PHOTO

Riyadh has emerged as one of the top 15 fastest-growing cities by 2033, according to the Savills Growth Hubs Index in the latest edition of Savills global thought leadership programme Impacts.

Saudi Arabia offers a plethora of opportunities for new development and business expansion, driven by Saudi Vision 2030. Riyadh is notably the only non-Asian city featured in Savills' top 15 Growth Hubs list, and its potential is linked to a forecast 26% population growth, taking the city from 5.9 million to 9.2 million in 10 years. This growth is expected to result in continued government spending on mega infrastructure projects as well as improved amenities and services to accommodate the growing population.

Richard Paul, Head of Professional Services & Consultancy Middle East, says, “Saudi Arabia boasts a population of around 36 million people and, astonishingly, 67% are under the age of 35. The employment potential and ultimate spending power of this segment of the population over the next decade are enormous.”

Earlier this month, government data showed that the net inflow of foreign direct investment (FDI) in Saudi Arabia increased by 5.6% to SAR 9.5 billion ($2.53 billion) in the first quarter of 2024 compared to the previous year. Ramzi Darwish, head of Savills in Saudi Arabia, says: “The 30-year tax relief for regional headquarters, expanding market, and promising prospects are attracting international companies and reinforcing Riyadh’s position as a vital regional hub for leading businesses across diverse industries. Riyadh is experiencing a remarkable surge in corporate interest, with over 180 foreign companies establishing their regional headquarters in the city in 2023, surpassing the initial target of 160. This growing confidence reflects the robust potential of the Saudi capital.”

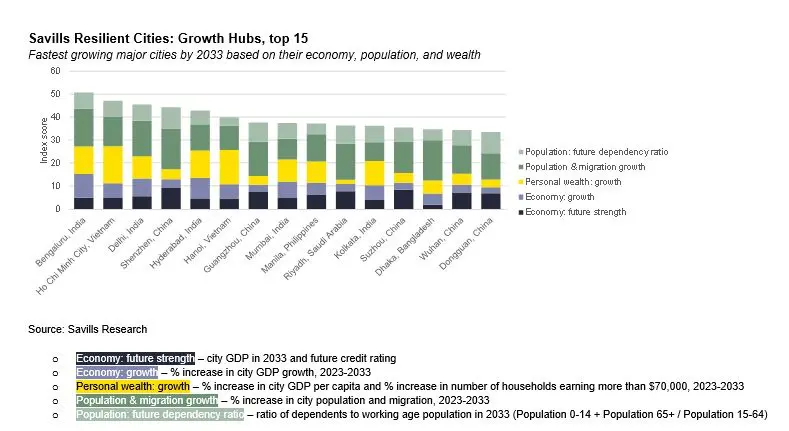

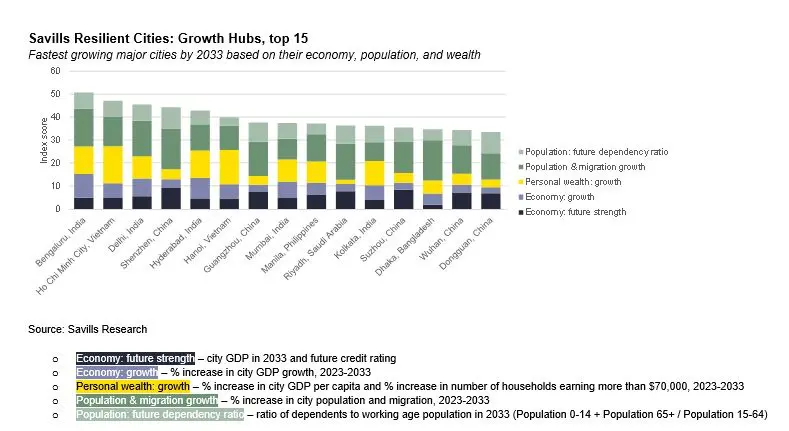

The Savills Growth Hubs Index is a companion of the Resilient Cities Index, where Savills specifically examined the economic strength pillar and forecast it to 2033, to identify high-growth cities with rising wealth and expanding economies. Indian and Chinese cities take five spots each in the top 15, followed by Vietnam with two, and the Philippines, Bangladesh, and Saudi Arabia with one each.

Data is city-metro level from Oxford Economics. Future credit rating is at a country level. Only cities with a GDP in 2023 of US$50bn or above are included in the analysis. The index identifies cities which are the fastest growing over the next decade, rather than the largest, as the chart showing city GDP in 2033 shows.

Paul Tostevin, director and head of Savills World Research, comments: “In economic terms, cities in India and Bangladesh are set to average GDP growth of 68% between 2023 and 2033, followed by those in Southeast Asia, including Vietnam and the Philippines, at 60%.”

“As global growth pivots further from west to east, the real estate implications for cities multiply. The new centres of innovation will become magnets for growing and scaling businesses, and this will underpin demand for offices, manufacturing and logistics space, and homes. Meanwhile, rising personal wealth and disposable incomes will drive opportunities for new retail and leisure developments.”

The transformation of Asia’s economic base, with its increased emphasis on tech-driven growth, underpins the dominance of the region’s cities in the rankings. However, planned infrastructure investment and strategies to improve connectivity and business competitiveness are other key factors.

While economic performance and population growth are promising indicators of future growth, there are other factors required to succeed. Tostevin explains, “Today’s global growth hubs won’t automatically turn into tomorrow’s Resilient Cities. For this, they’ll need to consider their own pathways to more environmentally sustainable development and improve education and labour force participation. They’ll also need to facilitate stable, transparent, and liquid real estate markets.”

Impacts is Savills global thought leadership publication and research programme. In 2024, Impacts is centred around the theme of “Inflection’, looking at the anticipated turning point in global real estate investment markets, and more broadly the future impact of social, environmental, technological, and demographic change (amongst other things) on places and spaces.

About Savills Middle East:

Savills plc is a global real estate services provider listed on the London Stock Exchange. With a presence in the Middle East for over 40 years, Savills offers an extensive range of specialist advisory, management and transactional services across the United Arab Emirates, Oman, Bahrain, Egypt, and Saudi Arabia. Expertise includes property management, residential and commercial agency services, property and business assets valuation, and investment and development advisory. Originally founded in the UK in 1855, Savills has an international network of over 700 offices and associates employing over 40,000 people across the Americas, UK, Europe, Asia Pacific, Africa, and the Middle East.

For further information, please contact:

Savills press office:

+971 50 316 5605

amjad.mkayed@savills.me

+971 50 331 5460

siddhi.sainani@savills.me

+971 (0)4 365 7700

www.savills.me