PHOTO

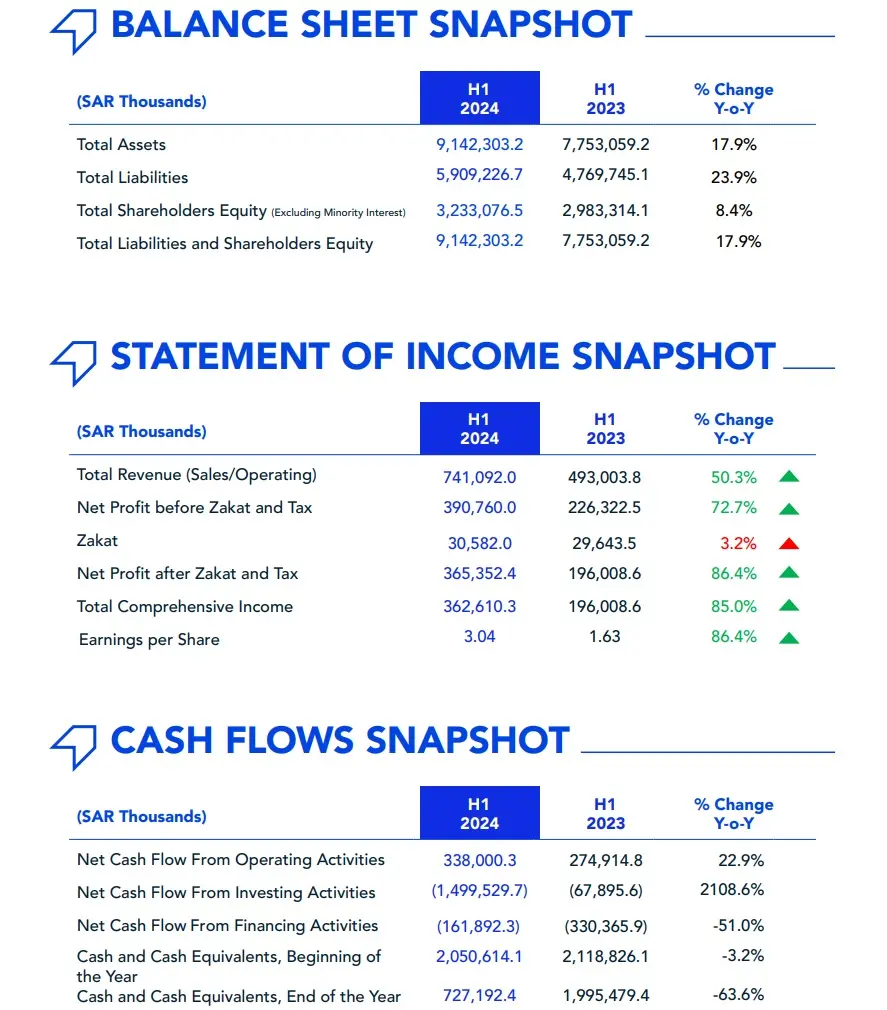

KEY FINANCIAL HIGHLIGHTS

Saudi Tadawul Group Holding Co. (the “Company”or the“Group”), a leading diversified capital markets group in the MENA region, announced its interim financial results for the period ended on 30th of June 2024.

Segment Information

The Group is organized into business segments based on services provided. The reportable segments of the Group are as below:

MESSAGE FROM THE GROUP CHIEF EXECUTIVE OFFICER

Eng. Khalid Al-Hussan CEO, Saudi Tadawul Group

By the end of the first half of 2024, the Group showcased exceptional performance, underscoring our unwavering commitment to advancing our strategy of growth, diversification, and resilience.

The successful completion of the strategic acquisition of DME Holdings Limited exemplifies our strategic diversification and supports our strategic move towards leveraging the Middle East’s geographic proximity to both key commodity production hubs and end-markets. Furthermore, organizing the inaugural international edition of the Saudi Capital Markets Forum isa continuation of the progress we have made in enhancing international partnerships and collaborative achievements.

The advancements we have made in Data Technology segment reflect thesuccessful strategy of our data center co-location services and other innovative initiatives aimed at maximizing data value.

These efforts and accomplishments reinforce our commitment to enhancing Saudi Arabia influence in the global financial sector, ensuring sustainable value for our stakeholders, and seizing future growth opportunities.

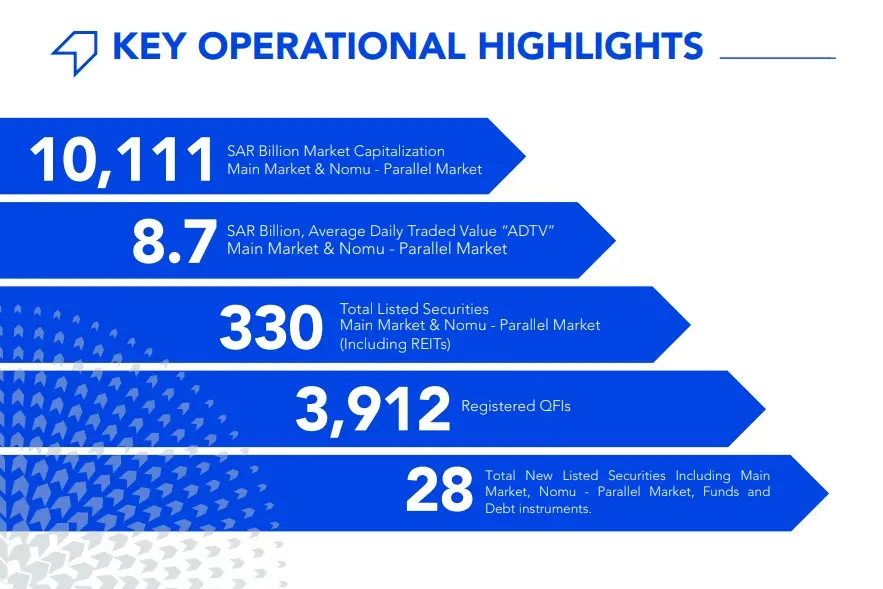

KEY OPERATIONAL HIGHLIGHTS

KEY OPERATIONAL HIGHLIGHTS

- Successful completion of a 32.6% strategic stake acquisition in DME Holdings Limited, marking a significant milestone in the Group’s strategic diversification journey.

- Following the successful completion of the Saudi Capital Market Forum 2024 in February, Group hosted an international edition of the event in Hong Kong aimed to enhance connectivity between Saudi Arabian and Asian capital markets.

- The Group continues to see robust revenue growth in our data and analytics segment, with substantial progress in initiatives aimed at monetizing our data resources.

- Muqassa has launched its Risk Working Group (RWG) to integrate market participants into its Risk Management framework, enhancing advisory capabilities and fostering stakeholder engagement in refining risk management practices in the Saudi capital market.

- The Saudi Exchange launches “TASI 50 “Index.

- The Saudi Exchange celebrated its 400 listed security, this mark a significant milestone in our mission to diversify and strengthen the Saudi capital market.

- The contribution by Edaa in the launch of the first government backed Saving Sukuk product for individuals in Saudi Arabia.

-Ends-