PHOTO

Main Highlights

- Net Profit at record EGP 4,198 million, up 67% Year-on-Year;

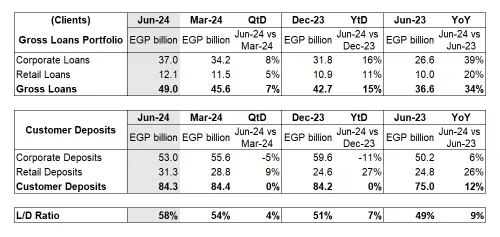

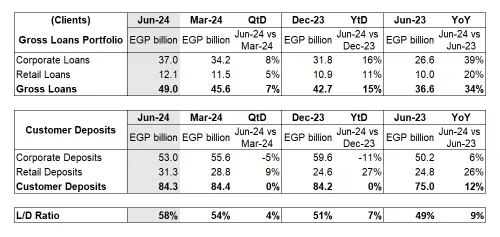

- Customer Deposits reached EGP 84.3 billion, up 12% Year-on-Year;

- Gross Loans reached EGP 49 billion, up 34% Year-on-Year;

- Current and Saving Accounts to Total Deposits reached 61% up by 4% Year-on-Year;

- Non-Performing Loans ratio at 1.6% and Coverage Ratio at 269.6%;

- Loans-to-Deposit Ratio at 58%, up +9% Year-on-Year driven by robust loan growth;

- Resilient Capital Structure, Capital Adequacy Ratio of 20%;

- Return on Average Assets at 7.6% up 1.6% Year-on-Year and Return on Average Equity at 53.1% up 7.2% Year-on-Year;

Economic Dynamics:

The global economic growth has been broadly on target so far in 2024 but has also resulted in slow disinflation driven primarily by stronger services and thereby impeding or delaying reversal of tighter monetary policy conditions by major central banks in their pursuit for price stability. The persistent geopolitical tensions in key zones continue to challenge the pace of disinflation and growth trajectory for most of the economies.

Domestically, the positive events in Q1 2024 (strong support from GCC and Global Institutions), have resulted in notable improvement in official FX reserves, stability in the USD/EGP rates & FX Liquidity, decent recovery of the production/trade cycle and good participation of foreign portfolio investors. This provides a strong platform to push ahead structural reforms to drive growth and manage external & fiscal risks despite slow pace of disinflation and persistent geopolitical risks.

Crédit Agricole Egypt: Record performance despite challenging environment

Crédit Agricole Egypt (CAE) continued to maintain its solid performance through H1 2024, generating a Net Banking Income of EGP 7,020 million, up 56%YoY, on the back of good performance by all business lines. Gross Loans outstanding reaching EGP 49 billion, up 34%YoY and Customer Deposits reaching EGP 84.3billion, up 12%YoY.

Corporate banking continued to achieve remarkable results in H1 2024, despite the challenging and differing market conditions in Q1 and Q2. The lending portfolio had robust growth of EGP 10.4billion, thereby achieving 39% YoY growth, with resilient and high quality of assets. The growth in corporate deposits was slower i.e. increasing by EGP 2.8billion, thereby achieving 6% YoY growth mainly driven by stable and liquid FX market in Q2. The strong performance reflects CAE’s commitment to providing best-in-class financial solutions and services to our corporate clients. Corporate performance improved significantly driven by strategic focus on product diversification and boosting of non-interest income.

As a step forward in its ambition to promote green and clean finance, the bank will be entering into a facility agreement with European Bank for Reconstruction and Development under the Green Energy Finance Facility (GEFF) and Global Climate Fund (GCF) program to support its SMEs and other eligible clients.

Retail banking achieved good portfolio growth in H1 2024 i.e. +20% for Loans and +26% for Deposits YoY. The performance was driven by targeted marketing campaigns, launching of new products and client acquisition despite the competitive CD market during H1 2024. Cash loans production achieved growth of +15% YoY driven by strategic cross-sell initiatives. Auto loans production achieved growth of +89% YoY driven by higher ticket size while market continue to being short of supply. Mortgage loans production was higher by 10% YoY supported by CBE Initiatives and targeted campaigns.

The bank witnessed growth in active customer i.e. 2% QoQ sequentially and 7% YoY driven by campaign/offers directed to customer acquisition, account acquisition, financial inclusion, loans and cross-sell. This was also supported by launching new products i.e. Cash loan Program (Drive cash), Education Loans, Solar Loans, New Visa Platinum business cards, 3 new floating CDs (Excellence, Premium & Standard) to meet all our clients’ needs, and participation in events hosted by Clubs.

Dynamic Commercial Activity and Solid Balance Sheet Structure

Commercial activity growth continues to be good with limited impact due to the evolution of the CDs and FX market thereby providing both Corporate and Individual customers with adequate financial solutions and increasing the active customer base. Gross Loans portfolio (including Loans to Banks) increased 15% YTD, to reach EGP 49billion, while Customer Deposits almost remained stagnant YTD, to reach EGP 84.3billion.

*Corporate and Retail breakdown based on Published Financial Statements

**Nil Loans to banks for all mentioned periods

Profitability Performance

Net Banking Income (NBI) increased +56% YoY, reaching EGP 7,020 million, where Net Interest Income increased +66% YoY due to higher yields, supported by exceptional other income +129% driven by FX activities. Operating Expenses increased +37% YoY demonstrating efficient controls on costs despite higher inflation and EGP devaluation of ~55% in H1 2024. Cost to Income Ratio (C/I) reduced to 18.1% from 20.8% and Gross Operating Income (GOI) increased +62% YoY to reach EGP 5,746 million.

Lower cost of risk at EGP -88 million, compared to -187 million in the same period last year driven by resilient portfolio and strong recoveries demonstrating the bank’s prudent risk management framework.

Net Profit reached EGP 4,198 million, +67% YoY, driven by higher NBI with effective control on operating expenses complemented by prudent risk management.

QoQ sequentially, NBI and GOI decreased by -11% and -13% respectively mainly resulting from the exceptional one-off FX revenues in Q1 2024 and also easing of market operating conditions in Q2 2024.

* Income Statement based on managerial reporting

High Quality of Assets, Strong Solvency and Liquidity

CAE NPL ratio of 1.6% reduced by 100 bps in H1 2024 and continues to remain among one of the lowest ratios within the banking sector and complemented by strong coverage buffer, demonstrating the high quality credit positioning of the bank to pursue healthy lending portfolio growth, with prudent risk management practices in place.

Furthermore, the bank’s strong liquidity position and solid capital buffer, well above regulatory requirements, provide adequate safeguard to absorb shocks, if any.

* CAR, LCR, NSFR and Leverage as reported to CBE.

Key Financial and Business Indicators

*Net Interest Margin “NIM” based on managerial reporting and Earnings per Share net of Profit Share to Employees

Digital Development

CAE digital channels continue to show competitive positive achievements.

For retail, Banki Mobile continues to be an essential tool for reinforcing CAE position as one of the leading banks in digital banking with more than 3M login during Q2 2024. CAE digital channels have witnessed more than 2.6M transactions executed during Q2 2024 (+240% YoY) with a remarkable 99% of domestic transfers being done online.

CAE went live on INSTAPAY in May 2023 and continues to make significant contribution i.e. over 5.4M outgoing transactions thereby demonstrating the participation of the bank within the growing digital banking ecosystem in alignment with the continuous efforts of the Central Bank of Egypt.

For corporate and SMEs customers, 41% of the companies have been digitally active on the online platform, with almost half of the domestic transfers now done digitally with 19% increase over Q2 2023. CAE witnessed an increase in digital governmental payments volumes by around 110% in Q2 2024 vis-à-vis Q2 2023.

For Ecommerce, CAE continued to capitalize on the payment acceptance product "banki Commerce" contributing further towards the Central Bank efforts for a "less cash society" as well as the gradual shift to payment acceptance. By the end of Q2 2024, "banki Commerce" had generated more than 43K eCommerce transactions processed through the new gateway since inception. CAE remains committed to its ambitious vision in the Payment Acceptance field, and its unique onboarding journey continues to make it easy for all customers to onboard.

Sustainability and CSR Activities

Credit Agricole Egypt will soon release its third integrated sustainability report for 2023, titled "Embracing an elevated journey". The report reflects CAE's strategic direction, towards adding value for its customers, investors, the general public, and the economy it serves. The bank is the first in Egypt to introduce integrated reporting in alignment with Integrated Reporting (IR) framework and in compliance with the Global Reporting Initiative (GRI).

In its pursuit to provide solar-powered agriculture solutions in rural villages, CAE Foundation in collaboration with Schneider Electric, Egypt, built a solar-powered water pump and cladded Water canal in Tita village, Menoufeya. The project enables 450 households to use clean energy, reduce water waste and increase crop production.

In celebration of World Blood Donor Day, CAE and CAE Foundation conducted a staff blood drive for the benefit and support of Ahl Masr Burns Hospital and its patients.

-Ends-

About Credit Agricole Egypt

Credit Agricole Egypt (CAE) is the sole French Bank in Egypt established in 2006 and is listed in the Egyptian Stock Exchange since 2015. CAE has one subsidiary Egyptian Housing Finance Company (EHFC) with 99.99% percent stake.

Credit Agricole Egypt continues to leverage on its digital infrastructure, diversified expertise, solid balance sheet structure, prudent risk management, strong liquidity position and adequate capital buffer allowing the bank to pursue its strategic profitable growth by serving its customers as well as the economy.