PHOTO

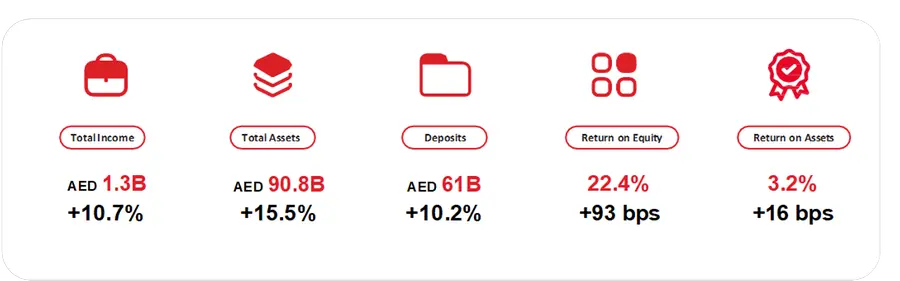

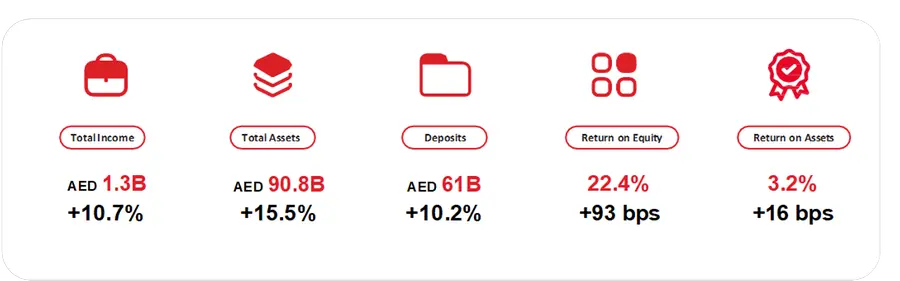

Highlights - Q1 2025

All percentage variances are YoY

Key Financial Highlights – Q1 2025

- Profit after tax of AED 704M for Q1’25 up 22.7% over Q1’24

- Operating Profit of AED 866M up 10.2% YoY on the back of strong growth in balance sheet and non-interest income

- Operating Expenses grew by 11.8% vs last year driven by continued investments in technology, data, people and customer experience. Cost to income ratio (CIR) at 33.4% vs. 33.1% for Q1’24

- Total Assets have crossed AED 90B for the first time in Bank’s history

- Gross loans & advances surpassed AED 50B mark, reflecting a 16.7% YoY increase. Growth driven by all segments, with Wholesale Banking loans growing by 30.1% YoY, aligning with the bank's diversification strategy

- Customer deposits reached AED 61.0B, up 18.2% YoY, with a CASA1 ratio of 65%, up 10.2% YoY, one of the highest in the industry

- Portfolio credit quality remains robust with cost of risk at 0.8% as against 1.5% during the same period last year, supported by a strategic shift in business mix towards secured, low risk assets

- The impaired loan ratio as at Q1’25 improved to 2.1% against 2.6% as at Q1’24 while ‘Provisions to Gross Loans’ ratio of 5.6% compared to 6.0% as of Q1’24, providing adequate coverage

- Shareholder returns remained strong with Return on Equity (ROE) of 22.4% against 21.4% in Q1’24 and Return on Assets (ROA) of 3.2% against 3.1% in Q1’24

- The Bank remains well capitalized with capital adequacy ratio (CAR) at 18.6% for Q1’25 against 17.2% as at Q1’24

- Strong liquidity position is reflected by an Eligible Liquid Asset Ratio of 17.1% vs. 13.5% at Q1’24 and Advances to Stable Resources Ratio at 76.4% vs. 78.7% at Q1’24

-Ends-

About RAKBANK

RAKBANK, also known as the National Bank of Ras Al Khaimah (P.S.C), is one of the UAE's oldest yet most dynamic banks. Since 1976, RAKBANK has been a market leader, offering a wide range of banking services across the UAE.

We’re a public joint stock company based in Ras Al Khaimah, UAE, with our head office located in the RAKBANK Building on Sheikh Mohammed Bin Zayed Road. The Government of Ras Al Khaimah holds the majority of our shares, which are publicly traded on the Abu Dhabi Securities Exchange (ADX).

RAKBANK stands out for its innovation and unwavering commitment to delivering awesome customer experiences. Our transformative digital journey aims to be a 'digital bank with a human touch,' accompanying you during key moments.

With 21 branches and advanced Digital Banking solutions, we offer a wide range of Personal, Wholesale, and Business Banking services. Through our Islamic Banking unit, RAKislamic, we provide Sharia-compliant services to make your banking experience seamless, whether you visit us in person or online.

For more information, please visit www.rakbank.ae or contact the Call Centre on +9714 213 0000

For more information, please contact:

Suzana Saoud

Senior Account Manager

Gambit Communications

Suzana@gambit.ae