PHOTO

Gulf Marine Services PLC ("GMS" or the "Company"), a leading provider of self‐propelled, self‐elevating support vessels to the offshore energy industry, is pleased to announce its full year financial results for the year to 31 December 2024.

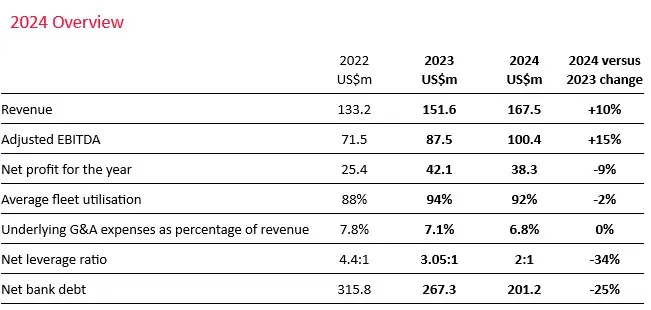

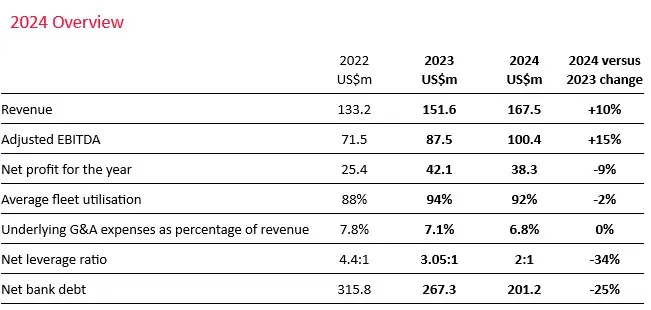

2024 Financial Highlights

- Group concluded the refinancing of US$ 300.0 million loan facility (US$ 250.0 million term loan amortised over five years and US$ 50.0 million working capital facility), denominated in United Arab Emirates Dirhams (AED).

- Net bank debt down to US$ 201.2 million (2023: US$ 267.3 million). Net leverage ratio reduced to 2.0 times (2023: 3.05 times).

- Revenue increased by 10% to US$ 167.5 million (2023: US$ 151.6 million) driven by the improvement in fleet average day rates across all vessel classes.

- Adjusted EBITDA increased by 15% to US$ 100.4 million (2023: US$ 87.5 million) driven by increase in revenue. Adjusted EBITDA margin also increased to 60% (2023: 58%).

- Finance expenses drops by 25% to US$ 23.5 million (2023: US$ 31.4 million), driven by the lower level of gross debt, the cessation of 250 basis points (bps) PIK interest and a reduction of the margin rate by 90 bps when the Group’s net leverage ratio passed below 4:1 as of March 2023, and a further reduction in the margin by 10 bps when the net leverage ratio passed below 3:1 as of March 2024. Additional reduction in margin rate is expected due to successful refinancing at better terms.

- The Group reported a net profit of US$ 38.3 million (2023: US$ 42.1 million).

- Cost of sales as a percentage of revenue is down 3% points to 51% (2023: 54%).

- Underlying general and administrative expenses as a percentage of revenue is down to 6.8% (2023: 7.1%).

- Net reversal of impairment of US$ 9.2 million (2023:US$ 33.4 million) reflecting continuous improvement in market conditions.

- Impact of changes in the fair value of the derivative decreased to US$ 5.3 million (2023: US$ 11.1 million), due to lower number of outstanding warrants offset by an increase in share price of the Company.

2024 Operational Highlights

- New charters and extensions secured during the year totalled 23.8 years (2023: 8.4 years).

- Strong operational efficiency is maintained with average fleet utilisation of 92% (2023: 94%).

- Average day rates increased to US$ 33.1k (2023: US$ 30.3k) with improvements across all vessel classes.

- Consistent low operational downtime of 1.0% (2023: 0.8%).

- Lost Time Injury Rate (LTIR) remaining at zero for 2024, while Total Recordable Injury Rate (TRIR) further reduced to zero (2023: 0.18).

2025 Strategic Progress and Outlook

- Adjusted EBITDA guidance is set at US$ 100 million to US$ 108 million for 2025. We are in the process of assessing the 2026 adjusted EBITDA guidance.

- Target utilisation for 2025 currently stands at 96%.

- Anticipate continued improvement on day rates as our vessel demand outstrips supply on the back of a strong pipeline of opportunities.

- Average secured day rates are 6% higher than 2024 actual levels.