PHOTO

- New membership marks a milestone in redefining the future of banking with efficiency and customer-centric financial solutions

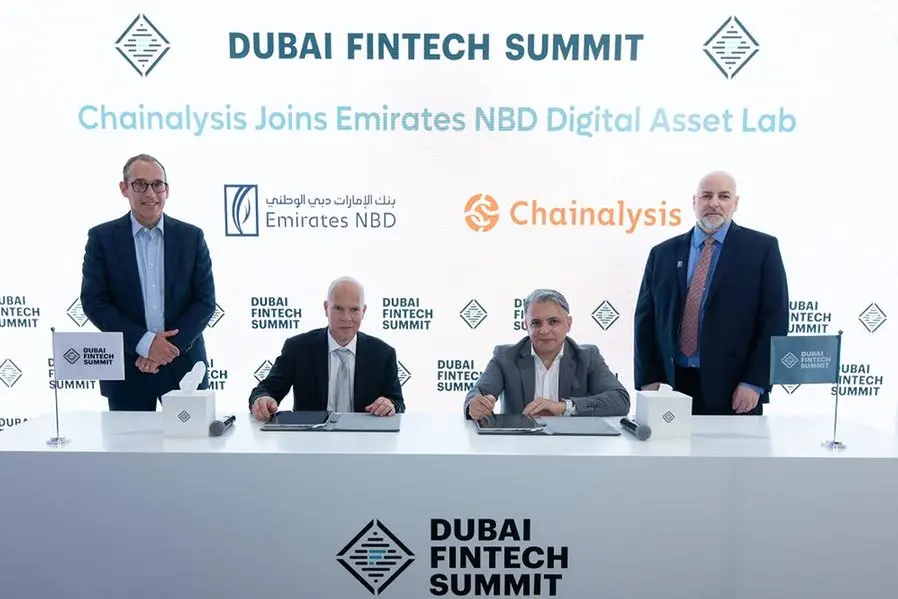

Dubai, UAE: Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, has announced Chainalysis as a key council member of the Digital Asset Lab. Chainalysis, the blockchain data platform, will join professional services firm PwC, digital asset transfer and direct custody technology platform Fireblocks, and R3, an enterprise Distributed ledger technology platform, as founding council members of the Lab.

Chainalysis’ expertise in blockchain analysis and compliance will strengthen the Digital Asset Lab by contributing to the development of innovative financial products and services that are compliant and secure.

As a national bank known for innovation, Emirates NBD plans to leverage Chainalysis’ analytics and investigative capabilities to further discern market trends and customer needs, while enhancing the integrity of the bank’s digital asset initiatives.

The strategic alliance demonstrates Emirates NBD’s commitment to upholding the highest standards of regulatory compliance in the rapidly evolving digital finance landscape.

Miguel Rio Tinto, Group Chief Digital and Information Officer at Emirates NBD, said: “As a leading local bank that has always been committed to innovation, Emirates NBD is proud to partner with Chainalysis and welcomes the company to the Digital Asset Lab to pave the way for pioneering solutions in the financial sector. By partnering with Chainalysis, the bank aims to provide a more transparent and reliable digital finance environment for customers, thereby fostering greater trust and confidence in the bank’s digital offerings.”

Nicola Buonanno, VP Southern EMEA at Chainalysis, said: "Financial institutions play a pivotal role in sculpting the future of digital assets, offering secure avenues for investor engagement with the right risk mitigation measures. Chainalysis is excited to collaborate with Emirates NBD through its Digital Asset Lab, leveraging its data and solutions to facilitate safe and transparent digital asset services. Together with the Emirates NBD, we aim to forge a resilient financial sector, fostering confidence and further advancing the UAE's leadership in digital assets innovation."

The Digital Asset Lab was announced in May 2023 at the Dubai FinTech Summit, with the goal of enabling and accelerating digital asset and financial services innovation in the UAE. As a bank committed to providing customers greater access to a wide range of financial products, Emirates NBD is establishing a robust platform with industry experts for the development of innovative ideas in financial services using digital assets and its underlying technologies.

The Lab focuses purely on digital assets and how underlying technologies can be leveraged to enable customers to effectively manage their financial services requirements in the evolving and dynamic environment of digital assets.

-Ends-

About Emirates NBD

Emirates NBD (DFM: Emirates NBD) is a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region with a presence in 13 countries, serving over 9 million active customers. As at 31st March 2024, total assets were AED 902 billion, (equivalent to approx. USD 246 billion). The Group has operations in the UAE, Egypt, India, Türkiye, the Kingdom of Saudi Arabia, Singapore, the United Kingdom, Austria, Germany, Russia and Bahrain and representative offices in China and Indonesia with a total of 858 branches and 4,450 ATMs / SDMs. Emirates NBD is the leading financial services brand in the UAE with a Brand value of USD 3.89 billion.

Emirates NBD Group serves its customers (individuals, businesses, governments, and institutions) and helps them realise their financial objectives through a range of banking products and services including retail banking, corporate and institutional banking, Islamic banking, investment banking, private banking, asset management, global markets and treasury, and brokerage operations. The Group is a key participant in the global digital banking industry with 97% of all financial transactions and requests conducted outside of its branches. The Group also operates Liv, the lifestyle digital bank by Emirates NBD, with close to half a million users, it continues to be the fastest-growing bank in the region.

Emirates NBD contributes to the construction of a sustainable future as an active participant and supporter of the UAE’s main development and sustainability initiatives, including financial wellness and the inclusion of people of determination. Emirates NBD is committed to supporting the UAE’s Year of Sustainability as Principal Banking Partner of COP28 and an early supporter to the Dubai Can sustainability initiative, a city-wide initiative aimed to reduce use of single-use plastic bottled water.

For further information on Emirates NBD, please contact:

Ibrahim Sowaidan

Senior Vice President

Head - Group Corporate Affairs

Emirates NBD

e-mail: ibrahims@emiratesnbd.com

asda’a bcw

Dubai, UAE

Email: emiratesnbd@bm.com