PHOTO

Fourth Milling Company (the “Company”), a leading company in the field of flour production in the Kingdom of Saudi Arabia (the “Kingdom”), announces the successful completion of the institutional bookbuilding process and the determination of the final offer price (the “Final Offer Price”) for its initial public offering (the “IPO” or “Offering”) on the Main Market of the Saudi Exchange.

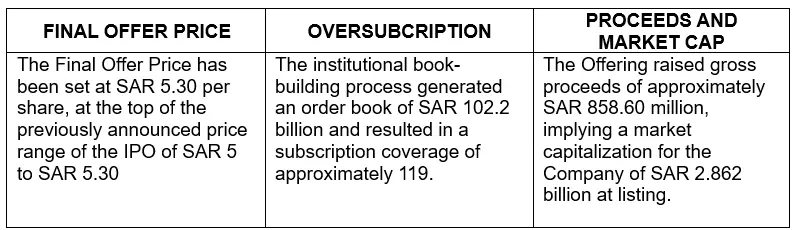

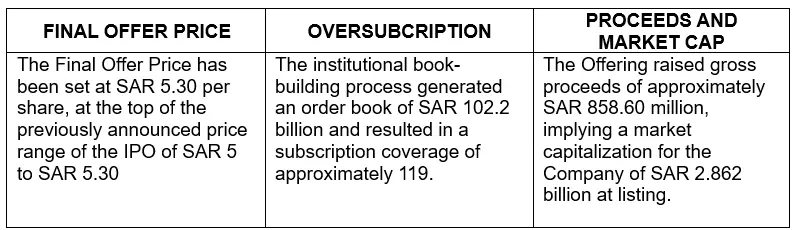

Following a highly successful bookbuilding process, the Final Offer Price has been set at SAR 5.30 per share, with a market capitalization of SAR 2.862 billion (USD 763.2 million) at listing. The price range for the Offering was set between SAR 5 and SAR 5.30.

The institutional bookbuilding process generated an order book of around SAR 102.2 billion (USD 27.26 billion) and was 119 oversubscribed, indicating strong investor demand.

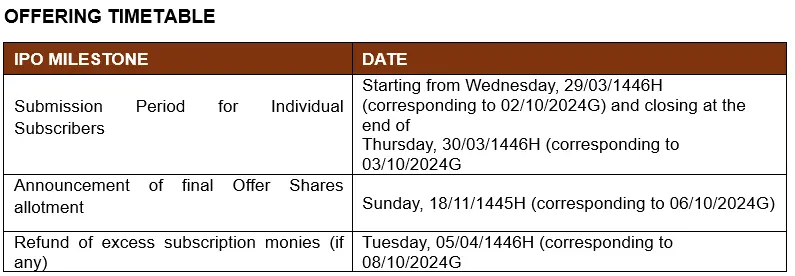

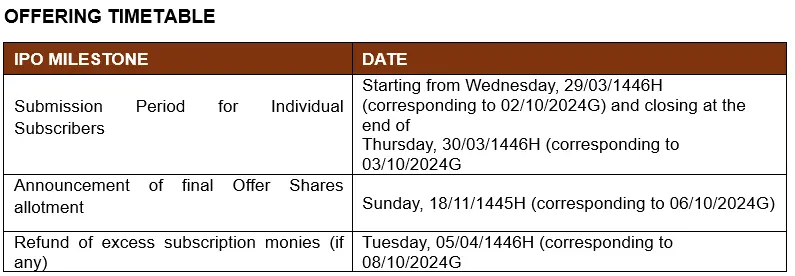

The retail subscription period will take place from Wednesday, 29/03/1446H (corresponding to 02/10/2024G) and closing at the end of Thursday, 30/03/1446H (corresponding to 03/10/2024G).

Khalid Al-Maktary, Chief Executive Officer of Fourth Milling Company commented: “The final offer price for our IPO, following a highly successful book-building process is a reflection of the strong interest from institutional investors and their confidence in our strategic vision and operational excellence within the Kingdom’s milling industry. This exceptional demand, will pave the way for a successful IPO and deliver another step on MC4’s growth journey. Our commitment to quality, innovation and sustainable growth positions us for continued success.”

CONFIRMATION OF OFFER DETAILS

- The Final Offer Price for the Offering has been set at SAR 5.30 per share, indicating the Company’s market capitalization of SAR 2.862 billion (USD 763.2 million) at listing.

- The total offering size is SAR 858.6 million (USD 228.96 million)

- The Offering will consist of a secondary offering of 162,000,000 Offer Shares representing 30% of the Company’s total issued share capital. 100% of the total Offer Shares have been provisionally allocated to institutional investors (the “Participating Parties) that took part in the book-building process. The Financial Advisor may, in coordination with the Company, reduce the number of Offer Shares allocated to Participating Parties to 129,600,000 Offer Shares, representing 80% of the total Offer Shares to accommodate individual subscriber demand. The final number of Offer Shares allocated to Participating Parties will be clawed-back accordingly based on subscription demand from individual subscribers.

- Following completion of the Offering, the current shareholder, Gulf Milling Industrial Company (the “Current Shareholder”) shall own, 70% of the Company’s share capital.

- Following the listing, the Company is expected to have a free float of 30% of the Shares.

- A maximum of 32,400,000 shares, representing 20% of the total Offer Shares, will be allocated to Individual Subscribers.

- The Offer Shares will be listed and traded on the Saudi Exchange’s Main Market following the completion of the Offering and listing formalities with both the CMA and the Saudi Exchange.

- Riyad Capital has been appointed as the Financial Advisor, Lead Manager, Bookrunner, and Underwriter.

- Riyad Bank and Arab National Bank have been appointed as receiving agents (collectively, the “Receiving Agents”).

For more information on the IPO, visit www.ipo.MC4.com.sa

CONTACT DETAILS

Fourth Milling Company (MC4)

Khalid Al Maktary, CEO

+966 138 299010

Financial Advisor, Lead Manager, Bookrunner, and Underwriter

Riyad Capital

Ayman Abdulaziz AlDrewesh

project.mongolia@riyadcapital.com

MEDIA ENQUIRIES (media@MC4.com.sa)

Instinctif Partners

Matthew Smallwood / Joann Joseph

Email: matthew.smallwood@instinctif.com / joann.joseph@instinctif.com