PHOTO

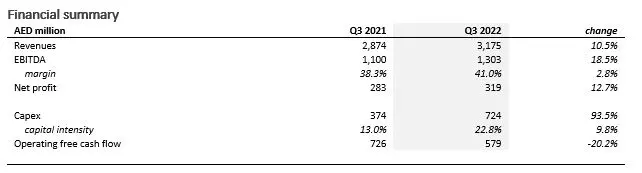

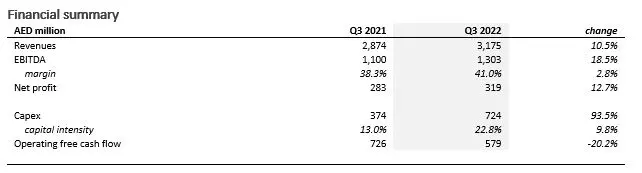

Dubai, UAE - Emirates Integrated Telecommunications Company PJSC (“EITC”) published its financial results for the quarter-ended 30 September 2022. Revenues increased by 10.5% to AED 3.17 billion on sustained demand for broadband and mobile services. EBITDA grew 18.5% to AED 1.3 billion thanks to a sharp increase in service revenues and gross margin expansion. Net profit increased by 12.7% to AED 319 million.

Operating highlights

- Our mobile customer base grew 14.7% to 7.4 million subscribers. We highlight the sustained performance of our postpaid segment with net-additions of 32,000, a fifth consecutive quarter of growth, to reach 1.4 million subscribers. Our prepaid customer base of 6 million remained stable compared to the previous quarter.

- Our consumer broadband customer base increased 53.8% to 510,000. Our broadband strategy continues to deliver. We attracted 37,000 customers during the quarter.

Financial highlights

- Revenues grew 10.5% to AED 3,175 million. Mobile service revenues continued their recovery: revenues increased 10.7% to AED 1,443 million while equipment sales generated revenues of AED 176 million. Fixed services revenues soared 22.2% to AED 892 million buoyed by the continued strong performance of the consumer segment. In aggregate, service revenues increased 14.8% to AED 2,335 million.

- EBITDA increased by 18.5% year-over-year to AED 1,303 million. The increase in service revenues (and its inherent higher profitability) lifted our gross margin to 65.2% (Q3’21 62.2%). As a result, our EBITDA margin expanded by 277bp to 41.0%.

- On a comparable basis, net profit jumped 49.8% to AED 319 million. On a reported basis, net profit increased 12.7%. The impact of higher EBITDA was partially offset by greater depreciation charges and Federal royalty charges.

- Capex spend of AED 724 million (capital intensity of 22.8%) reflects a seasonality effect. Most of the Capex spend is skewed towards the second half of the year. More importantly, our capex profile is continuing to normalize following two consecutive years of high capital intensity.

- Operating free cash flow (EBITDA – Capex) decreased by 20.2% to AED 579 million. This is due to the phasing of Capex spend.

- Debt-free balance sheet. During the quarter, we fully repaid the AED 200 million drawn on our revolving credit facilities. This leaves us with a net cash position of AED 910 million and AED 3.8 billion of undrawn facilities.

Fahad Al Hassawi, CEO said:

“This quarter’s results have been excellent on all fronts. Our business environment has clearly transitioned to a post-pandemic normality. We are benefiting from the UAE’s economic dynamism and healthy macro trends. Our results validate the efforts we deploy to: provide new products and services; improve customer experience; and execute our transformation journey. All these initiatives have laid the foundations of our commercial momentum.

Our service revenues are recovering and growing at an encouraging pace: we generated service revenues in excess of AED 2 billion for a fifth consecutive quarter. Our profitability continued to improve on a sequential and year-on-year basis. We have invested and will continue to invest in our infrastructure to give our customers a simple and the best available experience in the UAE.”