PHOTO

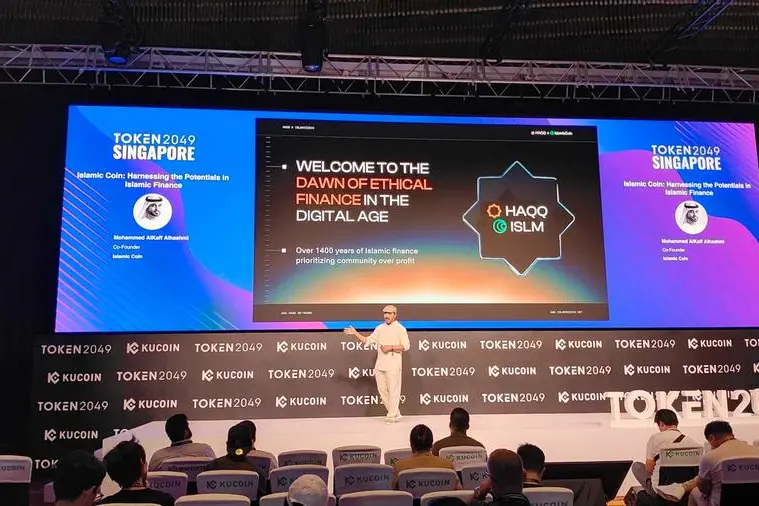

SINGAPORE – During his speech at TOKEN2049 in Singapore, Mohammed AlKaff AlHashmi, Founder of Islamic Coin, announced a landmark Memorandum of Understanding (MoU) between Islamic Coin, a native currency of HAQQ, a community-run network, dedicated to empowering an ethics-first Shariah-compliant financial ecosystem, and CoinDesk Indices (CDI), the leading provider of digital asset indices by AUM since 2014, to explore a strategic partnership to develop groundbreaking index strategies.

“This partnership marks a promising alignment of interests as both entities look to tap into the rapidly growing interest in crypto and inclusive finance,” said Mohammed AlKaff AlHashmi. “With the global Islamic finance market forecasted to surpass $3.69 trillion by 2024, this collaboration is poised to reshape the landscape of Shariah-compliant digital financial services.

Major highlights of this proposed relationship include:

- Index-Based Products – Licensing of various CDI indices for exchange-traded financial products, paving the way for innovative instruments such as an Islamic Coin ETF, Staked Islamic Coin ETF, and multi-token Shariah-compliant products.

- New Indices – Creating new Shariah-compliant indices, incorporating the Shariah oracle and compliant systematic strategies.

- Index Data – CDI will offer API access to selected digital assets for HAQQ’s internal use, including its digital asset exchange.

“We are excited to expand our presence into the MENA region through this collaboration,” said Alan Campbell, President of CoinDesk Indices. “CoinDesk is committed to serving global markets and offering solutions that drive the digital asset opportunity and community forward.”

Over the past year, Islamic Coin has garnered massive support from the industry. Earlier this year, the project partnered with Sushi, one of the world's top decentralized exchanges. This partnership promises several benefits for the Islamic Coin community, including liquidity provision, asset staking, and token earning during the liquidity mining phase. The project has also won several awards including, Most Promising ESG Crypto and the Golden Excellence Award from The Middle East Blockchain Awards.

The latest proposed collaboration between Islamic Coin and CDI heralds a new chapter in ethical finance and digital currency. With a shared vision and commitment, both entities intend to drive revolutionary change and grow participation in digital asset solutions.

Be the first to know about updates regarding this exciting partnership by contacting us today.

About Islamic Coin

Islamic Coin is a Shariah-compliant cryptocurrency native to the HAQQ ethics-first financial ecosystem. It aims to equip the global Muslim community with halal financial instruments for the digital age, enabling seamless transactions and interaction while supporting transparency, innovation, and philanthropy.

Shariah Oracle’s on-chain mechanism controls a whitelist of smart contracts to ensure users interact only with Shariah-compliant dApps. At the same time, 10% of each $ISLM issuance is deposited into Evergreen DAO for further investment into Islam-related ventures or charities, bringing direct economic value to the community. The project raised $400 million during a private sale, beating all previous records. Islamic Coin is set to launch on both centralized and decentralized exchanges in September 2023.

About CoinDesk Indices

CoinDesk Indices (CDI), a subsidiary of CoinDesk, has been the leading provider of digital asset indices by AUM since 2014. CDI is driven by research and a desire to educate the marketplace and empower investors. CoinDesk is the most trusted media, events, indices and data company for the global crypto economy.

CDI has three distinct product lines: single-asset reference rates and indices, broad market and sector indices, and dynamic strategy indices. The CoinDesk Bitcoin Price Index (XBX) has the longest index track record and underlies the world’s largest digital asset products. The broad market and sector indices offer the most comprehensive suite of broad market benchmarks, and the investible sectors are constructed using CDI’s industry-adopted taxonomy. The dynamic strategy indices help investors target specific outcomes.

Press Contacts

Islamic Coin

Anastasiia Kulibaba, PR Manager

anastasiia@inputpr.com

Casey Craig, Global Head of Communications at CoinDesk

casey@coindesk.com

JConnelly

CDI@jconnelly.com

Disclaimer

The Information is not an offer to buy or sell, nor is it a solicitation of an offer to buy or sell, any investment banking services, securities, futures, options, commodities or other financial instruments or to participate in any investment banking services or trading strategy.

CoinDesk Indices, Inc. ("CDI") does not sponsor, endorse, sell, promote or manage any investment offered by any third party that seeks to provide an investment return based on the performance of any index, indicator or signal. CDI is neither an investment adviser nor a commodity trading adviser and makes no representation regarding the advisability of making an investment linked to any CDI index, indicator or signal. CDI does not act as a fiduciary. A decision to invest in any asset linked to a CDI index, indicator or signal should not be made in reliance on any of the statements set forth in this document or elsewhere by CDI. All content contained or used in any CDI index, indicator or signal (the "Content") is owned by CDI and/or its third-party data providers and licensors, unless stated otherwise by CDI. CDI does not guarantee the accuracy, completeness, timeliness, adequacy, validity or availability of any of the Content. CDI is not responsible for any errors or omissions, regardless of the cause, in the results obtained from the use of any of the Content. CDI does not assume any obligation to update the Content following publication in any form or format. © 2023 CoinDesk Indices, Inc. All rights reserved.