PHOTO

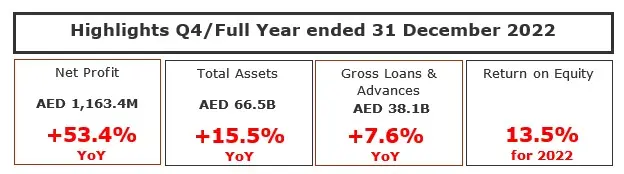

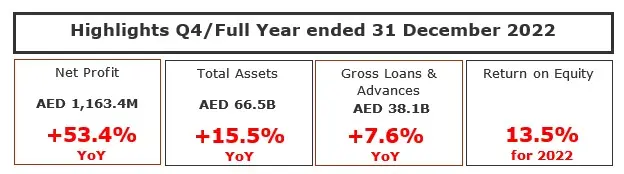

Ras Al Khaimah, United Arab Emirates: – The National Bank of Ras Al Khaimah (RAKBANK) today reported its financial results for the full year 2022 (FY’22) and the fourth quarter of 2022 (Q4’22)

Highest net profit growth rate in over a decade. A high single digit income growth supported by robust increases on both sides of the balance sheet.

- FY’22 net profit of AED 1,163.4M, up 53.4% YoY. Q4’22 net profit of AED 284.6M, up 27.3% YoY.

- FY’22 total income of AED 3,451.8M, up 6.9% YOY, with Q4’22 total income of AED 994.8M, up 25.5% YoY.

- Total income for FY’22 was supported by a strong net interest income of AED 2,489.3M, up 14.8% YoY with Q4’22 net interest income of AED 733.1M, up 34.0% YoY. The FY’22 non-interest income was AED 962.5M, lower by 9.4% YoY mainly due to lower trading profits in Q1’22. The non interest income for Q4’22 was AED 261.6M, up 6.7% YoY.

- A well-diversified balance sheet and resilient UAE economic environment led to a 25.3% reduction in impairments as against FY’21. The impairments for Q4’22 reflect an increase of AED 141M against Q4’21 largely on account of prudent management overlays in anticipation of the expected developments in the fast evolving regulatory landscape, uncertain global economy & rising interest rate environment.

- Gross loans & advances at AED 38.1B, reflecting a 7.6% increase YoY on the back of a changing balance sheet mix in line with the strategic direction of the bank.

- Customer deposits stood at AED 44.9B, an increase of 15.3% YoY.

Healthy returns whilst remaining well capitalized and having one of the best provision coverage ratios in the industry.

- The return metrics remained strong with ROA of 1.9% and ROE of 13.5% for FY’22 as against a 1.4% and 9.5% respectively for FY’21.

- The Bank remained well capitalized with a Capital Adequacy Ratio (CAR) of 16.4%.

- Net interest margins increased to 4.1% against 4.0% (FY’21) and continues to be among the highest in the Industry.

- The Bank’s non-performing loans ratio improved to 3.0% against 4.0% for FY’21.

- Impaired Loan provision coverage ratio increased to 181.7% against 133.7% last year, remaining one of the strongest in the industry.

Continued focus on maximizing shareholder returns

- The Board of Directors recommended distribution of a cash dividend of 34 fils per share for the shareholders’ consideration and approval at the Annual General Meeting (AGM).

H.E. Mohamed Omran Alshamsi, Chairman

Just as the UAE economy accelerated its post-COVID recovery in 2022, RAKBANK’s performance has entered a new and transformative era of growth. Following this strong recovery, we are now on track for sustained expansion underpinned by targeted investments and a sharp focus on fiscal and operational resilience.

As a leading financial institution in the UAE, RAKBANK recognizes the important role we play in supporting the country’s vision and growth for the year 2050. We are committed to investing in technology and innovation to drive financial inclusion and create a more diverse and sustainable economy. We understand the importance of supporting the career growth and development of Emiratis and strive to provide them with empowering programs aimed to contribute to their personal growth and that of the UAE economy.

Looking ahead, we foresee 2023 to be a year of opportunity in the midst of uncertainty caused by geopolitical and economic headwinds. Therefore, we will diversify our business mix and further strengthen our credit profile and lay the foundation of a long term, sustainable growth.

Through the execution of our latest multi-year strategic plan, we will build on the Bank’s existing strengths, while continuing to transform the Bank to navigate through a challenging external environment, and ultimately exceed the expectations of our customers.

By accelerating our digital transformation, we will continue to build digital journeys that enable fast, easy, personal, and relevant customer experiences. These outcomes are fundamental to the Bank’s continued success.

Raheel Ahmed, CEO

RAKBANK delivered a net profit of AED 1,163.4 M, completing a marquee year of recovery and growth with a 53.4% YoY increase – achieving its highest annual growth rate in net profit since 2008. The growth was diversified across all of our segments, and was accompanied by growths in total assets of 15.5%, loans & advances of 7.6%. It is also worth noting that customer deposits grew by 15.3% YoY and CASA ratio was 70.4% as at 31 December 2022 – an important achievement given the rising interest rate environment.

We have seen balance sheet momentum across Wholesale Banking and Business Banking segments that grew by AED 1,589.1M (18.3% YoY) and AED 996M (12.4% YoY) respectively. We also saw Retail Banking grow by AED 102.8M (0.5% YoY).

This stand out performance marks the year of reset.

A reset of performance: where we have achieved a V-shaped recovery by curbing the declines in the pandemic years. We re-ignited growth in both sides of the balance sheet, while prudently managing costs and strengthening our capital position to achieve an ROE of 13.5%.

A reset of strategy: where the Board, the management and employees across the Bank set out our vision to become the ‘digital bank with a human touch with our customers in their key moments of truth’, and defined the strategic programs to achieve that vision.

A reset of the way we work: working as one team, across departments front to back, towards a common goal with clear ownership and accountability.

With the successful completion of the reset phase, now it is time to deliver on the new strategy. We will continue to develop a sustainable business mix including growing the contribution of ‘lower risk’ segments such as Wholesale Banking, Commercial Banking and the Affluent Segment. We will change the way the Bank generates revenue by reducing our reliance on unsecured lending and increasing the proportion of fee and non-financing income as well as driving cross-sell across all segments. Finally, we will create a more scalable business by making investments to enhance our digital journeys and capabilities and improve efficiency in both customer acquisition and servicing.

As we work on these strategic deliverables, we continuously remind ourselves of our north star to stay ahead of the curve in customer experience. We understand that the hallmarks of a superior customer experience are hyper-personalization and relevance, achieved through harnessing the power of data and analytics. To this end, we at RAKBANK will continue to make strides in building trusted partnerships with our customers, as we believe this is ultimately the way we compete - and win.

Profitability Growth supported by Income momentum and improvement in Provisions

- 53.4% increase in Net Profit to AED 1,163.4M for year ended 31 Dec 2022. Net profit for the quarter at 284.6M up 27.3% compared to Q4 2021.

- Net Interest Income and Income from Islamic products net of distribution to depositors stood at AED 2.5B for year ended 31 Dec 2022, an increase of 14.8% compared to same period in 2021.

- Interest income from conventional loans and investments was up by 26.1% compared to year 2021, and interest costs on conventional deposits and borrowings was up by 109.0%. Net income from Sharia-compliant Islamic financing was up by 5.3%.

- Non-Interest Income at AED 962.5M, reflects a reduction of 9.4% mainly on account of exceptional trading losses that were booked in Q1 2022. Non-Interest Income for Q4 2022 was up 6.7% compared to Q4 2021.

- Non-interest income for year ended 2022 was down by AED 99.6M mainly due to a decrease of AED 72.7M in trading profits, decrease of AED 28.7M in Wealth Management Sales income, decrease of AED 24.2M in Other operating income and a reduction in the Net insurance underwriting profit by AED 31.5M. This was partly offset by an increase of AED 57.6M in Forex and Derivative income.

- Total Income continues to benefit from the momentum attained from the balance sheet achieving a growth of 6.9% as against the previous year and 25.5% increase compared to Q4 2021.

- Operating Expenditure is at AED 1.5B for year ended 31 Dec 2022, reflecting an increase of 6.4% as compared to the same period 2021 and is flat when compared to Q4 2021 as the Bank continued to invest for growth. When measured against the previous quarter, the Operating Expenditure marginally decreased by 0.4%.

- Compared to 31 December 2021, operating expenses for year 2022 were higher mainly due to an increase of AED 75.6M in staff costs, AED 29.6M in Card expenses and AED 6.4M in IT expenses. This was partly offset by a reduction of AED 11.6M in occupancy costs, 8.7M in depreciation and AED 2.7M in marketing expenses.

- Cost-to-Income ratio for the bank decreased to 43.0% compared to 43.2% at the end of last year. As for Q4 2022, the same was at 37.3%, improving against the 40.7% for Q3 2022.

- The Provision for credit loss at AED 804.0M for FY 2022, decreased by 25.3% compared to FY 2021 and is higher by 71.3% for Q4 2022 reflecting an increase of AED 141M against Q4 2021 largely on account of prudent management overlays in anticipation of the expected developments in the fast evolving regulatory landscape, and uncertain global economy & rising interest rate environment.

- Net Credit Losses to average loans and advances closed at 2.1% compared to 3.1% as at 31 December 2021.

Balance Sheet crosses AED 66B with a strong uptick across customer segments

- Balance sheet crosses AED 66.5B as the Total Assets increased by AED 8.9B YoY reflecting a growth of 15.5%, with an increase in Lending to Banks by AED 3.0B, Gross Loans and Advances by AED 2.7B, Investments by AED 2.0B and Cash/Central Bank balances by AED 819.8M as compared to 31 December 2021.

- The Wholesale Banking portfolio increased by AED 1.6B, Business Banking by AED 1.0B and Retail Banking segment increased by AED 102.8M compared to 31 December 2021. Wholesale Banking reflected a strong growth of 27% YoY on the back of a resilient economic environment in the UAE, fueled by the banks strategic balance sheet diversification roadmap.

- Business Banking recorded 12.4% growth YoY with Business Loans growing by 11.4% and an increase of 13.0% on the Trade and Working Capital Loans portfolio.

- Retail Banking reflected a growth of AED 102.8M supported by a strong sales momentum across products with Mortgages growing by 6.2%, Auto Loans by 4.4%, Credit Cards by 3.8% and the balance sheet decline on the Personal Loans front being restricted for FY’22. The overall growth on the Retail Banking was subdued by a drop on loans against investments and other retail loans marred by a rising interest rate environment as compared to 31 December 2021.

- Non-performing Loans and Advances to Gross Loans and Advances ratio declined to 3.0% as at 31 December 2022 compared to 4.0% as at December 2021.

Strong Growth in Customer Deposits as we continue to be the main bank for most of our customers

- Customer deposits increased by 15.3% compared to 31 December 2021, mainly due to an increase of AED 3.7B in time deposits and AED 2.2B in CASA deposits, endorsing the trust our customers place in RAKBANK’s solutions and services. RAKBANK has built a strong CASA franchise with a CASA ratio of 70.4 % as at 31 December 2022.

Comfortable Capital and Liquidity position

- The Bank’s Capital and Liquidity ratios remained strong.

- With a Total Capital Ratio as per Basel III, after the application of prudential filter, at 16.4% compared to 17.0% at the end of 2021.

- The regulatory eligible liquid asset ratio at the end of 31 December 2022 at 12.8%, compared to 11.6% as at 31 December 2021, and the advances to stable resources ratio stood comfortably at 79.7% compared to 82.8% at the end of 2021.

Healthy Cash Flows from operating activities

- Cash and cash equivalent as at 31 December 2022 were AED 4.3B compared to AED 3.3B as at 31 December 2021.

- Net cash generated from operating activities was AED 5.3B, AED 2.6B was used in investing activities and AED 1.7B used in financing activities.

Impact of Projected Capital Expenditure and developments

- The Group incurred AED 82.6M in capital expenditure primarily focused on implementing and embedding Consumer Protection Framework while enhancing our AML / CFT systems, and investing in digital experiences.

- RAKBANK will carry on advancing its investment towards customer-centric technology transformation.

2022 was full of developments for RAKBANK and marked by achievements and transformation

- RAKBANK signed a Memorandum of Understanding (MoU) with Tradeling, the hyper growing e-marketplace focused on business-to-business (B2B) transactions in the Middle East and North Africa, to provide enhanced value offering to the Bank’s Business Cardholders.

- RAKBANK announced the launch of a “first of its kind” digital onboarding experience in the region that will enable SMEs to apply for Business Loans, Term and Working Capital Finance and Asset based finance through the Bank’s Quick Apply portal.

- RAKBANK and Abu Dhabi Global Market (ADGM), the international financial center of UAE’s capital, have signed a Memorandum of Understanding (MoU) to provide preferential banking services to ADGM-licensed entities. The agreement facilitates efficient bank account opening for all entities, including SMEs, exchange houses dealing in virtual assets, hedge funds and corporations.

- RAKBANK joined the Arab Monetary Fund (AMF)’s Buna payment platform. This partnership is in line with the Bank’s digital transformation strategy and aims to provide customers with an enhanced payment service platform for sending and receiving cross-border, multicurrency payments safely and securely.

- RAKBANK partnered with global AI Cloud leader, DataRobot and local AI service provider e& enterprise, to build and deploy industry leading AI platform to accelerate its artificial intelligence and machine learning- driven analytics.

- RAKBANK and Honeywell announced a strategic energy saving project to help improve energy efficiencies and carbon reduction goals. Honeywell will optimize heating, ventilation and air conditioning (HVAC), building management system (BMS) and chillers within RAKBANK’s headquarters building, located in Ras Al Khaimah and Dubai, spanning a total area of 19,900sqm.

- RAKBANK teamed up with Etihad Credit Insurance (ECI), the UAE Federal export credit agency, to boost SME financing through the UAE Trade Finance Gateway, a digitized platform that helps exporters and re-exporters based in the country to obtain finance easily and expand their businesses internationally.

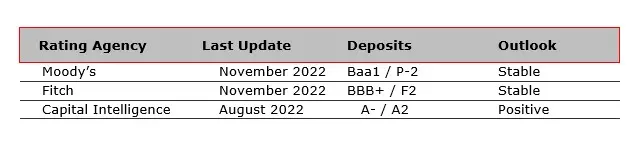

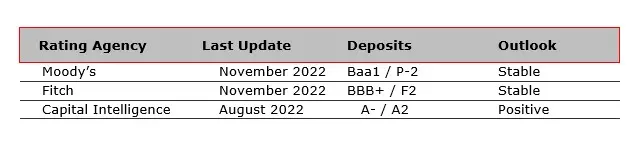

Ratings

RAKBANK gets continuously rated by leading rating agencies with their latest ratings shown in the table below. This rating reflects the institutional strength of the Bank that is backed up by trust and transparency in financial reporting.

-Ends-

About RAKBANK

RAKBANK, also known as The National Bank of Ras Al Khaimah (P.S.C), is one of the UAE’s most dynamic financial institutions. Founded in 1976, it underwent a major transformation in 2001 as it rebranded into RAKBANK and shifted its focus from purely corporate to retail and small business banking. In addition to offering a wide range of Personal Banking services, the Bank increased its lending in the traditional SME, Commercial, and Corporate segment in recent years. The Bank also offers Islamic Banking solutions, via RAKislamic, throughout its branches and its Telephone and Digital Banking channels. RAKBANK is a public joint stock company headquartered in the emirate of Ras Al Khaimah and listed on the Abu Dhabi Securities Exchange (ADX). For more information, please visit www.rakbank.ae or contact the Call Centre on +9714 213 0000. Alternatively, you can connect with RAKBANK via twitter.com/rakbanklive and facebook.com/rakbank.

For enquiries, please contact:

Geraldine Dagher

Geraldine@rakbank.ae

Michelle Saddi

michelle.saddi@rakbank.ae

DISCLAIMER

The information in this document has been prepared by The National Bank of Ras Al Khaimah (P.S.C) a public joint stock company, United Arab Emirates (“RAKBANK”) and is general background information about RAKBANK’s activities and is not intended to be current as on the date of the document. This information is given in summary form and does not purport to be complete.

The information is intended to be read by investors having knowledge in investment matters. Information in this document, including forecast or financial information, should not be considered as an advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities or other financial products or instruments and does not take into account your particular investment objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, you should seek independent financial and legal advice. All securities and financial product or instrument transactions involve risks, which include (among others) the risk of adverse or unanticipated market, financial or political developments and, in international transactions, currency risk.

This document may contain published financial information, or information obtained from sources believed to be reliable, forward looking statements based on numbers or estimates or assumption that are subject to change including statements regarding our intent, belief or current expectations with respect to RAKBANK’s businesses and operations, market conditions, results of operation and financial condition, specific provisions and risk management practices. Readers are cautioned not to place undue reliance on these forward-looking statements. RAKBANK does not undertake any obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside RAKBANK’s control. Past performance is not a reliable indication of future performance.

RAKBANK disclaims any responsibility for the accuracy, fairness, completeness and correctness of information contained in this document including forward looking statements and to update or revise any information or forward-looking statement to reflect any change in RAKBANK’s financial condition, status or affairs or any change in the events, conditions or circumstances on which a statement is based. Neither RAKBANK nor its related bodies, corporate, directors, employees, agents, nor any other person, accepts any liability, including, without limitation, any liability arising from fault or negligence, for any direct, indirect or consequential loss arising from the use/reference of this document or its contents or otherwise arising in connection with it for the quality, accuracy, timeliness, continued availability or completeness of any data or calculations contained and/or referred to in this document.