PHOTO

Doha, Qatar – Qatar Islamic Bank (QIB), Qatar's leading digital bank, announced the addition of innovative features to its award-winning QIB Mobile App, enhancing the customer banking experience with greater convenience, control, and security in managing their financial needs.

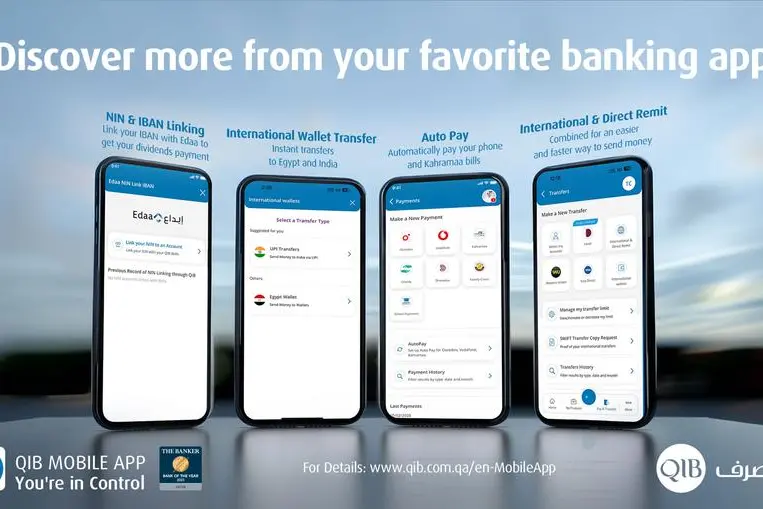

QIB Mobile App now supports international wallet transfers, including UPI transfers to India and Mobile Wallet Payments to Egypt. UPI transfers to India enables real-time account-to-account transfers using UPI ID, allowing QIB customers to send money instantly and easily to any recipient in India. This feature offers significant convenience for Indian nationals in Qatar who wish to transfer money back home effortlessly. Mobile Wallet transfers to Egypt facilitates immediate transfers to any wallet in Egypt using the registered local mobile numbers. This provides a real-time and secure method for fund transfers, enhancing financial inclusion and offering a valuable service to customers with ties to Egypt.

The QIB Mobile App also includes improved payment management features. The new AutoPay feature brings added convenience by allowing customers to set up automatic payments for their utility bills, including Ooredoo, Vodafone, and Kahramaa. It ensures that bills are paid on time without manual intervention, saving time and effort while providing peace of mind that essential services will not be disrupted.

Furthermore, the app introduces the EDAA NIN & IBAN Linking feature, which simplifies the process of receiving dividend payments via the EDAA platform. Investors in the Qatari Stock Exchange can link their National Investor Number (NIN) with their QIB International Bank Account Number (IBAN) via the QIB Mobile App. This ensures dividends are promptly credited to their accounts and prevents unclaimed dividends.

The QIB Mobile App now delivers an enhanced transfer experience by combining International SWIFT transfers and Direct Remit into a single, smooth process. This update simplifies the transfer journey, integrating both services into one feature. For countries where Direct Remit is available, transfers are processed instantly and securely at competitive exchange rates. This unified approach eliminates the need to choose between SWIFT and Direct Remit, as the app automatically selects the most efficient method based on the recipient's country.

Commenting on the new features, Mr. D. Anand, QIB’s General Manager – Personal Banking Group, said: “At QIB, we are committed to continuously improving our customers’ banking experience. These new additions to the QIB Mobile App are designed to provide our customers with more control over their financial needs, making their online banking experience easier, more personalized and beneficial. By transforming our app into a digital one-stop-shop, we cater to our customers’ banking needs anytime, with 24/7 accessibility.”

With over 280 features and a refined user experience, the QIB Mobile App has become the preferred banking channel for most customers, offering a comprehensive and user-friendly platform for all their banking needs. The App offers customers the ability to have full control of their accounts, cards, and transactions and to fulfill all their banking requirements remotely. In addition, QIB customers can open a new account, apply for personal financing, a Credit Card, or open additional accounts instantly via the QIB Mobile App.

Available on the App Store, Google Play, and Huawei AppGallery, customers can download the QIB Mobile App and easily self-register using their active ATM/Debit Card number and PIN.

For more details, please visit: www.qib.com.qa/en-MobileApp