PHOTO

Dubai-based International financial advisory firm Hoxton Wealth has introduced powerful new features to its Hoxton Wealth App, further strengthening its position as a comprehensive financial management platform. These new updates, available starting today, offer users greater control and visibility over their assets and liabilities.

Key New Features:

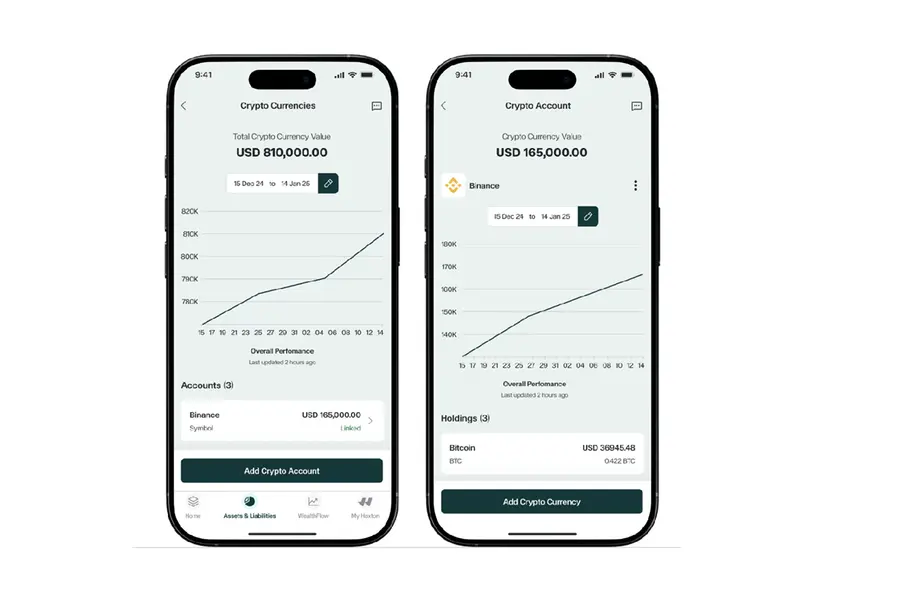

Multiple Crypto Accounts – Users can now organize their cryptocurrency holdings into separate accounts, enhancing visibility and streamlined management.

Expanded Account Linking – The app now supports linking additional asset types, including crypto accounts, personal loans, vehicle loans, and mortgages, with automated updates for seamless financial tracking.

Auto-Deduct for Loans – Users manually adding loans can now set automatic monthly deductions, making it easier to track outstanding balances and manage repayments.

Currently, the Hoxton Wealth App tracks over £115 million in assets and liabilities through its open banking integrations.

The Hoxton Wealth App provides easy access to a consolidated view of users' entire net worth on mobile or desktop—regardless of whether they are Hoxton clients. Leveraging open banking technology, the app aggregates financial data from over 20,000 global sources, including bank accounts, brokerage accounts, crypto exchanges, pensions, and cash accounts. Users can also track static assets like real estate and monitor investments in stocks, shares, and cryptocurrencies. Financial liabilities, including credit cards and mortgages, are seamlessly integrated for a holistic wealth overview. The platform is available on both web and mobile.

Beyond financial tracking, WealthFlow empowers users to visualize their financial future by mapping out their wealth trajectory based on key inputs like net worth, retirement plans, and major financial events. Users can explore multiple scenarios, adjust assumptions, and gain a clearer understanding of their long-term financial outlook. Whether planning for retirement or major investments, WealthFlow helps users take control of their financial journey with confidence.