PHOTO

- Madinet Masr delivers record-breaking full-year results, with contracted sales surging to EGP 41.0 billion and net profit reaching an all-time high of EGP 2.8 billion, driven by robust demand and strategic expansions.

Cairo – Madinet Masr, one of Egypt’s leading urban community developers, announced its standalone financial results for the full-year ended 31 December 2024 (FY 2024), reporting a net profit of EGP 2.8 billion on total revenue of EGP 8.2 billion, with contracted sales of 41.0 billion. For the fourth quarter (Q4 2024), the Company recorded a net profit of EGP 262.7 million, with revenues reaching EGP 952.5 million and contracted sales exceeding 8.3 billion.

| Summary Income Statement | Q4 2024 | Q4 2023 | Change | FY 2024 | FY 2023 | Change |

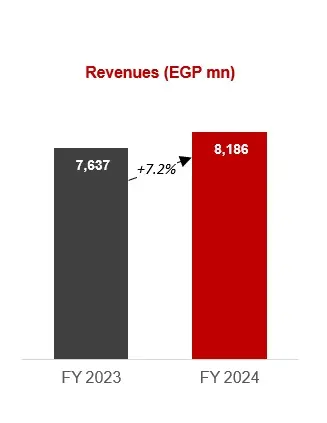

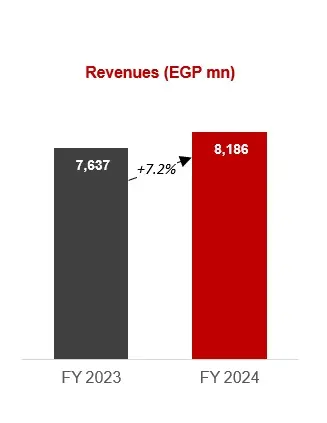

| Revenue | 952.5 | 3,195.2 | -70.2% | 8,186.3 | 7,637.2 | 7.2% |

| Gross Profit | 287.1 | 2,157.4 | -86.7% | 5,722.5 | 5,041.8 | 13.5% |

| Gross Profit Margin | 30.1% | 67.5% | -37.4 pts | 69.9% | 66.0% | 3.9 pts |

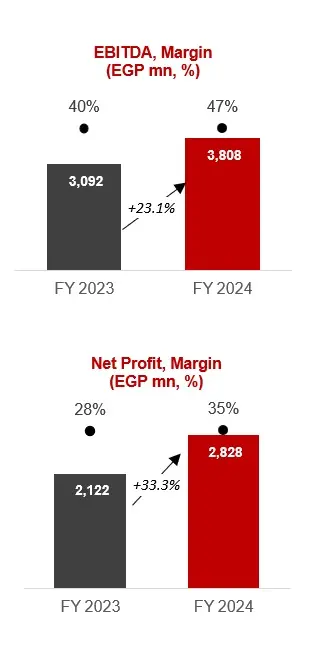

| EBITDA | 348.7 | 1,160.9 | -70.0% | 3,807.8 | 3,092.5 | 23.1% |

| EBITDA Margin | 36.6% | 36.3% | 0.3 pts | 46.5% | 40.5% | 6.0 pts |

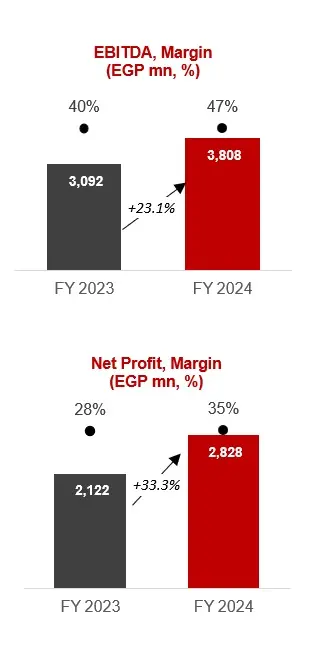

| Net Profit | 262.7 | 764.4 | -65.6% | 2,828.2 | 2,122.3 | 33.3% |

| Net Profit Margin | 27.6% | 23.9% | 3.7 pts | 34.6% | 27.8% | 6.8 pts |

| Key Operational Indicators | Q4 2024 | Q4 2023 | Change | FY 2024 | FY 2023 | Change |

| Gross Contracted Sales (EGP mn) | 8,313.5 | 15,044.8 | -44.7% | 40,995.9 | 29,901.7 | 37.1% |

| Units Sold | 711 | 2,858 | -75.1% | 4,808 | 5,443 | -11.7% |

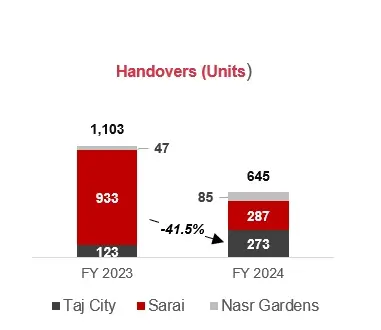

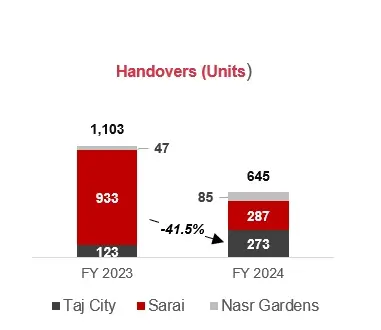

| Deliveries | 167 | 311 | -46.3% | 645 | 1,103 | -41.5% |

| Land Bank (million sqm) | 12.8 | 9.6 | 33.8% | 12.8 | 9.6 | 33.8% |

|

|

Key Highlights

- Madinet Masr booked gross contracted sales of EGP 41.0 billion for FY 2024, up 37.1% year-on-year, reflecting sustained demand and the successful launch of new projects. In Q4 2024, the Company recorded gross contracted sales of EGP 8.3 billion.

- The Company delivered 645 units during FY 2024, down 41.5% year-on-year from the 1,103 units delivered in FY 2023. In Q4 2024, 167 units were delivered, a 46.3% decline compared to the same period last year, as the Company focused on mass construction efforts in Taj City and Sarai during this year.

- Madinet Masr recorded total revenue of EGP 8.2 billion in FY 2024, up 7.2% year-on-year, driven by sustained demand and strong contracted sales. In Q4 2024, revenue stood at EGP 952.5 million, reflecting a 70.2% slowdown compared to the previous year due to market dynamics and project delivery timelines.

- Madinet Masr’s gross profit reached EGP 5.7 billion in FY 2024, increasing 13.5% year-on-year, with an associated gross profit margin of 69.9%. In Q4 2024, gross profit stood at EGP 287.1 million, with a margin of 30.1%.

- Madinet Masr recorded an EBITDA of EGP 3.8 billion for FY 2024, up 23.1% year-on-year, yielding an EBITDA margin of 46.5%. In Q4 2024, EBITDA reached EGP 348.7 million, down 70.0% with an EBITDA margin of 36.6%.

- Net profit surged to EGP 2.8 billion for FY 2024, growing 33.3% year-on-year, with a net profit margin of 34.6%. In Q4 2024, net profit recorded EGP 262.7 million, down 65.6% with a margin of 27.6%.

- Madinet Masr closed FY 2024 with a net debt position of EGP 358.5 million, compared to a net cash position of EGP 35.6 million at the end of FY 2023. The shift was due to an increase in loans to finance Midar and other projects. The net debt/EBITDA ratio remained at a healthy level of (0.05) as of 31 December 2024, compared to 0.01 at year-end 2023.

- Net notes receivable recorded EGP 2.3 billion as of 31 December 2024, down from EGP 4.0 billion at year-end 2023, yielding a receivables/net debt ratio of (6.42) for FY 2024 versus 113.40 at the close of FY 2023. Total accounts and notes receivable, including off-balance PDCs for undelivered units, amounted to EGP 57.7 billion as of 31 December 2024 compared to EGP 29.8 billion as of 31 December 2023.

- Cash collections surged 112.0% year-on-year to EGP 13.7 billion in FY 2024, more than doubling from EGP 6.4 billion in FY 2023, reflecting improved collection efficiency and strong sales momentum.

- Madinet Masr deployed EGP 6.5 billion in construction and infrastructure CAPEX in FY 2024, up from EGP 2.2 billion in FY 2023, as the Company accelerated project execution across its developments.

Management Comment

Abdallah Sallam, Chief Executive Officer:

As we close 2024, I am pleased to share Madinet Masr’s strong financial and operational performance, reflecting the resilience of our strategy, the strength of our business model, and our ability to navigate a dynamic market environment. This year we maintained our momentum by leveraging our core strengths: innovative product offerings, strategic expansions, and a deep commitment to delivering value to our customers and stakeholders.

In FY 2024, Madinet Masr recorded gross contracted sales of EGP 41.0 billion, marking a 37.1% year-on-year increase. This growth was driven by the successful launch of new projects and strong demand across our flagship developments, Taj City and Sarai. We also reported revenues of EGP 8.2 billion, a 7.2% rise from the previous year, while net profit climbed to EGP 2.8 billion, up 33.3% year-on-year. The success of our recent launches, coupled with our ability to adapt to evolving consumer demands, has reinforced our market positioning.

Throughout the year, we focused on expanding our footprint, accelerating construction, and strengthening our financial position. We significantly increased our CAPEX investment to EGP 6.5 billion, reinforcing our commitment to construction completion and delivering high-quality developments across Taj City, Sarai, and multiple new projects such as The Butterfly in Mostakbal City. We also introduced innovative real estate solutions that cater to changing customer preferences. These initiatives underscore our vision to be at the forefront of Egypt’s evolving real estate sector.

As we move into 2025, we are confident in our ability to sustain this momentum. Our focus remains on expanding our development projects, enhancing our product offerings, and maintaining financial strength. With a solid pipeline of projects and a proactive approach to market trends, Madinet Masr is well-positioned for continued growth and value creation in the years ahead.

Operational Performance

Gross Contracted Sales

Madinet Masr’s gross contracted sales recorded EGP 41 billion during FY 2024, increasing 37.1% y-o-y from EGP 29.9 billion in FY 2023. Approximately 60.7% (EGP 24.9 billion) of Madinet Masr’s gross contracted sales for FY 2024 were recorded at Sarai, the Company’s 5.5-million-sqm mixed-use project near the New Administrative Capital on the Cairo-Suez Road. Meanwhile, 26.5% (EGP 10.9 billion) of Madinet Masr’s gross contracted sales for FY 2024 were generated at Taj City, a 3.6-million-sqm mixed-use development in the eastern suburbs of Cairo.

The Company sold a total of 4,808 units in FY 2024, down 11.7% y-o-y from 5,443 units in FY 2023 due to an exceptional increase in contract sales in Q4 2023. Madinet Masr sold 1,290 units at Taj City during the year (FY 2023: 2,934), 3,199 units at Sarai (FY 2023: 2,494), and 319 units at other projects (FY 2023: 15) as part of its diversification into new projects. 2024 saw the launch of 5 new zones across Sarai and Taj City. As of 31 December 2024, Madinet Masr’s sales reached EGP 24.9 billion in newly launched projects.

On a quarterly basis, the Company recorded gross contracted sales of EGP 8.3 billion for Q4 2024, down 44.7% y-o-y from the EGP 15.0 billion booked in Q4 2023. Newly launched projects such as The Butterfly accounted for 62% of the quarter’s gross contracted sales. Sarai accounted for 15.4% (EGP 1.3 billion) of the quarter’s gross contracted sales, while Taj City accounted for 21.8% of the quarter’s gross contracted sales (EGP 1.8 billion). Madinet Masr sold a total of 711 units during Q4 2024, down 75.1% from the same quarter of the previous year. Sarai sold 208 units in Q4 2024 (Q4 2023: 1,660), while 190 units were sold at Taj City (Q4 2023: 1,195).

Cash Collections

Madinet Masr made cash collections of EGP 13.7 billion for FY 2024, an increase of 112.0% from the EGP 6.4 billion collected in FY 2023. The Company recorded a cumulative delinquency rate of 0.9% at the end of FY 2024, down from the rate of 2.0% reported for FY 2023. The decline in the delinquency rate reflects successful efforts to purge the Company’s receivables portfolio of nonperforming contracts.

On a quarterly basis, net cash collections amounted to EGP 3.6 billion, up 31.8% y-o-y from EGP 2.7 billion in Q4 2023. The delinquency rate stood at 1.5%, down from 2.6% in Q4 2023.

Cancellations

Cancellations stood at EGP 1.4 billion for FY 2024, up 71.9% y-o-y from EGP 807.7 million in FY 2023, despite a 16.9% y-o-y decrease in number of units cancelled. Cancellations as a percentage of gross contracted sales booked 3.4% during FY 2024, up by 0.7 percentage points from 2.7% recorded in FY 2023. The cancellation rate sits well below the normal range of 10-15%.

In Q4 2024, cancellations recorded EGP 691.5 million, up 301.1% y-o-y from the EGP 172.4 million booked in Q4 2023. Cancellations made up 8.3% of gross contracted sales in Q4 2024, up by 7.2 percentage points from 1.1% in Q4 2023.

Deliveries

The Company delivered 645 units across its developments during FY 2024, down 41.5% y-o-y from the 1,103 deliveries booked for FY 2023. Madinet Masr is focusing on mass construction in the public areas of Taj City and Sarai and unit deliveries are expected to rebound following their completion. In 2024, Madinet Masr completed 287 handovers at Sarai (FY 2023: 933), 273 handovers at Taj City (FY 2023: 123) and 85 handovers at Nasr Gardens (FY 2023: 47), a subsidized housing project.

On quarterly basis, Madinet Masr recorded 167 deliveries in Q4 2024, down by 46.3% from the 311 units recorded for Q4 2023. The Company delivered 51 units at Sarai during the quarter (Q4 2023: 242), 106 units at Taj City (Q4 2023: 24) and 10 units at Nasr Gardens (Q4 2023: 45).

CAPEX

Madinet Masr deployed construction and infrastructure CAPEX of EGP 6.5 billion during FY 2024 compared to EGP 2.2 billion in FY 2023. The Company’s construction and infrastructure investments at Taj City amounted to EGP 2.3 billion in FY 2024, against EGP 1.4 billion for FY 2023. At Sarai, Madinet Masr recorded a construction and infrastructure CAPEX spend of EGP 1.2 billion for FY 2024, against EGP 507.7 million for FY 2023. Construction and infrastructure CAPEX at New Heliopolis, The Butterfly, and other projects booked EGP 3.0 billion for FY 2024, collectively accounting for 45.6% of the total CAPEX outlay for FY 2024.

Madinet Masr made construction and infrastructure CAPEX outlays of EGP 1.5 billion for Q4 2024, an increased CAPEX investment over the EGP 621.0 million construction and infrastructure CAPEX spent in Q4 2023, with the increase mainly attributed to Sarai and Taj City. CAPEX spending in Q4 2024 recorded EGP 761.1 million at Taj City (Q4 2023: EGP 465.1 million), EGP 435.3 million at Sarai (Q4 2023: EGP 96.9 million), while the rest of the projects accounted for EGP 323.4 million (Q4 2023: EGP 59.1 million).

Land Bank

Madinet Masr held a land bank measuring 12.8 million sqm at the close of FY 2024. The Company’s primary land bank is strategically located in Greater Cairo (Taj City and Sarai) with new additions in Mostakbal City and New Heliopolis City. As at 31 December 2024, 43.0% of Madinet Masr’s land bank was held at Sarai, 28.4% at Taj City, 25.3% at newly launched developments, and 3.4% at Zahw Assiut.

Nearly 78.3% of Taj City’s land area was under development at the close of FY 2024, with no residential land unlaunched. Commercial projects in Taj City accounted for the remaining 21.7% of unlaunched land. At Sarai, 67.0% of the total land area was under development by end of 2024, with unlaunched residential projects and unlaunched nonresidential projects accounting for 18.3% and 14.7% of Sarai’s total land bank, respectively.

As of FY 2024, 26.5% of Madinet Masr’s land bank in Assiut was under development, and 65.4% was unlaunched residential land, while the remaining 8.1% represented unlaunched non-residential land. The Butterfly, a newly launched 998.9 thousand sqm project in Mostakbal City, was 91.1% under development at the close of FY 2024, with unlaunched nonresidential land accounting for the remaining 8.9%.

Madinet Masr’s newest partnerships, New Heliopolis and Zahraa El Maadi, remain fully unlaunched as at end of FY 2024.

Financial Performance

Income Statement

Revenues

Madinet Masr’s revenues reached EGP 8.2 billion in FY 2024, up by 7.2% y-o-y compared to EGP 7.6 billion in FY 2023. Revenue growth for the FY 2024 period was driven by significantly higher gross contracted sales value.

New sales generated the largest share of revenues in FY 2024 totaling EGP 7.7 billion, up by 28.3% y-o-y, accounting for 87.7% of the Company’s FY 2024 gross sales revenue of EGP 8.2 billion before cancellations, land sale, installment interest and rental revenue. Meanwhile, unit deliveries generated EGP 1.0 billion in revenue during the same period, declining by 29.3% y-o-y. Revenue from deliveries accounted for 12.3% of the Company’s sales revenue before cancellations, land sale, installment interest and rental revenue. At the close of FY 2024, Madinet Masr had an unrecognized revenue backlog of EGP 64.9 billion calculated at the nominal price of undelivered sales.

On the quarterly basis, Madinet Masr booked revenues of EGP 952.5 million for Q4 2024, decreasing by 70.2% y-o-y. Revenue from new sales represented 74.2% of the Company’s gross top line during Q4 2024, while revenue from deliveries accounted for the remaining 25.8% for the quarter.

Gross Profit

Gross profit booked EGP 5.7 billion for FY 2024, increasing 13.5% y-o-y against EGP 5.0 billion during the previous year. Growth in gross profit was supported by the Company’s strong top-line expansion for the period, driven by higher new sales revenues. Madinet Masr booked a gross profit margin of 69.9% in FY 2024 compared to 66.0% in FY 2023. The expansion in the gross profit margin (GPM) during the period was achieved due to the increase in revenue from new sales with higher margins as compared to revenue from unit deliveries with lower margins.

Madinet Masr booked a gross profit of EGP 287.0 million for Q4 2024, down by 86.7% y-o-y due to no revenue recognition from EGP 5.2 billion of contracted sales in the Butterfly and Zahw Assiut, which were deferred until final delivery of the units. The gross profit margin stood at 30.1% for the quarter, down from the 67.5% booked in Q4 2023.

Sales, General & Administrative Expense

Sales, general & administrative (SG&A) expenses recorded EGP 2.1 billion for FY 2024, increasing by 11.6% y-o-y from the EGP 1.9 billion booked for FY 2023. SG&A expenses rose on the back of increased marketing activities and an increase in finance costs. As a percentage of revenues, SG&A expense recorded 25.2% for FY 2024, up by 1.0 percentage point from 24.3% the previous year. SG&A expenses recorded EGP 330.0 million for Q4 2024, up by 8.7% y-o-y and accounting for 34.6% as a percentage of revenues compared to 26.0% in Q4 2023.

Finance Cost

Finance cost booked EGP 560.5 million in FY 2024, up by 26.1% from EGP 444.4 million for FY 2023, reflecting the general increase in interest rates. On a quarterly basis, finance cost recorded EGP 150.6 million in Q4 2024, down 27.0% from EGP 206.1 million in the same quarter last year.

EBITDA

Madinet Masr booked an EBITDA of EGP 3.8 billion for FY 2024, increasing 23.1% y-o-y from EGP 3.1 billion in FY 2023. The associated EBITDA margin was 46.5% in FY 2024 compared to 40.5% in FY 2023 due to the increase in the share of new sales with higher profit margins in the Company’s revenue mix for FY 2024.

In Q4 2024, Madinet Masr reported an EBITDA of EGP 348.7 million, down by 70.0% y-o-y with a corresponding EBITDA margin of 36.6% versus 36.3% in Q4 2023.

Net Profit

Net profit reached EGP 2.8 billion for FY 2024, growing 33.3% y-o-y from EGP 2.1 billion in FY 2023. The net profit margin (NPM) recorded 34.6% for FY 2024 compared to 27.8% in FY 2023.

On quarterly basis, Madinet Masr booked a net profit of EGP 262.7 million for Q4 2024, decreasing 65.6% y-o-y due to no revenue recognition from EGP 5.2 billion of contracted sales in the Butterfly and Zahw Assiut, which were deferred until final delivery of the units. The Company’s NPM booked 27.6% for the quarter, up from 23.9% in Q4 2023.

Balance Sheet

Net Cash & Short-term Investments

On the balance sheet front, Madinet Masr held net cash and short-term investments of EGP 3.1 billion as at 31 December 2024, up 50.2% from EGP 2.0 billion at the close of 2023, primarily due to increased revenues coming from new sales.

Debt

As at 31 December 2024, Madinet Masr had outstanding debts of EGP 2.7 billion, up 30.4% from the EGP 2.1 billion booked at year-end of 2023. The increase comes on the back of the new loan received from NBK, with the main purpose of paying the Midar downpayment. The Company’s debt/equity ratio stood at 0.28 as at 31 December 2024, similar to the level of 0.28 posted at the close of 2023. Due to the new loans, the Company changed from a net cash position to a net debt position of EGP 358.5 million as at 31 December 2024, down from a net cash position of EGP 35.6 million at the close of 2023. Madinet Masr recorded a net debt/EBITDA ratio of (0.05) as at 31 December 2024, down from 0.12 as at 31 December 2023.

Notes Receivable

Madinet Masr held EGP 2.3 billion in notes receivable at the close of FY 2024, of which EGP 1.1 billion were short-term receivables, EGP 1.1 billion long-term receivables and EGP 200.5 million were due from customers. Total accounts and notes receivable as of 31 December 2024, including off-balance sheet PDCs for undelivered units amounted to EGP 57.7 billion compared to EGP 29.8 billion as of 31 December 2023. Receivables to net debt stood at (6.42) by the end of FY 2024, compared to the 113.40 recorded at year-end 2023.

PP&E

PP&E, fixed assets under construction, and property investments booked EGP 1.7 billion at the close of FY 2024, up from the EGP 691.4 million booked at the close of 2023.

Recent Corporate Developments

In January 2024, Madinet Masr launched the first phase of Sheya, its latest project in Sarai. Sheya spans an area of 228,212 sqm and offers a total of 744 mixed residential units.

In February 2024, Madinet Masr signed a first of its kind Memorandum of Understanding (MoU) with Elmarakby Steel. The MoU aims to reduce waste, lower carbon emissions, and enhance the environmental and economical sustainability of Madinet Masr’s construction.

In March 2024, Madinet Masr unveiled “Theqa” the latest innovation by Madinet Masr Innovation Labs. Theqa is the first-of-its-kind property warranty solution to substitute maintenance deposits.

In May 2024, Madinet Masr launched “Tajed”, the first integrated commercial district in Taj City spanning over 39,000 sqm, covering various commercial activities and customer needs.

In June 2024, Madinet Masr partners with Blue Ribbon and CIRA Education’s subsidiaries to establish the first sports-focused Swiss International School in the Region and Klub Kayan, aiming to combine high quality education with professional sports and healthy lifestyles.

In July 2024, Madinet Masr signs a MoU with Aboelwafa for Contracting & Real Estate Investment to carryout construction work at Sarai, with total investments exceeding EGP 1 billion.

In July 2024, Madinet Masr signs a co-development project in New Heliopolis City in partnership with Misr Al-Gadida for Housing and Development and a partnership agreement with Midar to develop an integrated residential project in the fourth phase of Mostakabal City.

In September 2024, Madinet Masr launches “The Butterfly” in Mostakbal City, a 187 acres development with targeted sales of EGP 64 billion.

In October 2024, Madinet Masr signed a strategic partnership with Redcon to accelerate construction at Sarai. The partnership includes an investment exceeding EGP 600 million for the construction of Z Villas in the East Wave project, with completion expected in 2025.

In November 2024, Madinet Masr announced its contribution to the restoration of Bayt Al-Razzaz in collaboration with the Egyptian Heritage Rescue Foundation and Kahhal Looms.

In December 2024, Madinet Masr introduced SAFE, a first-of-its-kind fractional ownership platform developed by Madinet Masr Innovation Labs. The platform enables investors to own shares in real estate properties, providing a flexible and secure investment model.

In December 2024, Madinet Masr secured a medium-term revolving joint financing facility of EGP 9 billion, provided by a consortium of leading banks. The facility is structured into two tranches: EGP 4 billion allocated to Taj City and EGP 5 billion to Sarai.

-Ends-

| Income Statement

Balance Sheet

|

About Madinet Masr

Madinet Masr, one of Egypt’s leading urban community developers was established in 1959. Headquartered in Cairo and listed on the Egyptian Stock Exchange (EGX) in 1996, Madinet Masr operates under a robust corporate governance structure and is committed to delivering exceptional value to all its stakeholders. Rebranded from Madinet Nasr to Madinet Masr in 2023, the company has become one of the most innovative real estate companies in Egypt, capitalizing on a long and successful track record of delivering distinguished and multi-functional developments that drives growth in Egypt by developing sustainable communities. Madinet Masr has become a prominent community developer and urban planner in Egypt after developing Nasr City, the largest neighborhood in Greater Cairo with a population of over three million people. Since then, it has actively taken on large-scale projects to transform sizeable areas of land into contemporary, integrated communities.

Today, Madinet Masr owns a land portfolio of 12.8 million sqm, with two renowned mega developments, Taj City and Sarai in East Cairo. Taj City, a 3.6 million sqm mixed use development positioned as a premier destination, and Sarai a 5.5 million sqm mixed use development strategically located in front of Egypt’s New Administrative Capital. Madinet Masr has launched Zahw in 2023, its first expansion project outside of Cairo Governorate. Zahw is a 104-acre mixed use development strategically positioned west of Assiut Governorate beside Assiut’s airport and 15-minutes away from its center. Zahw compliments the contemporary real estate products in Upper Egypt.

Some of the key strategic partnerships signed include the development of a project in New Heliopolis City, covering an area of 491 feddans, and the development of an integrated residential urban project in the fourth phase of Al Amal Axis in Mostakbal City, covering an area of 238 feddans (approximately 1 million square meters).

Shareholding Structure and Contact Information

Investor Relations Contact

Ahmed Khalil

akhalil@madinetmasr.com

Investor Relations Department

investor.relations@madinetmasr.com

Madinet Masr

4 Youssif Abbas Street, District 2

Nasr City, Cairo, Egypt

www.madinetmasr.com

Disclaimer

The information, statements and opinions contained in this Presentation do not constitute a public offer under any applicable legislation or an offer to sell or solicitation of any offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. Information in this Presentation relating to the price at which investments have been bought or sold in the past, or the yield on such investments, cannot be relied upon as a guide to the future performance of such investments. This Presentation contains forward-looking statements. Such forward-looking statements contain known and unknown risks, uncertainties and other important factors, which may cause actual results, performance or achievements of Madinet Masr (the "Company") to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on numerous assumptions regarding the Company's present and future business strategies and the environment in which the Company will operate in the future. None of the future projections, expectations, estimates or prospects in this Presentation should be taken as forecasts or promises nor should they be taken as implying any indication, assurance or guarantee that the assumptions on which such future projections, expectations, estimates or prospects are based are accurate or exhaustive or, in the case of the assumptions, entirely covered in the Presentation. These forward-looking statements speak only as of the date they are made and, subject to compliance with applicable law and regulation, the Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in the Presentation to reflect actual results, changes in assumptions or changes in factors affecting those statements. The information and opinions contained in this Presentation are provided as of the date of the Presentation, are based on general information gathered at such date and are subject to changes without notice. The Company relies on information obtained from sources believed to be reliable but does not guarantee its accuracy or completeness. Subject to compliance with applicable law and regulation, neither the Company, nor any of its respective agents, employees or advisers intends or has any duty or obligation to provide the recipient with access to any additional information, to amend, update or revise this Presentation or any information contained in the Presentation. Certain financial information contained in this presentation has been extracted from the Company's unaudited management accounts and financial statements. The areas in which management accounts might differ from International Financial Reporting Standards and/or U.S. generally accepted accounting principles could be significant and you should consult your own professional advisors and/or conduct your own due diligence for complete and detailed understanding of such differences and any implications they might have on the relevant financial information contained in this presentation. Some numerical figures included in this Presentation have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in certain tables might not be an arithmetic aggregation of the figures that preceded them.