PHOTO

- Bank aims to encourage investors to invest in domestic stocks, contributing to the growth of the national economy

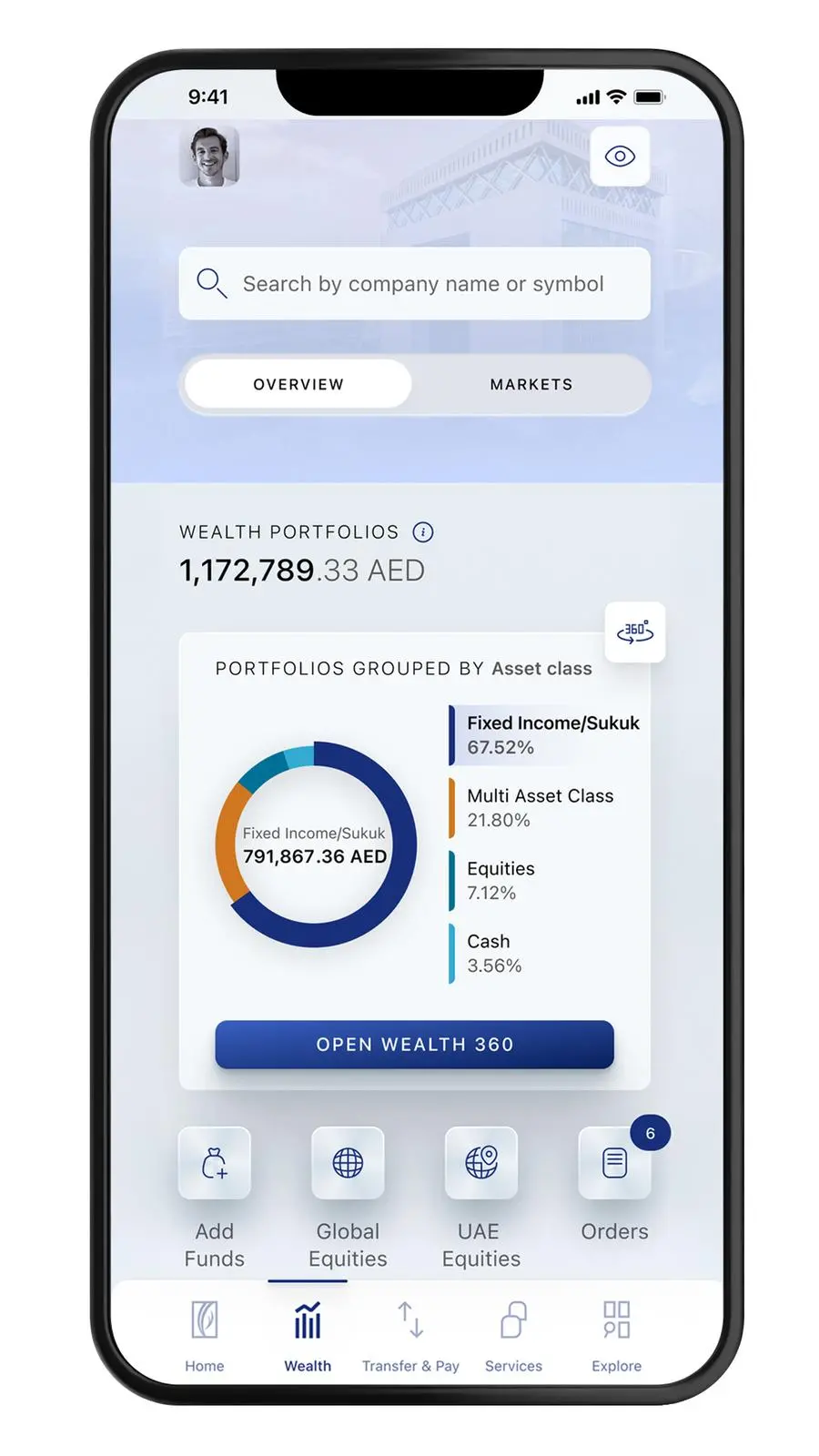

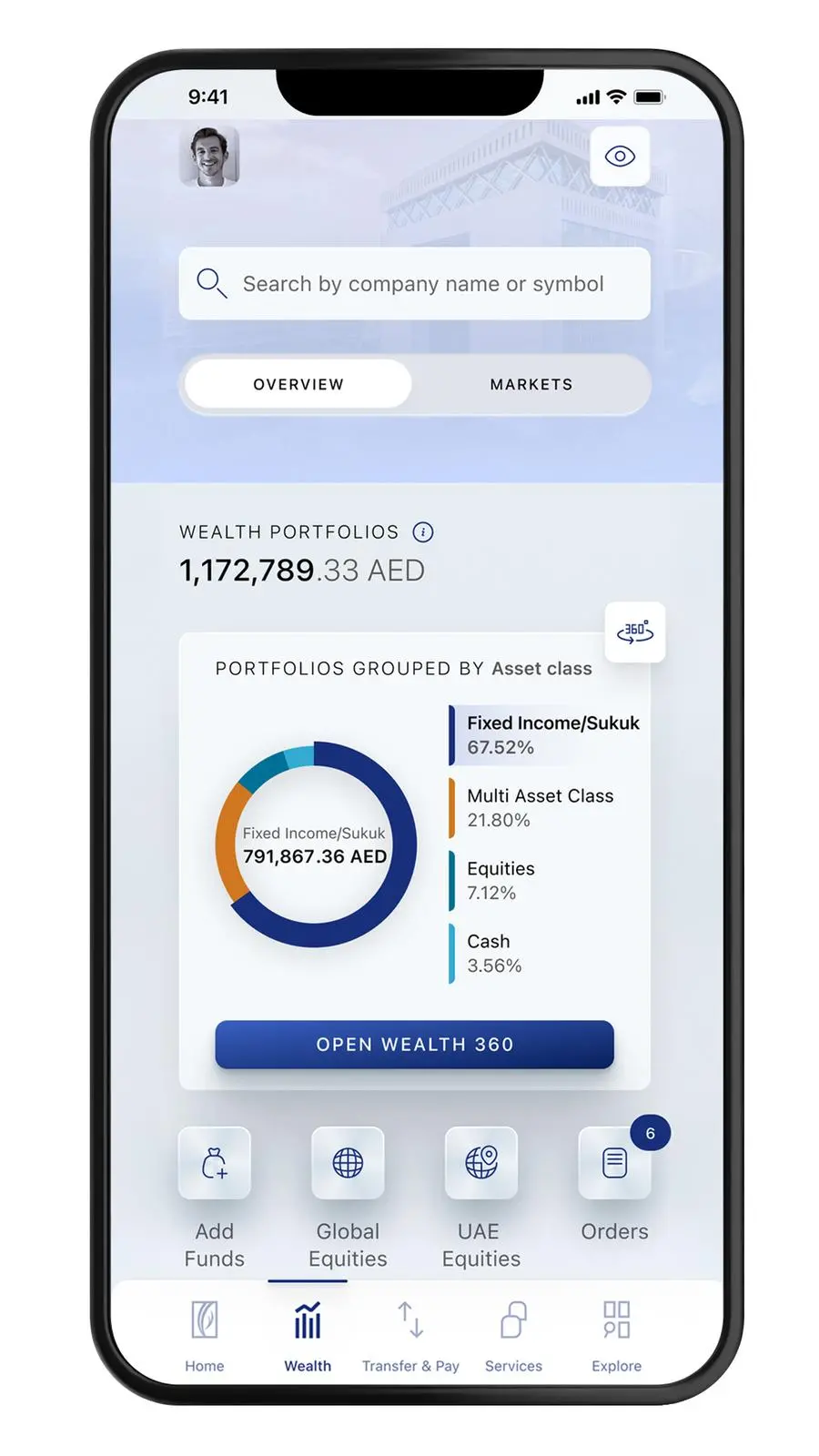

- Customers can now invest in the UAE equity markets with no transaction fees on ENBD X

- Digital wealth platform on ENBD X provides customers fast, transparent and around-the-clock accessibility to the UAE equity markets

Dubai, UAE: Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, has introduced a new initiative enabling customers to invest in the UAE equity markets at zero transaction fees, thereby encouraging the growth of domestic stocks and boosting economic growth in the country.

The bank’s recent initiative is in line with the nation’s ‘We the UAE 2031’ vision, focussing on enhancing the position of the UAE as a global partner and an attractive and influential economic hub. By offering customers an opportunity to invest in the UAE equity markets, Emirates NBD strengthens the bank’s ongoing commitment to support the UAE’s economy and economic agenda. Emirates NBD continues to work closely with the UAE’s government, regulators and the private sector to boost the nation’s global standing as a key global investment hub.

Emirates NBD customers can conveniently explore and trade local equities for free, using their everyday mobile banking app, ENBD X, with more than 150 regional equities available to trade on the platform.

Marwan Hadi, Group Head of Retail Banking and Wealth Management at Emirates NBD, said: “Emirates NBD continues to finance the real economy of the UAE and contribute to the long-term economic growth and development of the region. As a leading national bank, we continue to introduce beneficial initiatives that advance the financial prosperity of our customers. Our new initiative not only provides investors access to local equity markets, but also allows them to explore and invest in domestic stocks at no cost, presenting an opportunity to diversify their portfolios.”

He added: “Investing in domestic stocks contributes directly to the success of local businesses and domestic companies, thereby supporting the growth of our national economy and aligning with the bank’s commitments and goals.”

Emirates NBD’s digital wealth platform allows customers to trade securities on both global and local exchanges. Overall, there are more than 11,000 global equities and 150 regional equities available to trade on the platform.

Since its launch last year, the bank continues to enhance its one-of-a-kind wealth platform, on its mobile banking app ENBD X. Earlier this year, the bank announced the launch of fractional bonds on the platform, marking a pivotal moment in its journey towards increasing access to financial markets. Besides allowing customers to conveniently invest and trade in complex financial instruments from the same app that also fulfils all their everyday banking needs, the platform also offers a unique Secure Sign facility, where customers with high trading volume can update and sign investment documents to complete any trade irrespective of its complexity or value.

About Emirates NBD

Emirates NBD (DFM: Emirates NBD) is a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region with a presence in 13 countries, serving over 9 million active customers. As at 30th June 2024, total assets were AED 931 billion, (equivalent to approx. USD 253 billion). The Group has operations in the UAE, Egypt, India, Türkiye, the Kingdom of Saudi Arabia, Singapore, the United Kingdom, Austria, Germany, Russia and Bahrain and representative offices in China and Indonesia with a total of 859 branches and 4,491 ATMs / SDMs. Emirates NBD is the leading financial services brand in the UAE with a Brand value of USD 3.89 billion.

Emirates NBD Group serves its customers (individuals, businesses, governments, and institutions) and helps them realise their financial objectives through a range of banking products and services including retail banking, corporate and institutional banking, Islamic banking, investment banking, private banking, asset management, global markets and treasury, and brokerage operations. The Group is a key participant in the global digital banking industry with 97% of all financial transactions and requests conducted outside of its branches. The Group also operates Liv, the lifestyle digital bank by Emirates NBD, with close to half a million users, it continues to be the fastest-growing bank in the region.

Emirates NBD contributes to the construction of a sustainable future as an active participant and supporter of the UAE’s main development and sustainability initiatives, including financial wellness and the inclusion of people of determination. Emirates NBD is committed to supporting the UAE’s Year of Sustainability as Principal Banking Partner of COP28 and an early supporter to the Dubai Can sustainability initiative, a city-wide initiative aimed to reduce use of single-use plastic bottled water.

For further information on Emirates NBD, please contact:

Ibrahim Sowaidan

Senior Vice President

Head - Group Corporate Affairs

Emirates NBD

e-mail: ibrahims@emiratesnbd.com

Burson

Dubai, UAE

Email: emiratesnbd@bm.com