PHOTO

Doha, Qatar: Ooredoo Q.P.S.C. (“Ooredoo”) – Ticker: ORDS today announced its financial results for the nine-month period ended 30 September 2023.

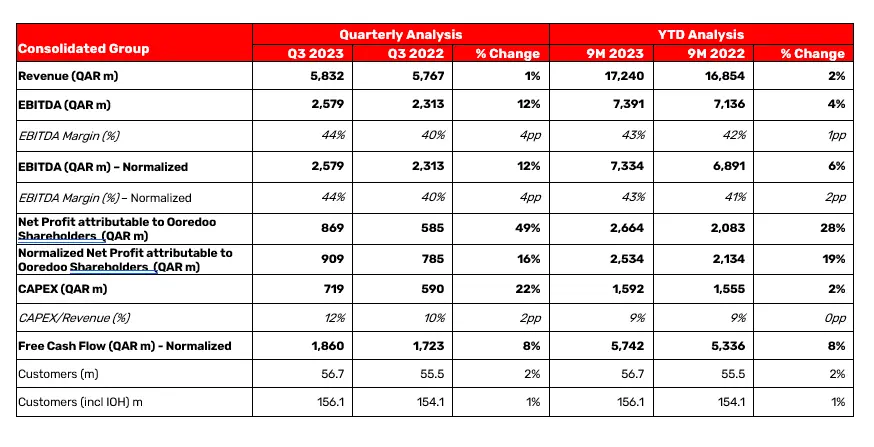

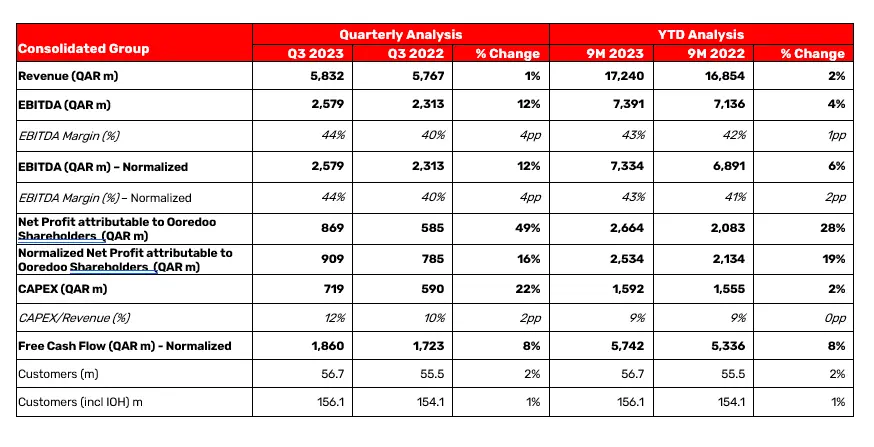

9M 2023 Highlights:

-

Revenue grew by 2% to QAR 17.2 billion

-

EBITDA up by 4% to QAR 7.4 billion and EBITDA margin improved to 43%, up by 1 percentage point (pp)

-

Normalized Net Profit, reached QAR 2.5 billion, up by 19%

-

CAPEX spend of QAR 1.6 billion with a stable capex intensity

-

Strong normalized Free Cash Flow growth of 8% to QAR 5.7 billion

-

Delivered a customer base of 156.1 million, up 1% (including IOH)

-

Group remains on track to achieve FY23 guidance

Commenting on the results, HE Sheikh Faisal Bin Thani Al Thani, Chairman of Ooredoo, said:

“In the first nine months of 2023, the Ooredoo Group has demonstrated its steadfast dedication to providing connectivity, delivering exceptional customer experiences, and maximizing value for our stakeholders. During this period, we achieved remarkable financial results, with revenues totaling QAR 17.2 billion and a significant increase in normalized net profit, reaching QAR 2.5 billion.

Our digital transformation is contributing to our success and making us more resilient while allowing us to seize market opportunities and position ourselves for future expansion. Our adaptability in navigating a dynamic, ever-changing market landscape ensures our ongoing success and attractive returns.

Looking ahead, we are dedicated to continuing our exploration of strategic paths that unlock capital and enhance value for our stakeholders, further cementing our status as an industry leader.”

Also commenting on the results, Aziz Aluthman Fakhroo, Managing Director and CEO of Ooredoo Group said:

“Ooredoo Group sustained its positive trajectory through Q3 2023, showcasing robust operational and financial results for the first nine months of 2023. Revenue grew by 2% to QAR 17.2 billion. The Group delivered positive operating leverage with EBITDA up by 4% to QAR 7.4 billion with a corresponding improvement in the EBITDA margin of 1pp to 43%, supported by disciplined cost control across our operations.

The growth in the quarter was supported by solid contributions from Iraq, Kuwait, Algeria, and Maldives. The Group recorded double-digit growth in normalized net profit of 19% to QAR 2.5 billion.

The success of these results is owed to the dedication of our employees. Their steadfast commitment has played a pivotal role in our achievements.

As we look ahead, our goal is to uphold operational efficiency while pursing our strategic objectives, keeping us on course to meet our FY 2023 guidance targets. We keep strengthening our position as a leading telecommunications company striving to deliver competitive services to our customers and exceptional value to our stakeholders.”

Strategic review

Ooredoo remains committed to its strategy based on five fundamental pillars: delivering exceptional customer experience, empowering our people, and nurturing talent, driving innovation as a smart telco, continuously evolving and fortifying our core operations, and maintaining a value-focused portfolio.

We announced an update on the progress made under our value-focused portfolio pillar of our strategy on 24 July 2023 where we detailed that Ooredoo, Zain and TASC Towers Holding entered exclusive negotiations to create an independent tower company comprising of up to 30,000 towers. The negotiations are ongoing in this complex transaction, we are aiming to sign before the end of the year.

We continue to move ahead on all these strategic programs, diligently working to create sustainable value for our customers, stakeholders, and the communities we serve.

On 06 December 2023, Ooredoo Group will hold a Capital Markets Day, where we will provide an update on how we are progressing against our strategic pillars.

Financial highlights

Revenue

Revenue for the first nine months of 2023 grew by 2% to QAR 17.2 billion compared to QAR 16.9 billion in the same period of the previous year. Solid growth in Iraq, Algeria, Kuwait and Maldives were partially offset by a decline in Revenue in Qatar, Oman and Tunisia as well as foreign exchange depreciation in Myanmar and Palestine.

Post quarter end, there has been severe damage to the infrastructure in Gaza, negatively impacting the Palestine operation. Palestine contributes approximately 2% to Group Revenue and on a consolidated basis, the impact is not material.

EBITDA & EBITDA Margin

In the first nine months of 2023, EBITDA increased 4% to QAR 7.4 billion, with EBITDA margin expanding by 1pp, benefiting from strong topline growth and disciplined cost control measures. Solid EBITDA improvement in Iraq, Algeria and Kuwait were offset by a lower EBITDA in Qatar, Oman, and Tunisia.

Net Profit

Net Profit increased 28% to QAR 2.7 billion, compared to QAR 2.1 billion in the first nine months of 2022.

Similarly, Normalized Net Profit, which takes into account various adjustments such as foreign exchange impact, impairment, and three one-off items (QAR 446 million gain from the NMTC legal case, Meeza IPO gain of QAR 139 million and QAR 56 million gains from Indonesian tower sales), grew by 19% YoY to reach QAR 2.5 billion, compared to QAR 2.1 billion in 2022. These strong growth figures demonstrate the Group's continued focus on profitability and the effective management of its operations.

Capital expenditure (CAPEX)

Group CAPEX spend came in at QAR 1.6 billion in the first nine months of 2023, representing a 2% increase compared to the same period last year. The Group made strategic investments in Oman, Iraq, Tunisia and Maldives to drive growth in these markets. The CAPEX spend is expected to increase in the last quarter of the year in line with the historic quarterly trend.

Free Cash Flow

Normalized Free Cash Flow increased by 8% YoY to QAR 5.7 billion, driven by higher EBITDA. All operations contributed to the Free Cash Flow generated during the nine-month period, highlighting the strong financial performance and cash generation capabilities.

Debt

Ooredoo Group retained its robust investment grade rating in the first 9 months of 2023. Leverage a Net Debt/EBITDA ratio of 0.9x, remains well below the board's guidance range of 1.5x to 2.5x. Furthermore, the Group’s financial position remains secure from interest rate risks as approximately 97% of the debt is structured on a fixed rate basis. Liquidity remains strong, with QAR 9.9 billion in cash reserves and QAR 4.9 billion available in undrawn facilities.

Customer base

The Group’s consolidated customer base reached 56.7 million, a 2% growth compared to 55.5 million in the same period last year. This performance was driven by solid growth across most of the operations. Including IOH, the customer base grew 1% to 156.1 million.

Guidance

Ooredoo Group continues to make consistent advancements toward its 2023 objectives. We anticipate the Revenue target to maintain stability, with the EBITDA margin expected to be within the low 40% range. Furthermore, our projected CAPEX for the entire year remains approximately at QAR 3 billion.

Operating Companies 9M 2023 highlights

Middle East

Ooredoo Qatar

Total revenue for the period was 4% lower YoY to QAR 5,500 million. The drop was mainly attributed to the decision to scale down on low margin wholesale business and the carve-out of Ooredoo Financial Services. Normalizing for these one-off impacts, revenue remained flat despite the slowdown in economic activity and increased competitive intensity within the mobile segment. Fixed revenues showed an increase of 2%, driven by successful B2B customer deals and win-backs.

EBITDA edged down 5% to QAR 2,699 million because of the one-off impacts. Normalizing for the aforementioned items and one-off provisions, EBITDA also remained flat.

The customer base remained flat at 2.9 million.

Ooredoo Qatar, as a leader in sustainability and technological innovation, introduced the Ooredoo Business Smart Waste Management solution, utilizing IoT technology to enhance waste management for businesses. Ooredoo was also the world's first operator to deploy 50GPON connectivity. Ooredoo launched its Fiber to the Room (FTTR) whereby customers can enjoy fast fibre connection straight to their selected rooms, giving them the full potential of connectivity and entertainment at Gigabit speeds.

Ooredoo's commitment to excellence was recognized as it received an award for its outstanding Corporate Governance at the prestigious World Finance Awards.

Ooredoo Oman

Against a competitive backdrop, accentuated by a third entrant, Ooredoo Oman grew its customer base by 6% to 3.1 million. Revenues decreased 2% to QAR 1,828 million mainly from lower mobile prepaid, wholesale business and fixed revenues.

EBITDA declined by 11% to QAR 878 million impacted mainly by lower gross margin and higher operating costs. To offset this impact the operation is executing a cost efficiency program.

Ooredoo Kuwait

Solid performance from Ooredoo Kuwait’s with customer base up by 5% to close at 2.9 million.

Revenue grew 4% to QAR 2,195 million. EBITDA jumped 12% to QAR 710 million due to higher revenue and cost efficiencies while EBITDA margin improved by 2pp to reach 32%.

During this period, they organized a captivating video game tournament on Twitch and launched "TRADE IN" in partnership with "Switch," a service enabling consumers to seamlessly upgrade their devices by exchanging old ones for new ones.

Asiacell – Iraq

Asiacell maintained its strong performance into Q3, delivering double-digit revenue and EBITDA growth. Asiacell’ customer base remained stable at 17.1 million customers.

Revenue increased 19% to QAR 3,221 million on account of higher data revenues.

Higher margin data revenues drove an EBITDA increase of 25% to QAR 1,483 million and a 2pp margin expansion to a healthy 46%.

The Arbaeen event was a significant highlight in Q3’23 with over 22 million visitors during the 40 days period. This event witnessed an increase in roaming revenues due to introduction of various offers and agreements. During the event Asiacell saw 3,800TB data usage, 3.6 million roamers and 72 million phone calls made. Another highlight of the quarter was launch of e-commerce platform amongst others.

Ooredoo Palestine

Ooredoo Palestine Revenue increased in local currency terms compared to the previous year, reaching QAR 305 million. While facing a challenging and volatile political and economic environment, there was a YoY increase in revenue when measured in local currency terms. However, due to a local currency depreciation of 9% against the US dollar (our reporting currency), Revenue declined by 4% YoY.

Despite top-line challenges, operations have realized the advantages of ongoing cost optimization, resulting in a notable 5% increase in EBITDA and maintaining a robust EBITDA margin of 41%. This growth has been facilitated by Ooredoo’s commitment to delivering superior customer experience and an enhanced product offering, which has driven a 3% YoY increase in customer base, now totaling 1.4 million.

North Africa

Ooredoo Algeria

A good performance from Ooredoo Algeria, recording growth of 2% in its customer base to reach 13.2 million customers. This growth was primarily driven by the ongoing network densification to improve the customer satisfaction in coverage and experience.

Revenues increased 9% to QAR 1,806 million as the Algerian Dinar appreciated 5% against the Qatari Riyal.

Ooredoo Algeria continues to optimize cost across the business to maintain profitability. EBITDA increased 17% to QAR 732 million while margin improved by 3pp to 41%.

To enhance its network capabilities, Ooredoo Algeria successfully deployed new 4G sites, providing additional capacity on its 4G network. This strategic initiative has contributed to maintaining high positions in the Data Network Performance benchmarks, ensuring a reliable and efficient network experience for its customers.

Ooredoo Tunisia

Against the backdrop of a challenging operating environment, the operation managed to grow its customer base by 1% to 7.3 million. Revenues retreated by 2% to QAR 1,096 million. EBITDA dropped 16% to QAR 417 million. The company continues to review its cost structure and introduce several initiatives to improve operations effectiveness and efficiency.

Asia

Indosat Ooredoo Hutchison (IOH)

Indosat Ooredoo Hutchison (IOH) is accounted for as a joint venture.

IOH’s customer base grew 1% to 99.4 million.

IOH announced its nine-month period to 30 September 2023 financial results on 30 October 2023. In local currency, the operation delivered a solid performance, recording a substantial 9% growth YoY in Revenue. EBITDA also increased by 24% YoY, resulting in a healthy EBITDA margin of 46% up by 5.7pp which showcases a strong operating leverage.

Ooredoo Maldives

The operation delivered another good set of results with the customer base reaching almost 400k, up by 4%. Revenue increased 8% to QAR 364 million with growth across all business segments. Healthy EBITDA growth of 10% to QAR 201 million on higher gross profit and effective cost control measures.

Ooredoo Maldives recently launched several initiatives and celebrations. The company celebrated its 18th anniversary with special offers and inaugurated a state-of-the-art headquarters. They integrated the eFaas National Digital Identity platform for streamlined customer verification and introduced m-Faisaa as a payment option in collaboration with Landhoo Council.

Ooredoo Myanmar

In September 2022, Ooredoo Group announced the sale of its telecom business in Myanmar to Nine Communications Pte. Ltd at an enterprise value of USD 576 million and total equity consideration of USD 162 million. This transaction is an important milestone in line with the Group’s strategic decisions to focus on markets where Ooredoo is leading. The sale is subject to customary closing conditions, including ongoing regulatory approvals in Myanmar. Several governmental-level approvals are needed, and while they are advancing, not all the requisite approvals have been acquired as of yet.

After a very successful year as Acting CEO, Htar Thant Zin has resigned for personal reasons and Chris Peirce was appointed Acting CEO effective 4 November. Chris is currently the Chief Legal and Regulatory Officer.

The customer base increased by 11% YoY to 8.4 million due to ongoing initiatives to engage with the customers and active digitization efforts.

On a local currency basis, revenue grew 3% due to customer growth and pricing optimizations that were implemented throughout the year. EBITDA remained flat, impacted by a challenging external environment. Revenues and EBITDA in Qatari Riyal continued to be impacted by sustained weakness in the Kyat.

Ooredoo Myanmar empowered young women with digital and leadership skills through its ongoing programs.

-Ends-

About Ooredoo

Ooredoo is an international communications Company operating across the Middle East, North Africa, and Southeast Asia. It serves consumers and businesses in ten countries, delivering Ooredoo a broad range of content and services through its advanced, data-centric mobile and fixed networks.

As of 31 December 2022, Ooredoo generated Revenues of QAR 23 billion. Its shares are listed on the Qatar Stock Exchange and the Abu Dhabi Securities Exchange.

Contact:

Investor Relations

Email: IR@ooredoo.com

For additional information, including detailed supplemental schedules, financial statements, and details about our investor call, please visit our website at www.ooredoo.com/en/investors/

Disclaimer

Ooredoo (parent company Ooredoo Q.P.S.C.) and the group of companies which it forms part of (“Ooredoo Group”) cautions investors that certain statements contained in this document state Ooredoo Group management's intentions, hopes, beliefs, expectations, or predictions of the future and, as such, are forward-looking statements.

Ooredoo Group management wishes to further caution the reader that forward-looking statements are not historical facts and are only estimates or predictions. Actual results may differ materially from those projected as a result of risks and uncertainties including, but not limited to:

-

Our ability to manage domestic and international growth and maintain a high level of customer service

-

Future sales growth

-

Market acceptance of our product and service offerings

-

Our ability to secure adequate financing or equity capital to fund our operations

-

Network expansion

-

Performance of our network and equipment

-

Our ability to enter into strategic alliances or transactions

-

Cooperation of incumbent local exchange carriers in provisioning lines and interconnecting our equipment

-

Regulatory approval processes

-

Changes in technology

-

Price competition

-

Other market conditions and associated risks

This document does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire or dispose of securities in any company within the Ooredoo Group

The Ooredoo Group undertakes no obligation to update publicly or otherwise any forward-looking statements, whether as a result of future events, new information, or otherwise