PHOTO

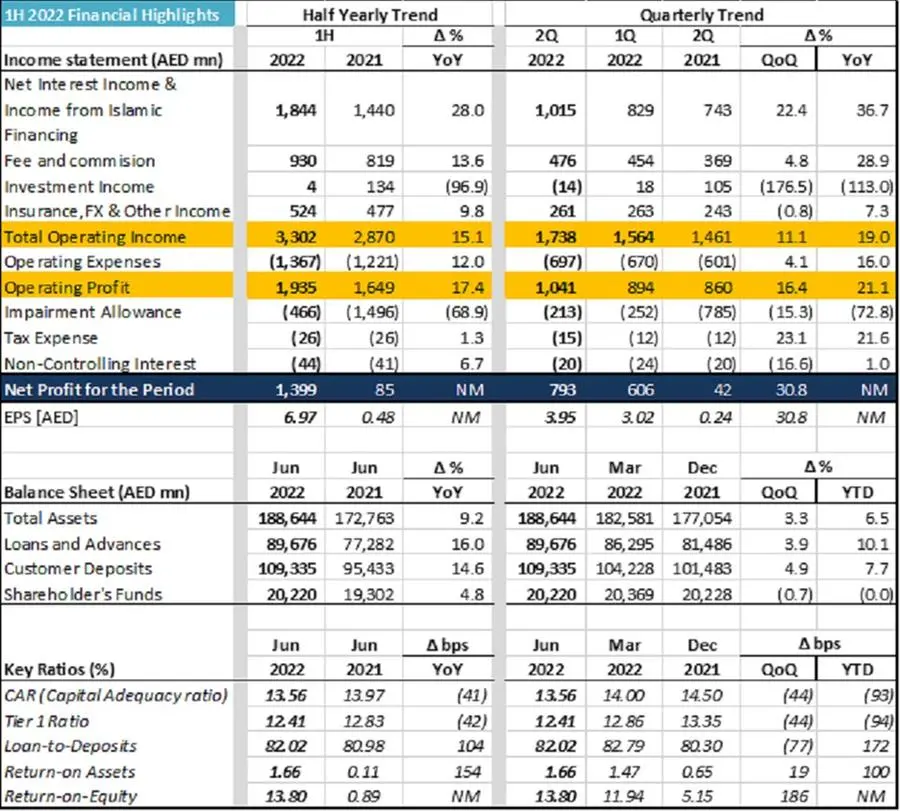

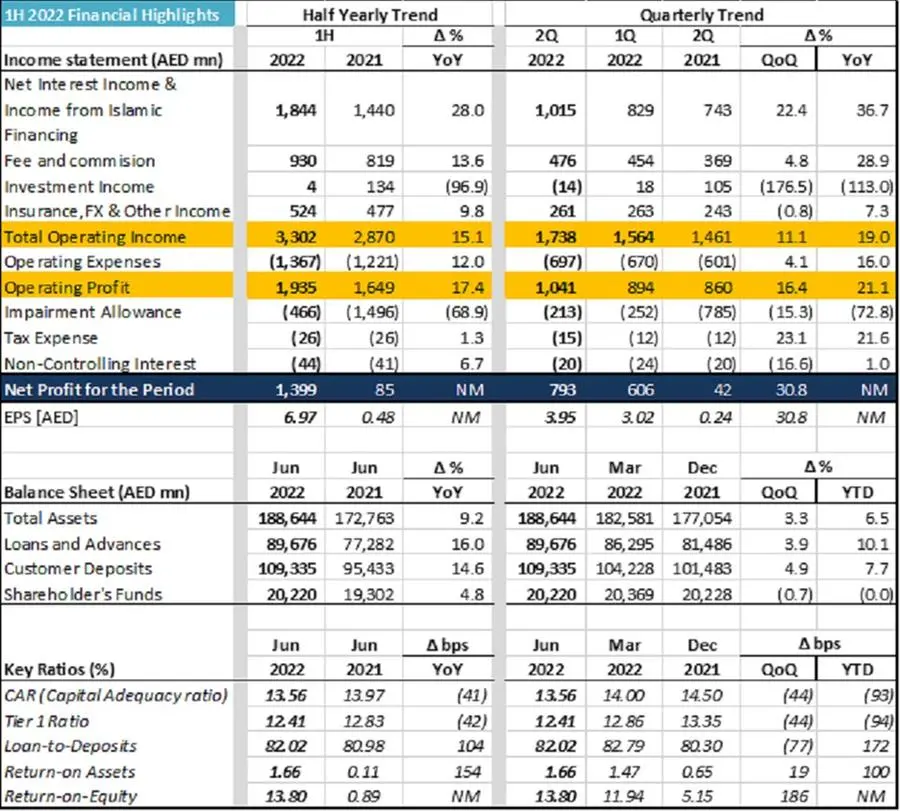

Key highlights:

- Strong Growth in Operating Income & Net Profit

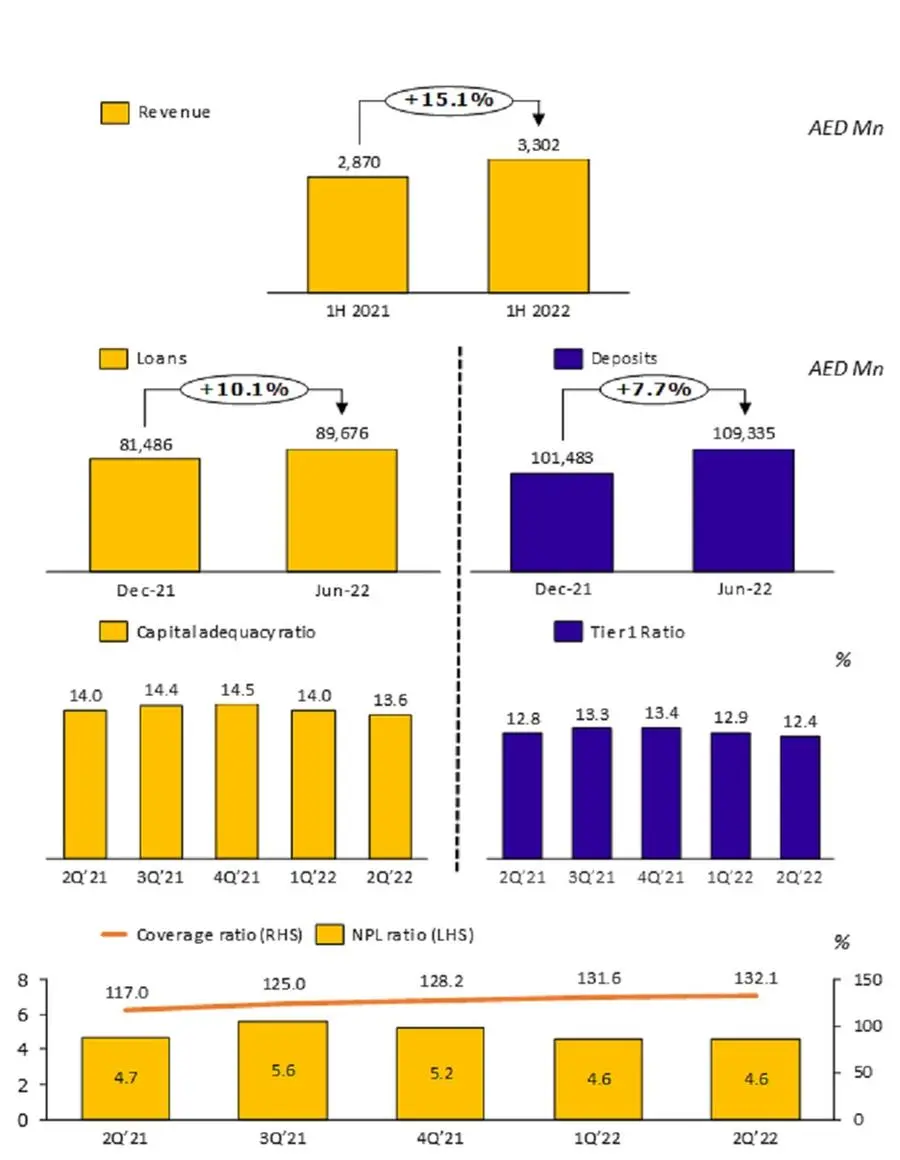

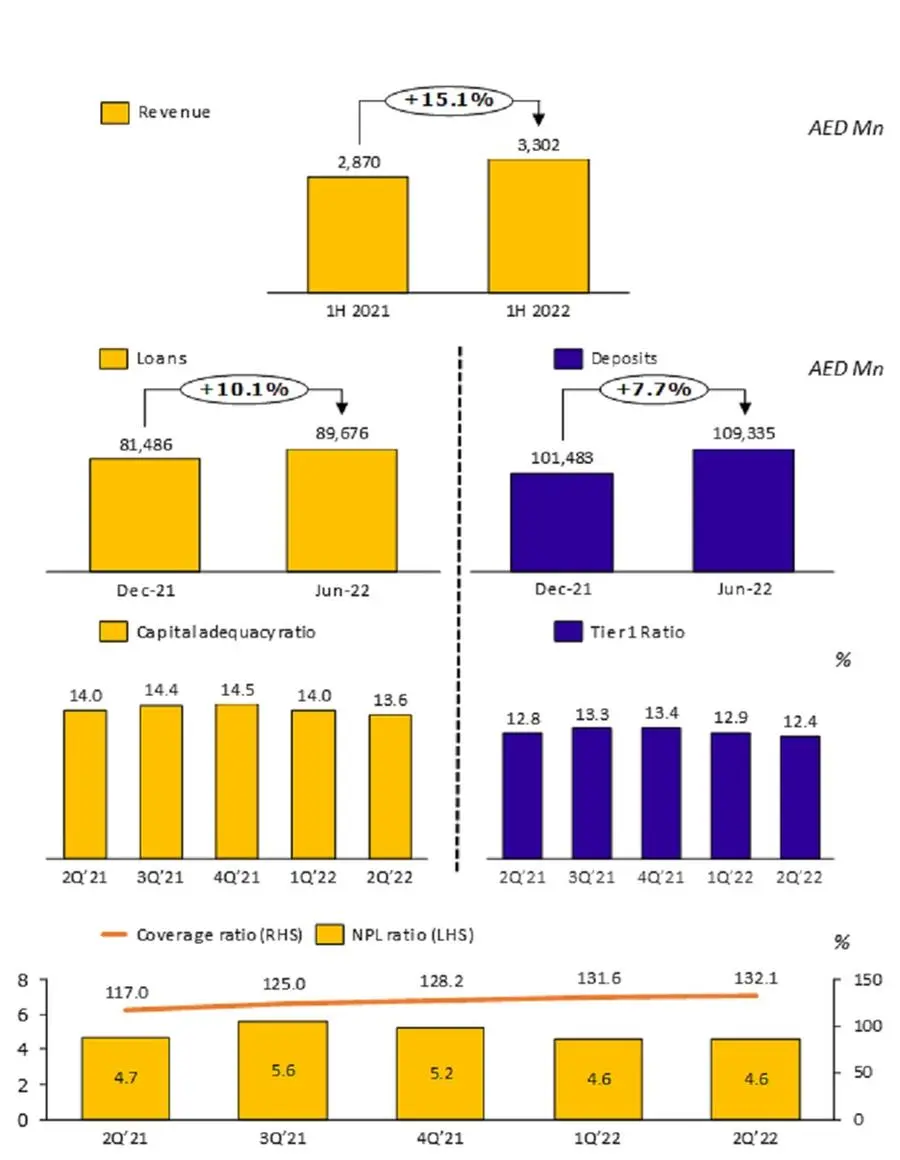

- Operating Income has increased by 15% over the previous year to AED 3.3 billion mainly due to increased Net Interest Income and Income from Islamic financing

- Mashreq’s non-interest income to operating income ratio continues to remain high at 44.2% (47.5% as of December 2021)

- Operating profit at AED 1.9 billion is a 17% increase compared to 1H 2021 as a result of higher operating income

- Mashreq posted a healthy Net Profit of AED 1.4 billion in 1H 2022.

- Comfortable Liquidity & Capital position

- Growth of 8% YTD in Customer deposits to reach AED 109.3 billion

- Liquid Assets ratio stood at 27.6% for June 2022 (29.0% in December 2021)

- Capital adequacy ratio is at 13.6%1) and Tier 1 Capital ratio at 12.4% as of June 2022

- Healthy Growth in the Loan Portfolio

- Total Loans and Advances increased by 10% YTD to AED 89.7 billion

- Loan-to-Deposit ratio remained stable at 82% at the end of June 2022

- Improved Credit Environment

- Impairment allowance reduced to AED 466 million from AED 1.5 billion in 1H 2021

- Non-Performing Loans to Gross Loans ratio declined to 4.6% as of end of June 2022 (5.2% as of December 2021)

- Total provision for loans and advances reached AED 6.6 billion and coverage ratio improved to 132.1% as on 30th June 2022 (128.2% in December 2021)

Dubai, UAE: Mashreq, one of the leading financial institutions in the UAE, today has reported its financial results for the first half ending 30th June 2022.

H.E AbdulAziz Al Ghurair, Chairman of Mashreq, said: “I am delighted to announce that Mashreq Bank has posted a healthy growth in net profits for the first half of 2022. As we continue to operate in increasingly uncertain economic times, we registered a net profit of AED 1.4 billion, which is a great achievement and one everyone associated with the Bank can be, quite rightly, proud of.”

"This growth was mainly driven by an increase in operating profit, which was up 17% compared to 1H 2021 as a result of higher operating income. Our non-interest income to operating income ratio, at 44.2%, remains one of the most robust in the industry and is also a true testament to the constant drive of our teams towards innovation, based on our fundamental customer-centric approach.”

“Every day we are enhancing our reputation as the region’s most progressive and inspirational challenger bank that is shaping the future of financial services through convenience, innovation, and trust, while delivering a seamless experience to our customers. We will continue on this mission throughout the remainder of 2022, developing new strategies and products and forging partnerships with key stakeholders to enhance the digital economy and place us at the very front and center of the banking industry in the region.”

Ahmed Abdelaal, Group CEO, Mashreq Bank, said: “The first six months of 2022 has delivered outstanding results for Mashreq Bank and strengthened our position as a powerful digital disruptor. In the midst of challenging global financial headwinds, we saw our total assets increase by 7% in the year, while our loans and advances experienced double-digit growth to reach AED 89.7 billion.”

“In recognition of the Bank’s constant mission to innovate, Mashreq was voted Market Leader for its best-in-class transactional banking services by our customers in the 2022 Euromoney Trade Finance Survey for the third consecutive year. As well as receiving this prestigious accolade in both the UAE and wider Middle East region, the Bank also received the Best Service accolades for Africa, Pakistan and Qatar. Mashreq was also named Best Digital Bank by Euromoney in the Middle East for the third consecutive year.”

“This year we have already launched several industry firsts, including the first phase of Neo NRI, the first ever non-resident account opening enabled from a UAE banking app. Our Neo NXT proposition, the first ever smart teen banking proposition targeting the Gen Z, was launched alongside a strategic partnership with Galaxy Racer focused around the gaming community.”

“Delivering innovation to enhance the customer experience is at the heart of everything we do at Mashreq and we look forward to the launch of more products and services through the remainder of this year.”

“I am grateful for the loyalty and support of our customers, employees, and shareholders, who have made these excellent results possible.”

Financial Highlights:

*Annualized

Subsequent to the six month period ended 30 June 2022, the Bank issued US$300 million (AED 1,101.9 million) Additional Tier 1 (AT1) perpetual securities following which the Group’s capital adequacy ratio is 14.25%.

Exhibits:

1H 2022 Awards:

- International Finance Awards

- Best Corporate Bank – Bahrain 2022

- Global Business Magazine

- Best Corporate Bank Qatar 2022

- The Global Economics awards 2022

- Best use of Technology in Banking - UAE 2022

- Most Innovative Retail Bank - UAE 2022

- Seamless 2022

- Best Digital Banking Experience of the Year’ for ETP-Onboarding Journey

- Global Private Banking Innovation Awards 2022

- Best local Private Bank in the UAE

- Best Private Bank for Funds

- Decarbonization and Climate Action (DACA) awards

- Torch bearer of Sustainable & Climate Friendly Investment

- Leader in Environmental, Social & Governance (ESG)

- The Banker Magazines "Deals of the Year Awards 2022"

- Deal of the Year-APAC- FIG (Axis Bank's Inaugural USD600m 144A/Reg S Perpetual-NC5 AT1 Issuance)

- Deal of The Year-Middle East - BONDS: SSA (US$ 4 Billion Triple Tranche Bond for Government of UAE)

- World Finance

- Best Retail Bank in the UAE

- Wealth Tech Awards - Professional Wealth Management

- Best private bank for client acquisition, Middle East

- MEA Finance Banking Technology Awards 2022

- Best Innovation in User Experience award by MEA Finance

- Global Business Outlook

- Most Innovative Islamic Banking Window –UAE 2022

- Euromoney Awards for Excellence 2022

- Regional awards: Middle East's Best Digital Bank

- Country awards: Best Bank for Digital Solutions in the UAE

- Customer Experience Live Middle East Awards 2022:

- Best Customer Care in the Middle East

- Best Contact Center Middle East

- MIDDLE EAST WEALTHTECH AWARDS 2022

- Top Bank in Wealth Management of Middle East 2022

- Global Finance – World’s Best Financial Innovation Labs

- Middle East and Africa Innovation Award 2022 from The Digital Banker

- Outstanding Achievement in AML / CFT in the Middle East’ for CBIA – Correspondent Banking Interactive Analytics.

- 2022 Euromoney Trade Finance Survey

- Market Leader in the UAE

- Market Leader in Middle East

- Best Service – Africa

- Best Service – Pakistan

- Best Service – Qatar

- International Business Magazine

- Best Digital Bank in the Middle East 2022

- Banking CEO of the Year in the Middle East 2022 - Ahmed Abdelaal

-Ends-

For media enquiries, please contact: For investor relations enquiries, please contact:

Rana AlBorno Ali Zaigham Agha

Public Relations, Mashreq Investor Relations, Mashreq

Email: RanaAlB@mashreq.com Email: AliAgha@mashreq.com