PHOTO

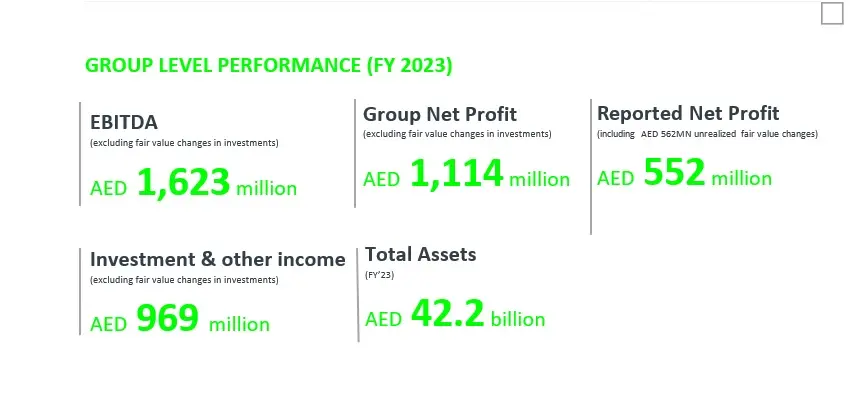

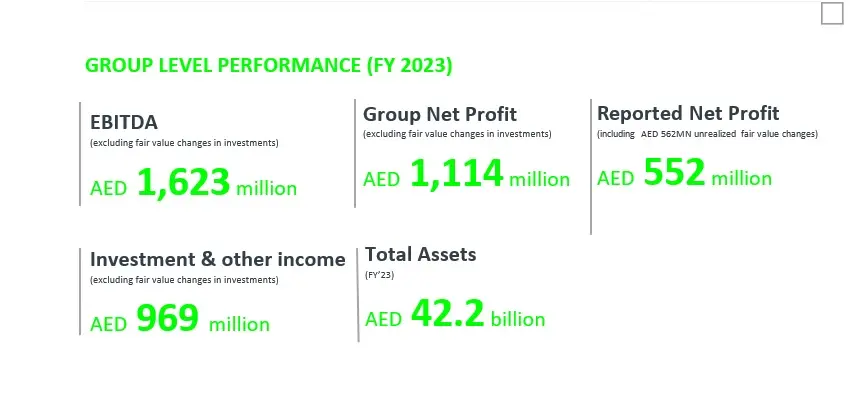

| Financial highlights (AED million) | Full Year 2023 |

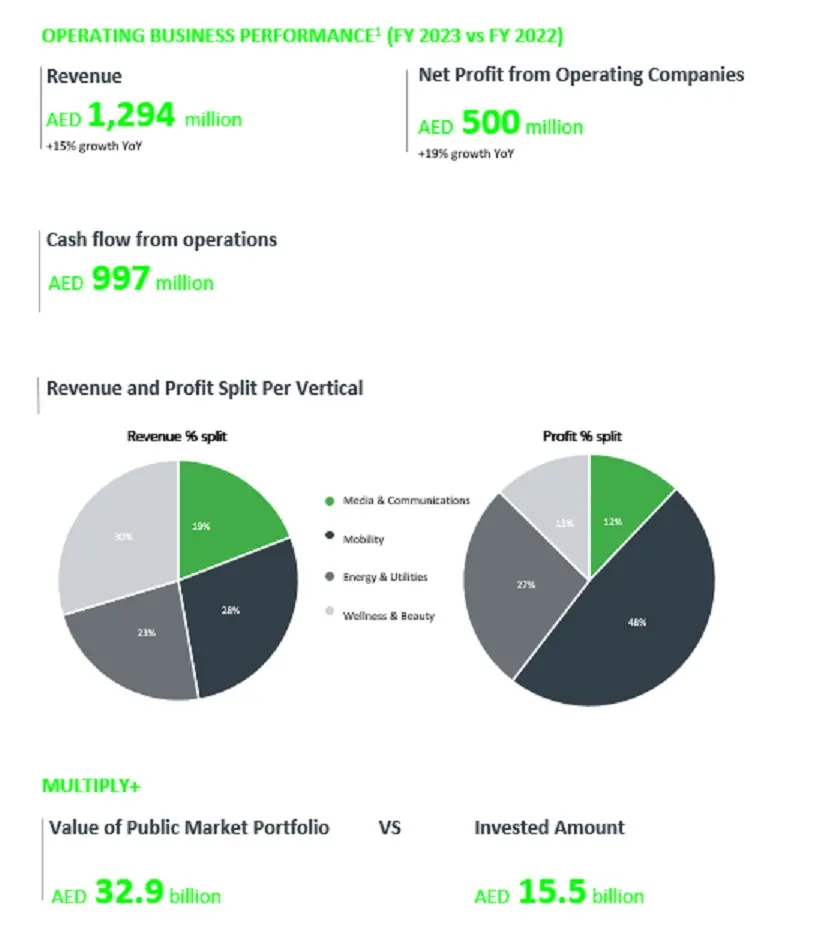

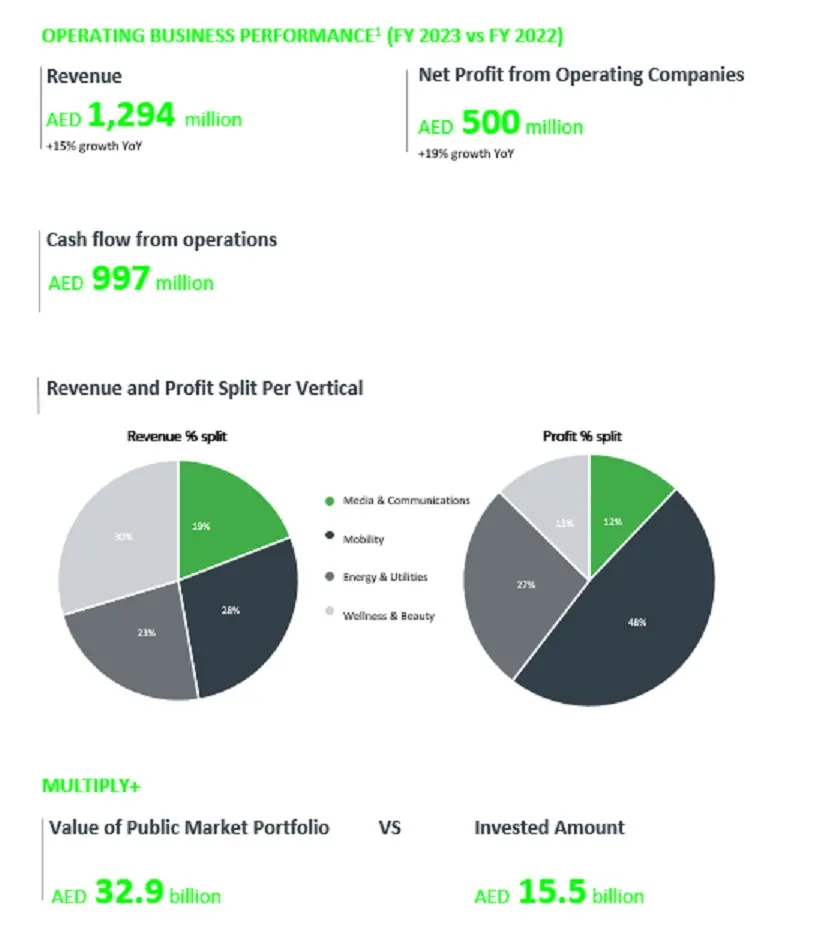

| Revenue | 1,294 |

| Gross profit margin % | 663 51.3% |

| General & Admin Expenses | (303) |

| Investment and other income | 407 |

| Share of profit from investment in a joint venture | 229 |

| EBITDA (excluding fair value changes) | 1,623 |

| Net profit (excluding fair value changes) | 1,114 |

| Reported Group Net profit (including fair value changes) | 552 |

ANDRE SAYEGH, CHAIRMAN:

“The financial results for 2023 round off another remarkable year of achievements for Multiply Group, with operating net profit and revenue of our subsidiaries growing by 15%. Throughout 2023, we were focused on delivering strong growth across our existing subsidiaries, as well as, new acquisitions within the diverse industries in which we operate. Our performance means that we are well-positioned and laser focused on the path ahead, where we seek to continue driving strategic investments that will create lasting and meaningful impact across the UAE economy. Being a diverse holding company, we are very well placed to improve our synergies across our operating entities, which will reflect in improved earnings in the years to come.”

SAMIA BOUAZZA, GROUP CHIEF EXECUTIVE OFFICER AND MANAGING DIRECTOR:

“In 2023, we worked diligently on building our verticals – creating value by adding new services, identifying portfolio-wide synergies, investing in bolt-on acquisitions, buying competitors and enhancing margins. This is reflected in our full year earnings which show excellent growth across our subsidiaries. We report a net profit excluding fair value changes of AED 1.1 billion, which more than doubled from that of last year, driven by strong vertical performance and dividend income. The year was also marked with strategic investments, where we completed the acquisition of a majority stake in Media 247, which closed the year with AED 79 million in profit; and under Multiply+ arm, we invested AED 367 million for a minority stake in EIG’s Breakwater Energy, which offers a strong dividend profile, as we continue to focus on our commitment to increase shareholder returns. Across the board, digital transformation coupled with AI tools in shared services has also resulted in cost savings and increased efficiency, as we continue to future-proof our businesses.

ABU DHABI – Multiply Group (ADX: MULTIPLY), a leading Abu Dhabi-based investment holding firm, today reports full year 2023 results with a net profit excluding fair value changes[1] of AED 1.1 billion, 2.4x last year. Robust underlying profit growth was led by strong operational performance, higher investment income and increased share of profit from Kalyon JV. The reported net profit, including unrealized fair value changes on market volatility backdrop, came in at AED 552 million.

Group revenue increased by 15% YoY to AED 1.3 billion, reflecting the strength of our vertical building strategy, driven by organic growth across the four verticals (+5% YoY) and the consolidation of Media 247 under the Media vertical and each of Fisio and The Juice Spa and Salon under Beauty & Wellness vertical. Blended gross profit margin improved to 51.3%, reflecting an improvement of 70 basis points YoY as a result of enhanced profitability across core verticals.

Group net profit growth (excluding unrealized fair value changes) which more than doubled YoY was driven by strong vertical performance (19% YoY blended growth) and was reinforced by increased share of profit from Kalyon JV with the commencement of solar power project (capacity of 1,350 MW) in early 2023 coupled with tripling of investment & other income[2] on higher dividends received from the Group’s public portfolio.

Balance sheet remains robust with cash balance of AED 1.56 billion. The Group demonstrated its financial prowess by building a diversified portfolio of strong assets across its four core verticals (Mobility, Energy and Utilities, Media and Communications, and Beauty and Wellness) whilst investing in lucrative assets under Multiply+ for double-digit returns. Under Multiply+, the public market portfolio closed the year with a valuation of AED 32.9 billion, compared to an initial investment of AED 15.5 billion. As for the core operational portfolio, the Group focusses on driving synergies and integration among the businesses under each vertical with emphasis on accelerating digital transformation and operational efficiencies.

Group Highlights

Strategic Investments in FY’23

In line with its vertical building strategy, Multiply completed the acquisition of a controlling stake in Media 247, a leading outdoor advertising firm in the UAE. Media 247, known for its extensive portfolio of over 45 exclusive outdoor premium hoardings, unipoles, and 3D structures across Dubai’s most prominent locations, solidifies Multiply Group’s position in the media vertical as we focus on value-add acquisitions.

Omorfia Group, Multiply’s Beauty anchor, consolidated each of Fisio and The Juice Spa & Salon as part of its strategic growth through bolt-on investments. Fisio is a specialized physiotherapy clinic dedicated to recovery and physical therapy in Dubai while the Juice Spa and Salon carved a niche for itself by offering luxury beauty experiences for the mid-market segment with 10 branches across the UAE.

Emirates Driving Company expanded its presence to Saudi Arabia, by signing an agreement to invest in Consultants Driving School, which is based in KSA, for a total value of SAR 10 million.

Under Multiply+ arm, Multiply Group invested AED 367 million for a minority stake in EIG’s Breakwater Energy which owns 25% interest in Repsol E&P, a North American-based gas-weighted exploration and production company. Through this acquisition, Multiply+ taps into a highly profitable and cash generative, diversified global upstream portfolio offering a highly attractive dividend profile.

Vertical updates

Media and Communication (Viola + Media 247)

Profitability of the vertical surged 3.3x on consolidation of margin accretive assets of Media 247 in H2’23 and Viola reporting a 21% YoY net profit growth driven by significant increase in agency services revenue and higher occupation of Out-of-Home (OOH) media assets benefiting from the addition of new signboards specifically digital bridge banners. During the year, Viola Communications and Multiply Group’s San Francisco-based associate Firefly partnered to launch disruptive digital out-of-home platforms in the UAE. The geo-targeted digital taxi-top screens introduced on Abu Dhabi’s Tawasul fleet of taxis deliver content using location-based, GPS-enabled triggers - ensuring millions of impressions per month. Viola Communications also launched new digital assets in Abu Dhabi located in prominent areas. The expanded range of digital assets comprise digital hoardings and distinctive free-standing totem roadside displays, the city’s first-of-their-kind digital road-side solutions, complementing existing digital assets such as bridge-banners and taxi-tops – the launch coincided with the UAE’s 52nd Union Day.

Mobility (Emirates Driving Company EDC)

EDC reported 4% growth in profitability in line with revenue growth driven by expanded demand from other UAE Emirates for light vehicle license training. During the year, EDC hosted the 11th National Dialogue for Climate Ambition in partnership with the UAE Ministry of Climate Change and Environment (MOCCAE). The company also achieved the ISO 31000 certificate for its risk management system.

Beauty & Wellness (Omorfia)

The vertical reported a significant jump in net profit of 34% year-on-year led by Omorfia’s overperformance on gross margin expansion largely driven by cost efficiency initiatives (namely, enhanced technician utilisation rates). In 2023, Omorfia Group acquired 100% of The Juice Spa and Salon, further solidifying its foothold in the UAE’s beauty sector. The Juice Spa & Salon has 10 locations in the UAE. The company also expanded its flagship brand, Tips & Toes, to 40 branches by inaugurating 3 new branches in Abu Dhabi and Dubai. While Bedashing Beauty Lounge, celebrated as the UAE’s favourite beauty salon in the FACT Spa & Wellness Awards 2023, also opened 3 branches in Fujairah, Sharjah and Al Dhafra the western region of Abu Dhabi, reaching 24 branches.

Utilities & Energy (PAL Cooling Holding + IEH[3])

The Profitability of the vertical was boosted by AED 229 million share of profit from Kalyon JV with the commencement of solar power plant project in Jan’23. PAL Cooling reported 9% YoY growth on improved gross margin and a one-time reversal of provision slightly countered by higher finance costs. In 2023, PAL successfully completed and commissioned the first phase of Tamouh district cooling plant's expansion, adding an additional installed capacity of 5,000 RT. PCH also connected the new Nord Anglia School in Reem Island, with a 1,250 RT cooling load requirement, to its Tamouh district cooling plant.

Commitment to Sustainability

Multiply Group continues to embark on a long-term journey to formalise and embed sustainability across its operations and portfolio. This work is driven by committed leadership and a purposeful vision to create opportunities beyond its business. As part of its investment model, the Group seeks opportunities that will create long-term positive impact in the communities where it operates.

COP28

In 2023, Multiply Group participated in COP28 in the UAE as a Climate Supporter where the Group showcased its sustainable initiatives, strategic ESG objectives and effective environmental impact management practices. The event was an ideal platform to engage in insightful discussions, exchange knowledge and experience with diverse entities, and maximize the Group’s contribution to a healthy climate and environment and drive future sustainability.

Multiply is targeting to issue the second ESG report which streamlined the Group’s material topics to 11 areas of relevant impact, across the four pillars of its Sustainability Framework: robust foundations, growing its human capital, investing in a sustainable future, and managing its influence. This adjustment guarantees that Multiply Group’s sustainability strategy is strongly focused on the issues that are most critical to its stakeholders.

In 2024, the Group will finalize an ESG Integration Framework that seamlessly incorporates ESG factors into investment analysis, due diligence approach and operational decision-making processes.

Sustainalytics, a global leader in environmental, social and governance (ESG) rating and research, rated Multiply Group’s risk level at 15.8. This commendable rating places the Group in the “Low Risk” category, positioning it among the top 10% of companies in the Diversified Financials sector. This is another testament to the Group’s commitment to sustainability.

Corporate Social Responsibility (CSR), Multiply’s ongoing activities include:

- Cleaning up the Oceans: initiative launched during the year of sustainability, in partnership with US-based 4ocean to offset over 100 thousand pounds of plastic waste in 2023. In Abu Dhabi, a group of employees from Multiply Group and its subsidiaries volunteered to clean up a stretch of Abu Dhabi’s coastal shoreline in Al Nouf, successfully collecting 420 pounds of plastic waste.

- Mangrove Planting: supporting the UAE's pledge to plant 100 million mangroves by 2030, Multiply Group engaged its employees to plant 5000 mangrove trees in the UAE, contributing to carbon storage and climate change mitigation.

- Community Book Drive: to foster knowledge and literacy by donating a collection of books to local organizations and by supporting the Logos Hope ship, world’s largest floating book fair, bringing knowledge, help, and hope to the world.

- Corporate wellness program: wrap-up after the completion of the final phase spanning 6 months in pursuit of a holistic approach to ensure overall health and wellbeing of its workforce through personalised nutritional sessions, doctor consultations, fitness challenges, biometric screenings, blood tests, and webinars.

International Recognition

In June 2023, Multiply Group earned a spot on Forbes’ Global 2000 list and was included in Forbes Middle East’s Top 100 Listed Companies in 2023, a testament to its financial strength and world-class position. Both lists rank companies based on sales, profits, assets, and market value.

Earlier this year, Multiply Group was officially certified as a Great Place to Work® by the global authority on workplace culture.

-Ends-

ABOUT MULTIPLY GROUP

With its trademark growth mindset, Multiply Group PJSC is an Abu Dhabi-based holding company that invests in transformative cash-generating businesses it understands.

Multiply Group will continue to deploy capital across its two distinct arms, both of which follow a disciplined approach to investing and ensure consistent, sustainable value creation for our shareholders in the short-, medium- and long-term:

Multiply, the investments and operations in long-term strategic verticals, currently investing and operating in Mobility, Energy & Utilities, Media & Communications and Wellness & Beauty. Anchor investments provide long-term recurring income, through which bolt-on acquisitions are made.

Multiply+, a flexible, sector-agnostic, and opportunistic investment arm.

For more information, visit www.multiply.ae

ADX: MULTIPLY

www.multiply.ae

CONTACTS

Multiply Group

Sahar Srour | Investor Relations

sahar@multiply.ae

For further information, please contact:

Mary Khamasmieh

Weber Shandwick

E: mkhamasmieh@webershandwick.com

Rawad Khattar

Weber Shandwick

E: rkhattar@webershandwick.com

[1] Fair value changes in investments = FV gains / losses from the Group’s investments in public equities which are mainly unrealized from changes in market prices. Multiply Group believes these unrealized changes are generally misrepresentative in understanding its reported quarterly or annual results or evaluating the economic performance of its operating businesses. As these gains and losses cause significant volatility in the Group’s periodic earnings, it excludes them from its underlying profitability metrics in this report.

[2] Investment & other income excluding unrealized fair value changes in investments (mainly Dividend income + interest income)

[3] IEH (International Energy Holding) does not contribute to top-line but its net profit includes share of profit from a 50% JV investment in Kalyon.