Saudi Arabia’s digital services market has long been lauded as the largest in the MENA region, with annual spend on digital transformation reaching SR12 billion ($3.19 billion) a year. For Saudi banking customers, however, the digital experience still leaves much to be desired.

This is according to the 2022 Saudi Banking Sentiment Index, conducted by leading social data business DataEQ, which reveals digital experience to be one of the most negatively-spoken-about topics among Saudi banking customers on social media. Complaints around digital experience mostly occur in periods when consumers are likely to transact more, like month-end.

Presenting the Index results in Riyadh at the recent Future Banks Summit, DataEQ’s Chief Executive Officer, Nic Ray, explained that system downtime, coupled with a lack of communication, frustrates consumers during these high-demand periods. “When drilling down into these negative posts, we found that frustration with the banking digital experience is often because of system outages or app downtime, which typically leaves consumers unable to complete critical banking transactions.

“This may suggest that there are constraints related to transaction capacity across some of the banks,” Ray noted.

Social sentiment towards Saudi banks is negative overall

The Saudi Banking Sentiment Index tracked close to 700 000 Twitter posts about five major retail banks . Each tweet received a sentiment rating — positive, neutral, or negative. These ratings were then used to calculate a Net Sentiment score for each bank.

Overall, the Saudi banking industry experienced more negative conversation (16.6%) than positive (4.5%), resulting in a negative overall Net Sentiment score of -12.1%. While all five banks in the Index had negative scores, Alinma Bank achieved the highest Net Sentiment score of -2.3% - almost 10 percentage points higher than the industry aggregate.

Social media response rates leave room for improvement

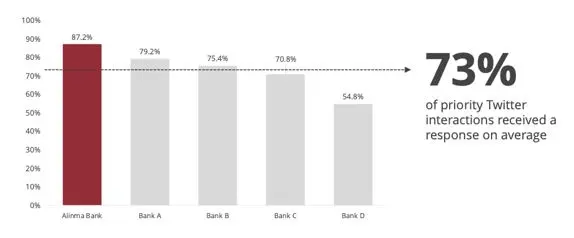

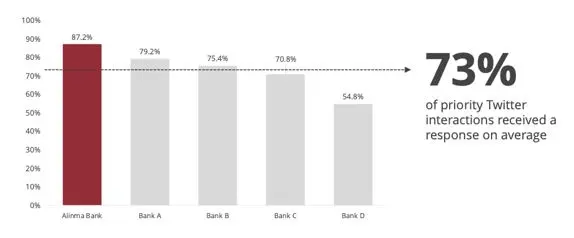

According to the social customer service results, Saudi banks publicly responded to 73% of priority tweets on average, leaving more than a quarter unanswered. While top performing bank, Alinma Bank, achieved an above-average response rate of 87.2%, the worst performing bank only responded to around half (54.8%) of their priority conversation.

While all five banks typically responded to priority tweets within two hours, response time varied across the industry, with three banks responding in under an hour. The other two banks were considerably slower, which means even when customers did receive a response, it was not immediate – something which has come to be expected in the realm of social customer service.

Digital transformation presents opportunity for Saudi’s banking sector

Saudi Arabia has attracted international attention for its Vision 2030, which is driving socio-economic transformation at an unprecedented pace. To realize this vision and become an economic leader, digital technology must sit at the heart of the transformation.

“The digital transformation taking place on a broader scale presents an opportunity for Saudi banks to utilize the available insights on social sentiment and consumption habits to tailor their digital strategy. Using real-time customer feedback to understand friction points in existing processes will enable banks to ensure their future digital experience meets the needs of their customers,” Ray concluded.

About DataEQ:

DataEQ, formerly known as BrandsEye, specialises in providing large organisations with high-quality, actionable data from unstructured customer and public feedback. Using a unique blend of AI and human intelligence, the company offers various tailored solutions that range from customer service and experience, to market conduct and risk management.