PHOTO

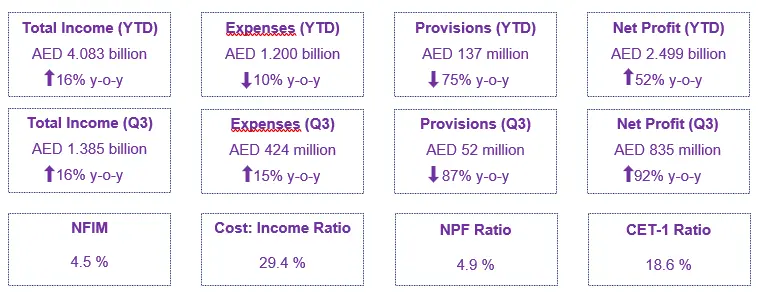

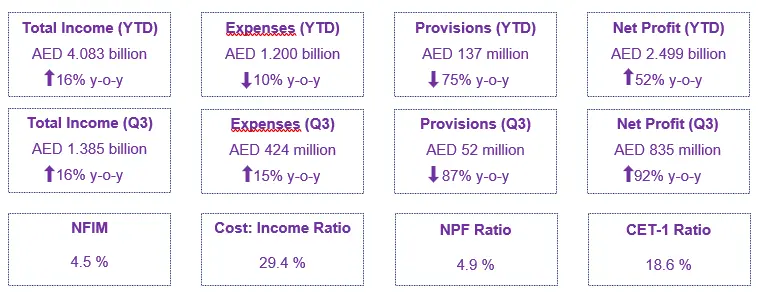

Emirates Islamic achieved its highest ever profit of AED 2.5 billion for the first nine month of 2024, a remarkable 52% increase y-o-y. Income for the year surged by 16% reaching AED 4.1 billion. This exceptional performance is driven by significant growth in both funded and non-funded income and a 24% increase in Customer Financing, which underscores the Bank’s steady growth trajectory. In Q3-24, Emirates Islamic profit increased by 92%, to AED 835 million, with income growing by 16% to AED 1.4 billion. These excellent results highlight the effectiveness of the Bank’s strategic growth initiatives and operational efficiencies.

Key Highlights – 9M’24:

- Strong operating performance on higher funded and non-funded income

- Total income up 16% y-o-y driven by higher funded and non-funded income

- Expenses decreased 10% y-o-y

- Operating profit improved 31% y-o-y

- Net profit sharply increased to AED 2.5 billion on the back of higher funded and non-funded income

- Net profit margin at 4.5% following relatively stable profit rates in the first nine months of 2024

- Strong capital and liquidity combined with a healthy deposit mix enable the Bank to support customers

- Total assets increased to AED 107 billion maintaining a solid asset base

- Customer Financing at AED 67 billion, increased 24% from 2023

- Customer deposits at AED 74 billion, increased 21% from 2023 with CASA balances at 72% of deposits

- Credit Quality: Non-performing financing ratio at 4.9% with strong coverage ratio at 135%

Hesham Abdulla Al Qassim, Chairman, Emirates Islamic said:

- “We are delighted to announce a record performance by Emirates Islamic for the first nine months of 2024. The bank’s net profit grew 52% to AED 2.5 billion, supported by higher funded and non-funded income.

- With profit rates remaining relatively stable, our net profit margin remained at a very healthy 4.5% in the first nine months of 2024.

- Our strong results reflect our consistent focus on providing innovative financial solutions to our customers, combined with a superior customer service experience backed by the latest technology and automation.

- Emirates Islamic continues to lead in the digital banking innovation within the Islamic financial services sector. This is evident from our many firsts, including being the first Islamic bank in the UAE to launch a Digital Wealth platform on our Mobile Banking App, as well as being the first Islamic bank in the region to introduce Fractional Sukuks for investors.

- As a leading Islamic bank in the region, Emirates Islamic continues to advance its Nationalisation efforts in line with our long-standing commitment to supporting the UAE’s drive towards Emiratisation. The Bank recorded strong metrics on Emiratisation in 2024, including for critical positions and senior management representation.

- Backed by our strong financials and a customer-focused, enthusiastic team, I am confident that

Emirates Islamic will maintain its leadership position in the sector and continue to support Dubai in its aim of becoming the global capital of Islamic economy.”

Farid AlMulla, Chief Executive Officer, Emirates Islamic said:

- “Following on from our remarkable financial results in the first half of 2024, we delivered profitable growth in the third quarter of 2024. The Bank’s Total Assets increased to AED 107 billion during this period, as we continue to maintain a solid asset base.

- Our total income grew by 16% y-o-y to AED 4.1 billion for the first nine months of the year. This growth was driven by higher funded and non-funded income, leading to an improvement in operating profit by 31% y-o-y.

- Strong capital and liquidity combined with a healthy deposit mix enabled the bank to better support customers, with a 24% increase in Customer Financing to AED 67 billion and a 21% increase in customer deposits to AED 74 billion.

- Emirates Islamic has always been committed to empowering women in the UAE. In August this year, we celebrated Emirati Women’s Day by organising an Emirati Souq at our headquarters to support local women entrepreneurs and artisans. The event helped boost local talent in the UAE and recognised the contributions of women entrepreneurs to the local economy.

- With our track record of pioneering innovation, we are always at the forefront of exciting developments in the UAE’s Islamic banking sector to support the needs of individuals, entrepreneurs, corporates and SMEs in the region.”

About Emirates Islamic:

Emirates Islamic (DFM: EIB), part of Emirates NBD Group, is a leading Islamic financial institution in the UAE. Established in 2004 as Emirates Islamic Bank, the bank has established itself as a major player in the highly competitive financial services sector in the UAE.

Emirates Islamic offers a comprehensive range of Shari’ah-compliant products and services across the Personal, Business and Corporate banking spectrum with a network of 40 branches and 226 ATMs/CDMs across the UAE. In the fast-growing area of online and mobile banking, the bank is an innovator, being the first Islamic bank in the UAE to launch a mobile banking app and offer Apple Pay, as well as being the first Islamic bank in the world to launch Chat Banking services for customers via WhatsApp.

Emirates Islamic has consistently received local and international awards, in recognition of its strong record of performance and innovation in banking. Emirates Islamic was recognized as ‘Best Overall Islamic Bank’ and ‘Most Innovative Islamic Bank’ at the Islamic Finance News Awards 2024. The Bank was also named the ‘Most Innovative Islamic Bank’ at the prestigious Euromoney Islamic Finance Awards 2024.

As part of its commitment to the UAE community, the Emirates Islamic Charity Fund provides financial aid to those in need, with a focus on food, shelter, health, education and social welfare contributions.