PHOTO

Amman Jordan: -- International General Insurance Holdings Ltd. (“IGI” or the “Company”) (NASDAQ: IGIC) today reported financial results for the third quarter and first nine months of 2022.

Highlights for the third quarter and first nine months of 2022 include:

IGI Chairman and CEO Mr. Wasef Jabsheh said, “IGI recorded another strong set of results in the third quarter of 2022, continuing the momentum of the prior two quarters, and culminating in a combined ratio of 73.6% and a core operating return on average shareholders’ equity of 26.9% for the first nine months of 2022.”

“Market conditions and rates are holding up across our portfolio and we continue to grow at a steady pace, with gross written premiums up more than 11% year-to-date. As always, our primary focus is on profitable growth, diversification and managing volatility.”

“As we look ahead to 2023, we continue to closely monitor the broader economic effects of rising inflation and interest rates as well as foreign exchange movements. The effect of the strengthening U.S. Dollar against our transactional currencies, the Pound Sterling and the Euro, particularly in our long-tail business which accounts for about a third of our total gross premiums, was evident in prior quarterly results and is again evident in the third quarter, resulting in a positive impact on our underwriting results.”

“We expect to see further opportunities to continue on our profitable growth trajectory, particularly after the headline events of the third quarter, which we expect will positively impact rates in some of our markets. While we were less impacted than others in our industry by these catastrophic events - in particular the devastation of Hurricane Ian - they once again provide a reminder of why we do what we do - to provide peace of mind in times of uncertainty. That is our purpose and our commitment at IGI and it is what enhances the value that we provide to our customers and our shareholders.”

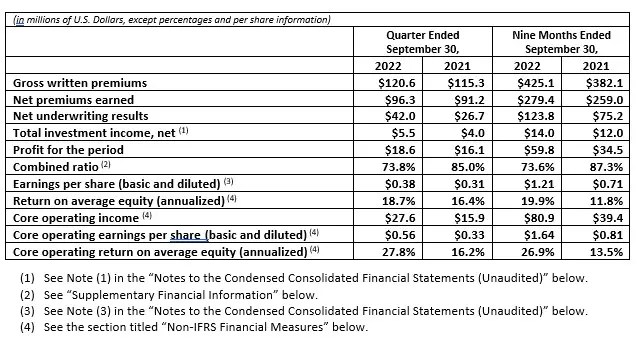

Results for the Periods Ended September 30, 2022 and 2021

Profit for the quarter ended September 30, 2022 was $18.6 million, compared to profit of $16.1 million for the quarter ended September 30, 2021.

Core operating income, a non-IFRS measure defined below, was $27.6 million for the quarter ended September 30, 2022, a significant increase over the core operating income of $15.9 million for the comparable period in 2021. The improvement in core operating income from the third quarter of 2021 to the third quarter of 2022 was primarily the result of higher favorable development of net loss reserves from prior accident years, which benefited from the currency devaluation impact on loss reserves denominated in Pound Sterling and Euro. The core operating return on average equity (annualized) increased 11.6 points to 27.8% for the third quarter of 2022 compared to the third quarter of 2021.

For the first nine months of 2022, profit was $59.8 million, compared to profit of $34.5 million for the first nine months of 2021.

Core operating income was $80.9 million for the nine months ended September 30, 2022 compared to core operating income of $39.4 million for the nine months ended September 30, 2021. The improvement in core operating income in the first nine months of 2022 compared to the first nine months of 2021 was primarily driven by the same reasons discussed above for the quarter.

The core operating return on average equity (annualized) increased 13.4 points to 26.9% for the first nine months of 2022 compared to the first nine months of 2021.

Underwriting Results

Net underwriting results improved to $42.0 million for the third quarter of 2022 from $26.7 million for the third quarter of 2021, largely driven by growth in net premiums earned and a lower level of net claims and claim adjustment expenses.

Gross written premiums were $120.6 million for the quarter ended September 30, 2022, representing growth of 4.6% compared to gross written premiums of $115.3 million for the quarter ended September 30, 2021. The increase in gross written premiums was the result of new business generated across all segments and most lines of business, as well as rate increases on existing business across all segments.

The net claims and claims expense ratio improved to 38.1% for the quarter ended September 30, 2022, compared to 50.4% for the quarter ended September 30, 2021, primarily driven by higher favorable development of net loss reserves from prior accident years of $21.7 million, or 22.5 points, compared to favorable development of $7.1 million, or 7.8 points, for the quarter ended September 30, 2021. The favorable development of net loss reserves from prior accident years in the third quarter of 2022 was driven by improvement in claims experience in most lines of business in the Long-tail Segment, and primarily the energy and property lines in the Short-tail Segment, and positively impacted by currency devaluation on prior period loss reserves denominated in Pound Sterling and Euro.

The general and administrative expense ratio increased 3.2 points to 17.4% in the third quarter of 2022 compared to the same quarter of 2021, largely due to expansion of the business including increased employee-related costs related to new hires, travel and entertainment, consulting, technology and infrastructure related costs.

The combined ratio for the quarter ended September 30, 2022 was 73.8% compared to 85.0% for the quarter ended September 30, 2021, was primarily the result of higher favorable development of net loss reserves from prior accident years, which benefited from the currency devaluation impact on loss reserves denominated in Pound Sterling and Euro.

For the first nine months of 2022, gross written premiums were $425.1 million, an increase of 11.3% compared to $382.1 million for the comparable period in 2021.

The net claims and claim expense ratio improved to 37.1% for the nine months ended September 30, 2022, compared to 52.5% for the nine months ended September 30, 2021, primarily driven by favorable development of net loss reserves from prior accident years of $44.7 million or 16.0 points, compared to favorable development of $10.4 million or 4.0 points for the nine months ended September 30, 2021. The favorable development of net loss reserves from prior accident years in the first nine month of 2022 was positively impacted by currency devaluation on loss reserves denominated in Pound Sterling and Euro.

The general and administrative expense ratio increased 1.6 points to 17.9% in the first nine months of 2022 compared to the same period of 2021, for the same reasons discussed above for the quarter.

The combined ratio for the nine months ended September 30, 2022 was 73.6%, compared to 87.3% for the nine months ended September 30, 2021, benefiting from the same factors discussed above for the quarter.

Segment Results

The Long-tail Segment, which represented approximately 37% of the Company’s gross written premiums for the nine months ended September 30, 2022, includes financial institutions, marine liability, inherent defects insurance, and professional lines, which is comprised of professional indemnity, directors and officers, legal expenses, and other casualty lines (non-U.S.).

Gross written premiums for the third quarter of 2022 in the Long-tail Segment were $53.4 million compared to $55.3 million for the third quarter of 2021. Net premiums earned for the quarter ended September 30, 2022 were $44.1 million, compared to $44.8 million in the comparable quarter in 2021. The net underwriting results for this segment were $36.2 million for the third quarter of 2022, compared to $17.1 million in the third quarter of 2021.

Gross written premiums for the first nine months of 2022 in the Long-tail Segment were $156.8 million compared to $156.6 million for the first nine months of 2021. Net premiums earned for the nine months ended September 30, 2022 were $125.7 million, compared to $127.5 million in the comparable period in 2021. The net underwriting results for this segment were $73.6 million for the first nine months of 2022, compared to $39.5 million in the first nine months of 2021. The growth in net underwriting results benefitted primarily from higher favorable development of net loss reserves from prior accident years, which were positively impacted by the currency devaluation impact on loss reserves denominated in Pound Sterling and Euro.

The Short-tail Segment, which represented approximately 57% of the Company’s gross written premiums for the nine months ended September 30, 2022, includes energy, property, general aviation, ports and terminals, marine trades, marine cargo, contingency, construction and engineering, and political violence.

Gross written premiums for the third quarter of 2022 in the Short-tail Segment were $60.7 million, an increase of 11.2% compared to $54.6 million in the third quarter of 2021. Net premiums earned for the quarter ended September 30, 2022 were $44.5 million, compared to $40.5 million in the comparable quarter in 2021. The net underwriting results for this segment were $4.7 million for the third quarter of 2022, compared to $8.8 million for the comparable quarter in 2021. The decline in net underwriting results was primarily due to a higher level of net claims and claim adjustment expenses in the third quarter of 2022, primarily due to lower favorable development of net loss reserves from prior accident years compared to the third quarter of 2021, partially offset by the increase in net premiums earned.

Gross written premiums for the first nine months of 2022 in the Short-tail Segment were $241.5 million, an increase of 17.5% compared to $205.5 million in the first nine months of 2021. Net premiums earned for the nine months ended September 30, 2022 were $131.6 million, compared to $114.3 million in the comparable period in 2021. The net underwriting results for this segment were $45.8 million for the first nine months of 2022, compared to $32.3 million for the comparable period in 2021. The first nine months of 2022 benefited from the increase in net premiums earned compared to the first nine months of 2021, partially offset by a slight increase in net claims and claim adjustment expenses.

The Reinsurance Segment, which represented approximately 6% of the Company’s gross written premiums for the nine months ended September 30, 2022, includes the Company’s inwards reinsurance portfolio.

Gross written premiums for the third quarter of 2022 in the Reinsurance Segment were $6.5 million, compared to $5.4 million in the third quarter of 2021. Net premiums earned for the quarter ended September 30, 2022 were $7.7 million, compared to $5.9 million for the comparable quarter in 2021. Net underwriting results for this segment were $1.1 million for the third quarter of 2022, compared to $0.8 million in the third quarter of 2021. The third quarter of 2022 benefited from an increase in net premiums earned, partially offset by the increase in net claims and claim adjustment expenses.

Gross written premiums for the first nine months of 2022 in the Reinsurance Segment were $26.8 million, compared to $20.0 million in the first nine months of 2021. Net premiums earned for the nine months ended September 30, 2022 were $22.1 million, compared to $17.2 million for the comparable period in 2021. Net underwriting results for this segment were $4.4 million for the first nine months of 2022, compared to $3.4 million in the first nine months of 2021. The nine months ended September 30, 2022 benefited from an increase in net premiums earned, partially offset by the increase in net claims and claim adjustment expenses.

Foreign Exchange Losses

The loss on foreign exchange in the third quarter of 2022 was $10.4 million, compared to $4.9 million in the third quarter of 2021, both of which largely represent currency revaluation losses. When compared with the third quarter of 2021, the third quarter of 2022 saw a greater degree of negative currency movement in the Company’s major transactional currencies against the U.S. Dollar.

The loss on foreign exchange in the first nine months of 2022 was $23.1 million, compared to $8.1 million in the first nine months of 2021, primarily driven by same reasons discussed above for the quarter.

Investment Results

Total investment income was $5.0 million in the third quarter of 2022, compared to $3.3 million in the third quarter of 2021. Total investment income, net, was $5.5 million and $4.0 million for the quarters ended September 30, 2022 and 2021, respectively. This represented an annualized investment yield of 2.3% on the average total investments, term deposits (bank deposits with a maturity of more than three months), and cash and cash equivalents (bank deposits with a maturity of three months or less) in the third quarter of 2022, compared to the 1.9% annualized investment yield in the corresponding period in 2021. The Company’s total investments and term deposits produced an investment yield of 2.6% in the third quarter of 2022, compared to 2.4% in the corresponding period in 2021. The increase in total investment income was primarily attributable to the growth in interest income by $1.4 million, partially offset by $1.0 million increase in unrealized loss on investments, in third quarter of 2022 compared to the same period of 2021.

Total investment income was $9.0 million in the first nine months of 2022, compared to $13.0 million in the first nine months of 2021. Total investment income, net, was $14.0 million and $12.0 million for the first nine months ended September 30, 2022 and 2021 respectively. This represented an annualized investment yield of 2.0% on the average total investments, term deposits, and cash and cash equivalents in the first nine months of 2022, which remained flat compared to the corresponding period in 2021. The Company’s total investments and term deposits produced an investment yield of 2.3% in the first nine months of 2022, compared to 2.5% in the corresponding period in 2021. The decline in total investment income was primarily attributable to a $4.2 million unrealized loss on investments in the first nine months of 2022 compared to a $2.1 million unrealized gain on investments in the first nine months of 2021, partially offset by the growth in interest income of $1.9 million compared to the same period of 2021.

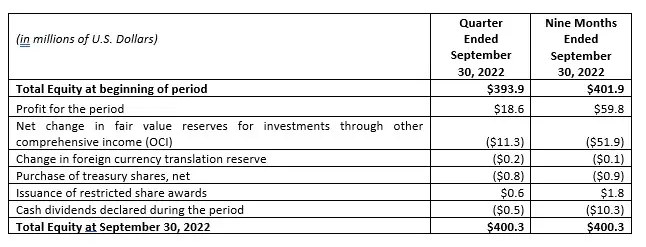

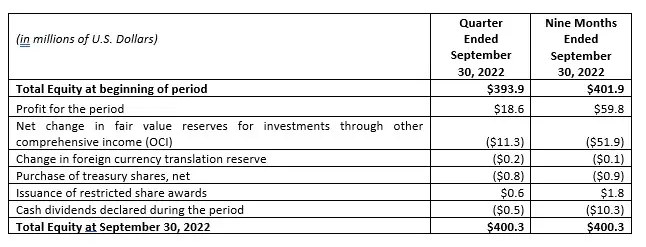

Total Equity

Total equity at September 30, 2022 was $400.3 million, compared to $401.9 million at December 31, 2021. The movement in total equity during the third quarter and nine months ended September 30, 2022 is illustrated below:

Book value per share was $8.80 at September 30, 2022, compared to $8.83 at December 31, 2021.

During the second quarter of 2022, the Company began to repurchase common shares in the open market pursuant to its 5 million common share repurchase program announced in May 2022. As of November 8, 2022, the Company had repurchased 210,206 common shares at an average price per share of $7.59.

-Ends-

About IGI:

IGI is an international specialty risks commercial insurer and reinsurer underwriting a diverse portfolio of specialty lines. Established in 2001, IGI has a worldwide portfolio of energy, property, general aviation, construction & engineering, ports & terminals, marine cargo, marine trades, contingency, political violence, financial institutions, general third-party liability (casualty), legal expenses, professional indemnity, D&O, surety, marine liability and reinsurance treaty business. Registered in Bermuda, with operations in Bermuda, London, Malta, Dubai, Amman, Labuan and Casablanca, IGI aims to deliver outstanding levels of service to clients and brokers. IGI is rated “A” (Excellent)/Stable by AM Best and “A-”(Strong)/Stable by S&P Global Ratings. For more information about IGI, please visit www.iginsure.com.

Forward-Looking Statements:

This press release contains “forward-looking statements” within the meaning of the “safe harbour” provisions of the Private Securities Litigation Reform Act of 1995. The expectations, estimates, and projections of the business of IGI may differ from its actual results and, consequently, you should not rely on forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” “commitment,” and similar expressions are intended to identify such forward-looking statements. Forward-looking statements contained in this press release may include, but are not limited to, our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, the outcome of our strategic initiatives, our expectations regarding pricing and other market conditions, and our growth prospects. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of the control of IGI and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) changes in demand for IGI’s services together with the possibility that IGI may be adversely affected by other economic, business, and/or competitive factors globally and in the regions in which it operates; (2) competition, the ability of IGI to grow and manage growth profitably and IGI’s ability to retain its key employees; (3) changes in applicable laws or regulations; (4) the outcome of any legal proceedings that may be instituted against the Company; (5) the potential effects of the COVID-19 pandemic and emerging variants; (6) the effects of the hostilities between Russia and Ukraine and the sanctions imposed on Russia by the United States, European Union, United Kingdom and others; (7) the inability to maintain the listing of the Company’s common shares or warrants on Nasdaq; (8) the inability of the Company to complete the proposed acquisition of EIO or the failure to realize the anticipated benefits of the proposed acquisition of EIO; and (9) other risks and uncertainties indicated in IGI’s filings with the SEC. The foregoing list of factors is not exclusive. In addition, forward-looking statements are inherently based on various estimates and assumptions that are subject to the judgment of those preparing them and are also subject to significant economic, competitive, industry and other uncertainties and contingencies, all of which are difficult or impossible to predict and many of which are beyond the control of IGI. There can be no assurance that IGI’s financial condition or results of operations will be consistent with those set forth in such forward-looking statements. You should not place undue reliance upon any forward-looking statements, which speak only as of the date made. IGI does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.