- Increase in sales volumes and average sales prices along with decline in unit cost of raw materials, leading to YoY expansion of gross margin

- Sustained focus on operational efficiencies and advanced production techniques boosts operating profit

- Long-standing and solid relationships with suppliers enable successful mitigation of global supply chain disruptions

- Strong pipeline of projects expected this year, with an increasing emphasis on the water sector

Dammam, Saudi Arabia: East Pipes Integrated Company for Industry (“East Pipes” or “the Company”, 1321 on the Saudi Exchange), Saudi Arabia’s leading manufacturer of Helical Submerged Arc Welded (HSAW) pipes, today announced its financial results for the first quarter ended 30 June 2022 (“1Q-FY23”) reporting an improvement in revenue, essentially due to a rebound in market activity and a continued tactical focus on operational efficiencies.

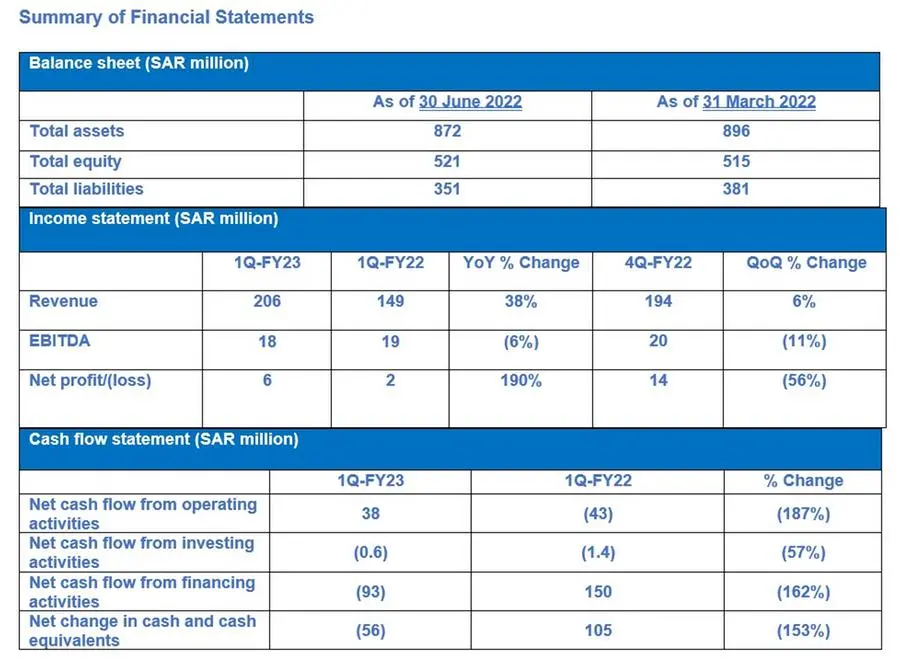

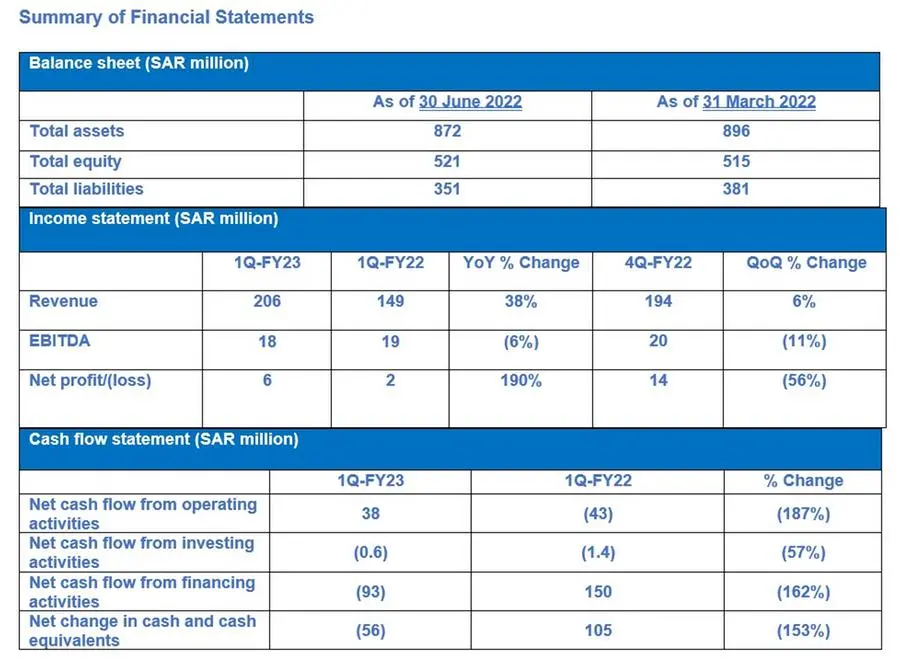

Financial highlights for 1Q-FY23

- Revenues of SAR 206 million increased 6% QoQ and 38% YoY (4Q-FY22: SAR 194 million; 1Q-FY22: SAR 149 million), as several key projects that had been postponed by major clients previously, due to COVID-19, have now largely come back on track.

- Gross profit of SAR 19 million increased 66% YoY (1Q-FY22: SAR 11 million) primarily due to a large pickup in sales volumes (+70% YoY), combined with a 14% YoY decline in the average cost per ton of the company’s main raw materials. East Pipes’ well-established and strong relationships with suppliers across the globe, have successfully positioned the company to reduce the impact of global supply chain disruptions, and allowed for continued successful execution of the backlog. On a sequential basis, gross profit declined 13% (4Q-FY22: SAR 22 million), on the back of a 30% QoQ drop in sales volumes, which was complemented by a 45% surge in average cost per ton of raw materials.

- EBITDA declined 11% QoQ and 6% YoY to SAR 18 million (4Q-FY22: 20 million; 1Q-FY22: SAR 19 million) with the YoY decline arising from an increase in general and administrative expenses as a result of restructuring expenses.

- EBITDA margin was 9% during the period (4Q-FY22: 10%; 1Q-FY22: 13%), with management guiding for an improvement in margins going forward, driven by the resumption of project activity.

- Net profit of SAR 6 million (1Q-FY22: 2 million) was boosted by the return of activity in the market, which is driving the pickup in sales volumes during this period. On a sequential basis, the net impact of the 30% decline in sales volumes and the 45% rise in average cost per ton of raw materials was a 21% decline in operating profit. In line with the company’s ongoing endeavours to reinforce its positioning in the evolving domestic HSAW market, East Pipes has continued to focus on production efficiencies. However, the considerable 64% QoQ hike in finance charges arising from the upward trend in SAIBOR, has largely outweighed the positive impact of the 30% QoQ reduction in SG&A expenses during the quarter.

- Cash and cash equivalents decreased to SAR 18 million (March 2022: SAR 74 million) due to the early settlement of a significant portion of outstanding debt, in order to effectively manage the company’s finance charges, given the expected rising trend in SAIBOR.

- Deleveraged the balance sheet, with total borrowings declining 34% YTD from SAR 274 million to SAR 181 million.

Operational highlights

- Continuing to pursue several high-profile projects from Saline Water Conversion Corporation (SWCC), and other key strategic partners, with the company currently executing projects exceeding SAR 1.3 billion in value. It is worth highlighting that the backlog has been further strengthened during July 2022, with the addition of major new projects.

- Integrated and advanced manufacturing facilities, high quality product offerings, as well as large scale of operations remained the key competitive advantages of the company.

- Sustained quality execution on key projects and industry-leading yield on raw materials.

- Increasing focus on ESG, with plans underway for a comprehensive review of the company’s sustainability framework.

Mohammed Al Shaheen, Chief Executive Officer at East Pipes said:

“We are pleased to have started the new year on a strong footing, with enhanced revenue, as we continue to capitalize our competitive positioning and industry-leading manufacturing efficiencies, to achieve the highest levels of operational excellence and capture a larger portion of the market share.

As market activity has been gaining momentum, we are witnessing a strong resumption of project awards and strongly seek to secure a massive portion of the upcoming pipeline of projects.

We are increasing our efforts to promote sustainability and align with government initiatives and global best practices, and in this regard, we are currently undertaking a comprehensive reassessment of our ESG framework. For the coming period, we remain dedicated to enhancing innovation and performance across the company, in order to deliver excellent value and long-term returns to our shareholders.”

Mohamed Darweesh, Chief Financial Officer at East Pipes said:

“East Pipes reported a good set of financial results in 1Q-FY23, supported by growth in revenue, which was driven by a sustained recovery in activity, as the market returns to normalcy.

During the quarter, we remained focused on fostering strong relationships with our key business partners which has enabled us to secure significant new projects and reinforce our position in the market. We continued to implement decisive cost rationalization measures, which resulted in an improvement in production efficiencies, and with the optimization of our financial position, we are working towards mitigating the impact of the changing interest rate environment.

The underlying strength and agility of our operating model and balance sheet are establishing a robust foundation for the upcoming phase of growth and development for East Pipes, as we eagerly look forward to further build our backlog and capture emerging opportunities on the back of the Kingdom’s transformational economic programs under the Vision 2030 agenda.”

Strategy and outlook

The demand for HSAW pipes is expected to continue rising over the next few years, supported by national initiatives including those under Vision 2030, which will see mega projects in both the water and oil & gas sectors coming to the market.

Through leveraging its pioneering position in the Saudi Arabian HSAW pipes market, East Pipes is targeting to maximize its sales outreach and increase market share, through diversifying its product offerings as well as enhancing marketing initiatives. The company is intending to increasingly pursue opportunities in the water and oil & gas sectors, where management foresees promising potential. East Pipes is committed to further advancing its R&D capabilities in order to enhance product innovation, in line with the changing demands of customers. Furthermore, the company is in the processing of revamping its sustainability framework, to align with best practices in the industry.

Balance sheet optimization will continue to be at the forefront, with leverage, operational costs and working capital being closely monitored, to dilute the impact of the expected increase in finance charges, as a result of higher interest rates.

East Pipes is confident that it is strongly positioned to take full advantage of mega projects coming onstream to substantially expand its backlog, with the ultimate goal being to deliver sustainable long-term value to shareholders and stakeholders alike.

-Ends-

About East Pipes:

Established in 2010, East Pipes Integrated Company for Industry (East Pipes) is one of the leading manufacturers of Helical Spiral Arc Welded (HSAW) pipes in Saudi Arabia, which are used in critical infrastructure sectors, predominantly water and oil & gas applications. Thanks to its state-of-the-art manufacturing capabilities and fully integrated business model, which includes a double joining plant and coating mill, the Company is capable of producing more than 500,000 metric tons of spiral pipes per annum, making it one of the largest integrated manufacturers of spiral pipes in the region.

Contact: IR@eastppipes.com

Disclaimer:

This communication has been prepared by East Pipes Integrated Company for Industry (“East Pipes”) and reflects the management’s current expectations or strategy concerning future events that are subject to known and unknown risks and uncertainties. Some of the statements in this communication constitute "forward-looking statements” that do not directly or exclusively relate to historical facts. These forward-looking statements reflect East Pipes’ current intentions, plan, expectations, assumptions, and beliefs about future events and are subject to risks, uncertainties and other factors, many of which are outside East Pipes’ control.

Important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements include known and unknown risks. East Pipes undertakes no obligation to revise any such forward-looking statements to reflect any changes to its expectations or any change in circumstances, events, strategy or plans. Because actual results could differ materially from East Pipes’ current intentions, plans, expectations, assumptions and beliefs about the future, you are urged to view all forward-looking statements contained in this presentation with due care and caution and seek independent advice when evaluating investment decisions concerning East Pipes.