PHOTO

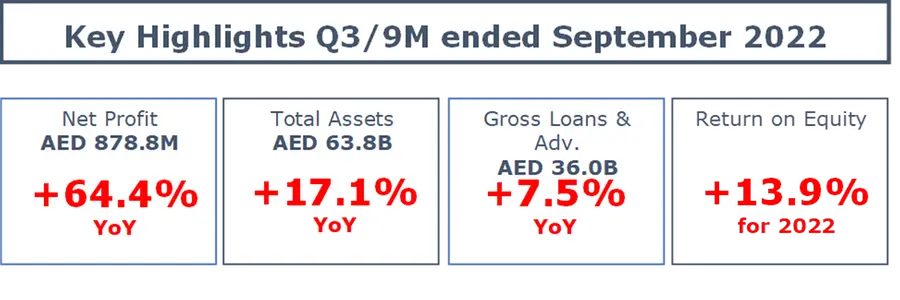

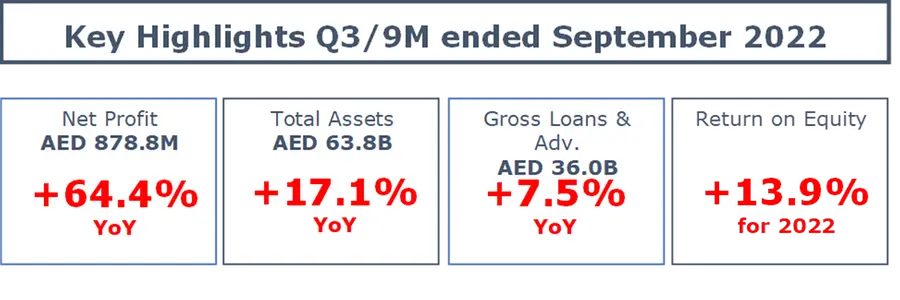

Ras Al Khaimah, United Arab Emirates – The National Bank of Ras Al Khaimah (PSC), RAKBANK, today reported its financial results for the first nine months of 2022

Highest net profit since Q3 2015 driven by diversified balance sheet & lower cost of risk in a robust macro-economic environment.

- Net profit for the quarter amounts to AED 351.4M up 53.7% compared to Q3 2021, reflecting the highest quarterly Net Profit since Q3 2015.

- Compared to Q3 2021, Total Income increased by 13.6% to AED 915.1M, supported by a strong increase of 19.5% for the Net Interest Income to AED 652.8M and an increase of 1.3% of the Non Interest Income to AED 262.3M.

- Gross Loans & Advances totals up to AED 36.0B, showing an increase of 7.5% YoY and 5.3% YTD.

- Customer Deposits stood at AED 40.3B, a boost of 8.8% YoY and 6.9% YTD.

- Well diversified asset growth and continued improvement in the UAE’s economic environment led to a 47.1% YoY reduction in impairments.

Healthy returns whilst remaining well capitalized and having one of the best provision coverage ratios in the industry.

- Net Interest Margins increased marginally to 4.0% and continue to be one of the highest in the Industry.

- The Bank’s Non-Performing Loans ratio is at 3.2% and continues to improve.

- Loan Provision coverage ratio is at 156.5% remaining one of the strongest in the industry.

- Strong profitability metrics with annualized ROA and ROE of 2.0% and 13.9% respectively.

- With Capital Adequacy Ratio (CAR) at 17.0%, the Bank remains well capitalized.

Raheel Ahmed, CEO: "This quarter we delivered a net profit of AED 351M, which is the highest since Q3 2015, as we continued on our path to sustainable growth & diversified business mix. Our operating Income is becoming well balanced and backed by robust balance sheet growth. We remain disciplined with cost, while reaping the benefits of our business mix shift through lower provisions. The RAKBANK team remains to be fully focused on providing the best service to our customers, while at the same time being relentlessly focused on delivering results."

"In order to support the cross border trade and promote strategic initiatives that enhance the region’s payments infrastructure, we have partnered with Buna, the Arab Monetary Fund (AMF)’s payment platform."

"We continue to back entrepreneurs and start-ups and opened more than 8,000 new accounts for them YTD. We have also offered financing solutions to more than 3,800 SMEs in the last nine months and helped 800 customers to buy their homes. Additionally we deepened existing relationships as evidenced by the growth in card spends and overall payments."

"As a result of our customers’ confidence and trust, we have been recognized as UAE’s Mid-sized Domestic Retail Bank of the Year and UAE’s best SME Bank of the Year by the Asian Banking & Finance Awards. We also received the Best SME Bank in the UAE Award from the Global Finance Magazine and the Banking Excellence Awards."

"This quarter’s net profit grew from strength to strength and our 9 months net profit recorded AED 879M, an increase of 64% YoY, as we benefit from income growth and stringent cost management."

"Our income growth is driven by the Bank’s solid balance sheet momentum across all the segments, with Business Banking and Wholesale Banking growing by AED 906M (up 11%) and AED 687M (up 8%) respectively, while Retail Banking grew by AED 231M (up 1.3%). Customer Deposits increased by 9% YoY, outpacing the growth in Gross Loans and Advances, given the importance of Liabilities in a rising interest rate environment."

"The continuing shift in the business mix to make our business more sustainable and resilient is resulting in the low level of Provision for Credit Loss that recorded AED 465M, marking a 47% decrease YoY."

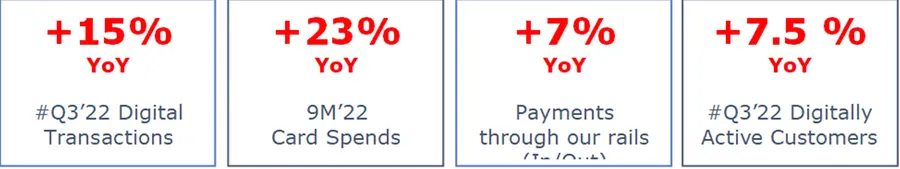

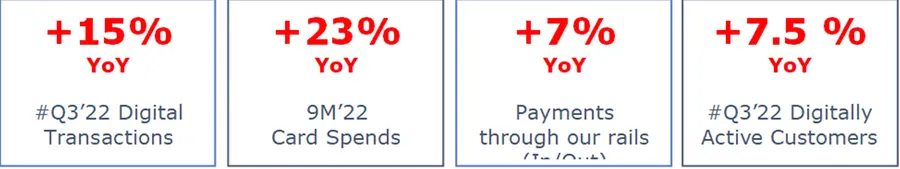

"Lastly, our digital transformation is starting to yield early results as our digitally active customers continued to increase by 7% YoY, while our digital transactions achieved a record growth of over 15% YoY."

Q3/YTD 2022 Management Discussion & Analysis

Financial Highlights for Q3/YTD 2022

| Income Statement Highlights | Quarter Results | 9 months Results | ||||||

| (AED M) | Q3’22 | Q3’21 | Q2’22 | Q3’22 vs Q3’21 | Q3’22 vs Q2’22 | YTD’22 | YTD’21 | YTD’22 vs YTD’21 |

| Net Interest Income and net income from Islamic financing | 652.8 | 546.5 | 563.0 | 19.5% | 15.9% | 1,756.2 | 1,621.3 | 8.3% |

| Non-Interest Income | 262.3 | 258.9 | 252.0 | 1.3% | 4.1% | 700.9 | 816.8 | (14.2%) |

| Total Income | 915.1 | 805.4 | 815.0 | 13.6% | 12.3% | 2,457.1 | 2,438.1 | 0.8% |

| Operating Expenditures | (372.9) | (351.4) | (367.7) | (6.1%) | (1.4%) | (1,113.0) | (1,024.5) | (8.6%) |

| Operating Profit Before Provisions for Impairment | 542.3 | 454.0 | 447.3 | 19.4% | 21.2% | 1,344.1 | 1,413.6 | (4.9%) |

| Provisions for Impairment | (190.9) | (225.3) | (140.0) | 15.3% | (36.4%) | (465.3) | (878.9) | 47.1% |

| Net Profit | 351.4 | 228.7 | 307.3 | 53.7% | 14.3% | 878.8 | 534.7 | 64.4% |

| Balance Sheet Highlights |

| Results as at | Variance | ||||||

| (AED B) | Sep’22 | Jun’22 | Dec’21 | Sep’21 | Sep’22 vs Dec’21 | Sep’22 vs Sep’21 | Sep’22 vs Jun’22 | ||

| Total Assets | 63.8 | 60.8 | 56.3 | 54.5 | 13.4% | 17.1% | 5.1% | ||

| Gross Loans & Advances | 36.0 | 35.8 | 34.2 | 33.5 | 5.3% | 7.5% | 0.6% | ||

| Deposits | 40.3 | 39.6 | 37.6 | 37.0 | 6.9% | 8.8% | 1.8% | ||

| Key Ratios | Quarter Ratios |

| Year to date Ratios | ||||||

| Percentage | Q3'22 | Q3'21 | Q2'22 | Q3'22 vs Q3'21 |

| Q3'22 vs Q2'22 | YTD Sep'22 | YTD Sep'21 | YTD Sep'22 vs YTD Sep'21 |

| Return on Equity* | 16.2% | 11.3% | 14.8% | 4.9% |

| 1.4% | 13.9% | 9.0% | 4.9% |

| Return on Assets* | 2.3% | 1.7% | 2.1% | 0.6% |

| 0.2% | 2.0% | 1.4% | 0.6% |

| Net Interest Margin* | 4.3% | 4.1% | 3.9% | 0.2% |

| 0.4% | 4.0% | 4.1% | (0.1%) |

| Cost to Income | 40.7% | 43.6% | 45.1% | 2.9% |

| 4.4% | 45.3% | 42.0% | (3.3%) |

| Impaired Loan Ratio | 3.2% | 4.5% | 3.6% | 1.3% |

| 0.4% | 3.2% | 4.5% | 1.3% |

| Impaired Loan Coverage Ratio | 156.5% | 134.3% | 142.1% | 22.2% |

| 14.4% | 156.5% | 134.3% | 22.2% |

| Total Capital Adequacy Ratio Basel III** | 17.0% | 17.8% | 16.8% | (0.8%) |

| 0.2% | 17.0% | 17.8% | (0.8%) |

* Annualized

**After application of Prudential Filter

Figures in brackets represent unfavorable movements

Key Highlights

Profitability Growth supported by Income momentum and improvement in Provisions

- 64.4% increase in Net Profit to AED 878.8M for nine months ended 30 Sep 2022. Net profit for the quarter at 351.4M up 53.7% compared to Q3 2021, reflecting the highest quarterly Net Profit since Q3 2015.

- Net Interest Income and Income from Islamic products net of distribution to depositors stood at AED 1.8B for nine months ended 30 Sep 2022, an increase of 8.3% compared to same period in 2021.

- Interest income from conventional loans and investments was up by 14.1% compared with the first nine months in 2021, and interest costs on conventional deposits and borrowings was up by 55.6%. Net income from Sharia-compliant Islamic financing was up by 3.7%.

- Non-Interest Income at AED 700.9M, reflects a reduction of 14.2% mainly on account of exceptional trading losses that were booked in Q1 2022. Non-Interest Income for Q3 2022 was up 1.3% compared to Q3 2021.

- Non-interest income was down by AED 116.0M mainly due to a decrease of AED 76.1M in investment income and a reduction in the Gross insurance underwriting profit by AED 21.4M. This was partly offset by an increase of AED 20.0M in Forex and Derivative income.

- Total Income continues to benefit from the momentum attained from the balance sheet achieving a growth of 12.3% as against the previous quarter and 13.6% increase compared to the same quarter previous year.

- Operating Expenditure is at AED 1.1B for nine months ended 30 Sep 2022, reflecting an increase of 8.6% as compared to the same period 2021 and 6.1% when compared to Q3 2021 as the Bank continued to invest for growth. When measured against the previous quarter, the Operating Expenditure marginally increased by 1.4% as we start delivering structured costs to fund our strategic investments.

- Compared to 30 September 2021, operating expenses for first nine months of this year were higher mainly due to an increase of AED 76.1M in staff costs and AED 27.0M in Card expenses. This was partly offset by a reduction of AED 6.5M in depreciation, AED 1.8M in marketing expenses and 6.4M in other expenses.

- Cost-to-Income ratio for the bank increased to 45.3% compared to 42.0% at the end of same period last year and 43.2% for FY 2021 largely due to the losses in the Trading book during the first quarter, leading to lower income for YTD 2022. As for Q3 2022, the same was at 40.7% improving against the 45.1% for Q2 2022.

- The Provision for credit loss at AED 465.3M as at 30 September 2022, decreased by 47.1% compared to same period 2021 and is lower by 15.3% for Q3 2022 when compared to Q3 2021 driven by a change in business mix and improvement in portfolio credit quality.

- Net Credit Losses to average loans and advances closed at 1.7% compared to 3.6% as at end of 30 September 2021.

Balance Sheet crosses AED 63B with a strong uptick across customer segments

- Balance sheet crosses AED 63B as the Total Assets increased year to date by AED 7.5B reflecting a growth of 13.4%, due to an increase in Gross Loans and Advances by AED 1.8B, Cash and Central Bank balance increased by AED 1.9B, an increase in Lending to Banks by AED 2.0B and Investments growth by AED 1.3B.

- A strong balance sheet drive was evident across all of the Bank’s segments. Lending in the Wholesale Banking increased by AED 687.1M, Retail Banking segment increased by AED 231.1M and Business Banking lending increased by AED 905.7M compared to 31 December 2021 respectively.

- Wholesale Banking Segment reflected a strong YTD growth on the balance sheet of 7.9% on the back of strong advancement in the Financial Institutions portfolio.

- The growth of the Retail Banking segment was supported by a strong sales momentum across products, with Mortgages growing by 3.5%, Credit Cards by 3.3%, Auto Loans by 4.0% and Personal Loans by 1.6%.

- Business Banking segment recorded an 11.2% growth YTD backed by a 9.2% increase on Business Loans as well as a raise in the trade and working capital loans by 12.5%.

- Non-performing Loans and Advances to Gross Loans and Advances ratio declined to 3.2% as at 30 September 2022 compared to 4.5% as at 30 September 2021 and 4.1% as at December 2021.

Strong Growth in Customer Deposits as we become the main bank for more of our customers

- Customer deposits increased by 8.8% compared to 30 September 2021 and 6.9% compared to 31 December 2021 mainly due to an increase of AED 1.8B in CASA accounts and AED 759M in time deposits; thus further endorsing the trust our customers place in RAKBANK’s solutions and services.

Comfortable Capital and Liquidity position

- The Bank’s total Capital Ratio as per Basel III, after the application of prudential filter was 17% which remained the same compared to the end of the previous year.

- The regulatory eligible liquid asset ratio at the end of 30 September 2022 was 14.5%, compared to 11.6% as at 31 December 2021, and advances to stable resources ratio stood comfortably at 84.8% compared to 82.9% at the end of 2021.

Healthy Cash Flows from operating activities

- Cash and cash equivalent as at 30 September 2022 were AED 5.1B compared to AED 2.3B as at 30 September 2021.

- Net cash generated from operating activities was AED 4.9B, AED 1.9B was used in investing activities and AED 1.2B used in financing activities.

Impact of Projected Capital Expenditure and developments

- The Group incurred AED 58.7M in capital expenditure primarily focused on implementing and embedding Consumer Protection Framework while enhancing our AML / CFT systems, and investing in digital experiences.

- RAKBANK will carry on advancing its investment towards customer-centric technology transformation.

Further embedding ESG into RAKBANK’s Strategy and Mission

- RAKBANK customers logged into our digital solutions over 9 million times in the third quarter of 2022, plus over 250,000 customers are digitally active. This further drives our strategic vision of creating a seamless digital journey for our customers.

- As we continue to be our customers’ long term financial partner and remain by their side through any life changing event, we have introduced RAKBANK Money Assist not only to help them assess their debt situations and make sounder financial decisions but also to support them in planning, spending, and taking control of their finances.

- Moreover, the Bank is working closely with the Ras Al Khaimah Municipality on an energy audit program for the industrial sector. The program will help industrial companies identify energy saving opportunities that will make them more environmentally friendly and competitive. The Bank’s role is to extend a credit facility to dilute these initiatives over time along with any other financial support that such companies may need when investing in the necessary equipment/gear to become energy efficient.

- In 2021, the Bank’s Environmental, Social and Governance (ESG) framework was rated as BBB by Morgan Stanley Capital International (MSCI). For more details on the Bank’s ESG Framework and Approach the Bank urges the public to read the RAKBANK 2021 Annual Integrated Report.

Strategy Going Forward

- RAKBANK has developed a refreshed 5-year strategy to build on the Bank’s existing strengths while creating sustainable growth across all key business lines and delivering a simply better customer experience.

Risk Management in the Current Economic Scenario

- The global economic activity is experiencing an overall slowdown, with inflation growing exponentially. There are plenty of factors that contributed to the situation from the Russian-Ukraine conflict, the effects of COVID-19, Supply-chain challenges, and more.

- According to the IMF, the global growth is forecast to slow from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the aftermath of the COVID-19 pandemic.

- These factors are going to prompt greater caution at the Bank and risk focus as we tread cautiously into the last quarter of 2022 & into 2023.

- The inflation increasing can have a ripple effect on the economy as it directly influences interest rates and borrowing costs. The Bank is looking for methods to offer continuous financial and non-financial support to its customers.

Ratings

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown in the table below. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

|

| ||||

| Rating Agency | Last Update | Deposits | Outlook | |

| Moody’s | May 2022 | Baa1 / P-2 | Stable | |

| Fitch | April 2022 | BBB+ / F2 | Stable | |

| Capital Intelligence | August 2022 | A- / A2 | Positive | |

-Ends-

About RAKBANK

RAKBANK, also known as The National Bank of Ras Al Khaimah (P.S.C), is one of the UAE’s most dynamic financial institutions. Founded in 1976, it underwent a major transformation in 2001 as it rebranded into RAKBANK and shifted its focus from purely corporate to retail and small business banking. In addition to offering a wide range of Personal Banking services, the Bank increased its lending in the traditional SME, Commercial, and Corporate segment in recent years. The Bank also offers Islamic Banking solutions, via RAKislamic, throughout its 27 branches and its Telephone and Digital Banking channels. RAKBANK is a public joint stock company headquartered in the emirate of Ras Al Khaimah and listed on the Abu Dhabi Securities Exchange (ADX). For more information, please visit www.rakbank.ae or contact the Call Centre on +9714 213 0000. Alternatively, you can connect with RAKBANK via twitter.com/rakbanklive and facebook.com/rakbank.

For enquiries, please contact:

Geraldine Dagher

Geraldine@rakbank.ae

Fatima Kloub

Fatima.kloub@rakbank.ae

DISCLAIMER

The information in this document has been prepared by The National Bank of Ras Al Khaimah (P.S.C) a public joint stock company, United Arab Emirates (“RAKBANK”) and is general background information about RAKBANK’s activities and is not intended to be current as on the date of the document. This information is given in summary form and does not purport to be complete.

The information is intended to be read by investors having knowledge in investment matters. Information in this document, including forecast or financial information, should not be considered as an advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities or other financial products or instruments and does not take into account your particular investment objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, you should seek independent financial and legal advice. All securities and financial product or instrument transactions involve risks, which include (among others) the risk of adverse or unanticipated market, financial or political developments and, in international transactions, currency risk.

This document may contain published financial information, or information obtained from sources believed to be reliable, forward looking statements based on numbers or estimates or assumption that are subject to change including statements regarding our intent, belief or current expectations with respect to RAKBANK’s businesses and operations, market conditions, results of operation and financial condition, specific provisions and risk management practices. Readers are cautioned not to place undue reliance on these forward-looking statements. RAKBANK does not undertake any obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside RAKBANK’s control. Past performance is not a reliable indication of future performance.

RAKBANK disclaims any responsibility for the accuracy, fairness, completeness and correctness of information contained in this document including forward looking statements and to update or revise any information or forward-looking statement to reflect any change in RAKBANK’s financial condition, status or affairs or any change in the events, conditions or circumstances on which a statement is based. Neither RAKBANK nor its related bodies, corporate, directors, employees, agents, nor any other person, accepts any liability, including, without limitation, any liability arising from fault or negligence, for any direct, indirect or consequential loss arising from the use/reference of this document or its contents or otherwise arising in connection with it for the quality, accuracy, timeliness, continued availability or completeness of any data or calculations contained and/or referred to in this document.