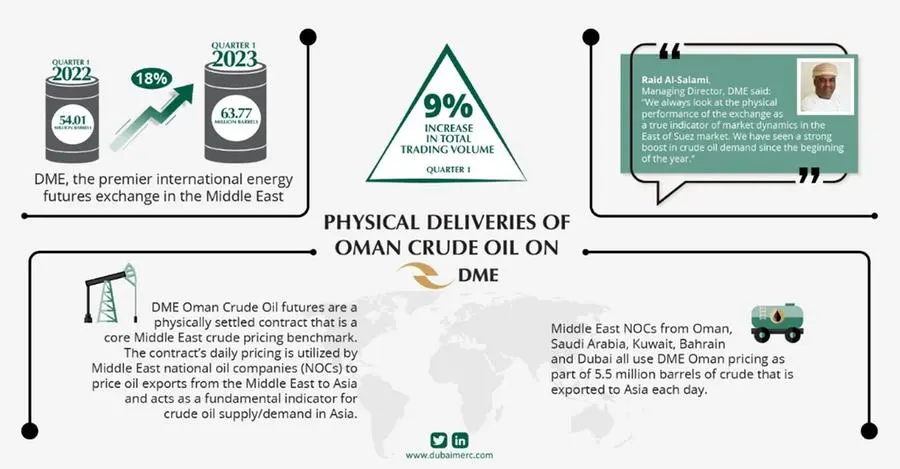

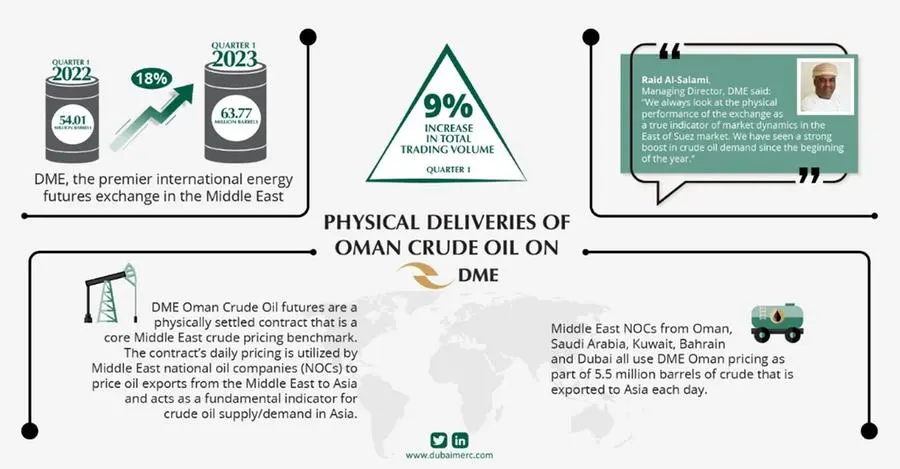

The Dubai Mercantile Exchange (DME), the premier international energy futures exchange in the Middle East, delivered 63.77 million barrels of Omani crude via its exchange delivery mechanism in the first quarter of 2023. This was an increase of 18% from the 54.01 million barrels delivered in the same quarter of 2022.

DME also recorded a 9% increase in total trading volume during the same period.

Raid Al-Salami, Managing Director, DME, said: “We always look at the physical performance of the exchange as a true indicator of market dynamics in the East of Suez market. We have seen a strong boost in crude oil demand since the beginning of the year.”

DME Oman Crude Oil futures are a physically settled contract that is a core Middle East crude pricing benchmark. The contract’s daily pricing is utilized by Middle East national oil companies (NOCs) to price oil exports from the Middle East to Asia and acts as a fundamental indicator for crude oil supply/demand in Asia.

Middle East NOCs from Oman, Saudi Arabia, Kuwait, Bahrain and Dubai all use DME Oman pricing as part of 5.5 million barrels of crude that is exported to Asia each day.

-Ends-