PHOTO

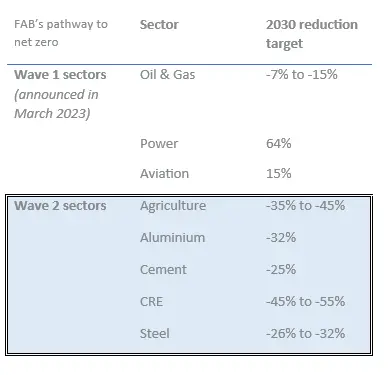

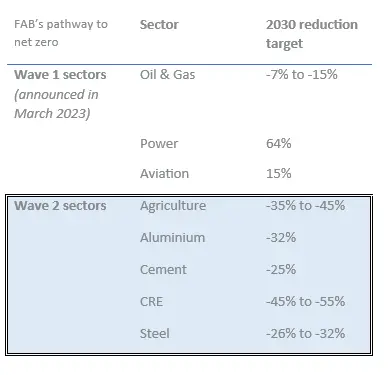

- Updated targets relate to ‘Wave 2’ sectors that include: agriculture, aluminium, cement, commercial real estate, and steel.

- Combined ‘Wave 1’ and ‘Wave 2’ targets are expected to cover approximately 90% of FAB’s corporate financed emissions and forms part of the bank’s commitment to become net zero by 2050, delivering on the Group’s commitment as a Net Zero Banking Alliance (NZBA) member.

Abu Dhabi: First Abu Dhabi Bank (FAB), the UAE’s largest bank and one of the world’s largest and strongest financial institutions, has expanded its financed emissions reduction targets to include five additional sectors: agriculture, aluminium, cement, commercial real estate (CRE), and steel.

The updated targets relate to FAB’s ‘Wave 2’ sectors and serves as both a continuation and acceleration of FAB’s announcement in March 2023 when it became the first Middle East North Africa (MENA) bank to set financed emissions reduction targets relating to its three ‘Wave 1’ sectors: oil & gas, aviation, and power generation.

The combined targets for the eight sectors will cover 90% of FAB’s financed emissions for corporates and forms part of the Group’s sustainable growth strategy; its ambition to become net zero by 2050; and its commitment as a member of the Net Zero Banking Alliance (NZBA) which the bank joined in October 2021.

Each sector has been analysed individually alongside considerations unique to that industry, including regional variations. FAB's financed emissions targets are not expected to have a material financial impact. The 2030 reduction targets by sector are outlined below:

FAB has continued to use a science-based and sector-specific methodological approach in target setting with this method fulfilling the requirements of leading standards, such as the Partnership for Carbon Accounting Financials (PCAF), and the United Nations convened Net Zero Banking Alliance (NZBA).

As part of its broader efforts related to emissions reduction, FAB continues to work alongside global peer banks and is playing a key role in the NZBA, where signatory banks must transition all operational and attributable greenhouse gas (GHG) emissions (Scope 1, 2, and 3) from their lending and investment portfolios to align with pathways to net zero by 2050.

Shargiil Bashir, Chief Sustainability Officer at FAB said: “Earlier this year FAB became the first bank in the MENA region to set financed emissions targets, and in doing so, we defined a clear pathway towards a net-zero future. By expanding our targets, we are now able to push forward with greater momentum towards the realisation of that future. Crucially, we understand that emissions reductions is a collaborative process involving diverse stakeholder groups – and we are fully committed to playing our part to deliver meaningful impact from every climate action taken. We believe this important update will inform and enable better investment decisions as well as advance the growth objectives of our clients, as they pursue their own transition and decarbonisation ambitions.”

FAB’s financed emissions reduction objectives strongly connect with the UAE’s vision to promote sustainable economic growth through the ‘UAE Net Zero by 2050 Strategic Initiative’ and the ‘Net Zero by 2050 Pathway’. The updated reduction targets represent another significant milestone in FAB’s ongoing sustainability journey as well as the bank’s overarching ESG strategy. In 2022, FAB committed to facilitate sustainable financing for USD 75 billion by 2030 to support the green transition.

As its journey to net zero advances, FAB understands that target-setting will be an evolving process and is committed to improving its approach as scenarios are updated by international organisations, as new standards emerge, where available data quality improves, and as its clients disclose new transition plans.

For more information, please refer to “FAB’s Pathway to Net Zero, Wave 2” report available in the sustainability section of FAB’s corporate website: Reports, Policy, and Frameworks | FAB - UAE (bankfab.com)

-Ends-

About First Abu Dhabi Bank (FAB):

Headquartered in Abu Dhabi with a strategic global footprint across 20 markets, FAB is the finance and trade gateway to the Middle East and North Africa region (MENA). With total assets of AED 1.2 trillion (USD 323 billion) as of September-end 2023, FAB is among the top 50 banks globally by market capitalisation and one of the world’s largest banking groups. The bank provides financial expertise to its wholesale and retail client franchise across four business units: Investment Banking, Corporate and Commercial Banking, Consumer Banking, and Global Private Banking. FAB is listed on the Abu Dhabi Securities Exchange (ADX) and rated Aa3/AA-/AA- by Moody’s, S&P and Fitch, respectively, with a stable outlook. On sustainability, FAB holds an MSCI rating of ‘A’, also ranked among the top 10% of banks globally by Refinitiv’s ESG Scores and the best performer in the MENA region. FAB is a strategic pathway partner of the 28th UN Climate Change Conference of Parties (COP28), which is being held in the UAE from November 30 to December 12, 2023.

For further information, visit: www.bankfab.com