PHOTO

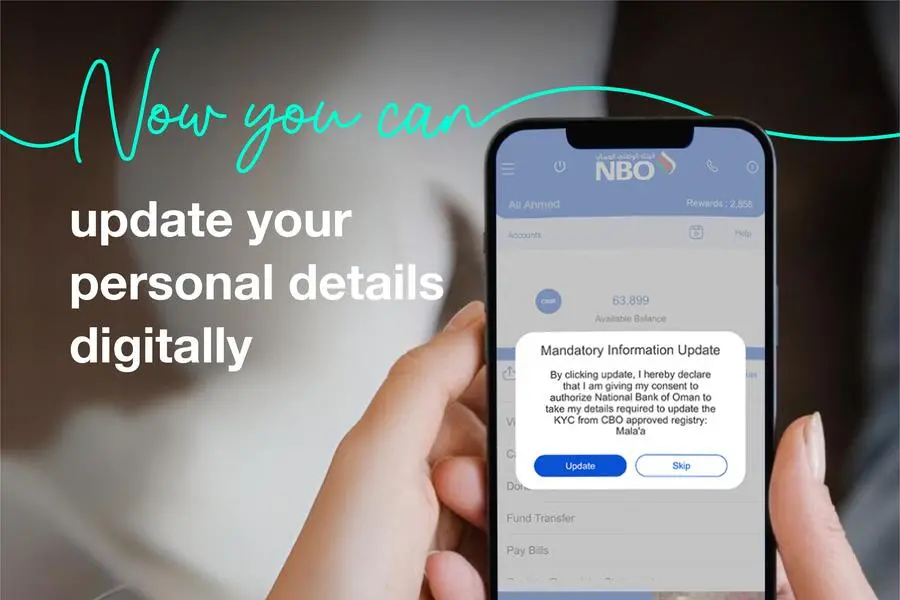

Muscat: In its ongoing efforts to improve customer convenience, streamline banking processes, and offer seamless digital banking products and services the National Bank of Oman (NBO) has introduced a new feature on its mobile application that allows customers to update their Know Your Customer (KYC) details seamlessly. This integral service, which was launched in June 2024, enables existing NBO customers to update their personal information directly through the mobile app; eliminating the need to visit branches due to the newly enabled digital signature feature, enhancing efficiency and user experience

NBO is committed to enhancing digital customer touchpoints through the new e-KYC feature. By leveraging its membership agreement with Mala’a, Oman’s Credit and Financial Information Centre, NBO can now automatically fetch and verify customers' identities. This integration ensures that the bank's information databases are accurate and comply with legal and regulatory requirements, minimising the need for customers to visit branches

Dr. Ali Salim Said Al Shekaili, Assistant General Manager – Head of Digital Banking & E-Channels at NBO, commented on the launch: "We're excited to have this new feature on our mobile banking app that ensures personal information is updated to better serve our customers. In addition to enhancing customer convenience, this feature streamlines our verification process for faster processing. At NBO, our customer-centric approach ensures that we simplify banking and directly address the needs and preferences of our customers, making their banking experience more seamless and efficient.”

With NBO's e-KYC service, customers can update a range of mandatory fields, including personal details such as full name, nationality, ID number, date of birth, and gender; address details including current and permanent addresses; occupation details including employment information; and financial details such as monthly income and source of funds. Additional details, such as whether the customer is a politically exposed person (PEP), has US tax residency (FATCA) or pays taxes in countries other than Oman (CRS), can also be updated. Once the required information is uploaded, it is instantly updated in the bank's records, and customers receive a confirmation SMS notification.

The Central Bank of Oman mandates KYC compliance for all financial institutions operating in Oman, requiring customers to update their KYC details based on their risk categorisation: low-risk customers every five years, medium-risk customers every three years, and high-risk customers once per year. The introduction of the new e-KYC feature will also be extended to new customers during the initial digital account opening process.

NBO continues to innovate, offering valuable benefits to its customers and making everyday banking transactions more efficient and secure. For more information on NBO's digital banking services, please visit www.nbo.om or contact the NBO Call Centre at 24770000.