PHOTO

Manama, Bahrain:

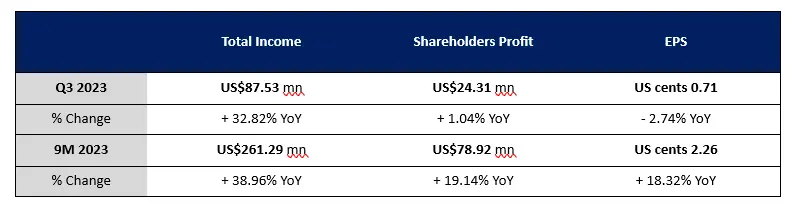

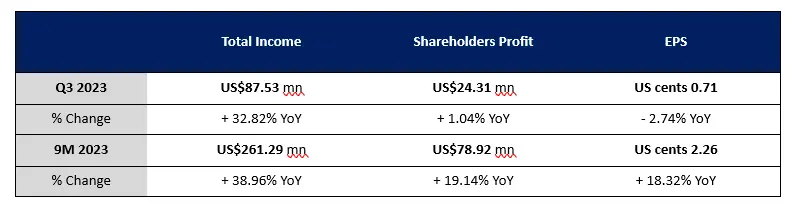

Group Highlights for Q3 and 9M 2023:

- Group continued to effectively implement its strategy delivering strong financial performance and results for the third quarter (Q3 2023) and first nine months of the year ended 30 September 2023 (9M 2023).

- Delivered double-digit growth in income and profitability for the first nine months of the year compared with 2022, with results supported by contributions from the Group’s core business lines – Investment Management, Commercial Banking and Treasury & Proprietary Investments.

- Generated US$75.75 million of income from investment banking activities during Q3 2023 and closed three new transactions - the US Opportunistic Fund, Saudi Food Logistics Fund, and US Student Housing Fund.

- Positive contributions from the Group’s subsidiaries and associates.

- During the third quarter, Capital Intelligence Ratings (CI) undertook a ratings review resulting in the affirmation of GFH’s Long Term Foreign Currency Rating (LT FCR) and Short-Term Foreign Currency Rating (ST FCR) at ‘BB-’ and ‘B’, respectively. According to CI, the ratings were underpinned by GFH’s sound liquidity and low refinancing risk, as well as geographical diversification of assets and business lines.

GFH Financial Group B.S.C (“GFH” or “the Group”) (Bahrain Bourse: GFH) today announced its financial results for the third quarter (“the quarter”) and first nine months of the year ended 30 September 2023 (“the period”).

The Group reported net profit attributable to shareholders of US$ 24.31 million for the third quarter of the year up 1.04% compared with US$24.06 million for the third quarter of 2022 reflecting steady progress. Investment banking income was one of the main contributor towards the profitability of the Group during this quarter. Earnings per share for the third quarter was US cents 0.71 compared to US cents 0.73 for the comparative quarter of 2022. Total income for the third quarter of 2023 was US$ 87.53 million compared to US$ 65.90 million for the third quarter of 2022, a rise of 32.82%. Consolidated net profit for the third quarter was US$23.86 million compared with US$26.1 million in the third quarter of 2022, a decrease of 8.58%. Total expenses for the third quarter were US$ 63.68 million compared to US$39.80 million in the comparative quarter of 2022, an increase of 60.00%.

Net profit attributable to shareholders increased by 19.14% to US$78.92 million for the first nine months of 2023 compared with US$ 66.24 million in the first nine months of 2022 in line with solid contributions from all business lines. Earnings per share for the period was US cents 2.26 compared to US cents 1.91 for the first nine months of 2022. Total income for the first nine months of 2023 was US$261.29 million versus US$188.03 million for the 2022 period, an increase of 38.96%. Consolidated net profit for the nine-month period increased by 13.39 % to US$ 81.05 million compared with US$ 71.48 million in the first nine months of 2022. Total expenses for the period were US$180.24 million up 54.63% from US$116.56 million for the first nine months of 2022.

Total equity attributable to shareholders was US$994.17 million at 30 September 2023 down 0.24% from US$996.60 million at 31 December 2022. Total assets of the Group increased by 7.99% reaching US$10.54 billion at 30 September 2023 compared with US$9.76 billion at 31 December 2022.

The Group’s financial results in full can be found at https://www.bahrainbourse.com/. Shares of GFH are traded under the ticker “GFH” on the Abu Dhabi Securities Exchange, Bahrain Bourse, Boursa Kuwait and Dubai Financial Market.

Ghazi Al Hajeri

Chairman, GFH Financial Group

“We’re pleased to report another quarter of steady growth in income and profitability for the first nine months of the year. Supporting results was income generated from our global and regional investment activities. Contributions were also realised from the Group’s commercial banking business and treasury and proprietary investment activities, although performance in these areas was impacted during the quarter by rising interest rates. While a high interest rate environment has put pressure on the performance of these business lines, they have been able to realign their funding strategies and capitalise on alternative strategies to mitigate the rising funding cost impact. The Group’s overall growth, however, despite challenging market conditions, reflects its resilience and the success of our strategy, which is concentrated on securing opportunities in defensive sectors and the continued pursuit of diversification. The effectiveness of our strategy was further underscored by a ratings review undertaken by Capital Intelligence during the quarter. The agency reaffirmed the Group’s ratings citing strong geographical diversification of assets and business lines among key ratings drivers. We enter the final months of 2023 with an attractive pipeline of opportunities in core sectors and markets, where we have expanded our presence and are growing our portfolio of income-yielding assets to generate even greater value for our investors and shareholders for the remainder of the year and beyond.”

Hisham Alrayes

CEO and Board Member, GFH Financial Group

“The third quarter of 2023 saw the Group make further progress across our business lines as we worked to maximise the value of our investments and continued to act on new opportunities in line with our strategy and focus on attractive, defensive sectors such as healthcare and life sciences, education and food logistics. During the quarter, we grew income by double digits and further enhanced profitability. Contributions were made largely in the third quarter from fees generated from our investment banking activities. We also took advantage of rising interest rates which contributed significantly to our investment income during the quarter. We also successfully closed three new transactions during the quarter – the US Opportunistic Fund, Saudi Food Logistics Fund, and US Student Housing Fund and placed more than US$361.1 million of investments relating to the Group’s regional and international funds with investors across the GCC. Building on long-term structural growth tailwinds in the GCC region, we also continued to seek out and close deals in our core sectors of focus. During the quarter, we further built our regional logistics assets platform with a US$150 million acquisition of a logistics and industrial portfolio comprised of assets located largely in Saudi Arabia as well as in the UAE. We also continued our focus in Saudi Arabia and undertook a number of unique opportunities including those in the healthcare sector, leveraging industry expansion resulting from the Kingdom’s Saudi Vision 2030 economic development strategy. We look to close the year with progress across each of our business lines and priority markets with an emphasis on further growth of our investment portfolios in the GCC and US.”

Business Unit Highlights

GFH operates three main business lines that each continued to deliver positive performance and contributions supporting growth in the Group’s top and bottom line during the third quarter and nine-month period of 2023.

Investment Management:

- During the third quarter, the Group’s subsidiary, GFH Partners, successfully close three new transactions – the US Opportunistic Fund, US Student Housing Fund and Saudi Food Logistics Fund that will provide investors with a diversified range of opportunities.

Commercial Banking:

- During the first nine months of 2023, the Group’s commercial banking business, Khaleeji Bank B.S.C. (Khaleeji), reported continued profitability resulting from a strategy focused on the expansion of partnerships, ongoing digital transformation and alignment of the business model with current trends and developments.

- For the nine months period, it reported a net profit of US$24.95 million, which was 13.59% lower compared to nine months of 2022. Total income for Khaleeji increased mainly due to an increase in income from financing and sukuk assets, as well as other fees and income.

Treasury & Proprietary Investments:

- The Group’s performance in its treasury and proprietary investment activities was supported by a largely conservatively positioned treasury portfolio but was impacted by higher funding costs and general market movements during the quarter.

- Treasury portfolio continues to generate a positive net profitability spread due to lower finance cost obtained in their books.

- Looking ahead, GFH seeks opportunities to lock in higher yields for the treasury portfolio and diversify its funding sources to support the Group’s growth.

ESG Highlights

During the third quarter, GFH continued to implement positive initiatives furthering its commitment to Environmental, Social and Governance (ESG) related practices. Key among these were:

- Support for Healthcare Expansion in Bahrain: GFH and Khaleeji signed a contract with the Royal Medical Services to build a specialized center for prostate cancer. The centre supports the Kingdom’s Vision 2030 ambition to expand and enhance specialist healthcare services and delivery in the Kingdom. The center will be equipped with the latest global technology enabling surgeons to perform operations with extreme precision and flexibility.

- Backing Entrepreneurship in Saudi Arabia: GFH Capital S.A. partnered with Hope Ventures, the investment arm of the Hope Fund, in the production of its upcoming season of “Beban”, an entrepreneurship-themed reality television. Through the partnership GFH Capital S.A. is supporting the expansion of the programme’s third season, into the Kingdom of Saudi Arabia. The partnership underscores GFH’s commitment to the growth of entrepreneurship and to empowering aspiring and innovative founders and business models in line with Saudi’s Vision 2030 development and economic diversification goals.

- Advancing Bahrain’s Sports Economy: GFH, in line with its efforts to help advance Bahrain’s sports economy, announced its sponsorship of the International Basketball Federation (FIBA) 3x3 Manama Masters, which will be held during November 2023 for the first time in the Kingdom. Attracting athletes and spectators, the sponsorship furthers national goals to bolster Bahrain’s position as a key regional center and destination for sports tourism.

-Ends-

About GFH Financial Group B.S.C.

GFH Financial Group is one of the most recognised financial groups in the Gulf region. Its businesses include Investment Management, Commercial Banking and Treasury & Proprietary Investments, with assets and funds under management exceeding US$18 billion dollars. The Group’s operations are principally focused across the GCC, North Africa and India, along with strategic investment in the U.S., Europe and the U.K. GFH is listed in Bahrain Bourse, Abu Dhabi Securities Exchange, Boursa Kuwait and Dubai Financial Market. For more information, please visit www.gfh.com.

Media Contacts:

- FinMark Communications

- Zahraa Taher

- Managing Director

- Email: info”finmarkcoms.com