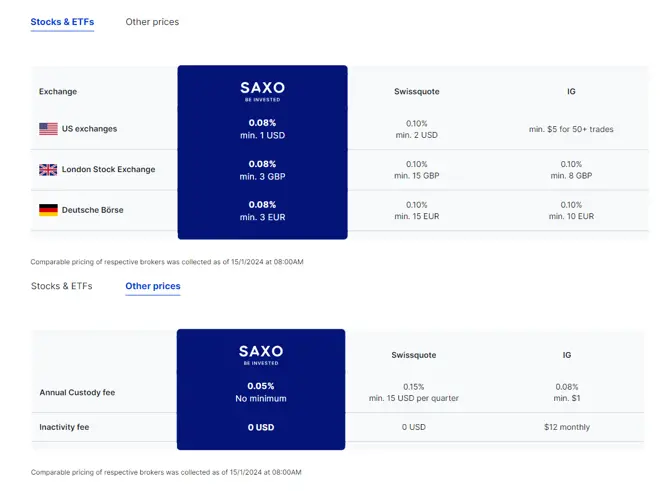

- Transaction-Based: Lower minimum commissions and overall commissions on trading

- Transparent Currency Conversion Fees: Standardisation of the basis points (bps) fee for automated currency conversions across all markets

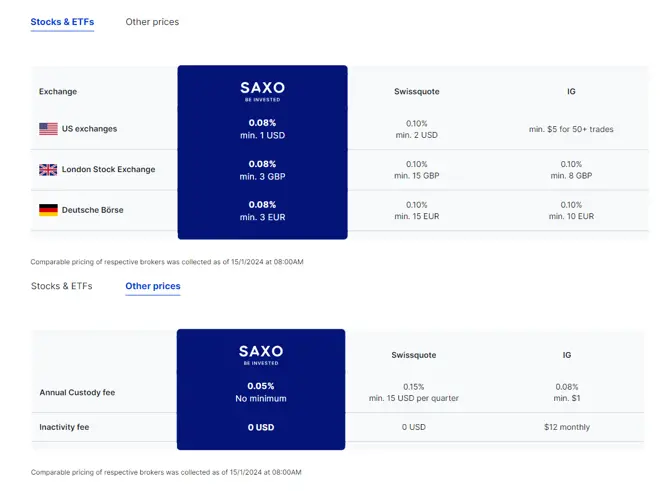

- No inactivity fees: Removal of inactivity fees in all markets

How does this compare locally against other trading providers and brokerages?

“We undertook a rigourous competitor analysis both locally and globally, and we believe our new pricing makes Saxo very competitive on investment and execution fees for our existing and new clients that open an account with us. This added to our global market access, user-friendly investment platforms and comprehensive suite of tools and market insights provide, in our opinion, a win-win opportunity for clients to continue to build and invest for their financial goals and future,” said Damian.

In 2023, Saxo reached a historic milestone of 1 million end clients and crossing USD 100 billion in client assets globally. In addition, the company, headquartered in Copenhagen, Denmark, was also appointed a Systemically Important Financial Institution (SIFI) by the Danish Financial Supervisory Authority (FSA) and received an investment grade rating from S&P. This highlights Saxo’s strong capital position and business model, as well as its cautious approach to risk management.

For more details on the price changes, please visit here.

About Saxo Bank Middle East

At Saxo, we believe that when you invest, you unlock a new curiosity for the world around you. As a provider of multi-asset trading and investment solutions, Saxo’s purpose is to Get Curious People Invested in the World. We are committed to enabling our clients to make more of their money. Saxo Bank was founded in Copenhagen, Denmark in 1992 with a clear vision: to make the global financial markets accessible to more people. In 1998, Saxo launched one of the first online trading platforms in Europe, providing professional-grade tools and easy access to global financial markets for anyone who wanted to invest. It was also the first Scandinavian bank to establish a presence in the GCC when it launched an office in Dubai back in May 2009 to cover its regional operations for the MENA region.

Today, Saxo is an international award-winning investment firm for investors and traders who are serious about making more of their money. As a well-capitalised and profitable Fintech, Saxo is a fully licensed bank under the supervision of the Danish FSA, holding broker and banking licenses in multiple jurisdictions, including a Representative Office license by the Central Bank of the UAE.

As one of the earliest fintechs in the world, Saxo continues to invest heavily in our technology. Saxo’s clients and partners enjoy broad access to global capital markets across asset classes on our industry-leading platforms. Our open banking technology also powers more than 200 financial institutions as partners by boosting the investment experience they can offer their clients. Keeping our headquarters in Copenhagen, Saxo employs more than 2,500 professionals in financial centres around the world including London, Singapore, Amsterdam, Hong Kong, Zurich, Dubai and Tokyo.

For more information, please visit http://www.home.saxo/me.

For media enquiries, please contact Matrix PR

Khushie Mallya: Khushie@matrixdubai.com

Krishika Mahesh: Krishika@matrixdubai.com

Or Call 04 343 0888