PHOTO

- Crunch Uses AI and Machine Learning algorithms to help customers make smart financial choices in line with the UAE’s vision for financial innovation

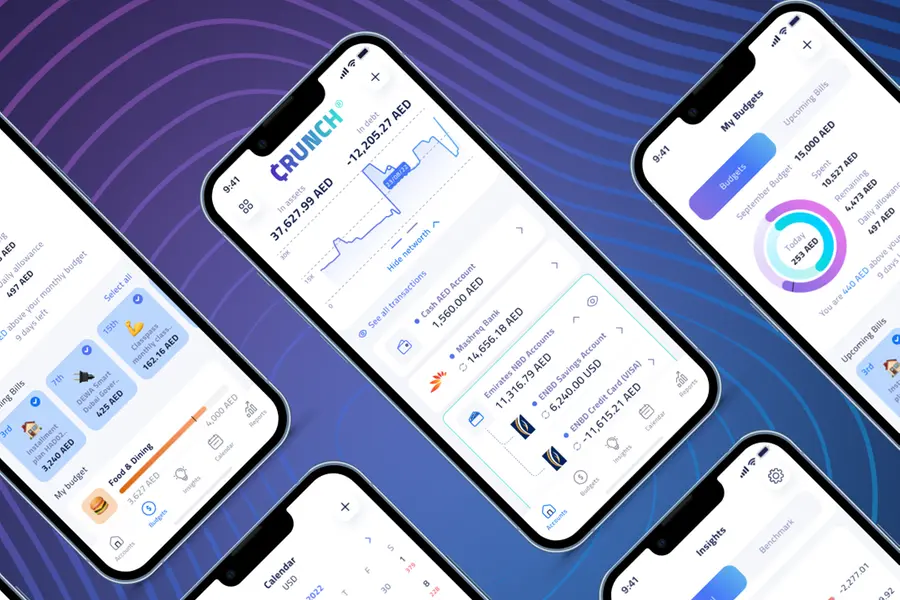

Dubai, UAE – Dubai-based FinTech Startup Crunch App Ltd. has announced today the launch of its mobile app ‘Crunch: Personal Finance’; a new personal finance management app that aims to empower individuals to effortlessly manage their money, grow their net worth and achieve financial well-being through a safe and secure platform.

The state-of-the-art platform syncs a user’s financial accounts including bank accounts, credit cards, and loans seamlessly into one place and gives an up-to-the-second view of a user’s earnings and spending. The user can also choose to track accounts manually and input transactions themselves, such as their cash account. By utilizing cutting edge technology such as Artificial Intelligence and Machine Learning to categorize transactions, savings and expenses, it allows them to monitor budgets, view monthly spending, track expenses and set personal financial goals and more.

Husam Aboul Hosn, Founder and CEO, Crunch App. Limited, stated, “Crunch is an innovative tool that empowers individuals with the means to help them make intelligent decisions about their financial well-being. It aims to deconstruct the intimidation behind dealing with finances by doing the heavy lifting on behalf of its users and providing them with the necessary tools to focus on growing their wealth across multiple investments and saving options. We believe that managing your finances should be as effortless as sending a text message: It should be done anywhere, anytime, and with just a few clicks; our focus is to make your financial life easy, accessible, and completely stress-free.”

Crunch begins its global growth plan with an initial UAE focus, with over 15 local and international banks and plans to expand to other countries in the region soon. Offering multi-currency capabilities and customizable alerts, Crunch provides users with all the necessary tools to focus on growing their wealth across multiple investments and saving options. Users can analyze their data with smart insights in a fully customizable dashboard, putting everything they need into one place.

In line with the UAE’s agenda to prioritize financial literacy as set out by the Department of Community Development, Crunch aims to transform how people use their money to achieve greater financial security, as well as educate them about the importance of good personal finance management.

“The UAE is the digital transformation and FinTech hub of the region, and in line with the local government’s vision to boost innovation, Crunch app fits in with people’s modern lifestyles by transforming how they use their money to achieve greater financial security” added Aboul Hosn.

The app offers customizable budgeting tools, insights, and analytics where users can set targets and personalized categories to improve their financial literacy and transform how they use their money. Users will have access to all the information they need to track their spending and savings, enabling them to make more informed, confident choices and stay on track to reach their savings goals and make healthier financial decisions.

Crunch also uses the highest level of bank-grade security such as TLS data encryption and FaceID login to keep data secure, private, encrypted, anonymous, safe, and protected at all times.

The app does not have access to, nor can it store or save users’ banking credentials, and has partnered with Lean Technologies, a technical service provider, regulated in the UAE by Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority, to ensure users’ security and privacy are assured, in line with banking-grade global financial standards.

Crunch is available for download on both Apple Store and Google Play Store. To learn more about Crunch and its full features you can visit: Crunch App (www.getcrunch.app)

-Ends-

About Crunch

Crunch is a personal finance management app founded in May 2022 under DIFC’s innovation license. The app empowers individuals to effortlessly manage their money, grow their net worth, and achieve financial well-being through a safe and secure platform. By allowing users to seamlessly connect their bank accounts, credit cards, loans, or savings accounts through a safe platform; Crunch automatically categorizes transactions, provides valuable insights on spending habits, monitors/tracks budgets, and even benchmarks a user’s financial performance with that of his/her peers, all done anonymously and privately. Our mission is to provide the tools, insights and analytics to improve financial literacy and transform how people use their money to achieve greater financial security.

For more information please contact:

Mohammed Elbatta

Fekra Communications

E: Mohammed.elbatta@fekracommms.com